Medical Marijuana Market Growth, Share & Forecast 2034

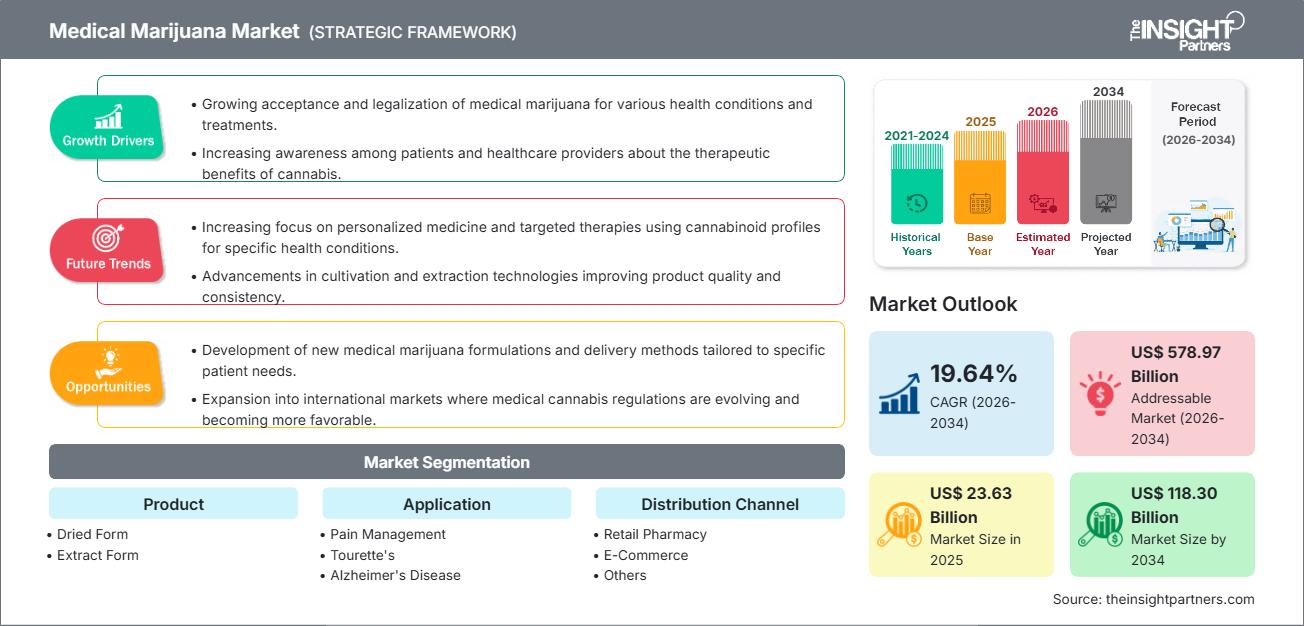

Medical Marijuana Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Dried Form and Extract Form), Application (Pain Management, Tourette’s, Alzheimer’s Disease, Migraines, Depression and Anxiety, Multiple Sclerosis, Cancer, and Others), Distribution Channel (Retail Pharmacy, E-Commerce, and Others)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPRE00022901

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

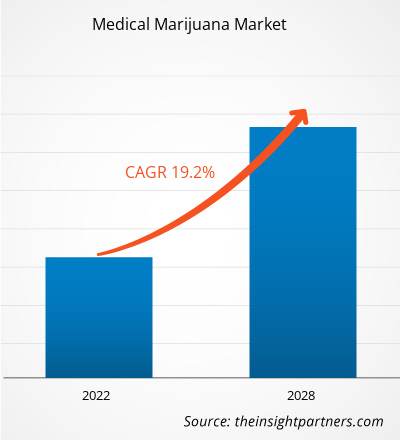

The Medical Marijuana Market size is poised for explosive expansion, expected to reach US$ 118.30 billion by 2034, a dramatic increase from US$ 23.63 billion in 2025. The market is anticipated to register an exceptional Compound Annual Growth Rate (CAGR) of 19.64% during the forecast period of 2026–2034.

Medical Marijuana Market Analysis

The global medical marijuana market forecast indicates a rapid, double-digit growth trajectory, owing to the unprecedented pace of cannabis legalization across various global jurisdictions and the corresponding surge in clinical research validating its therapeutic efficacy. Market expansion is fundamentally driven by the increased acceptance of cannabinoids for managing chronic, often debilitating conditions, including chronic neuropathic pain, multiple sclerosis, and treatment-resistant epilepsy. This growth is further propelled by significant private and public investment in cannabis research and development, which is leading to advanced cultivation practices, standardized extraction technologies, and the creation of novel, accurately dosed cannabinoid-based pharmaceutical formulations. Strategic corporate actions, such as global mergers, acquisitions, and cross-border distribution agreements among key industry players, are streamlining supply chains and accelerating market penetration worldwide.

Medical Marijuana Market Overview

Medical marijuana refers to the therapeutic use of the Cannabis sativa plant and its primary bioactive compounds, cannabinoids, such as delta-9-tetrahydrocannabinol (THC) and cannabidiol (CBD), under the supervision of a licensed healthcare professional. These compounds exert their effects primarily through interaction with the body’s endocannabinoid system (ECS), which regulates numerous physiological processes, including mood, pain sensation, appetite, and memory. It is prescribed for indications including chronic refractory pain, chemotherapy-induced nausea and vomiting (CINV), spasticity associated with Multiple Sclerosis (MS), and certain severe forms of epilepsy (e.g., Dravet and Lennox-Gastaut syndromes). The market landscape is highly complex, characterized by fragmentation, rapidly evolving and often conflicting regulatory frameworks (from prescription-only models to legalized commercial dispensaries), rising patient enrollment in medical programs, and the continuous integration of specialized e-commerce platforms and sophisticated seed-to-sale tracking systems to ensure compliance and product integrity.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMedical Marijuana Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical Marijuana Market Drivers and Opportunities

Market Drivers:

- Rising Legalization of Medical Cannabis Across Multiple Countries: The most powerful driver is the legislative movement, particularly in North America, Latin America, and emerging parts of Europe, transitioning cannabis from a prohibited substance to a regulated medical product, thereby opening vast new consumer bases and investment capital.

- Increasing Prevalence of Chronic Pain and Neurological Disorders: The global health burden associated with conditions like fibromyalgia, neuropathic pain, MS, and epilepsy is enormous. Medical marijuana and cannabinoid-based drugs offer alternative or adjunctive treatments for patients who have not responded adequately to traditional therapies.

- Growing Investments in Cannabis Research and Product Innovation: Dedicated funding into clinical trials is crucial for establishing standardized dosing, safety profiles, and expanding approved therapeutic indications. This research underpins the development of safer, purer, and more predictable medicinal products.

Market Opportunities:

- Expansion in Emerging Markets with Evolving Regulatory Frameworks: Countries in Latin America and Southeast Asia that are currently undergoing regulatory shifts present massive untapped opportunities. Early movers who establish cultivation and distribution networks in these regions stand to capture significant future market share.

- Development of Novel Cannabis-Based Formulations for Targeted Therapies: The future lies in pharmaceutical-grade products offering precise, single-cannabinoid or controlled-ratio dosing (e.g., aerosols, transdermal patches, specialized oral mucosal sprays) for highly specific clinical outcomes, moving beyond raw cannabis.

- Strategic Partnerships for Global Distribution and Brand Positioning: International alliances, especially between companies in countries with established cultivation (e.g., Canada, Colombia) and markets with high regulatory barriers (e.g., Germany, UK), are essential for overcoming export/import hurdles and establishing brand dominance in a globally fragmented regulatory environment.

Medical Marijuana Market Report Segmentation Analysis

The medical marijuana market share is segmented across product form, primary therapeutic application, and distribution channel, which helps in identifying key growth pockets and investment priorities. Below is the standard segmentation approach used in most industry reports:

By Product

- Dried Form

- Extract Form

By Application

- Pain Management

- Tourette

By Distribution Channel

- Retail Pharmacy

- E-Commerce/Online

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Medical Marijuana Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 23.63 Billion |

| Market Size by 2034 | US$ 118.30 Billion |

| Global CAGR (2026 - 2034) | 19.64% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Medical Marijuana Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Marijuana Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Medical Marijuana Market Share Analysis by Geography

Market growth is highly asymmetrical, dictated by the speed and scope of regulatory reform and the maturity of local cultivation infrastructure. Below is a summary of market share and trends by region:

North America

- Market Share: Dominates the global market due to the early federal legalization in Canada and extensive state-level legalization in the United States, creating the world's most mature consumer and medical base.

- Key Drivers: High patient enrollment, robust R&D investment, established commercial scale-up infrastructure, and the presence of the world’s largest cannabis companies.

- Trends: Continuous expansion of product lines (edibles, beverages, vapes) and a focus on overcoming federal-level regulatory banking and research hurdles in the U.S.

Europe

- Market Share: Holds a significant share and is poised for accelerating growth, particularly driven by Germany, which has established a strong medical prescription program and is one of the largest importers of cannabis flower.

- Key Drivers: Government-supported, pharmacocentric approach to medical cannabis adoption; rising patient acceptance in countries like the UK, Italy, and Poland.

- Trends: High barriers to entry favoring pharmaceutical-grade extract products; reliance on imports due to limited local cultivation capacity; focus on GDPR-compliant patient data management.

Asia Pacific

- Market Share: The fastest-growing region, though starting from a smaller base, due to emerging reforms in Australia, Thailand, and South Korea, which have legalized medical use.

- Key Drivers: Rapidly expanding awareness of cannabinoid therapies; large patient populations; government-supported health and wellness initiatives.

- Trends: Strong potential for local, low-cost cultivation centers (e.g., Thailand, Australia) that could become major global exporters.

South and Central America

- Market Share: Emerging market with rapidly growing cultivation potential.

- Key Drivers: Favorable climate for low-cost outdoor cultivation; progressive regulatory frameworks in countries like Colombia, which positions itself as a major global cannabis exporter.

- Trends: Focus on bulk flower and crude extract production for the international B2B pharmaceutical supply chain, with local markets gradually opening.

Middle East and Africa

- Market Share: Developing market driven by select governmental research and medical pilot programs.

- Key Drivers: Rising healthcare investment; focused initiatives (e.g., Israel’s long-established medical cannabis research program) that drive innovation.

- Trends: Highly specialized, often government-controlled distribution channels; slow, deliberate expansion driven by scientific evidence and clinical trials.

Medical Marijuana Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

The medical marijuana market is highly fragmented but undergoing intense consolidation. Competition is primarily focused on achieving economies of scale in cultivation, securing patents for novel extraction and delivery technologies, and establishing global cross-border supply agreements. Key players compete fiercely on product quality, consistency and adherence to Good Manufacturing Practices (GMP) and Good Agricultural Practices (GAP) to meet strict international medical standards.

Differentiation is achieved through:

- Scientific and Clinical Validation: Investing in clinical trials to support specific product claims (e.g., the success of GW Pharmaceuticals/Jazz Pharmaceuticals' Epidiolex for epilepsy).

- Genetic and Cultivation Superiority: Developing proprietary, high-yielding cannabis genetics tailored for specific cannabinoid profiles (e.g., high CBD, specific terpene mixes).

- Vertical Integration and Supply Chain Control: Major players control the entire process from seed to final distribution (cultivation, extraction, formulation, branding) to ensure quality and regulatory compliance.

Major Companies operating in the Medical Marijuana Market are:

- Aphria, Inc.

- Canopy Growth Corporation

- CanaQuest Medical Corporation

- GW Pharmaceuticals

- Organigram Holdings Inc.

- VIVO Cannabis Inc

- Panaxia Pharmaceutical Industries Ltd.

- Phoena Holdings Inc.

- Emerald Health Therapeutics Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

Medical Marijuana Market News and Recent Developments

- Tilray completed Phase I of its strategic growth plan by increasing production capacity at its Aphria One and Diamond facilities in Canada, adding 60 metric tons and bringing total annual output to 210 metric tons for domestic and international supply. In October 2025, Tilray Medical expanded into Panama through a joint venture with Top Tech Global, securing a medical cannabis license covering cultivation, processing, export, and distribution.

- On November 18, 2025, Canopy expanded its Spectrum Therapeutics softgel line in Australia to meet rising patient demand. Earlier, on October 8, 2025, the company designated DOJA as a Canadian medical hub, reinforcing its domestic capabilities. Its Q2 FY2026 results reported a 17% increase in Canadian medical cannabis revenue, reflecting strong market traction.

- Jazz Pharmaceuticals finalized the acquisition of GW Pharmaceuticals and incorporated its cannabinoid medicines platform into Jazz’s neuroscience and oncology divisions. This integration is expected to accelerate development across autism, epilepsy, and movement disorder pipelines.

Medical Marijuana Market Report Coverage and Deliverables

The “Medical Marijuana Market Size and Forecast (2021–2034)” report provides a detailed analysis of the market covering the following areas:

- Medical Marijuana Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Medical Marijuana Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Medical Marijuana Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Medical Marijuana Market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For