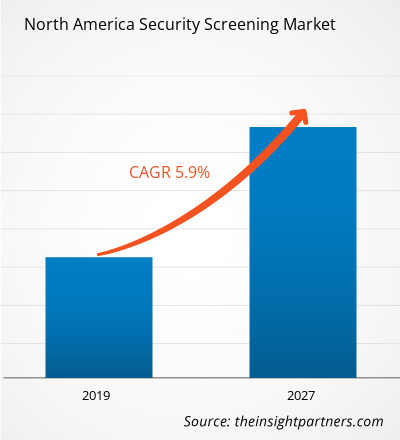

Security screening market in North America is expected to grow from US$ 2.31 Bn in 2018 to US$ 4.01 Bn by the year 2027 with a CAGR of 5.9% from the year 2019 to 2027.

The increase in the global air passenger traffic, loss of human life owing to persistent attacks, and prospering e-commerce sector propelling domestic and international trade are the key factors driving the growth of the security screening market. Moreover, the increase in investments in the development of the infrastructural sector is anticipated to boost the security screening market growth in the near future. A rise in government initiatives and compliances for policies and security by the regulatory bodies have resulted in an increase in investments related to security by the companies. Increase in life-threatening threats such as terrorist attacks and criminal activities, including recent mass shooting incidences in the US has resulted in installing enhanced security screening system in the buildings. The Airport Council International-North America has estimated a need of around US$ 100 Bn during 2017 – 2021 in the US 63% of the development is envisioned to accommodate passenger and cargo activity growth, and 30% is envisioned to upgrade existing infrastructure, maintain a state of good repair, as well as retain airports up to standards for the aircraft that use them. This would further result in upgrading airports across the region; thus, bolstering the demand for metal & trace detectors and x-ray scanners in the region.

These devices and equipment play a major in identifying the presence of any explosives, metallic objects, and prevents the entrance of an unauthorized person. Pertaining to threats such as terrorist activities and attack, the adoption of security systems integrated with advanced technologies is rising at a larger extent. The market for security screening by-product is classified into the x-ray scanner, biometric systems, electromagnetic metal detector, and explosive trace detector. The X-ray scanner segment led the security screening market in the year 2018 with the highest market share and is expected to flourish its dominance during the forecast period. Further, biometric systems are expected to have the fastest growth rate during the forecast period. Biometric device integration has become a standard requirement for secure access control, thereby delivering greater security for non-transferable devices. The airports and public places are expected to witness the gradual adoption of advanced technologies over the coming three to five years. Adoption of biometric systems, including facial recognition system is growing exponentially, which are projected to benefit many airlines.

The US dominated the security screening market in 2018 and is expected to dominate the market with the highest share in the North America region through the forecast period. Airports across the US are working on key infrastructure and construction projects to enhance and renovate their facilities. These projects comprise of new and upgraded terminals, lighting and passenger amenities, and runways and taxiways. In January 2016, New Orleans city started construction of its new US$ 807 Mn North Terminal complex at the airport. Other airports such as Orlando International Airport is also working on a US$ 1.1 Bn expansion and up-gradation project. These initiatives in the expansion of airports in the country are contributing to the security screening market growth. The figure given below highlights the revenue share of the Mexico in the security screening market in the forecast period:

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

NORTH AMERICA SECURITY SCREENING MARKET SEGMENTATION

By Product

- X-Ray Scanner

- Biometric Systems

- Explosive Trace Detector

- Electromagnetic Metal Detector

By Application

- Public Places

- Border Check point

- Government

- Airport

- Others

By Country

- US

- Canada

- Mexico

Security screening Market - Companies Mentioned

- Aware, Inc.

- Anviz Global

- Analogic Corporation

- Iris ID Inc.

- L3 Security & Detection Systems

- Magal Security Systems Ltd.

- Nuctech Company Limited

- OSI Systems, Inc.

- Smiths Detection Inc.

- Teledyne ICM (Teledyne Technologies Incorporated)

North America Security Screening Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 2.31 Billion |

| Market Size by 2027 | US$ 4.01 Billion |

| Global CAGR (2019 - 2027) | 5.9% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies

- Aware, Inc.

- Anviz Global

- Analogic Corporation

- Iris ID Inc.

- L3 Security & Detection Systems

- Magal Security Systems Ltd.

- Nuctech Company Limited

- OSI Systems, Inc.

- Smiths Detection Inc.

- Teledyne ICM (Teledyne Technologies Incorporated)

Get Free Sample For

Get Free Sample For