Insourcing Contract Logistics Market Size, Share, and Growth Analysis by 2031

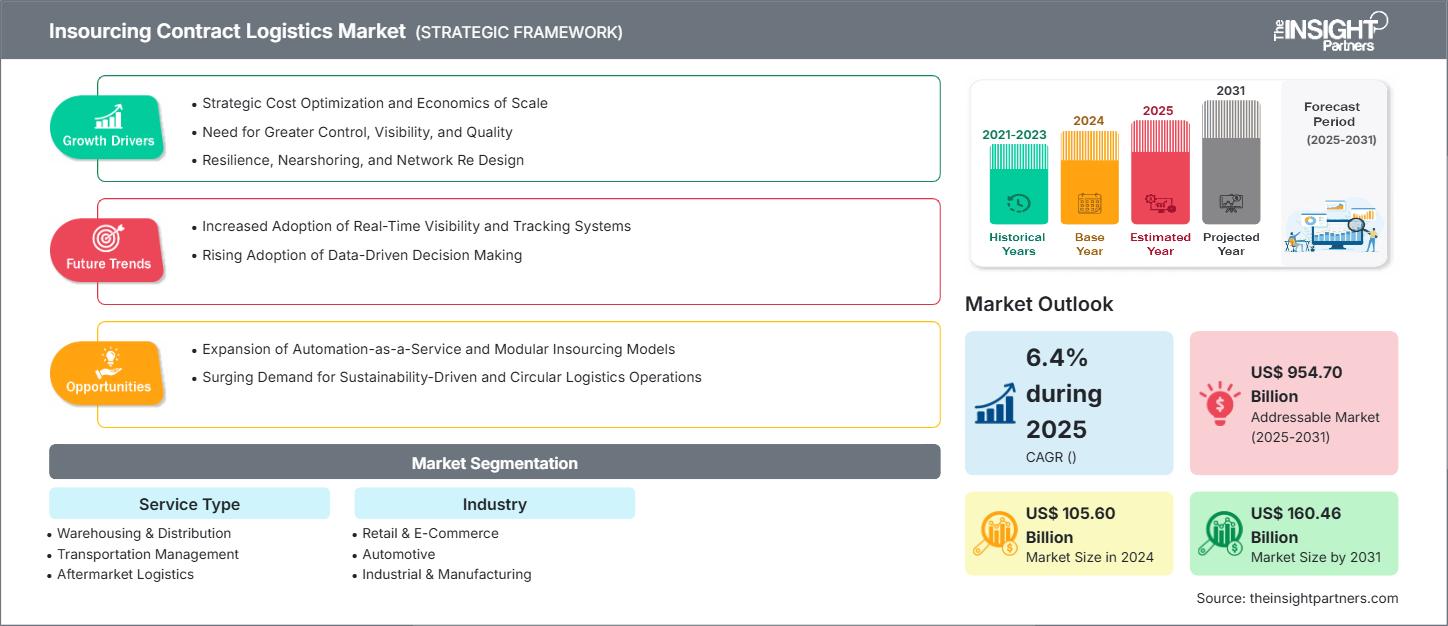

Insourcing Contract Logistics Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Warehousing & Distribution, Transportation Management, Aftermarket Logistics, and Others), By Industry (Retail & E-Commerce, Automotive, Industrial & Manufacturing, Pharma & Healthcare, Consumer Goods & Electronics, Aerospace & Defense, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jan 2026

- Report Code : TIPRE00042184

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 166

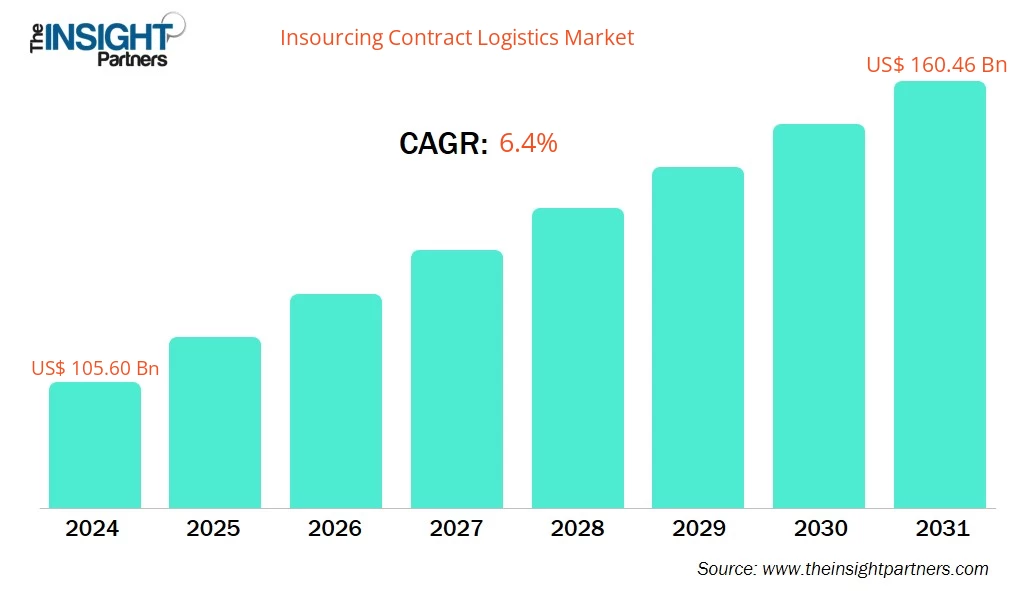

The insourcing contract logistics market size is projected to reach US$ 105.60 billion in 2024 and is expected to reach US$ 160.46 billion by 2031. The insourcing contract logistics market is estimated to register a CAGR of 6.4% during 2025–2031.

Insourcing Contract Logistics Market Analysis

Companies that insource contract logistics use their own physical facilities, logistical systems, and in-house people to carry out various aspects of the logistics function (e.g., warehousing, transportation, inventory management, order fulfilment, etc.) instead of relying on third parties for these same services (3PL). It is similar to the scope of work of an outsourced logistics provider (3PL) but has the added benefit that the company retains complete control of its operations, data, and strategic decisions. Companies make long-term investments in distribution centers, transportation fleets, and internal logistics personnel supporting their insourced logistics model. An insourced approach is common when the company believes the logistics function will provide a competitive advantage to their customers, enhance their brand image, or meet regulatory compliance obligations.

Insourcing Contract Logistics Market Overview

Companies are looking for ways to have more control over their logistics operations, cutting costs, and increasing flexibility from disruptions that can happen in logistics, and seeking total cost of ownership over the long run as compared to third-party logistics providers (3PLs). Companies want to mitigate against disruptions to shipments based on the recent logistics disruptions resulting from the COVID-19 pandemic and globally related logistical constraints and capacity shortage issues. Hence, companies reassessed their need to get away from their reliance on 3PLs and chose to incorporate additional logistics nodes back in-house to retain the flexibility and capacity as needed.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONInsourcing Contract Logistics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Insourcing Contract Logistics Market Drivers and Opportunities

Market Drivers:

- More control, visibility, and quality over the entire logistics process: Shippers are insourcing logistics to re-establish control, ensure quality, safeguard customer data, and increase responsiveness to customers. The ability to use digital tools for internal functions allows shippers to mirror 3PL performance and achieve greater speed, greater detail about what is happening in their operations, and to provide better customer service.

- The need to optimize costs through greater economies of scale: As the high costs of 3PLs and the rise in automation technology are driving shippers to insource for cost savings, they have found that building their own internal networks will achieve greater scale and allow them to create more transparency and flexibility through the reduction of mark-ups and the ability to use data to optimize their entire logistics function.

- Increased resilience, nearshoring, and network redesign: As a result of the growth of nearshoring and regionalizing, companies have been forced to insource logistics to increase supply chain resilience, create more environmentally friendly and sustainable supply chains, and maintain greater control over their logistics process. Additionally, converting to an internal distribution system allows for faster response to customer needs, better inventory optimization, and greater alignment with the goals of ESG and Strategic Sourcing.

Market Opportunities:

- The expansion of Automation as a Service and Modular Insourcing Solutions: Multiple suppliers are providing subscription-based Automation and modular leasing services, allowing companies with limited resources to fill the gap in their Automation and modular leasing needs. By working with service providers, companies can take advantage of all types of robotics, automated storage and retrieval systems, and advanced software, providing them with the ability to develop scalable, hybrid solutions that potentially provide less risk to capital investment and technology risk, especially for mid-sized companies.

- The Rise of Sustainability-Driven and Circular Logistics Solutions: By insourcing logistics, companies can implement and manage their sustainability objectives through the application of energy-efficient warehouses, optimized transport modes, and reusable packaging. By controlling the logistics process, companies can implement and optimize their ability to track emissions, adhere to ESG Regulations, and design closed-loop systems.

Insourcing Contract Logistics Market Report Segmentation Analysis

The insourcing contract logistics market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in industry reports:

By Pressure:

- Warehousing & Distribution: The warehousing and distribution segment is the largest insourced segment of logistics services, including storage, fulfilment, and value-added services. By controlling all aspects of warehousing and distribution, companies can improve their inventory visibility and service quality and integrate their systems better.

- Transportation Management: Transportation management encompasses routing, carrier selection, freight auditing, and multimodal coordination, which comprise more than 30% of a company's logistics spend. By insourcing transportation management, a company can have more control over scheduling, fleet operations, and costs.

- Aftermarket Logistics: Aftermarket logistics encompasses reverse logistics, spare parts, repairs, and recycling due to increased returns as a result of e-commerce and decreasing product lifecycles. By insourcing aftermarket logistics, a company can ensure higher quality, protect intellectual property, and have sustainably-focused aftermarket logistics.

- Others: The ‘Others’ segment of the insourced logistics market includes a range of specialized services such as labelling, packaging, customs, and consulting. Although the ‘Others’ segment is far smaller than warehousing and distribution and transportation management, by using in-house resources for these specialized value-added service functions, companies can better control branding, improve compliance, and differentiate themselves from competitors.

By Industry:

- Retail & E-Commerce

- Automotive

- Industrial & Manufacturing

- Pharma & Healthcare

- Consumer Goods & Electronics

- Aerospace & Defense

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The regional trends and factors influencing the Insourcing Contract Logistics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Insourcing Contract Logistics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Insourcing Contract Logistics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 105.60 Billion |

| Market Size by 2031 | US$ 160.46 Billion |

| Global CAGR () | 6.4% during 2025 |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Insourcing Contract Logistics Market Players Density: Understanding Its Impact on Business Dynamics

The Insourcing Contract Logistics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Insourcing Contract Logistics Market Share Analysis by Geography

Due to the industry's higher demand for oil and gas, North America dominates in terms of volume. Europe continues to see steady growth based on regulations and compliance, while there is significant industrialization taking place within the Asia Pacific countries. The Middle East & Africa and South America offer developing opportunities in this market.

Below is a summary of market share and trends by region:

1. North America

- Market Share: Largest market—especially in the US—due to strong industrial growth.

- Key Drivers:

- Strong e-commerce and retail sector driving demand for in-house fulfillment and transportation control.

- Nearshoring into Mexico and regionalization

- Trends: Strong focus on green logistics

2. Europe

- Market Share: Large, highly regulated market with strong presence in Germany, the UK, France, and Benelux

- Key Drivers:

- Stringent regulations for sustainability, labor, and data regulations.

- Continuous growth in cross-border trade.

- Trends: Strong focus on green logistics

3. Asia Pacific

- Market Share: Fastest-growing regional market driven by rapid industrialization and vehicle manufacturing dominance

- Key Drivers:

- Expansion of manufacturing and e‑commerce in China, India, Southeast Asia, Japan, and South Korea.

- Local champions and large multinationals are building proprietary, automated warehouses and transport networks for scale and control.

- Trends: Gradual shift from basic 3PL‑centric models towards advanced logistics

4. Middle East and Africa

- Market Share: Emerging insourced contract logistics market, anchored in GCC and key African economies.

- Key Drivers:

- Government-led industrial diversification program

- Growing infrastructure, free zones, and ports are encouraging manufacturers and retailers to build in‑house regional hubs

- Trends: Increased localization of warehousing and distribution operations.

5. South America

- Market Share: A growing market largely supported by the growing manufacturing sector in Brazil and Chile.

- Key Drivers:

- Expansion in automotive and agribusiness

- Efforts to modernize infrastructure and reduce logistics costs

- Trends: Strategic partnership with global companies.

Insourcing Contract Logistics Market Players Density: Understanding Its Impact on Business Dynamics

Medium Market Density and Competition

The competitive landscape is shaped by established players such as ASHLEY LOGISTICS SOLUTIONS LTD, PepsiCo Inc., and Toyota Motor Corp. Regional and niche players are also contributing across different regions.

This high level of competition urges companies to stand out by offering:

- To minimize the energy consumption and process losses of warehouses and transportation networks, they should be redesigned.

- The warehouses of production, distribution, and transportation should implement integrated warehouse management systems (WMS) and transportation management systems (TMS) and control towers with IoT sensors and telematics for real-time visibility, condition monitoring, and predictive maintenance across both insourced and outsource fleets.

- Micro-fulfillment and modular warehouse designs are best developed to allow rapid integration into existing and brownfield facilities.

Opportunities and Strategic Moves

- Companies are teaming up with Automation, robotics, and IoT vendors to co-create smart warehousing, control towers, and integrated logistics nodes in factories.

- Automation vendors are building modular, skid-mounted, and pre-engineered warehouse/process modules (racking + conveyor, Shuttle/ASRS modules, and packing cells) that can be easily assembled and installed with minimal disruption to operations.

- Digital technologies and smart features are found in insourced logistics assets, such as IoT sensors, telematics, or Smart Labels, to capture real-time data about inventory, equipment health, and process performance.

- This data, combined with AI/Analytics, allows for predictive maintenance, dynamic slotting, and continuous optimization, providing insourced logistics operations with increased reliability, uptime, and utilization.

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- The Boeing Co

- Airbus SE

- Amazon.com Inc

- Walmart Inc

Insourcing Contract Logistics Market News and Recent Developments

- Amazon launched new services: Amazon will now offer its cost-effective logistics services to businesses across India, independent of their association with the Amazon marketplace. The company has launched Amazon Freight for intra-city and inter-city transportation services nationally, with full truckload options ranging from 5 to 40 ft to accommodate varied capacity requirements.

- PepsiCo announced organizational changes: PepsiCo announced a series of organizational changes designed to advance its growth strategy. They have unified their North America businesses, continued investments in advanced technology, and AI.

Insourcing Contract Logistics Market Report Coverage and Deliverables

The "Insourcing Contract Logistics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Insource contract logistics market size and forecast at global, regional, and country levels for all the segments covered under the scope

- Insource contract logistics market trends, as well as dynamics such as drivers, restraints, and opportunities

- Detailed PEST and SWOT analysis

- Insource contract logistics market analysis covering key trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the insourcing contract logistics market

- Detailed company profiles

Frequently Asked Questions

2. The need to optimize costs through greater economies of scale

3. Increased resilience, nearshoring, and network redesign

1. In‑House Technology Adoption

2. Integrated Supply Chain Control

3. Advanced Warehouse Automation

4. Real‑Time Data and Analytics.

2. Technology Implementation Barriers

3. Talent Recruitment & Retention

4. Scalability Limitations

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For