Image Intensifier Tube Market Key Players and Forecast by 2031

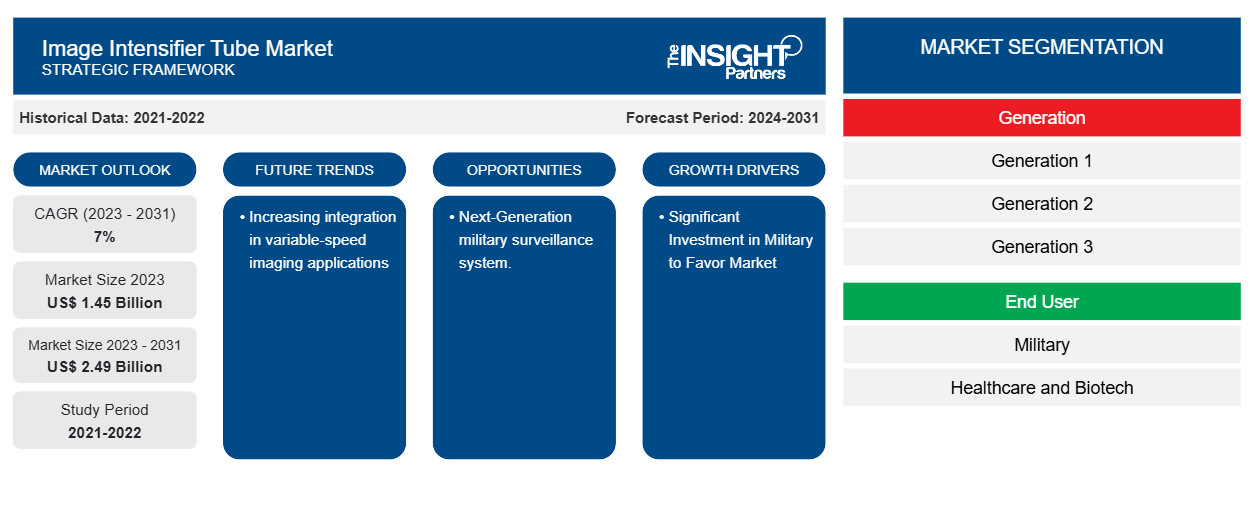

Image Intensifier Tube Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Generation (Generation 1, Generation 2, and Generation 3), End User (Military, Healthcare and Biotech, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Status : Data Released

- Report Code : TIPRE00010542

- Category : Electronics and Semiconductor

- No. of Pages : 150

- Available Report Formats :

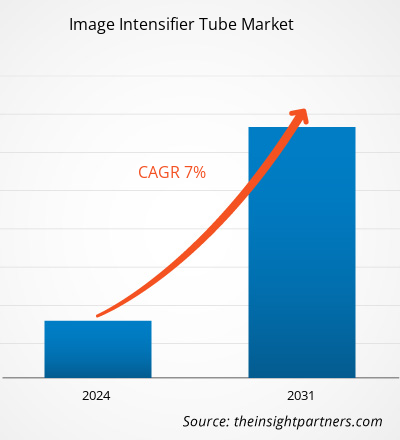

The image intensifier tube market size is projected to reach US$ 2.49 billion by 2031 from US$ 1.45 billion in 2023. The market is expected to register a CAGR of 7.0% during 2023–2031. Increasing contracts for procurement and advancement of night vision systems and rising demand for X-ray machines are likely to remain key trends in the market.

Image Intensifier Tube Market Analysis

The demand for the image intensifier tube market is anticipated to grow with the increasing procurement of high-speed camera systems, including HiCATT, which is an intensifier attachment for any high-speed camera. Instruments like these are used to capture the images in moving conditions. Moreover, the increasing contracts for procurement and advancement of night vision systems and rising demand for X-ray machines are driving the image intensifier tube market growth.

Image Intensifier Tube Market Overview

Image intensifier tubes (IITs) are vacuum tubes that intensify a low light-level image to observable levels. Image intensifier tubes are one of the most important modules of night vision devices that define a crucial role in industrial/defense/security/applications. The technology of manufacturing image intensifier tubes is difficult, and the performance parameters of modern IITs vary even within the same technological process. Moreover, test reports provided by manufacturers cannot be totally trusted because there are differences in test methods utilized by different manufacturers. Furthermore, literature sources offer conflicting claims from a variety of manufacturers. It is common to find on the world market two-night vision devices of the same data sheet constraints but of different quality of the image. Because of some reasons mentioned above, testing image intensifier tubes is of high importance for both tube manufacturers, manufacturers of night vision devices (NVDs) and final users of NVDs.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONImage Intensifier Tube Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Image Intensifier Tube Market Drivers and Opportunities

Significant Investment in Military to Favor Market

Night vision has become a very crucial optoelectronic technology in modern warfare, and more combats are emerging and taking play at night. Photonis image intensifier tubes are integrated into equipment of the world’s leading suppliers of optical systems. Various companies offer image intensifier tubes for military use. For example, Photonics is one of the pioneers in the manufacturing and design of state-of-the-art image intensifier tubes for military and defense. Photonis offers high-quality image intensifier tubes for a broad range of night vision devices to give soldiers a strategic advantage in night operations.

Moreover, companies are taking several initiatives. For instance, companies are taking various initiatives, such as delivering a large number of image intensifier tubes. For instance, in February 2024, Photonis, the brand of Exosens and one of the world leaders in image intensifier tubes, was selected, for the second time, to supply 40,000 4G 16mm image intensifier tubes for Mikron night vision binoculars of Theon Sensors to be supplied to German and Belgian Armed Forces. Thus, a significant investment in the military is driving the image intensifier tube market.

Next-generation military surveillance system.

The Army is conscripting a requirement for a next-generation mobile passive radar, a type of the Army Long Range Persistent Surveillance system mounted on a tactical truck that can quickly deploy a 60-foot-tall sensor to help distinguish cruise missiles, aircraft and smaller uncrewed flying systems. On March 26, the Army office responsible for developing and buying service air defense artillery and field artillery sensors published a notice seeking feedback from companies potentially interested in competing for the new radar. Furthermore, leading armies are equipped with Gen 3 and Gen 4 NVDs that offer superior image quality, extended range, and reduced halo effects. Gen 3 devices utilize gallium arsenide photocathodes and microchannel plate (MCP) amplification. Thus, the next-gen military surveillance system holds a lot of opportunities in the image intensifier tube market.

Image Intensifier Tube Market Report Segmentation Analysis

Key segments that contributed to the derivation of the image intensifier tube market analysis are generation and end user.

- Based on generations, the image intensifier tube market is divided into generation 1, generation 2, and generation 3. Generation 2 held a significant market share in 2023.

- By end user, the market is segmented into military, healthcare biotech, and others. The military segment held a significant share of the market in 2023.

Image Intensifier Tube Market Share Analysis by Geography

The geographic scope of the image intensifier tube market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the image intensifier tube market. North America is one of the most advanced regions with regard to the adoption of advanced technologies. Over the years, North America has experienced a rise in the adoption of technologically advanced military equipment to enhance its military capabilities. Government bodies across countries such as the US, Canada, and Mexico have increased their military expenditure. Moreover, countries in North America have experienced a rise in investment in the healthcare sector to enhance their medical infrastructure. Thus, increasing investments in the sectors where the image intensifier tube is essential is driving market growth.

Image Intensifier Tube Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.45 Billion |

| Market Size by 2031 | US$ 2.49 Billion |

| Global CAGR (2023 - 2031) | 7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Generation

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Image Intensifier Tube Market Players Density: Understanding Its Impact on Business Dynamics

The Image Intensifier Tube Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Image Intensifier Tube Market News and Recent Developments

The image intensifier tube market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the image intensifier tube market are listed below:

- Exosens announced the expansion of its Photonis Ultimate Detection Scientific Imaging product portfolio with the introduction of the 25 mm Image Intensifier solution. This latest technology, designed to support a wide variety of scientific applications such as medical and high-speed imaging, machine vision, robotics, and research, will be showcased at SPIE Photonics West.

(Source: Exosens, Company Website, January 2024)

- Photonis, a brand of Exosens and one of the world leaders in image intensifier tubes, was selected, for the second time, to supply 40,000 4G 16mm image intensifier tubes for Mikron night vision binoculars of Theon Sensors to be supplied to German and Belgian Armed Forces.

(Source: Photonis Company Name, February 2024)

Image Intensifier Tube Market Report Coverage and Deliverables

The “Image Intensifier Tube Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Image intensifier tube market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Image intensifier tube market trends as well as market dynamics such as drivers, restraints, and key opportunities.

- Detailed PEST/Porter’s Five Forces and SWOT analysis.

- Image intensifier tube market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the image intensifier tube market.

- Detailed company profiles.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For