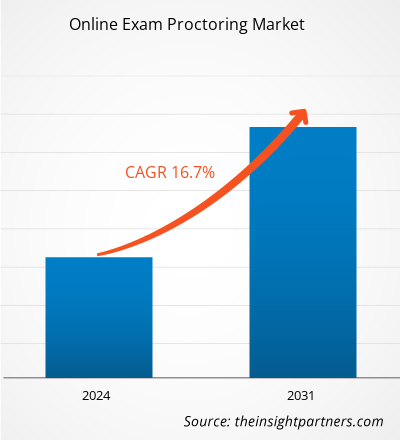

The online exam proctoring market size was valued at US$ 868.95 million in 2024 and is projected to reach US$ 2,346.94 million by 2031; it is expected to register a CAGR of 15.5% during 2025–2031. Integration with blockchain for immutable records is likely to remain a key market trend.

Online Exam Proctoring Market Analysis

Online exam proctoring is a software designed to monitor and oversee the integrity of online assessments, ensuring that exams are conducted fairly and securely, even in remote settings. It uses a combination of video, audio, artificial intelligence (AI), machine learning (ML), biometric authentication, and other monitoring tools to track candidate behavior during an online exam. It prevents cheating, impersonation, or any other unauthorized activities that could compromise the exam’s validity. The three main types of online exam proctoring are live proctoring, automated proctoring, and recorded proctoring. This software is used in educational institutions, professional certification programs, and corporate training environments to ensure the credibility of online assessments and maintain academic and professional standards in remote testing environments.

Online Exam Proctoring Market Overview

Cheating involves using unfair means to gain an undue advantage in a test or an exam. The introduction of remote proctoring solutions has helped eliminate the external factors that lead to cheating. The online exam proctoring market has experienced significant growth, driven by the increasing adoption of e-learning solutions, rising demand from the corporate sector, and the cost-effectiveness of online exam proctoring. The soaring demand for certification and upskilling programs, and AI-enhanced proctoring are expected to provide growth opportunities for the market in the upcoming years. Integration with blockchain for immutable records is likely to be a key future trend in the online exam proctoring market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Online Exam Proctoring Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Online Exam Proctoring Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Online Exam Proctoring Market Drivers and Opportunities

Increasing Adoption of E-Learning Solutions

Online learning is experiencing rapid adoption among students and working professionals. As it becomes an integral part of mainstream education, e-learning delivers advantages over traditional models, including enhanced accessibility, greater flexibility, and scalable delivery. According to the Yellow Bus ABA, in March 2025, nearly half (49%) of students participated in online learning globally, underscoring its widespread reach. In the US, daily engagement stands even higher, with 63% of students actively using digital education tools, demonstrating a dependence on virtual learning platforms. In 2024, 33% of internet users in the European Union (EU) reported using an online course or digital learning materials within the past three months, marking a 3-percentage-point increase from 30% in 2023. This growth reflects the continued expansion of online education across the region.

The Japan Online Training & Education Industry Association (JOTEA) is promoting e-learning initiatives and advising government stakeholders on policies to support sector development. JOTEA is driving industry engagement through the e-Learning Award Forum, aimed at accelerating growth and collaboration within the e-learning ecosystem. In May 2024, tourism professionals in the region gained access to a robust portfolio of professional development courses through the launch of the EAC Online Tourism Capacity Development Programme. Developed in partnership with the EU and the German Development Cooperation Agency (GIZ), the initiative is designed to raise industry standards and strengthen the skillsets of tourism practitioners across the region. According to March 2025 data, each year, between 30,000 and 40,000 exams are proctored online across the 17 campuses of the University of North Carolina (UNC). As educational institutions and organizations transition to digital platforms for training and assessment, the need for secure and scalable remote testing solutions is surging. Online proctoring plays a critical role in maintaining academic integrity, minimizing fraud, and enabling flexible learning environments. This alignment between digital learning and proctoring technologies is accelerating their integration across schools, universities, and corporate training programs.

Rising Demand for Certification and Upskilling Programs

According to Learning & Development (L&D) professionals, 79% believe that reskilling an existing employee is more cost-effective than hiring a new one. 57% of respondents identified improving job performance as the primary driver for upskilling and reskilling initiatives. These efforts were seen as key factors in enhancing employee retention (52%) and fostering stronger employee engagement (49%). Great Learning's newly published 'Upskilling Trends Report 2024-25' reveals that 85% of professionals in India intend to allocate resources toward upskilling efforts in FY25. As individuals strive to enhance their qualifications and stay competitive in the job market, the need for secure online assessments has surged. With an increasing number of professional courses and certifications shifting to digital platforms, maintaining exam integrity has become paramount. Certification vendors that offer proctored online certification exams are Cisco, EC-Council, ISACA, and CompTIA. Cisco initiated the delivery of its certification exams through online proctoring in partnership with Pearson VUE, enabling candidates to complete assessments remotely in a secure, controlled environment.

Online proctoring solutions offer institutions the ability to monitor test-takers, ensure fairness, and minimize cheating risks. The combination of convenient remote testing and advanced proctoring technologies is enabling access to high-quality education while allowing learners to demonstrate their skills. Thus, rising demand for certification and upskilling programs is expected to create future growth opportunities for the online exam proctoring market.

Online Exam Proctoring Market Report Segmentation Analysis

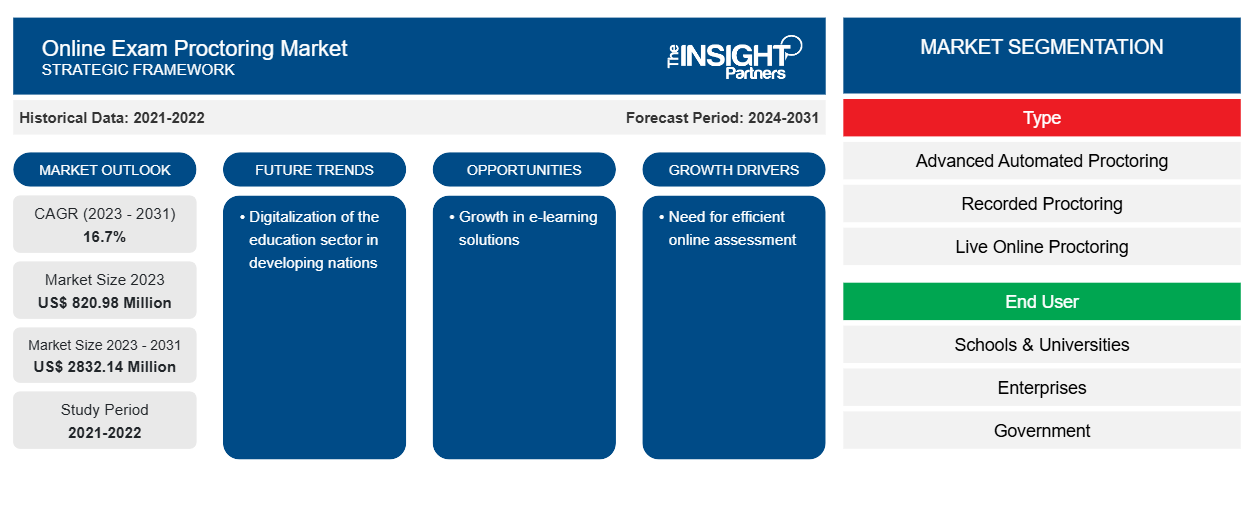

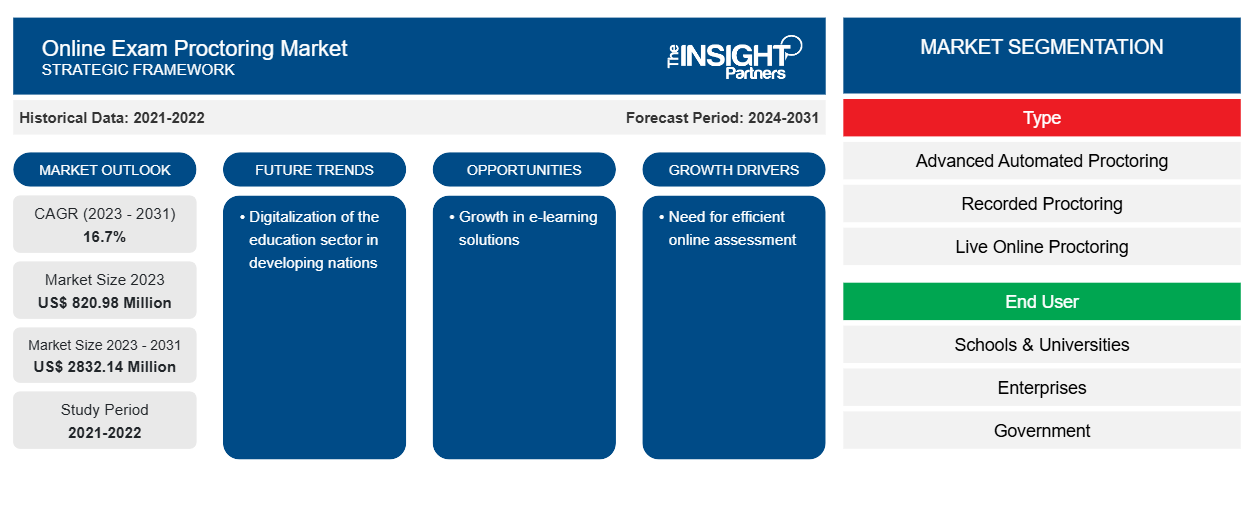

Key segments that contributed to the derivation of the online exam proctoring market analysis are type, deployment, and end user.

- Based on type, the market is divided into advanced automated proctoring, recorded proctoring, and live online proctoring. The advanced automated proctoring segment dominated the market in 2024.

- By deployment, the market is bifurcated into cloud and on-premises. The cloud segment dominated the market in 2024.

- Per end user, the online exam proctoring market is segmented into educational institutions, online learning platforms, enterprises, and government. The educational institutions segment dominated the market in 2024.

Online Exam Proctoring Market Share Analysis by Geography

- The online exam proctoring market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the online exam proctoring market in 2024. Europe is the second-largest contributor to the global online exam proctoring market, followed by Asia Pacific.

- Online exam proctoring is seeing widespread adoption across North America, driven by the need for flexible, secure, and scalable testing solutions, particularly in the post-pandemic landscape. Educational institutions and government bodies are leveraging technology to uphold academic integrity in remote learning settings. The US Department of Education's support for distance learning and Canada's investment in digital education tools have accelerated this shift. Proctoring platforms, combining AI technology with human oversight, ensure secure and fair assessments. As hybrid and online education models become more prevalent, these solutions play a vital role in preserving the credibility and reliability of academic evaluations. Universities across the region are adopting online end-to-end exam monitoring. In March 2021, Students at the University of Alberta advocated for the continuation of online proctoring services designed to prevent cheating as final exams draw near. Courses in the university have employed tools such as Smart Exam Monitoring and Exam Lock, which run in the background on students' computers during tests, tracking movements to identify potential signs of cheating.

Online Exam Proctoring Market Regional Insights

The regional trends and factors influencing the Online Exam Proctoring Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Online Exam Proctoring Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Online Exam Proctoring Market

Online Exam Proctoring Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 868.95 Million |

| Market Size by 2031 | US$ 2,346.94 Million |

| Global CAGR (2025 - 2031) | 15.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

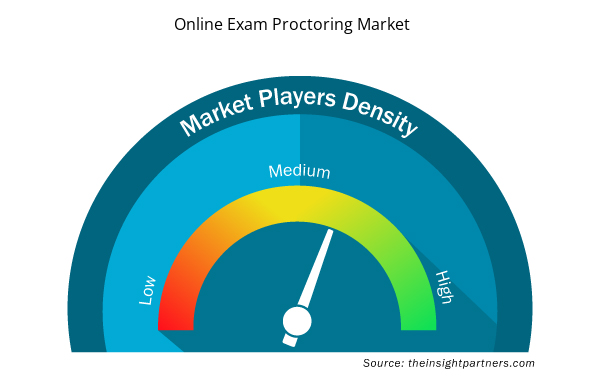

Online Exam Proctoring Market Players Density: Understanding Its Impact on Business Dynamics

The Online Exam Proctoring Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Online Exam Proctoring Market are:

- Comprobo

- Honorlock Inc.

- Inspera AS

- ProctorEdu LLC

- Verificient Technologies, Inc (Proctortrack)

- PSI Services LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Online Exam Proctoring Market top key players overview

Online Exam Proctoring Market News and Recent Developments

The online exam proctoring market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Key developments in the online exam proctoring market are listed below:

- Inspera, a global digital assessment provider, announced the renewal of its partnership with the University of Auckland, New Zealand, for an additional three years with a two-year extension option. This contract extension reinforces the strong collaboration between the partners and underscores Inspera's position as a trusted leader in digital assessment and continued commitment to delivering flexible assessments with integrity.

(Source: Inspera, Press Release, February 2025)

- Proctortrack, a premier global proctoring company, celebrated a milestone of 350,000 secured exam sessions globally with its partner, Janison, a global test delivery firm. Since 2013, Proctortrack by Verificient has delivered reliable exam integrity in more than 130 countries.

(Source: Proctortrack, Press Release, January 2025)

Online Exam Proctoring Market Report Coverage and Deliverables

The "Online Exam Proctoring Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Online exam proctoring market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Online exam proctoring market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Online exam proctoring market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the online exam proctoring market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, Chile, China, Colombia, France, Germany, India, Italy, Japan, Mexico, Peru, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the estimated global market size for the online exam proctoring market in 2024?

The online exam proctoring market was valued at US$ 868.95 million in 2024 and is projected to reach US$ 2,346.94 million by 2031; it is expected to grow at a CAGR of 15.5% during 2025–2031.

What will be the online exam proctoring market size by 2031?

The online exam proctoring market is expected to reach US$ 2,346.94 million by the year 2031.

What are the driving factors impacting the online exam proctoring market?

Increasing adoption of e-learning solutions, rising demand from the corporate sector, and cost effectiveness of online exam proctoring are the driving factors impacting the online exam proctoring market.

Which are the key players holding the major market share of online exam proctoring market?

The key players, holding majority shares, in online exam proctoring market includes PSI Services LLC, ProctorU, Mercer LLC, Meazure Learning, and Honorlock Inc.

What are the future trends of the online exam proctoring market?

Integration with blockchain for immutable records are the future trends of the online exam proctoring market.

Which region is holding the major market share of online exam proctoring market?

The North America held the largest market share in 2024, followed by Europe.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Online Exam Proctoring Market

- Comprobo

- Honorlock Inc.

- Inspera AS

- ProctorEdu LLC

- Verificient Technologies, Inc (Proctortrack)

- PSI Services LLC

- Talview Inc

- TestReach Ltd.

- Meazure Inc

- Mercer LLC

Get Free Sample For

Get Free Sample For