Page Updated:

Dec 2020

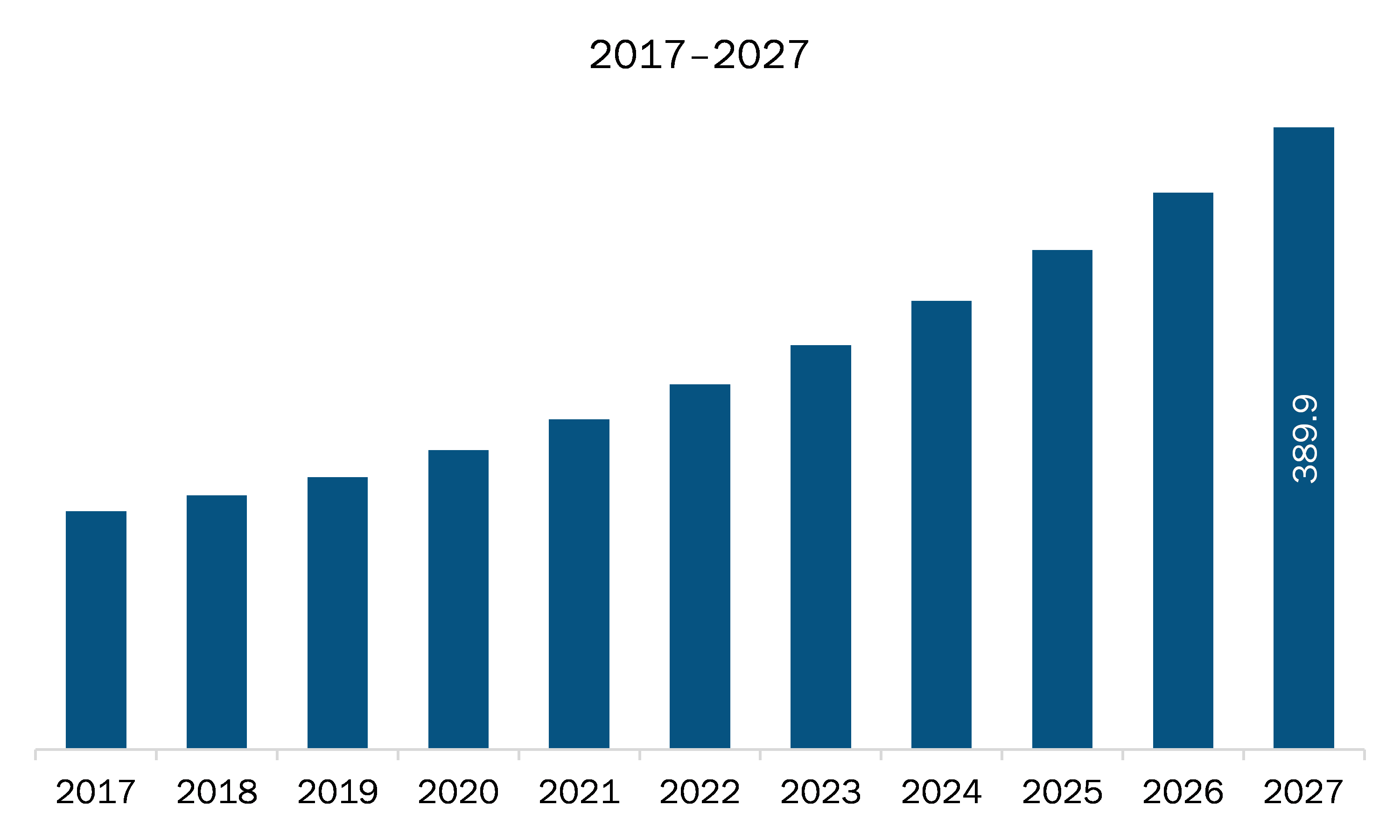

The virtual desktop infrastructure market in MEA is expected to grow from US$ 170.6 million in 2019 to US$ 389.9 million by 2027; it is estimated to grow at a CAGR of 11.0% from 2020 to 2027.

South Africa, Saudi Arabia and UAE are the major economies in MEA. Propelling growth due to growing trend of digital transformation has come to huge demand after slow growth in past years. Digitalization is getting adopted everywhere by various business platforms as it presents a massive opportunity for businesses to utilize digital technologies and automation to transform their business models and to enhance the existing processes in order to get operational efficiency and improved revenue. Recently the use of smart devices, adoption of Internet of Things (IoT), cloud computing, and artificial intelligence (AI) have increased the upcoming of smart workplaces. In general, digital transformation refers to the integration of digital technologies in business processes, and organizational activities/models. The growing demand for end to end business process optimization, high operational efficiency, and reduced human errors are the major drivers responsible for the growth of digital transformation in various industries. From past few years, desktop virtualization is becoming popular among enterprises allowing them to virtualizing entire workgroups for higher efficiency and lower costs. With solutions such as virtual desktop infrastructure and Desktop-as-a-Service (DaaS), industry verticals such as IT & telecom, government & defense, education, BFSI, healthcare, research, and manufacturing are able to decrease their endpoint footprint, offer feature-rich apps, and provide better user experiences. This solutions help enterprises in increasing business agility, responsiveness, and flexibility and thus allow them to cater the ever-changing IT demands. Thus, overall the various offers by virtual desktop infrastructure and other desktop virtualization tools enable the digital transformation in various industries helps to drive the demand of these solutions among enterprises. So this is surely going help in the growth of virtual desktop infrastructure in the coming years, which is again expected to accelerate the market in MEA. Also the COVID-19 is having a severe impact on the MEA region. In the MEA region, Iran, Saudi Arabia, Qatar, South Africa, and UAE are some of the countries with high number of COVID-19 confirmed cases and deaths. The overall number of COVID-19 confirmed cases crossed 1.76 million with more than 38,000 deaths in the MEA region. The economic and industrial growth of these countries has been affected negatively in the past few months. The MEA region comprises of many growing economies which are prospective markets for virtual desktop infrastructure vendors, owing to the huge presence of industry sectors such as energy & power and manufacturing & construction. The adoption of advanced technologies such as IoT and AI is also quite high especially in countries such as the UAE. The demand for digitalization is growing at an impressive pace in this region and thus it is expected to offer ample growth opportunities for virtual desktop infrastructure market in the coming years. However, the COVID-19 pandemic is having significant effects on various economies across the MEA and the economy of this region is also anticipated to get affected negatively by this crisis. In addition to this, there is pressure on economies of oil based countries such as Saudi Arabia due to falling oil prices and thus, the COVID-19 outbreak is further aggravating the economic problems of such countries. Hence, to tackle these problem and to maintain regular operations without disruptions, the companies present in this region are expected to invest heavily in virtual desktop infrastructure solutions and services in the coming years.With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the virtual desktop infrastructure market. The Middle East and Africa virtual desktop infrastructure market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MEA Virtual Desktop Infrastructure Market Segmentation

MEA Virtual Desktop Infrastructure Market – By Offering

- Solutions

- Services

MEA Virtual Desktop Infrastructure Market – By Deployment

- Cloud

- On-Premises

MEA Virtual Desktop Infrastructure Market – By Enterprise Size

- SMEs

- Large Enterprises

MEA Virtual Desktop Infrastructure Market – By End User

- IT & Telecom

- Government

- Healthcare

- BFSI

- Education

- Retail

- Manufacturing

- Other End Users

MEA Virtual Desktop Infrastructure Market - By Country

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

MEA Terahertz Technology Market-Companies Mentioned

- Amazon.com, Inc.

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Dell Technologies Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP (HPE)

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Microsoft Corporation

- VMware, Inc.

Middle East and Africa Virtual Desktop Infrastructure Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 170.6 Million |

| Market Size by 2027 | US$ 389.9 Million |

| CAGR (2020 - 2027) | 11.0% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Our Clients

Sales Assistance

US: +1-646-491-9876

UK: +44-20-8125-4005

Email: sales@theinsightpartners.com

Chat with us

87-673-9708

ISO 9001:2015

Get Free Sample For

Get Free Sample For