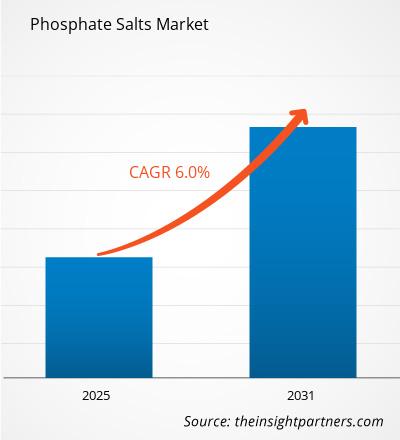

The Phosphate Salts Market is expected to register a CAGR of 6% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The phosphate salts market report is segmented by type (sodium, aluminum, potassium, calcium, ammonium, and others). The market is segmented based on application [food (dairy products, bakery products, meat poultry and seafood, others), beverages, pharmaceuticals, water treatment, agriculture, textile, paints and coatings, detergent, and others]. The global analysis is further broken down at the regional level and major countries. The market size and forecast at global, regional, and country levels for all the key market segments are covered under the scope. The report offers the value in USD for the above analysis, segments, regions, and countries. The report covers market trends, as well as market dynamics such as drivers, restraints, and key opportunities. The report also covers industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the market.

Purpose of the Report

The report Phosphate Salts Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Phosphate Salts Market Segmentation

Type

- Sodium

- Aluminum

- Potassium

- Calcium

- Ammonium

Application

- Food

- Beverages

- Pharmaceuticals

- Water Treatment

- Agriculture

- Textile

- Paints and Coatings

- Detergent

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Phosphate Salts Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Phosphate Salts Market Growth Drivers

- Agriculture Sector (Fertilizer Production): The agriculture sector drives the highest demand for phosphate salts primarily for the phosphate-based fertilizers production. Often referred to as the second most abundant crop nutrient after nitrogen, phosphorus plays a vital role in plant growth, while phosphate salts enhance and maintain crop production by improving soil fertility. Due to rapidly growing global population, its sustenance requires more food which translates to better productivity in agriculture. This growth in global agriculture, especially in the developing regions of the world, is one of the factors encouraging the growth in the market of phosphate salts as every farmer strives to Produce more crops and feed the hungry population.

- Cleaning and Water Treatment: Phosphate salts in this case refer to those substances that find applications in all kinds of detergents and cleaning agents, in water treatment, and in other industries. They serve as water softeners, stabilizers, and dispersing agents in order to enhance the effectiveness of the products. The above factors are contributing to the increased demand for phosphate salts in these industries thanks to the growing industrialization and urbanization in the developing economies and advance in household and industrial cleaning products. In the course of urban development and industrialization processes where cleaning and water treatment, respectively are important, the use of phosphate salts for industrial has a live market.

- Food and Beverage Industry: Phosphate salts are generally incorporated into food products in the form of food preservatives, texture enhancers and flavor enhancers in the food and beverage sector. They assist in preventing moisture loss in meat, improve the quality of carbonated drinks and serve as baking powders in packed cakes. Processed and fast foods are becoming more popular with consumers, so it is expected that the food and beverage sector will use more phosphate salts in the near future.

Phosphate Salts Market Future Trends

- Phosphorus Recycling and Sustainable Practices: As world agriculture confronts issues that compromise environmental sustainability and resource availability, there has been a surge in the demand for green or environmentally friendly fertilizers. The extraction of phosphates and the manufacture of fertilizers can lead to negative effects on the environment including but not limited to land erosions and water contamination. As a result, the sector is now focusing on more environmentally friendly solutions, including the manufacture of inorganic fertilizers containing recycled phosphorus instead of mining new phosphate ores and improving the sustainable practices employed in the mining of phosphate salts. There is considerable potential for improvements in technologies to convert waste to fertilizers and in phosphorus sources besides mining e.g., recycling of phosphate rock.

- Organic and Bio-Fertilizers as Alternatives: Increasing organic farming practices, in turn, increases the need for bio and organic fertilizers due to the fact that such fertilizers do not use fertilizer-active ingredients containing synthetic phosphates. Organic agriculture does not use chemicals such as fertilizers and thus is making use, to a great extent, of phosphate salts that are found in nature and made through an organic process. This is part of the growing sentiments towards change in agricultural practices that are more environmentally and health-friendly. Increasingly, as consumers warm up to organic food, phosphate salts, which are organic or natural, are projected to do well in the untapped edges of the world market.

- Challenges with Phosphate Rock Reserves: Due to the concerns raised about the diminishing reserves of phosphate rock and the environmental implications of phosphate mining, phosphorus recovery and recycling have gained importance. Advanced development is underway in order to design systems that utilize wastewater, sewage sludge and agricultural runoff for the purpose of recovering phosphorus. Such turning-green projects mitigate environmental impacts and enhance the circular economy as well. Suffice it to say as the supply of phosphate rock becomes scarce, so will access to new sources of phosphorus via the reclamation and recycling of existing waste materials within the products of the phosphate salts industry.

Phosphate Salts Market Opportunities

- Expansion of Emerging Markets: With the increase in industrial use, the market for phosphate salts is expected to grow in the regions of Asia-Pacific, Latin America and Africa, which are classified as emerging markets. There are many areas where population growth rates have necessitated some investment in farming, and fertilizers are being used more in developing agriculture. Also, the growth includes industrial development, which increases demand for phosphate salts for example, in cleaning agents, water treatment, and shampoos. These markets can be penetrated by manufacturers by selling cheap, available, if possible, local phosphate salts corresponding to local requirements.

- Technological Advancements in Fertilization: There is a significant fertilization technology improvement potential due to factors such as the growing call for more effective as well as more eco-friendly agricultural processes. Salts of Phosphate are at the center of this shift, as the industry is focusing on slow soluble granules in the production of fertilizers in addition to the tactics of precision farming that attempts to be economical on nutrients. The careful engineering of phosphate salts to have either enhanced uptake by the plants or a slow release rate will minimize the wastage of the fertilizers and maximize the yields, thus creating a window for the firms to innovate new products in the market.

- Phosphorus Recovery and Recycling: As environmental and environmentally sustainable issues surrounding conventional mining of phosphates become aggravated, there abound good prospects in phosphorus recovery and recycling investment. Recovering phosphorus from waste sources (for example, restoring phosphorus from municipality waste water treatment plants and agricultural runoffs) will help the industries to cut down on mining operations and also encourage sustainable management of phosphorus. This opportunity is a reflection of the world in its endeavors to practice circular economy and waste management, hence providing both economic and ecological advantages.

Phosphate Salts Market Regional Insights

The regional trends and factors influencing the Phosphate Salts Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Phosphate Salts Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Phosphate Salts Market

Phosphate Salts Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Phosphate Salts Market Players Density: Understanding Its Impact on Business Dynamics

The Phosphate Salts Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Phosphate Salts Market are:

- The Mosaic Company

- OCP Group

- EuroChem Group AG

- Israel Chemicals Ltd.

- Nutrien Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Phosphate Salts Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Phosphate Salts Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Phosphate Salts Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Frequently Asked Questions

What is the future trend for phosphate salts market?

Focus on sustainable fertilizer solutions are expected to be the key market trends.

Which is the fastest growing segment based on application?

Based on application, the agriculture segment is expected to witness the fastest growth during the forecast period.

Based on geography, which region held the largest share of the phosphate salts market?

Based on geography, Asia Pacific held the largest share of the phosphate salts market due to the strong growth of the food, beverage, and agriculture industry in the region.

What are the driving factors impacting the phosphate salts market ?

Growing demand in agriculture is driving the market growth.

What are the key players operating in the phosphate salts market?

ICL, Innophos, Haifa Group, Merck KGaA, Reephos Chemical Co Ltd, Fengchen Group Co Ltd, Omnisal Gmbh, Airedale Group, Jost Chemical Co, and Aditya Birla Chemicals are the key players operating in the phosphate salts market.

What is the expected CAGR of the Phosphate Salts Market ?

The Phosphate Salts Market is estimated to witness a CAGR of 6% from 2023 to 2031

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For