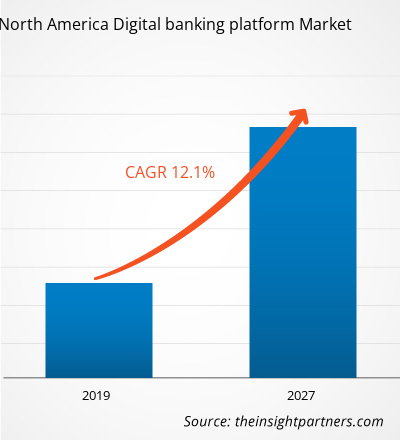

North America digital banking platform market is expected to grow from US$ 1.00 Bn in 2018 to US$ 2.76 Bn by the year 2027. This represents a CAGR of 12.1% from the year 2018 to 2027.

With changing customer preferences, today’s banks are shifting fast towards digital channels. Various banking services are now commonly available through convenient digital channels. However, in order to deliver exceptional customer experiences and survive in the highly competitive banking industry, banks need to move towards a much broader digital shift. In order to meet expectations of both digital and non-digital consumers, banks are now adopting omnichannel banking, which helps in maintaining traditional service channels and optimizing them to meet customer needs. To achieve this, traditional banks have started partnering and sharing data with new ecosystems, which include FinTechs, open banking, payment services directive, and SWIFT standards. In the global banking industry, digital disruption is gaining pace due to entry of online-only banks, and challenger banks. The collaboration between retail banks and emerging ecosystems help retail banks in better understanding changing consumer needs. The switching behavior among bank customers is extremely aggressive nowadays, and banks are forced to deliver better services and value to today’s empowered consumers. These new trends of collaborating and sharing information among banking ecosystem players to gain customer trust and improve customer’s digital experience is expected to boost the digital banking platform market during the forecast period of 2019 to 2027.

Currently, the U.S is dominating in the North America digital banking platform market owing to the high rate of adoption of new technologies in the region. Factors such as the growing popularity of mobile-based banking applications and increasing digitization across BFSI sector is contributing substantially towards the growth of the digital banking platform market in North America. The figure is given below highlights the revenue share of Mexico in the North America digital banking platform market in the forecast period:

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

NORTH AMERICA DIGITAL BANKING PLATFORM MARKET - SEGMENTATION

North America Digital Banking Platform Market by Type

- Corporate Banking

- Retail Banking

North America Digital Banking Platform Market by Deployment Type

- On-Premise

- Cloud

North America Digital Banking Platform Market by Country

- U.S

- Canada

- Mexico

Companies Mentioned

- Appway AG

- Backbase

- CREALOGIX Holding AG

- EdgeVerve Systems Limited

- Fiserv, Inc.

- nCino, inc.

- Oracle Corporation

- SAP SE

- Sopra Steria

- Tata Consultancy Services Limited (TCS)

- Worldline SA

North America Digital banking platform Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 1.00 Billion |

| Market Size by 2027 | US$ 2.76 Billion |

| Global CAGR (2018 - 2027) | 12.1% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Deployment, Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies

- Appway AG

- Backbase

- CREALOGIX Holding AG

- EdgeVerve Systems Limited

- Fiserv, Inc.

- nCino, inc.

- Oracle Corporation

- SAP SE

- Sopra Steria

- Tata Consultancy Services Limited (TCS)

Get Free Sample For

Get Free Sample For