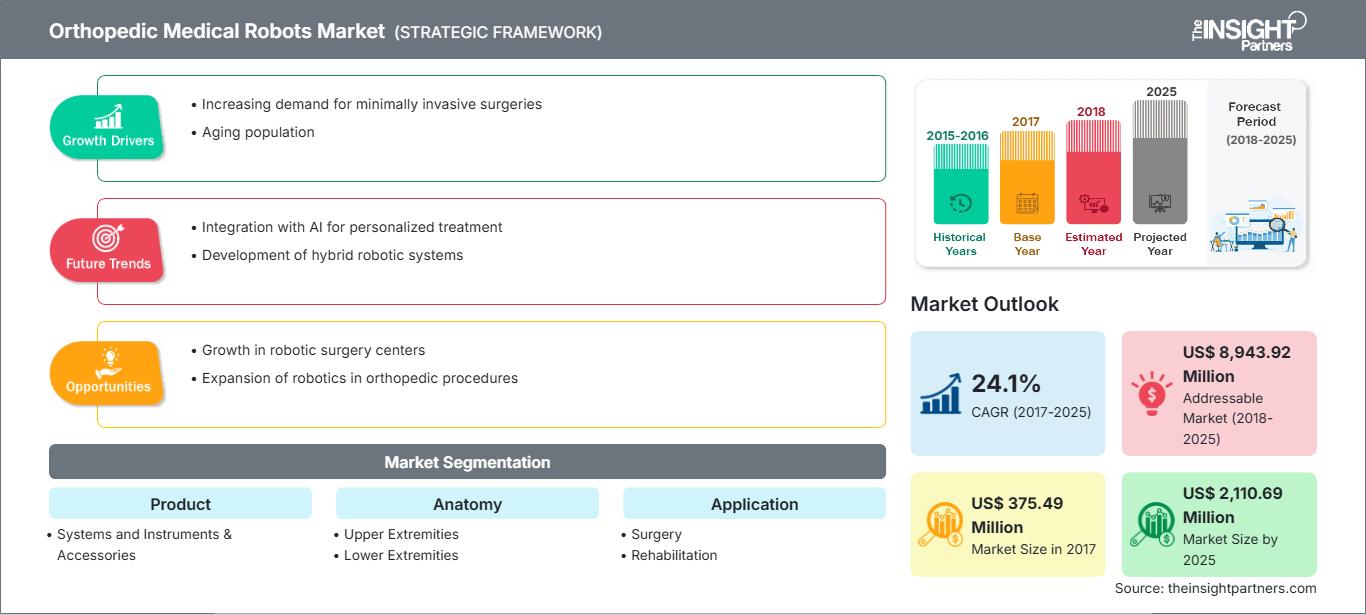

Orthopedic Medical Robots Market Trends and Analysis by 2025

Orthopedic Medical Robots Market to 2025 - Global Analysis and Forecasts by Product (Systems and Instruments & Accessories), Anatomy (Upper Extremities, Lower Extremities, and Others), Application (Surgery, Rehabilitation, and Others), End User (Hospitals, Orthopedic Clinics, and Ambulatory Surgical Centers) and Geography

Historic Data: 2015-2016 | Base Year: 2017 | Forecast Period: 2018-2025- Report Date : Dec 2018

- Report Code : TIPMD00002588

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 192

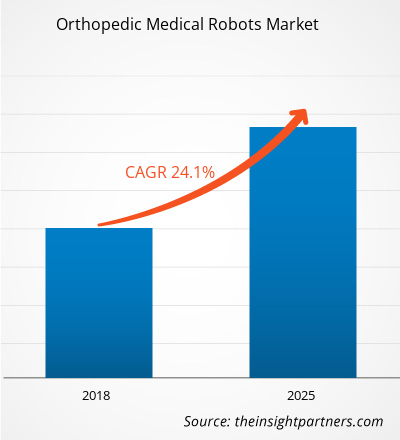

The Orthopedic Medical Robots market was valued at US$ 375.49 million in 2017 and it is projected to reach US$ 2,110.69 million by 2025; it is expected to grow at a CAGR of 24.1% from 2018 to 2025.

Orthopedic medical robots refer to the robotic systems and equipment used in medical institutions to aid physicians in an orthopedic surgery as well as post-surgical care and rehabilitation. Moreover, the automated guided vehicles also serve as lifting aids during surgical and assistive care procedures. The growth of the Orthopedic Medical Robots market is attributed to the increasing number of musculoskeletal diseases, rise in funds allocated for medical robotics research and technological developments in orthopedic surgical robots are expected to be the prominent drivers of the global orthopedic medical robots market. However, high costs and safety concerns associated with the robotic systems are likely to refrain the growth of market to a certain extent. In addition, the increased patient preferences towards robot-assisted surgeries and development in the healthcare market are likely to have a positive impact on the growth of the orthopedic medical robots market in the coming years.

The Orthopedic Medical Robots market is expected to witness substantial growth post-pandemic. The Orthopedic Medical Robots market is expected to witness substantial growth post-pandemic. The COVID-19 has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The COVID-19 crisis has overburdened public health systems in many countries and highlighted the strong need for sustainable investment in health systems. As the COVID-19 pandemic progresses, the healthcare industry is expected to see a drop in growth. The life sciences segment thrives due to increased demand for invitro diagnostic products and rising research and development activities worldwide. However, the medical technologies and imaging segment is witnessing drop in sales due to a smaller number of surgeries being carried out and delayed or prolonged equipment procurement. Additionally, virtual consultations by healthcare professionals are expected to become the mainstream care delivery model post-pandemic. With telehealth transforming care delivery, digital health will continue to thrive in coming years. In addition, disrupted clinical trials and the subsequent delay in drug launches is also expected to pave the way for entirely virtual trials in the future. New technologies such as mRNA is expected to emerge and shift the pharmaceutical industry and market is also expected to witness more vertical integration and joint ventures in coming years.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOrthopedic Medical Robots Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growing Applications of Orthopedic Medical Robots in Healthcare to Drive Orthopedic Medical Robots in Healthcare Market Growth

Musculoskeletal conditions comprise of over 150 diagnoses that affect the locomotor system of the muscles, bones, joints, tendons and ligaments. These disorders range from the ones that arise suddenly and are short-lived such as fractures, sprains and strains to lifelong conditions associated with disability and ongoing pain. Majority of musculoskeletal conditions are characterized by pain, limitations in mobility, dexterity and functional ability, reducing people’s ability to work and participate in social roles with associated impacts on mental wellbeing, and at a broader level impacts on the prosperity of communities. Musculoskeletal conditions affect people across the life-course in all regions of the world. While the prevalence of musculoskeletal conditions increases with age, younger people are also affected, often during their peak income-earning years. According to the World Health Organization (WHO), the prevalence and impact of musculoskeletal conditions is predicted to rise with the ageing global population as well as increase in prevalence of risk factors for non-communicable diseases (NCD).

According to the 2018 factsheet by World Health Organization, musculoskeletal conditions are the second largest contributor to disability worldwide, with low back pain being the single leading cause of disability globally. Moreover, according to the Global Burden of Diseases (GBD), the impact of musculoskeletal diseases (MSD) highlighted significant burden and were reported to be second largest cause of disability associated burden in its 2016 study report. Additionally, the WHO also reports that between 20%–33% of people across the globe live with a painful musculoskeletal condition. Musculoskeletal diseases are one of the most common causes of severe and long-term pain as well as physical disability in the US. According to the American Society of Orthopedic Surgeons (ASOS), an estimated 126.6 million Americans in 2016 were affected by a musculoskeletal condition. Moreover, according to the data released by American Academy of Orthopedic Surgeons’ annual meeting in 2016, approximately 1 in 2 adults suffered with musculoskeletal disorder in the US. Given the significant rising impact of musculoskeletal disorders, potential applications of navigation and robotic technologies for orthopedic problems such as knee, hip and spine injuries are likely to boom and flourish witnessing their robust existence in the treatment and patient care in the future.

The increasing number of musculoskeletal diseases are directly responsible for the increasing number of orthopedic surgical procedures across the world. According to the 2017 report of the American Joint Replacement Surgery, approximately 860,080 hip and knee replacement procedures by 4,755 surgeons were performed in 654 medical institutions in the US. Additionally, according to the Journal of Bone and Joint Surgery 2015, around 7 million Americans are living with a hip or knee replacement, and consequently, in most cases, are mobile, despite advanced arthritis. These numbers underscore the substantial public health impact of total hip and knee arthroplasty. The trends of high number of orthopedic procedures can also be witnessed in the Asian countries as well. According to the International Osteoporosis Foundation (IOF), there are approximately 600,000 hip fractures cases per year in China that demands emergency medical treatment. The rising number of patient pool propels the growth of the orthopedic medical robots worldwide.

Medical robots that helps the surgeons to improve their efficiency and accuracy with the help of various artificial intelligence (AI) supported systems can lead to improved patient outcomes, efficiency and accuracy in the treatment procedure. Medical robotics is causing a paradigm shift in therapy. New uses for medical robots are created regularly, as in the initial stages of any technology-driven revolution.

Orthopedic robots have so far targeted the hip and knee for replacements or resurfacing. However, robotic systems for various surgeries of upper extremities are still in early stages and not yet convincingly commercialized. Increasing investments in the field of medical robotics is thus likely to generate ample revenue to conduct these studies leading to the introduction of new systems in the market thereby propelling the global orthopedic medical robots market.

Innovations in healthcare robotics are making it possible to identify, invent, investigate, and implement technologies that deliver the right treatment to the right patient at that right time. Moreover, the immense potential of robotics to change the treatment delivery, patient care and access to medical facilities are driving the interest of investors to offer significant finance to the manufacturers as well as researchers. For instance, in July 2018, OrthoSpin Ltd., announced that the company completed an investment round of US$ 3 Mn for its smart, robotic external fixation system for orthopedic treatments.

Moreover, in June 2018, CMR Surgical Ltd, the British company developing a next-generation surgical robot, announces that it has closed a Series B funding round raising $100 million from new investor, Zhejiang Silk Road Fund and existing investors Escala Capital Investments, LGT, Cambridge Innovation Capital and Watrium. The Versius system intends to act as a four-axis wrist joint is inspired by the human arm and is designed to meet requirements of laparoscopic surgery. The massive investments by local and international investors in the field of orthopedic medical robots is likely to support the global market growth over the years to come.

Modern surgeries relies not only on the practice of skilled professionals, but also the appropriate use of state-of-art technology based advanced surgical equipment to gain an effective and accurate treatment outcomes. Similar to other innovative concepts, orthopedic robotics and navigation are still in the transition phase resulting into introduction of new systems and advanced technologies at relative intervals in the market. The researchers and manufacturers are heavily investing into designing and conceptualizing these robotic systems to ease the job of care-givers as well as offer innovative solutions to the orthopedic patients. Recently introduced systems circumvent this requirement and allow the templates to be directly applied to the joint surface, permitting less-invasive techniques. A number of systems have been introduced that incorporate similar basic principles.

The manufacturers of these systems are consistently focused towards helping the surgeons worldwide to perform better, niche and more complex surgeries with easier visualization and critical care management through technological improvements in the orthopedic robots. For instance, in March 2017, Stryker Corporation introduced the Mako robot intended to perform knee replacement and partial knee replacement procedures. Following the Stryker’s launch, Smith & Nephew in November 2017 introduced a cost-efficient Navio robotic surgical system competing the Stryker’s Mako that offers both partial and total knee options.

Several leading market players have their products in pipelines and are likely to introduce their systems featuring latest innovations and technologies in the near future. For instance, Zimmer Biomet announced to launch a robot-assisted surgical platform to perform total knee procedures in the latter half of 2018 at the annual conference of the American Academy of Orthopedic Surgeons in San Diego conducted in 2017. Moreover, Johnson & Johnson is aimed to mark its entry in the orthopedic medical robots market through its acquisition of Orthotaxy Ltd., which is currently in early-stage development for total and partial knee replacement. Thus, the upcoming launches offering new and cutting edge technology products are expected to propel the growth of orthopedic medical robots market over the forecast years.

Product-Based Insights

In terms of product, the Orthopedic Medical Robots market is segmented into systems and instruments & accessories. In 2017, the instruments and accessories segment held the largest share of 60.7% of the total market, by product owing to recurring purchase of these components along with the capital robotic systems.

Anatomy-Based Insights

Based on anatomy, the Orthopedic Medical Robots market is segmented into upper extremities, lower extremities, and others. In 2017, lower extremities segment is anticipated to grow at a CAGR of 24.6% during the forecast period. The lower extremities segment held the largest share of the market, by anatomy as the current orthopedic robotic systems are majorly dedicated to perform surgeries of lower extremities.

Application-Based Insights

Based on application, the Orthopedic Medical Robots market is segmented into surgery, rehabilitation, and others. In 2017, surgery segment is anticipated to grow at a CAGR of 24.5% during the forecast period. The surgery segment held the largest share of the market, by application owing to the fact that orthopedic robots available in the market are majorly intended to perform surgical tasks.

End User-Based Insights

In terms of end user, the Orthopedic Medical Robots market is segmented into hospitals, orthopedic clinics, and ambulatory surgical centers. Hospitals segment is anticipated to grow at a CAGR of 24.5% during the forecast period. The hospitals segment held the largest share of 53.6% in the market, by end user.

The Orthopedic Medical Robots market players are adopting the product launch and expansion strategies to cater to changing customer demands worldwide, which also allows them to maintain their brand name globally.

Orthopedic Medical Robots Market Regional InsightsThe regional trends and factors influencing the Orthopedic Medical Robots Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Orthopedic Medical Robots Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Orthopedic Medical Robots Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 375.49 Million |

| Market Size by 2025 | US$ 2,110.69 Million |

| Global CAGR (2017 - 2025) | 24.1% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Orthopedic Medical Robots Market Players Density: Understanding Its Impact on Business Dynamics

The Orthopedic Medical Robots Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Orthopedic Medical Robots Market top key players overview

Orthopedic Medical Robots in Healthcare Market – by Product

- Systems

- Instruments & Accessories

Orthopedic Medical Robots in Healthcare Market – by Anatomy

- Upper Extremities

- Hand

- Elbow

- Wrist

- Shoulder

- Lower Extremities

- Knee

- Foot & Ankle

- Hips

- Others

- Others

Orthopedic Medical Robots in Healthcare Market – by Application

- Surgery

- Rehabilitation

- Others

Orthopedic Medical Robots in Healthcare Market – by End User

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

Orthopedic Medical Robots in Healthcare Market – by Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- UK

- Spain

- Rest of Europe

-

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

-

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

-

South America and Central America (SCAM)

- Brazil

- Argentina

- Rest of SCAM

Company Profiles

- Smith & Nephew

- Stryker

- Medtronic

- intuitive Surgical

- Ekso Bionics

- Zimmer Biomet

- Wright Medical Group N.V.

- General Electric

- THINK Surgical

- OMNI

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For