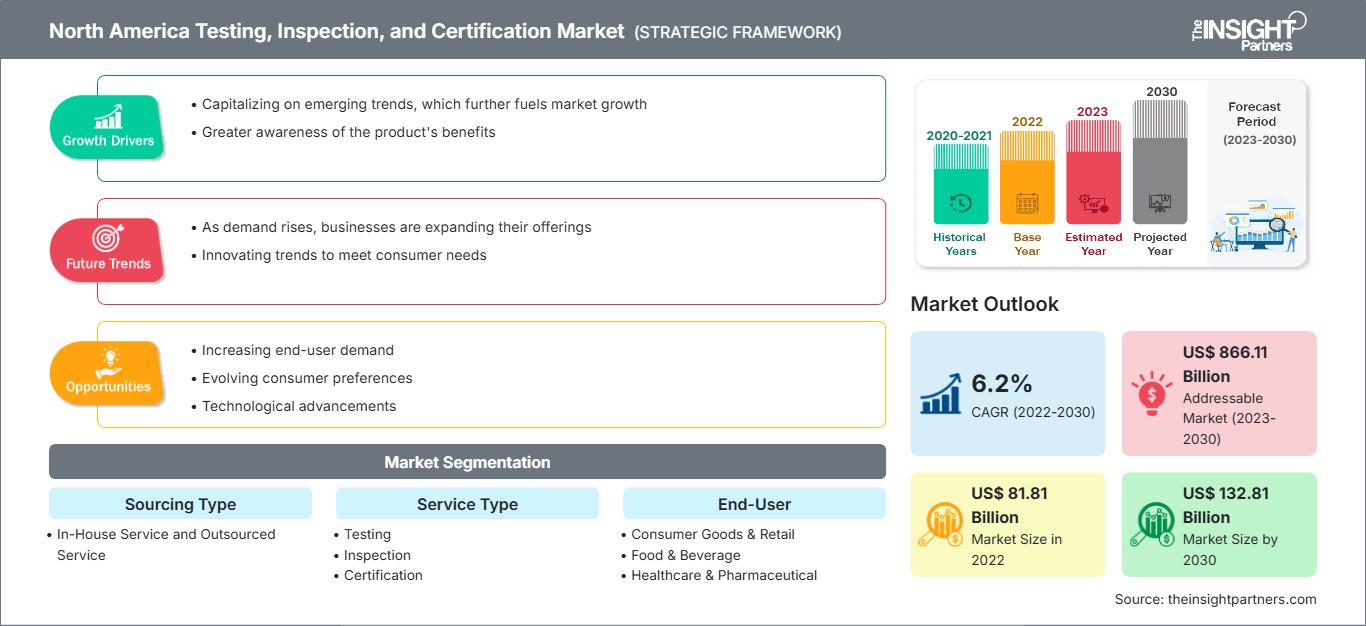

North America Testing, Inspection, and Certification Market Segments and Growth by 2030

North America Testing, Inspection, and Certification Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Sourcing Type (In-House Service and Outsourced Service), Service Type (Testing, Inspection, and Certification), End-User (Consumer Goods & Retail, Food & Beverage, Healthcare & Pharmaceutical, Energy & Power, Manufacturing & Construction, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Oct 2023

- Report Code : TIPRE00006284

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 101

The North America testing, inspection, and certification market was valued at US$ 81.81 billion in 2022 and is projected to reach US$ 132.81 billion by 2030; it is expected to grow at a CAGR of 6.2% from 2022 to 2030.

Analyst Perspective:

The testing, inspection, and certification industry is focusing on the adoption of various advanced technologies to promote safer and faster testing and inspection. Smart laboratories of the digital age is relying on technologies, namely artificial intelligence (AI), big data, cloud computing, and machine learning (ML), among several others. AI and ML, in conjunction with digital images, are being leveraged for semi-automated processes to reduce errors and lower uncertainties of conformity assessments in industrial testing. Big data allows for the management and analysis of the increasing qualities and types of data available for testing and inspecting products. Cloud computing is promoting instant data sharing, report issuing, and certification automation, among others. Drones and unmanned aerial vehicles (UAVs) are offering novel methods of conducting remote inspections and aerial mapping. They can be fitted with multispectral sensors for precise measurements in agriculture or thermal cameras for measuring heat distribution. Drone-based inspection of remote equipment is expected to grow rapidly in the conventional and renewable energy sectors.

Drones, fitted with thermal imaging equipment, are expected to assist in remotely monitoring the health of power lines and other equipment. Sensors are also expected to play an increasingly important role in process control and automated production lines. This can also provide growth potential for connectivity, data sharing, and integration with logistics while providing valuable data and feedback from markets. Integration of blockchain technology can improve traceability, transparency, and trade potential. It can offer a transparent, secure, and decentralized method of verifying certificates with increased efficiency and reduced costs. Thus, the adoption of advanced technologies by the North America testing, inspection, and certification market players is expected to transform the North America testing, inspection, and certification market in the coming years.

Market Overview of North America Testing, Inspection, and Certification Market:

The increased demand for safety and infrastructure improvements is fostering the North America testing, inspection, and certification market expansion. The North America testing, inspection, and certification market is also expanding owing to the adoption of sophisticated technologies, shorter product lifecycles, and intricate supply chains in numerous end use industries. Also, food safety audits are becoming more common in countries such as the US, which drives the North America testing, inspection, and certification market. The Food and Drug Administration of the US introduced the Food Safety Modernization Act in order to improve the country's food safety system, with a primary focus on reducing foodborne illnesses. The government established different requirements for various food goods under this act. As a result, the country's testing, inspection, and certification activities expanded rapidly.

Further, DEKRA was chosen by the California Energy Commission to create a Vehicle-Grid Innovation Laboratory (ViGIL) to enhance the interoperability of electric vehicles and charging infrastructure. The facility, which is located in Concord, California, started its operations in 2022. The lab was supposed to assist electric car manufacturers, suppliers, device manufacturers, electric vehicle charging station manufacturers, charging point operators, and service providers with a variety of cutting-edge testing and certification services. Moreover, in Canada, as the need for medical-grade personal protective equipment (PPE) grows, it is crucial to guarantee that this equipment is available and safe to use in Canada. As of October 2020, the CSA Group has announced the establishment of a certified, special-purpose laboratory dedicated to testing and certifying the safety of medical-grade personal protective equipment (PPE). The laboratories will test and certify medical-grade PPE such as masks, filtering facepiece respirators, medical gloves, protective drapes, and gear such as surgical and isolation gowns for usage across Canada.

Moreover, the Government of Mexico is supporting product safety standards in the country. For instance, Intertek provides Electrical Testing Laboratories (ETL) certification, which is accepted in Mexico as a product’s proof of compliance with applicable safety standards. As a result, the government awarded equal recognition to certain North American certification bodies such as Intertek and Mexico's NOM certification for a limited range of electrical and electronic devices brought into Mexico.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Testing, Inspection, and Certification Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver of Testing, Inspection, and Certification Market:

Increased Implementation of Industry 4.0 To Fuel North America Testing, Inspection, and Certification Market Growth

Industry 4.0 has transformed the industrial scenario in North America. Using data analytics and the Industrial Internet of Things (IIoT), Industry 4.0 digitizes manufacturing processes. Smarter endpoints, scalable computing, data analytics, visualization, and mobility are reshaping the future of industrial automation in the region. The industrial processes are witnessing a heightened alliance of information technology (IT) and operational technology (OT) for overall performance and business improvement. Several North America testing, inspection, and certification market players are also expanding their business, owing to the higher acceptance of advanced technology in countries such as the US and Canada, fuelling demand for such services. In February 2023, L&T Technology Services Limited, a leading engineering services company, unveiled a new suite of Industry 4.0 technology offerings by integrating cutting-edge technologies, including Artificial Intelligence (AI), 3D-vision systems, robotics, and connected machines, for prominent verticals such as medical devices and transportation.

Industry 4.0 technologies are complex and interconnected; hence, it is critical to guarantee that they are tested and certified to fulfill safety and performance criteria. With the proliferation of digital transformation, industries are strongly relying on various components, including both hardware and software, to accomplish various tasks. Such component vendors require reliable North America testing, inspection, and certification market players to ensure the quality of these systems.

The quality and sustainability of automation systems have to be carefully tested before it reaches the market. The components must be dependable and defect-free to avoid any repercussions to the company arising from the fault of the product during active operations. Hence, it requires interoperability testing, field device testing, pre-certification or pre-compliance testing, and security testing apart from the standard functional and nonfunctional testing. Additionally, digital products introduced to the market are frequently updated with new features and added components. Such updates often require revalidation to ensure that they conform to the required standards post the updates. Thus, market players are playing a vital role in assisting businesses to ensure the quality and dependability of the products and services used for Industry 4.0.

Industry 4.0 creates additional opportunities for North America testing, inspection, and certification market players to innovate and offer new services. The advent of the Internet of Things (IoT), for example, is increasing the demand for testing and certification services for linked devices. Furthermore, the growing use of big data and analytics in manufacturing creates a need for testing, inspection, and certification providers to assist organizations in managing and analyzing their data in order to improve quality and efficiency. Thus, the implementation of Industry 4.0 drives the North America testing, inspection, and certification market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis of North America Testing, Inspection, and Certification Market:

The North America testing, inspection, and certification market is segmented on the basis of sourcing type, service type, and end-user. Based on sourcing type, the North America testing, inspection, and certification market is bifurcated into in-house service and outsourced service. In terms of service type, the North America testing, inspection, and certification market is segmented into testing, inspection, and certification. In terms of end-user, the North America testing, inspection, and certification market is segmented into consumer goods & retail, food & beverage, healthcare & pharmaceutical, energy & power, manufacturing & construction, and others. By country, the North America testing, inspection, and certification market is segmented into the US, Canada, and Mexico.

Regional Analysis of North America Testing, Inspection, and Certification Market:

The US has established itself as the dominant region in the North America testing, inspection, and certification market, with a leading market share. The high internet penetration across the US is the main factor catalyzing the adoption of digital solutions across industries such as healthcare, manufacturing, defense, oil & gas, and transportation. There is a rise in demand for constant power supply from these industries for efficient production output. As testing, inspection, and certification have several applications in manufacturing, defense, and other industries, the demand for testing, inspection, and certification is growing. For instance, in October 2021, National Technical Systems, Inc. (NTS)—the leading provider of qualification testing, inspection, and certification solutions in North America—was granted a US$ 9,962,646 contract from the US Navy. The award is an indefinite-delivery/indefinite-quantity (IDIQ) contract for testing across different NTS laboratories, including the company’s defense facility in Camden, Arkansas.

The objective of testing, inspection, and certification is to boost manufacturing productivity and assist producers in achieving precise conformity to global standards in the medical sector. Thus, several healthcare facilities are deploying testing, inspection, and certification services. For instance, in May 2021, Atlas Technical Consultants, Inc., a prominent infrastructure and environmental services provider, received a US$ 3 million contract to provide on-call special inspection and materials testing in various healthcare facilities for the Los Angeles County Department of Public Works.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Key North America Testing, Inspection, and Certification Market Player Analysis:

ALS Limited, Applus Services SA, Bureau Veritas SA, DEKRA SE, DNV Group AS, Eurofins Scientific SE, Intertek Group Plc, SGS SA, TUV Rheinland AG, and TUV SUD AG are among the key testing, inspection, and certification market players profiled during this market study. In addition to these players, several other important market players were studied and analyzed during this market research study to get a holistic view of the market in North America and their ecosystem. The leading testing, inspection, and certification market players focus on feature upgrades, expansion and diversification, collaboration, and acquisition strategies, which enable them to grab new business opportunities.

Key Recent Developments in North America Testing, Inspection, and Certification Market:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by North America testing, inspection, and certification market players for increasing their North America testing, inspection, and certification market share. A few recent key North America testing, inspection, and certification market developments are listed below:

- In September 2023, Hexagon Digital Wave, a subsidiary of Hexagon Composites, received an equivalency certificate from Transport Canada (TC) authorizing the usage of its Modal Acoustic Emission (MAE) technology for the requalification of composite overwrapped pressure vessels (COPV) used in virtual pipeline trailers manufactured by Quantum Fuel Systems, which are subject to inspection & testing once every five years.

- In April 2023, DEKRA, a leading testing, inspection, and certification company, and LatticeFlow, a leading artificial intelligence (AI) development and deployment platform provider, formed a strategic partnership to provide AI safety assessments for enterprise clients. The collective offering will deliver the industry’s first AI model assessment service, following the latest ISO standards for data quality and model robustness.

- In May 2022, Intertek, a leading TIC provider, launched Intertek Hydrogen, a revolutionary global platform delivering end-to-end solutions for the hydrogen ecosystem.

North America Testing, Inspection, and Certification Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 81.81 Billion |

| Market Size by 2030 | US$ 132.81 Billion |

| CAGR (2022 - 2030) | 6.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Sourcing Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For