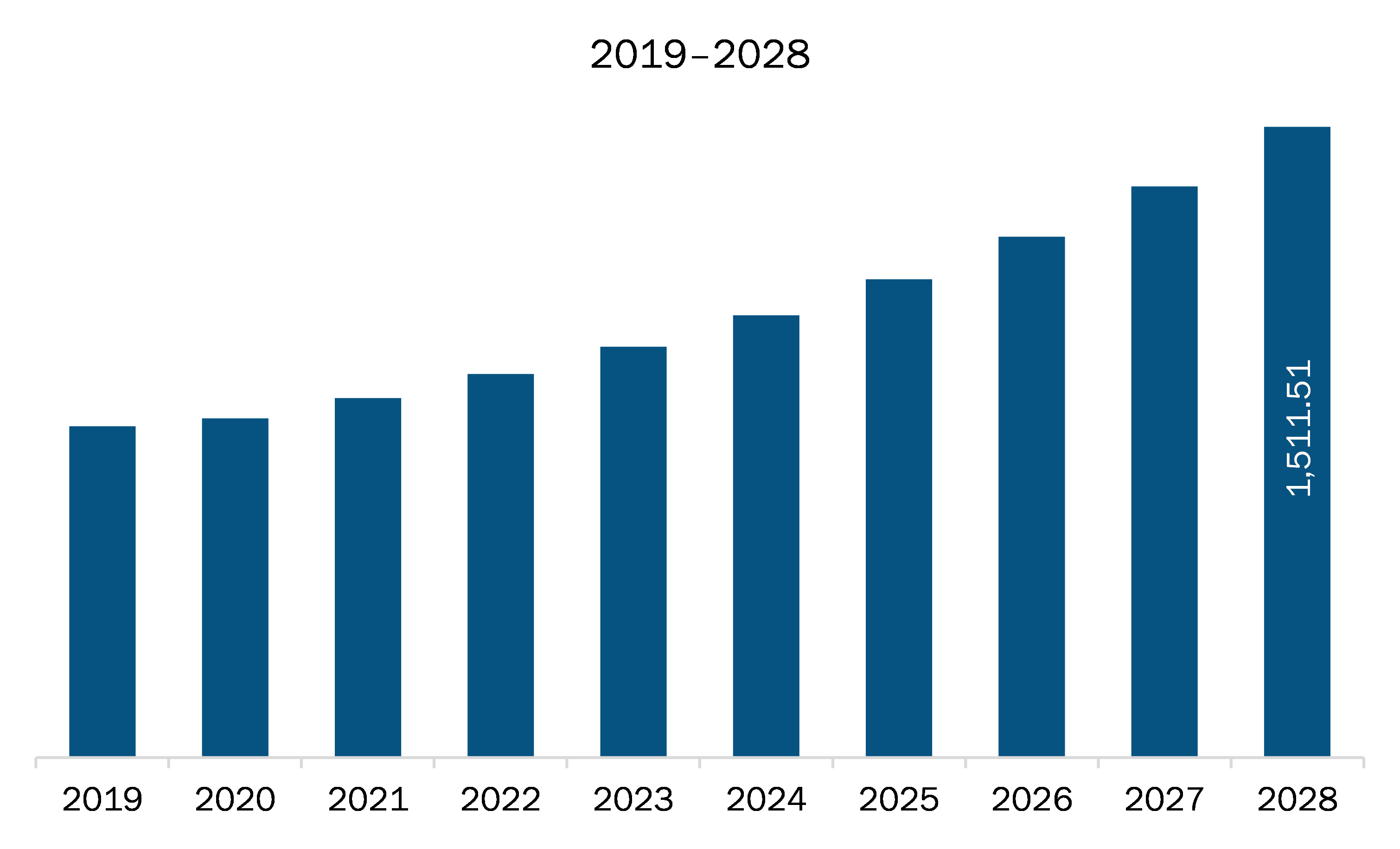

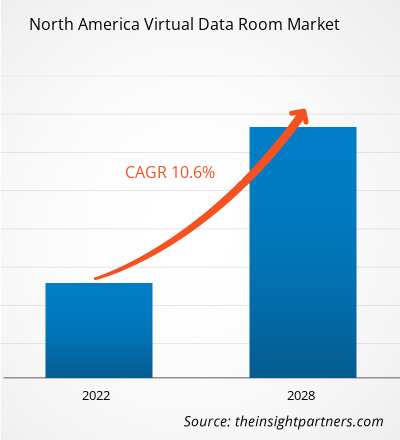

The North America virtual data room market is expected to grow from US$ 675.12 million in 2021 to US$ 1,511.51 million by 2028; it is estimated to grow at a CAGR of 10.6% from 2021 to 2028.

Merger & Acquisition activities, whether auction processes, acquisitions, or mergers, employ technology to enhance deals' success rate and increase productivity. A virtual data room (VDR) has emerged as a due diligence tool, which is technology-based. It intends to promote the use and access of a data room in various business processes across multiple industries, such as Merger & Acquisition activities/transactions and financial investments. The due diligence process is performed by equity research analysts, broker-dealers, fund managers, broker-dealers, and companies going through a merger or an acquisition. The due diligence process is segmented into nine key areas: Compatibility audit, financial audit, macro-environment audit, legal/environmental audit, marketing audit, production audit, management audit, information systems audit, and reconciliation audit. All these areas can be conveniently accessed and managed through a virtual data room, making the due diligence process more effective and timelier.North America witnessed severe impact of the COVID-19 outbreak in 2020. The enactment of lockdowns and travel restrictions, shutdown of production facilities, and shortage of employees adversely affected the performances of major players across multiple industries in North America. However, in the first half of 2021, the disclosed value of M&A deals summed up to US$ 1.2 trillion, compared to just US$ 287.50 billion in the first half of the pandemic-affected 2020. Furthermore, the ongoing adoption of work-from-home and remote work practices across multiple industries has led to a huge demand for virtual data rooms for collaborating important data and documents among the key stakeholders and employees of companies. An August Willis Towers Watson survey of North American organizations found that employers expected 19% of their workforce to be fully remote after the pandemic, from a baseline of 7% before COVID-19. Thus, after a plummeting market due to COVID-19 related uncertainties in 2020, key North American players in the virtual data room market have begun momentum from the second half of 2021.

With the new advancements and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America virtual data room market. The addition of multiple functionalities to improve the due diligence and other aspects of an entire deal with the help of data mining tools have created a more significant potential for VDRs to penetrate across industries. The ongoing development of artificial intelligence AI and machine learning (ML) models have been integrated with VDRs for precise and accurate analysis, classification, and verification of documents. Since AI and ML tools can perform the task of reviewing a large volume of data faster and be accurate at the same time, the demand for an optimized algorithm to ensure effective decision making has increased. For example, to link a related file while typing, AI in a VDR assists in recalling the exact file and connecting it there. Since virtual data rooms primarily store sensitive business information and critical data, any leak or cyber-attack on any such activity could be catastrophic for businesses. Leading VDR providers deploy several different security procedures to aid the safe storage of information, including detailed file permissions, to deal with security breach concerns. For instance, modern Merger & Acquisition virtual data rooms, such as DealRoom, have four file permission options. Promising VDR security features are strict ID protocol, two-factor authentication, encrypted and protected data, and customizable allowances.

North America Virtual Data Room Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Virtual Data Room Market Segmentation

North America Virtual Data Room Market – By Component

- Software

- Service

North America Virtual Data Room Market – By Deployment

- On - Premises

- Cloud

North America Virtual Data Room Market – By Organization Size

- SMEs

- Large Enterprises

North America Virtual Data Room Market – By Business Function

- Merger & Acquisition

- Finance

- Marketing and Sales

- Compliance and Legal

- Workforce Management

- Others

North America Virtual Data Room Market – By End User

- BFSI

- IT & telecommunication

- Healthcare

- Energy & Power

- Retail

- Others

North America Virtual Data Room Market – By Country

- US

- Canada

- Mexico

North America Virtual Data Room Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 675.12 Million |

| Market Size by 2028 | US$ 1,511.51 Million |

| Global CAGR (2021 - 2028) | 10.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

- Ansarada Group Limited

- BMC Group, Inc.

- Brainloop AG

- CapLinked

- EthosData

- iDeals Solutions Group

- Intralinks, Inc.

- Datasite

- Thomson Reuters Corporation

- Donnelley Financial Solutions, Inc.

Get Free Sample For

Get Free Sample For