Powersports Market Trends, Size & Growth Outlook by 2034

Powersports Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (All-Terrain Vehicles, Side-by-Side, and Motorcycles)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPRE00016949

- Category : Automotive and Transportation

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

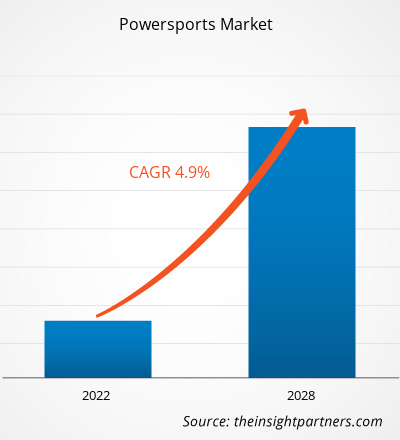

The powersports market size is expected to reach US$ 121.23 billion by 2034 from US$ 27.01 billion in 2025. The market is anticipated to register a CAGR of 28.44% during 2026–2034.

Powersports Market Analysis

The powersports market is undergoing a significant transformation, driven by changing consumer preferences, technological innovation, and regulatory developments. Adventure tourism and outdoor recreational activities have become major lifestyle trends, particularly among younger demographics, fueling demand for vehicles such as ATVs, side-by-sides, and motorcycles. This shift is creating opportunities for manufacturers to diversify product portfolios and introduce models tailored to both leisure and utility applications. Competitive dynamics are intensifying as global players like Polaris, BRP, Yamaha, and Honda compete with regional brands, focusing on differentiation through electrification, connectivity, and aftermarket customization. Regulatory pressure for cleaner mobility solutions is accelerating the adoption of electric and hybrid powertrains, while connectivity features such as telematics, GPS integration, and predictive maintenance are becoming standard offerings. These advancements not only enhance user experience but also open new revenue streams through subscription-based services and data-driven solutions. In essence, the analysis indicates that companies should prioritize sustainability, digital integration, and regional expansion to capture emerging demand and maintain a competitive edge.

Powersports Market Overview

The powersports market encompasses a wide range of recreational and utility vehicles designed for off-road and adventure activities, including all-terrain vehicles (ATVs), side-by-side vehicles (SxS), and motorcycles. These vehicles are widely used for leisure, sports, agriculture, and commercial purposes, making the market highly versatile. Growth is supported by rising disposable incomes, increasing participation in outdoor recreation, and the popularity of adventure tourism worldwide. Technological advancements are reshaping the industry, with manufacturers integrating smart dashboards, advanced safety systems, and electric drivetrains to meet evolving consumer expectations and regulatory requirements. North America currently dominates the market due to its strong recreational culture and well-established infrastructure, while Asia Pacific is emerging as the fastest-growing region, driven by urbanization, rising middle-class incomes, and government initiatives promoting tourism and mobility. Overall, the powersports market is evolving from a traditional recreational segment into a technology-driven lifestyle industry, where personalization, sustainability, and digital engagement define future growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPowersports Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Powersports Market Drivers and Opportunities

Market Drivers:

- Rising Demand for Outdoor Recreation and Adventure Tourism: The growing popularity of outdoor recreational activities and adventure tourism is a major driver for the powersports market. Consumers are increasingly seeking thrilling experiences such as off-road riding, trail adventures, and motorsport events. This trend is particularly strong among millennials and Gen Z, who value lifestyle experiences and leisure activities. As tourism infrastructure expands globally, powersports vehicles like ATVs, side-by-sides, and motorcycles are becoming essential for adventure destinations, fueling consistent market growth.

- Electrification and Sustainability Push: Environmental concerns and stringent emission regulations are accelerating the shift toward electric and hybrid powersports vehicles. Governments worldwide are implementing policies to reduce carbon footprints, prompting manufacturers to invest heavily in clean-energy technologies. Electric ATVs and motorcycles are gaining traction as they offer lower emissions without compromising performance. This sustainability trend is not only a regulatory requirement but also a consumer preference, creating a strong growth avenue for eco-friendly powersports solutions.

- Integration of Connectivity and Smart Features: Modern consumers expect advanced technology in their vehicles, and powersports manufacturers are responding by integrating smart features such as GPS navigation, telematics, and predictive maintenance systems. Digital dashboards, IoT-enabled connectivity, and over-the-air updates are becoming standard, enhancing convenience and safety. These innovations also enable manufacturers to offer subscription-based services and data-driven solutions, creating recurring revenue streams while improving customer engagement.

Market Opportunities

- Expansion into Emerging Markets: Emerging regions such as the Asia Pacific, Latin America, and Africa present significant growth potential for powersports manufacturers. Rising disposable incomes, rapid urbanization, and government initiatives to promote tourism and mobility are creating favorable conditions for market expansion. Companies that localize their offerings—by adapting vehicles to regional terrains and price sensitivities—can capture untapped demand and establish a strong foothold in these high-growth markets.

- Aftermarket Customization and Accessories: The trend toward personalization is creating lucrative opportunities in the aftermarket segment. Consumers increasingly seek to customize their vehicles with performance upgrades, aesthetic enhancements, and functional accessories. This demand for personalization not only boosts sales of accessories but also strengthens brand loyalty. Manufacturers and dealers that offer bundled customization packages or exclusive accessory lines can significantly enhance profitability and customer retention.

- Subscription-Based Ownership and Financing Models: Flexible ownership solutions are gaining popularity as consumers look for convenience and affordability. Subscription-based models that include maintenance, insurance, and roadside assistance are transforming the traditional ownership experience. These models provide predictable costs for consumers and recurring revenue for manufacturers, while also improving customer engagement through value-added services. This shift toward holistic ownership experiences represents a major opportunity for powersports brands to differentiate themselves in a competitive market.

Powersports Market Segmentation Analysis

By Type:

- All-Terrain Vehicles (ATVs): These versatile off-road vehicles used for recreation and utility help lead the market and grow steadily due to utility and leisure applications.

- Side-by-Side Vehicles (SxS): The enclosed off-road vehicles are suited for multiple passengers and utility use. This helps in growing interest in commercial and military applications, with a projected higher CAGR.

- Motorcycles: The category includes heavyweights and street bikes, with value-led by touring and lifestyle segments, appealing to road and sport riders.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Powersports Market Regional Insights

The regional trends and factors influencing the Powersports Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Powersports Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Powersports Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 27.01 Billion |

| Market Size by 2034 | US$ 121.23 Billion |

| Global CAGR (2026 - 2034) | 28.44% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Powersports Market Players Density: Understanding Its Impact on Business Dynamics

The Powersports Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Powersports Market top key players overview

Powersports Market Regional Analysis

North America

- Market Share: Holds the largest share due to strong recreational culture and advanced infrastructure.

- Key Drivers:

- High adoption of ATVs and side-by-sides for both leisure and utility purposes.

- Strong dealership networks and financing options support easy access.

- Early adoption of electric and connected powersports vehicles driven by sustainability initiatives.

- Trends: Integration of telematics and IoT features, growth in subscription-based ownership models, and rising popularity of electric ATVs and motorcycles.

Europe

- Market Share: Significant share driven by stringent emission regulations and strong motorcycling culture.

- Key Drivers:

- Regulatory mandates promoting electrification and low-emission vehicles.

- High consumer interest in motorcycling and winter sports activities.

- Well-developed tourism infrastructure supporting adventure sports.

- Trends: Rapid shift toward electric and hybrid powertrains, increased customization demand, and adoption of advanced safety technologies.

Asia Pacific

- Market Share: Fastest-growing region due to urbanization and rising disposable incomes.

- Key Drivers:

- An expanding middle-class population with a growing interest in outdoor recreation.

- Government initiatives promoting tourism and mobility infrastructure.

- Increasing adoption of electric powersports vehicles driven by environmental awareness.

- Trends: Deployment of electric ATVs and motorcycles, integration of smart connectivity features, and the rise of off-road events and adventure tourism.

Central & South America

- Market Share: Emerging region with growing adoption of powersports vehicles for leisure and utility.

- Key Drivers:

- Expansion of adventure tourism and recreational activities.

- Agricultural and commercial applications for ATVs and side-by-sides.

- Government support for rural mobility and infrastructure development.

- Trends: Localization of production, growth in budget-friendly models, and expansion of dealer networks.

Middle East & Africa

- Market Share: Developing market with high growth potential in the desert and off-road segments.

- Key Drivers:

- Tourism in desert regions is boosting demand for off-road vehicles.

- Military and commercial utility applications are driving adoption.

- Investments in lifestyle and recreational projects by governments.

- Trends: Increased demand for rugged, high-performance models, adoption of connected technologies, and growing interest in electric powersports vehicles.

Powersports Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

The powersports market is moderately fragmented, with global players and regional brands competing aggressively. The competitive landscape is shaped by innovation, product diversification, and strategic partnerships. Companies are focusing on electrification, connectivity, and aftermarket services to differentiate themselves in a market where consumer expectations are evolving rapidly.

Opportunities and Strategic Moves:

- Partnerships with tourism operators, rental agencies, and adventure sports companies to increase market penetration.

- Expansion into emerging markets with localized products tailored to regional terrains and price points.

- Investment in R&D for advanced safety technologies and connected vehicle ecosystems.

- Leveraging digital platforms for marketing and customer engagement to strengthen brand presence.

Major Companies Operating in the Powersports Market

- American Landmaster

- ARCTIC CAT

- BRP

- Hisun Motors Corp., USA

- Kawasaki Motors Corp

- Polaris Inc.

- Yamaha Motor Corporation

- Suzuki Motor USA

- Volcon ePowersports

Disclaimer: The companies listed above are not ranked in any particular order

Powersports Market News and Recent Developments

- In January 2025, Polaris Off Road, a global leader in powersports and off-road innovation, announced six new 2025 purpose-built ATV models. These included the 850 and XP 1000 Mud Edition, Scrambler 850, Scrambler XP 1000 S, and Sportsman Touring 850 and Touring XP 1000. The new models featured upgrades that gave riders the confidence to explore the outdoors and provided all-day comfort, while elevating the powersports experience in off-road mudding and sport riding. Whether riders were powering through mud pits or tackling challenging trails, the new offerings delivered smooth, strong, and versatile performance, taking the powersports adventure to the next level.

- In November 2025, Kawasaki, after styling and equipment updates for the Brute Force 750 in 2024 and the introduction of the Brute Force 450 the following year, the smallest model, the Brute Force 300, received the latest Brute Force family design, a new fuel-injection system, and upgraded features. First introduced in 2005, the Brute Force® lineup included the Brute Force® 750, Brute Force® 450, and Brute Force® 300 models. These enhancements aligned the Brute Force 300 with the capabilities of its older siblings, strengthening Kawasaki's position in the Powersports market by delivering improved performance and reliability for off-road enthusiasts.

Powersports Market Report Coverage and Deliverables

The "Powersports Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Powersports Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Powersports Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Powersports Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Powersports Market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For