Peptide Therapeutics Market Growth Drivers and Forecast by 2031

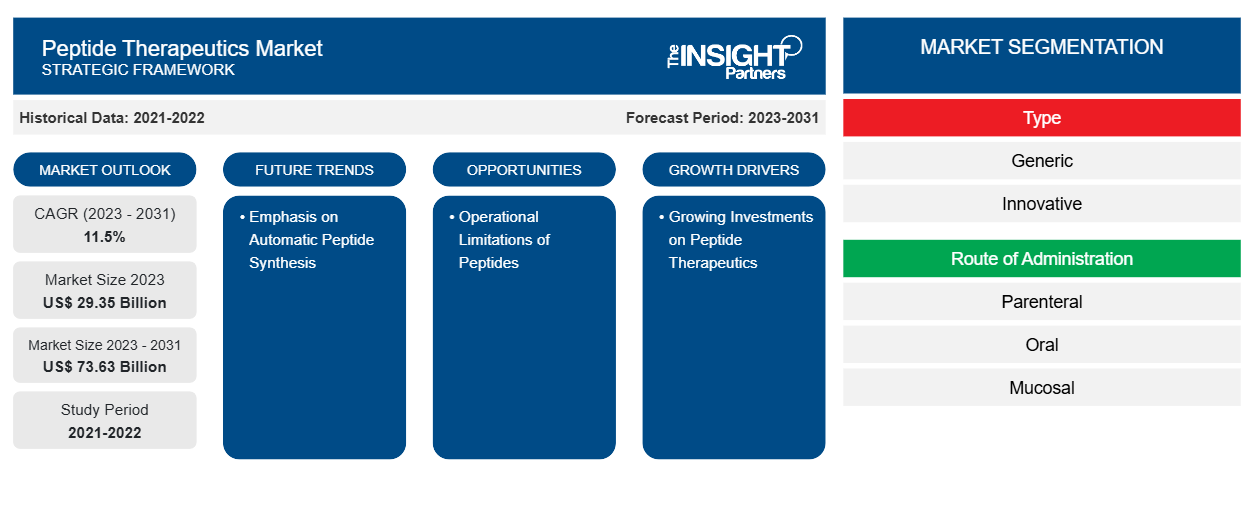

Peptide Therapeutics Market Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Generic and Innovative), Route of Administration (Parenteral, Oral, Mucosal, Pulmonary, and Others), Synthesis Technology [Solid Phase Peptide Synthesis (SPPS), Liquid Phase Peptide Synthesis (LPPS), and Hybrid Technology], Application (Cancer, Cardiovascular Disorder, Metabolic Disorder, Respiratory Disorder, Pain, and Dermatology), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : Mar 2026

- Report Code : TIPRE00003793

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

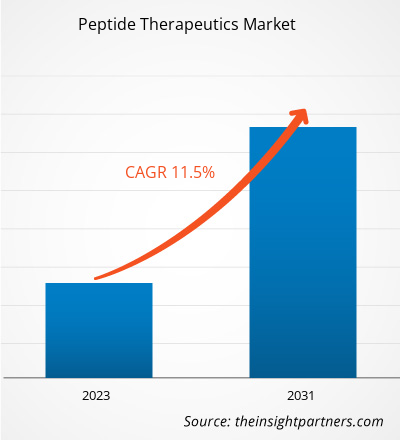

The peptide therapeutics market size is projected to reach US$ 73.63 billion by 2031 from US$ 29.35 billion in 2023. The market is expected to register a CAGR of 11.5% in 2023–2031. Growing popularity reducing the pace of manufacturing of peptide drugs and adoption of new technologies are likely to remain key peptide therapeutics market trends.

Peptide Therapeutics Market Analysis

As the global burden of chronic diseases increases, the demand for targeted and efficient therapeutic approaches increases. With their precision and specificity, peptide therapeutics are proving to be a compelling solution that meets the therapeutic needs of various chronic diseases. Robust research pipelines promise a future full of novel and breakthrough peptide therapeutics. The shift toward personalized medicine is consistent with the unique properties of peptide therapeutics. As peptides show promise in treating rare diseases, pharmaceutical companies focus on developing therapeutic solutions for niche patient populations. Innovations in synthetic methods lead to more complex and specialized peptides, expanding the therapeutic arsenal available to healthcare professionals. Further, combined efforts in research initiatives between scientists and market players drive innovation in the peptide therapeutics market. Additionally, partnerships and alliances create synergies that advance the development of cutting-edge peptide-based therapies. However, stringent regulations and high drug development costs are expected to restrain market growth.

Peptide Therapeutics Market Overview

The peptide therapeutics market is emerging as a dynamic and promising sector within the pharmaceutical industry, offering a unique approach to treating various diseases and medical conditions. Peptide therapeutics composed of short amino acid sequences have attracted considerable attention due to their specificity, efficacy, and potential applications in various therapeutic areas. This emerging market stands at the intersection of innovation and medical science and is poised to reshape the healthcare landscape. The market includes various peptides, from naturally occurring to synthetic analogs, designed for improved therapeutic results. These peptides are versatile agents targeting specific receptors, enzymes, or cellular mechanisms, making them a valuable tool in precision medicine.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPeptide Therapeutics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Peptide Therapeutics Market Drivers and Opportunities

Increasing Prevalence of Metabolic Disorders and Infectious Diseases to Favor Market

As per an article in the National Library of Medicine, infectious diseases remain a leading cause of sickness and mortality worldwide, causing more than 52 million deaths per year worldwide. According to the IDF published in December 2021, an estimated 14 million adults in Mexico have diabetes. Peptides such as amide (GLP-1) are effective in treating diabetes. In February 2022, the Nova Scotia provincial government reported that Nova Scotians have registered in pharmacare programs that would begin switching to a biosimilar version of certain biologic medicines, including some insulins and medications, for the treatment of Crohn's disease and rheumatism. The increasing cases of some metabolic disorders, such as organ dysfunction, genetic disorders, and mitochondrial dysfunction, are one of the factors that drive the market growth. The progressive storage of glucocerebrosides in macrophages, primarily in the bone, bone marrow, spleen, and liver are the indications of Gaucher disease (GD) which is an autosomal recessive lysosomal storage disorder. As per the Journal of Pediatric Haematology/Oncology (JPHO), in July 2022, the prevalence of GD cases per 100,000 live births worldwide was 1.5. Therefore, the high prevalence of infectious and metabolic diseases drives the demand for peptide therapeutics for treating these diseases, thereby boosting market growth.

Strong Pipeline and Applications of Peptide Drugs – An Opportunity for Peptide Therapeutics Market Growth

The most common peptide indications are oncology, endocrinology, and metabolic diseases. Other peptide target areas that have received attention include gastroenterology, cardiovascular disease, dermatology, bone diseases, and sexual dysfunction. Due to their high immunogenicity, peptide vaccines also have great potential to become an alternative to classical vaccines as they are completely synthetic and do not cause undesirable side effects. To overcome their limitations, various modifications of peptides have been introduced. Furthermore, the ongoing studies related to the application of peptides are expected to positively impact the pipeline, thereby providing lucrative opportunities for market growth. Some peptide drug pipelines are as follows:

Company |

Peptide |

Therapeutic Area |

Developmental Stage |

3B Pharmaceuticals (Germany) |

FAP-2286 |

Oncology-FAP expressing tumours |

Phase-I clinical trials |

|

3B 401 |

Neuroendocrine tumors |

Pre-clinical trials |

|

Allysta Pharmaceuticals (US) |

ALY688 |

Ophthalmology-Dry eye disease |

Phase-II clinical trials |

|

ALY688SR |

Liver diseases and obesity |

Phase-I clinical trials |

Source: Issar Pharma, Willing Wellness

Peptide Therapeutics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the peptide therapeutics market analysis are component, application, and end user.

- Based on type, the peptide therapeutics market is divided into generic, and innovative. The innovative segment held the largest share of the market in 2023, whereas the generic segment is anticipated to register the highest CAGR during the forecast period.

- By route of administration, the market is segmented into parenteral, oral, mucosal, pulmonary, others. The parenteral segment held the largest share of the market in 2023, and oral segment is anticipated to register the highest CAGR during 2023–2031.

- Based on synthesis technology, the peptide therapeutics market is divided solid phase peptide synthesis (SPPS), liquid phase peptide synthesis (LPPS), hybrid technology. The solid phase peptide synthesis segment held the largest share of the market in 2023. However, the hybrid technology segment is anticipated to register the highest CAGR during the forecast period.

- In terms of application, the market is segmented into cancer, cardiovascular disorder, metabolic disorder, respiratory disorder, pain, and dermatology. The cancer segment held the largest share of the market in 2023. However, the metabolic disorder segment is estimated to register the highest CAGR during 2023–2031.

Peptide Therapeutics Market Share Analysis by Geography

The geographic scope of the peptide therapeutics market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the peptide therapeutics market. The growth of the market in North America is attributed to the renowned academic institutions, state-of-the-art laboratories, and collaborations between science and industry contribute to a vibrant R&D ecosystem that promotes the discovery and development of novel peptides with therapeutic potential. In North America, the biotechnology sector in plays an important role in developing peptide therapeutics. The presence of leading biotech companies and a supportive regulatory environment promote translating research findings into clinically viable peptide-based treatments, positioning North America as a leader in the global peptide therapeutics space. The prevalence of chronic diseases in North America highlights the need for advanced therapeutic solutions. With their targeted mechanisms of action, peptide therapeutics are proving to be promising candidates for treating diseases such as diabetes, cardiovascular diseases (CVDs), and various types of cancer. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Peptide Therapeutics Market Regional Insights

The regional trends and factors influencing the Peptide Therapeutics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Peptide Therapeutics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Peptide Therapeutics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 29.35 Billion |

| Market Size by 2031 | US$ 73.63 Billion |

| Global CAGR (2023 - 2031) | 11.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Peptide Therapeutics Market Players Density: Understanding Its Impact on Business Dynamics

The Peptide Therapeutics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Peptide Therapeutics Market top key players overview

Peptide Therapeutics Market News and Recent Developments

The peptide therapeutics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for peptide therapeutics:

- Novo Nordisk announced that the U.S. Food and Drug Administration (FDA) approved an additional indication for Wegovy to reduce the risk of major cardiovascular events such as death, heart attack, or stroke in adults with known heart disease and with either obesity or overweight along with a reduced calorie diet and increased physical activity. (Novo Nordisk A/S, Press Release, 2024)

- Ono Pharmaceutical Co., Ltd. announced that it entered into a drug discovery collaboration agreement with PeptiDream Inc., to discover and develop novel macrocyclic constrained peptide drugs against multiple targets. Under the terms of the agreement, PeptiDream will identify and optimize macrocyclic constrained peptide drug candidates for multiple targets of interest selected by Ono, by using PeptiDream’s proprietary Peptide Discovery Platform System (PDPS) technology. (Source: ONO PHARMACEUTICAL CO., LTD., News, 2023)

- Biosynth, a supplier of critical materials to the life science industry, announced the acquisition of Pepceuticals, a UK producer of synthetic peptides with multi-kilogram GMP facilities and fill-finish capabilities designed to support customers from clinical trials to commercial supply. The acquisition enables the support of all phases of the product life cycle from discovery to commercialisation. (Source: Biosynth, News, 2023)

- IRBM, an innovative contract research organization, announced that it has signed a new agreement with Merck & Co. Inc., to continue their collaboration in the peptide therapeutics area. The collaboration allows to combine IRBM’s first-class scientific expertise in peptide design and synthesis with Merck & Co. Inc.’s exceptional drug development capabilities with a focus on delivering innovative therapies to patients in need. (Source: IRBM S.p.A.; Press Release; 2023)

- Hokkaido University researchers have developed a novel method to design and develop peptide antibiotics in large numbers, which will prove critical to controlling antibiotic resistance. (Hokkaido University, Press Release, 2023)

Peptide Therapeutics Market Report Coverage and Deliverables

The “Peptide Therapeutics Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For