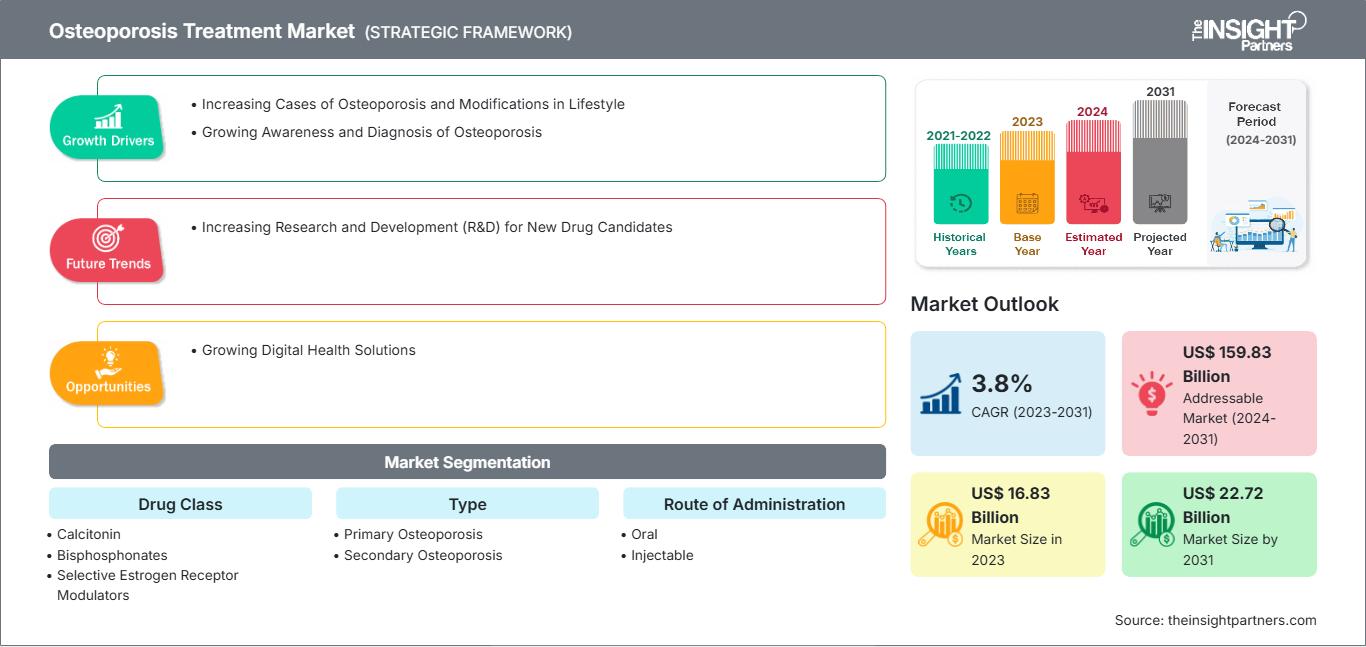

Osteoporosis Treatment Market Growth Drivers and Forecast by 2031

Osteoporosis Treatment Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Drug Class (RANKL, Bisphosphonates, Selective Estrogen Receptor Modulators (SERMs), Hormone Therapies, and Others), Type (Primary Osteoporosis and Secondary Osteoporosis), Route of Administration (Oral and Injectable), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Mar 2026

- Report Code : TIPRE00004071

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

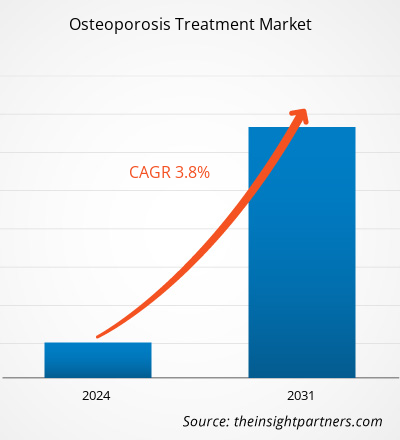

The osteoporosis treatment market size is projected to surge from US$ 16.83 billion in 2023 to US$ 22.72 billion by 2031; the market is estimated to record a CAGR of 3.8% during 2023–2031.

Analyst Perspective:

The report includes growth prospects owing to the current osteoporosis treatment market trends and their foreseeable impact during the forecast period. Osteoporosis can cause bones to become brittle to an extent that a minor fall can result in fractures, thereby affecting the quality of life. Early detection and treatment help in slowing or even stopping the progression of osteoporosis, in turn, reducing the risk of fractures. Thus, the prevalence of osteoporosis increases the need for diagnosis, which subsequently boosts the growth of the osteoporosis treatment market. Osteoporosis is mainly observed in women due to hormonal changes at menopause that affect the bone density. Apart from hormonal changes, other factors that increase the risk of osteoporosis in aging individuals are rheumatoid arthritis, a family history of osteoporosis, and long-term use of medications that affect bone strength. According to the International Osteoporosis Foundation, of the majority of people who have osteoporosis, 25% are women and 5% are men aged over 65.

Market Overview:

Osteoporosis is a progressive disease associated with high-risk fractures in men, postmenopausal women, and the geriatric population. Osteoporosis patients are particularly prone to bone, hip, forearm, spine, and wrist fractures. Therefore, it is described as a metabolic disease that lowers bone mineral density and leads to bone fractures. The therapeutic arsenal often includes bisphosphonates, hormone therapy, denosumab, and a range of nutritional supplements recommended along with lifestyle adjustments such as increased physical activity and a calcium-rich diet. Key factors driving the osteoporosis treatment market growth include an increase in healthcare spending on discovery and drug development and increasing awareness about available drugs for the treatment of osteoporosis.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOsteoporosis Treatment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing Cases of Osteoporosis and Modifications in Lifestyle Propel Market Growth

The prevalence of osteoporosis is increasing worldwide, largely due to improper lifestyle, poor diet, lack of exercise, inadequate calcium and vitamin D intake, and hormonal imbalance. As per the International Osteoporosis Foundation, more than 8.9 million fractures are caused because of osteoporosis annually, resulting in one osteoporotic fracture every three seconds, and it is estimated that it affects 200 million women worldwide. The increasing geriatric population is also an important factor driving the osteoporosis treatment market growth. According to a study published in Labiotech, "Advancements in Osteoporosis Research," about 10 million Americans have osteoporosis. ~44 million people have low bone density, putting them at an increased risk of osteoporosis. The risk of developing osteoporosis significantly increases with age; it is estimated that adults aged 50 and above are at high risk of fracture. Three-quarters of adults aged 65 and older suffering from hip fractures annually in the US are women, and it is estimated that around 15–36% of hip fracture patients die within a year. A broader emphasis on holistic health and wellness encourages the adoption of regular health screenings, including bone density scans. As individuals proactively monitor their bone health, early diagnosis and interventions are becoming increasingly important, further stimulating the expansion of the market. The osteoporosis treatment market is receiving significant impetus from increasing awareness about bone health, which drives the demand for preventive and therapeutic solutions.

Segmental Analysis:

The osteoporosis treatment market analysis has been carried out by considering the following segments: drug class, type, route of administration, and distribution channel.

Based on drug class, the osteoporosis treatment market is segmented into RANKL, bisphosphonates, selective estrogen receptor modulators (SERM), hormone therapies, and others. The RANKL segment held the largest market share in 2023. However, the hormone therapies segment is estimated to register the highest CAGR during 2023–2031. The bisphosphonates segment also holds a considerable share in the osteoporosis treatment market. Bisphosphonates, which include compounds such as alendronate and zoledronic acid, have proven to be effective in inhibiting bone resorption, increasing bone density, and minimizing the risk of fractures. Their extensive clinical history, regulatory approvals, and availability of oral and intravenous formulations make them the preferred choice by healthcare professionals. Furthermore, their cost-effectiveness and comprehensive insurance coverage contribute to their wide adoption in the osteoporosis treatment market.

The market, based on type, is bifurcated into primary osteoporosis and secondary osteoporosis. The primary osteoporosis segment held a larger osteoporosis treatment market share in 2023. Primary osteoporosis occurs with aging, which results in slow bone renewal. According to a study published in the National Library of Medicine titled “Prevalence of Primary Osteoporosis and Low Bone Mass in Postmenopausal Women and Associated Risk Factors,” 30% of women aged over 50 have osteoporosis worldwide. 8–9% of bone fractures per year are known to be caused by osteoporosis. In addition, men and women aged 70 years and above experience an imbalance between bone formation and loss, leading to back pain, reduced quality of life, and impairment of daily activities.

Based on the route of administration, the osteoporosis treatment market is bifurcated into oral and injectable. The injectable segment held the largest osteoporosis treatment market share in 2023. The injectable segment is anticipated to register the highest CAGR during 2023–2031. The dominant presence of the injectable segment in the market can be attributed to its effectiveness and reliability as a drug delivery method. Administering treatment through injections ensures direct entry of the drug into the bloodstream, resulting in rapid and predictable absorption, which is a key advantage in the treatment of osteoporosis. Additionally, certain osteoporosis medications are available only in injectable form, further promoting its market share. With improving patient compliance for self-administered injections and the continued development of innovative drug delivery solutions, the injectable segment is poised to maintain its strong market position.

Regional Analysis:

The scope of the osteoporosis treatment market report includes North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America was valued at US$ 8.26 billion in 2023 and is projected to reach US$ 11.26 billion by 2031; it is expected to register a CAGR of 3.9% during 2023–2031. One of the key factors driving the market growth in this region is the significant aging population in the region, with greater awareness of osteoporosis. Second, advanced healthcare infrastructure and comprehensive access to medical services enable timely diagnosis and treatment. In addition, the presence of large pharmaceutical companies and ongoing research and development initiatives are encouraging the introduction of innovative therapies. Finally, favorable reimbursement policies and insurance coverage support patients seeking osteoporosis treatment, promoting the osteoporosis treatment market in North America.

The Asia Pacific osteoporosis treatment market is expected to record the highest CAGR of 4.7%. The region, especially with countries such as India and China, is home to a sizable pharmaceutical industry. China is a pharmaceutical manufacturing hub. The projected market growth in this region is attributed to the growing middle class and increased accessibility to healthcare. Additionally, improvements in healthcare infrastructure and the emerging pharmaceutical sector make the Asia Pacific a hub for the significant growth and development of the osteoporosis treatment market.

Osteoporosis Treatment Market Regional InsightsThe regional trends and factors influencing the Osteoporosis Treatment Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Osteoporosis Treatment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Osteoporosis Treatment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 16.83 Billion |

| Market Size by 2031 | US$ 22.72 Billion |

| Global CAGR (2023 - 2031) | 3.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Drug Class

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Osteoporosis Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The Osteoporosis Treatment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Osteoporosis Treatment Market top key players overview

Key Player Analysis:

Pfizer Inc.; Amgen Inc.; Cadila Pharmaceuticals; Eli Lilly and Company; Daiichi Sankyo Company, Limited; Teva Pharmaceuticals Inc.; Asahi Kasei Corporation; Novartis AG; Chugai Pharmaceutical Co., Ltd.; and Teijin Pharma Limited are among the key players profiled in the osteoporosis treatment market report.

Recent Developments:

Companies operating in the osteoporosis treatment market adopt mergers and acquisitions as key growth strategies. As per company press releases, a few recent market developments are listed below:

- In October 2021, Entera Bio, a leading biotechnology company, released key data for its mid-stage oral osteoporosis drug formulation study. The company has advanced Phase 3 registration of this study.

- In August 2021, the Drug Controller General of India (DCGI) gave Marketing Authorization (MA) to Enzene Biosciences Ltd, for its biosimilar drug Denosumab, which is indicated for treating osteoporosis in adults.

- In January 2021, Theramex, a pharmaceutical company headquartered in London, launched the osteoporosis drug Livogiva in Europe.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For