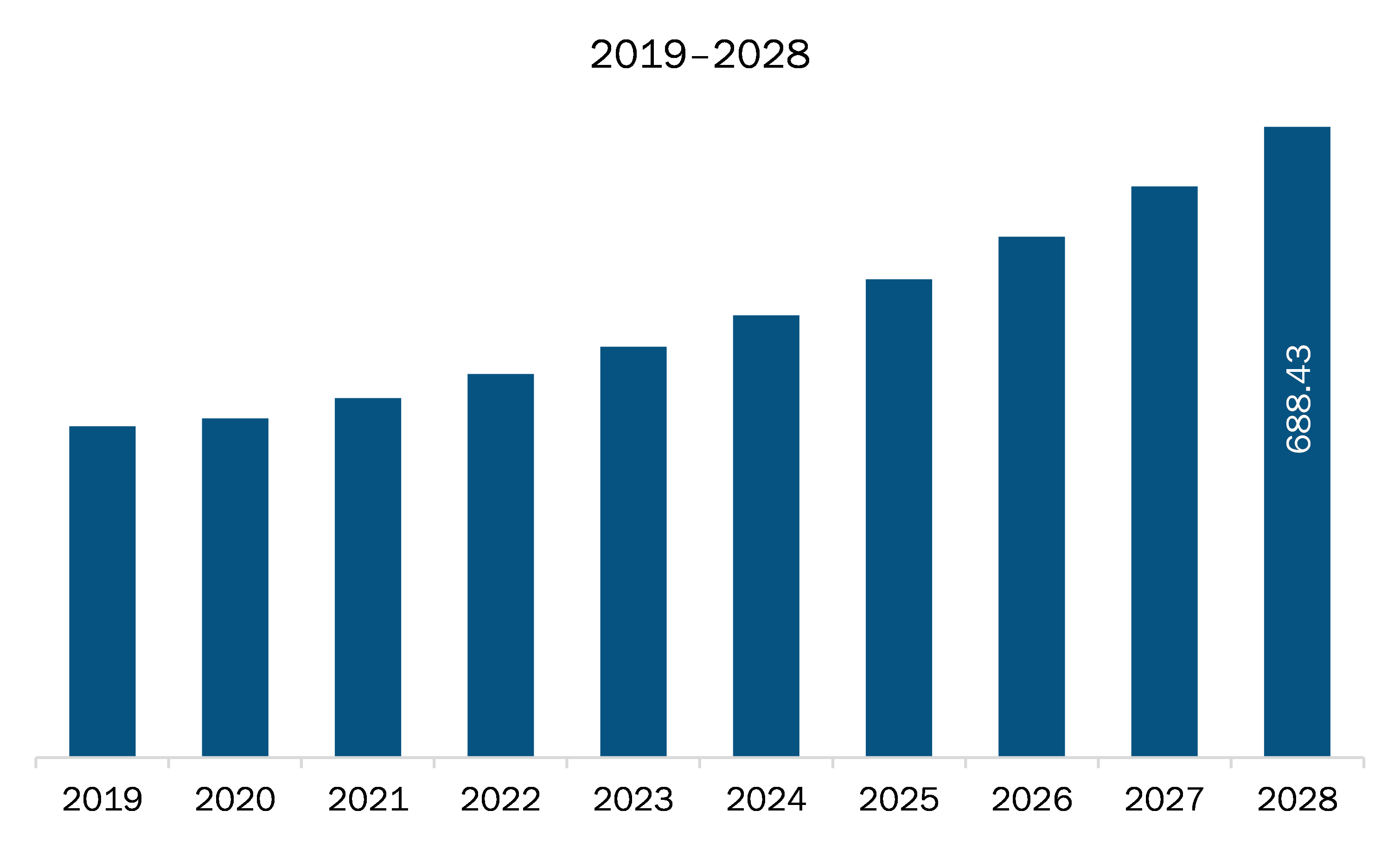

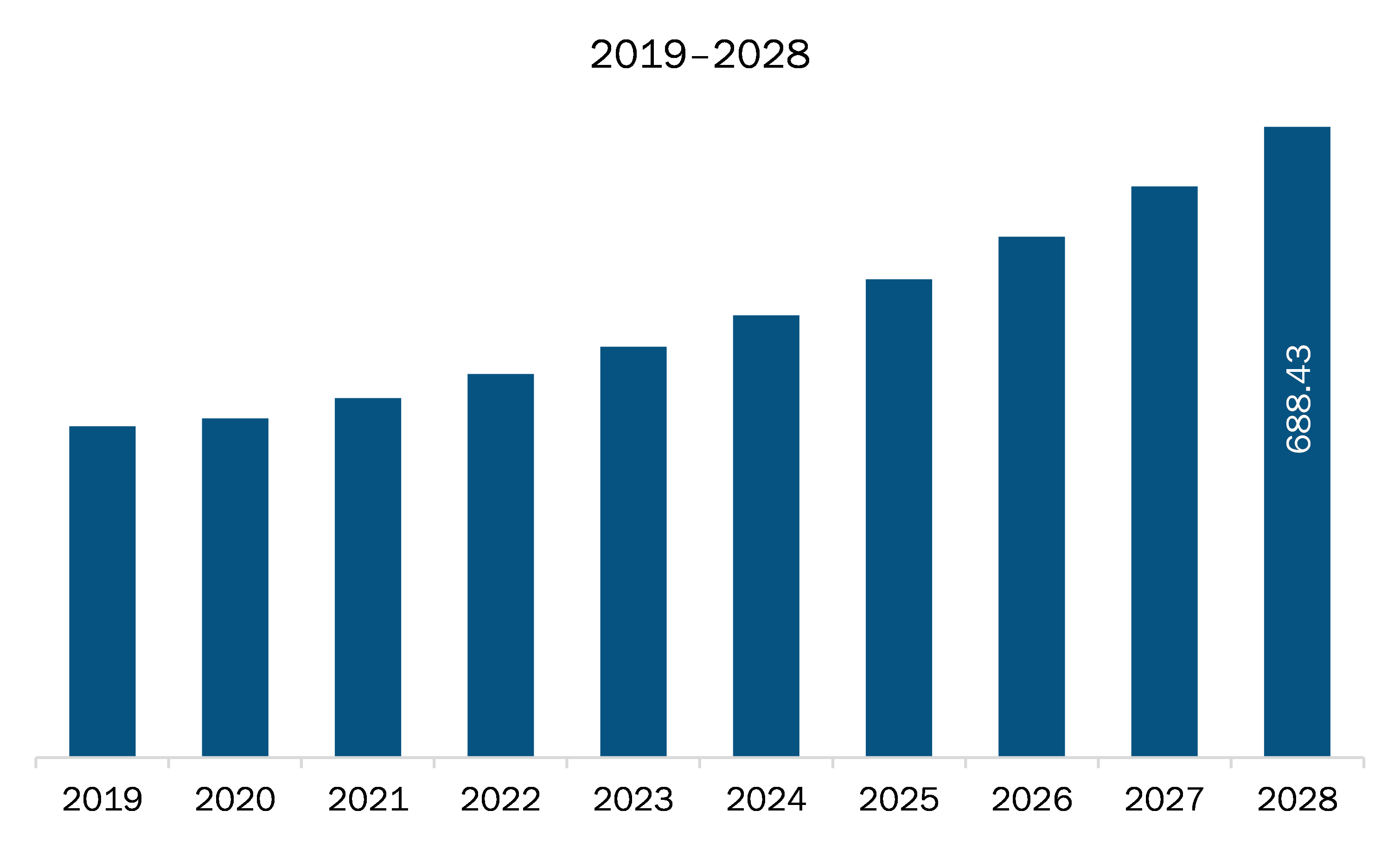

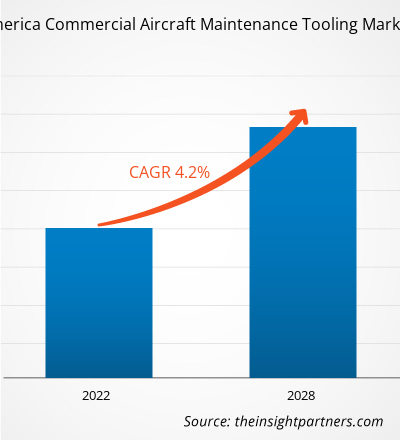

The North America commercial aircraft maintenance tooling market is expected to grow from US$ 515.22 million in 2021 to US$ 688.43 million by 2028; it is estimated to grow at a CAGR of 4.2% from 2021 to 2028.

The number of aircraft fleets in commercial aviation has increased significantly over the years. Airlines and regional carriers with a fleet of ATR and Embraer Commercial have been procuring a noteworthy number of aircraft fleets over the past few years. A surge in the procurement of various commercial aircraft fleets has led to a substantial rise in the number of aircraft MRO shops or hangars in the region. The construction of new aircraft MRO hangars and MRO bays is directly proportional to the demand for various maintenance tools, which is one of the critical catalyzers of the commercial aircraft maintenance tooling market. In addition, the continuous investments by companies in the commercial aircraft MRO industry in the expansion of their existing MRO hangars with new bays fuel the commercial aircraft maintenance tooling market growth.

The civil aviation industry across the region experienced dramatic changes after the advent of COVID-19. According to the Bureau of Transportation Statistics (BTS),US, domestic air travel across the US experienced a 97% decrease in passenger revenue between February and April 2020. The Canadian and Mexican aviation industries experience similar trends. This impacted the civil aviation manufacturers leading to a decline in the demand for commercial aircraft from the region. The supply chain of several maintenance-related tools and machinery was also impacted due to a significantly lower volume of aircraft movement. This impacted the commercial aircraft maintenance tooling market heavily. In addition, the aircraft manufacturers observed a drop in demand for newer aircraft fleet, cancelation or rescheduling of aircraft orders and delivery, shortage of laborers, and other factors that hampered their businesses and ability to deliver substantial volumes of new aircraft fleet. The decline in new aircraft delivery highlighted a limited number of aircraft fleet at the Maintenance, Repair and Overhaul (MRO) facilities, which reduced the demand for newer and aircraft OEM specific tools and machinery among the MRO facilities. This ultimately led to a decline in revenues in the commercial aircraft maintenance tooling market.

With the new advancements and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America commercial aircraft maintenance tooling market. Commercial aircraft line maintenance service providers and engine maintenance service providers focusing on the procurement of advanced maintenance tools to perform their tasks efficiently. Both line maintenance and engine maintenance are of utmost importance for any aircraft operator. The engine maintenance needs are growing steadily as modern engines are equipped with advanced technologies, while the maintenance cycles are defined by the engine manufacturers. An engine is the highest revenue generation stream for aircraft MRO service providers due to a continuous rise in the production and installation of engines as well as maintenance requirements of the existing engines. The engine segment in aircraft MRO is expected to continue generating significant revenues in the years to come. This is majorly due to the constant rise in production and installation of engines coupled with existing engines. Attributing to the continuous growth of engine usage, the maintenance frequencies, as well as maintenance bays, are also expected to surge in the coming years. Thus, an increase in engine maintenance frequencies and bay. As a result, the engine MRO segment generates noteworthy demand for various maintenance tools, which would bolster the commercial aircraft maintenance tooling market during the forecast period.

North America Commercial Aircraft Maintenance Tooling Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Commercial Aircraft Maintenance Tooling Market Segmentation

North America Commercial Aircraft Maintenance Tooling Market – By Tool Type

- Speed Handle

- Wrenches

- Safety Wire Pliers

- Vibration Meters

- Metal Working Tools

- NDT Tools

- Others

North America Commercial Aircraft Maintenance Tooling Market – By Users

- MRO Service Providers

- Airline Operator

North America Commercial Aircraft Maintenance Tooling Market – By Application

- Engine

- Airframe

- Landing Gear

- Line Maintenance

- Others

North America Commercial Aircraft Maintenance Tooling Market – By Country

- US

- Canada

- Mexico

North America Commercial Aircraft Maintenance Tooling Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 515.22 Million |

| Market Size by 2028 | US$ 688.43 Million |

| Global CAGR (2021 - 2028) | 4.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Tool Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

- HYDRO SYSTEMS KG

- Red Box Aviation

- Stanley Black & Decker, Inc.

- STAHLWILLE Eduard Wille GmbH & Co. KG

- Field International Group Limited

- Henchman Products

- Dedienne Aerospace

- Tronair Inc.

- Snap-On Incorporated

Get Free Sample For

Get Free Sample For