Outsourcing Contract Logistics Market Size, Share, Trends, Growth Analysis & Forecast by 2031

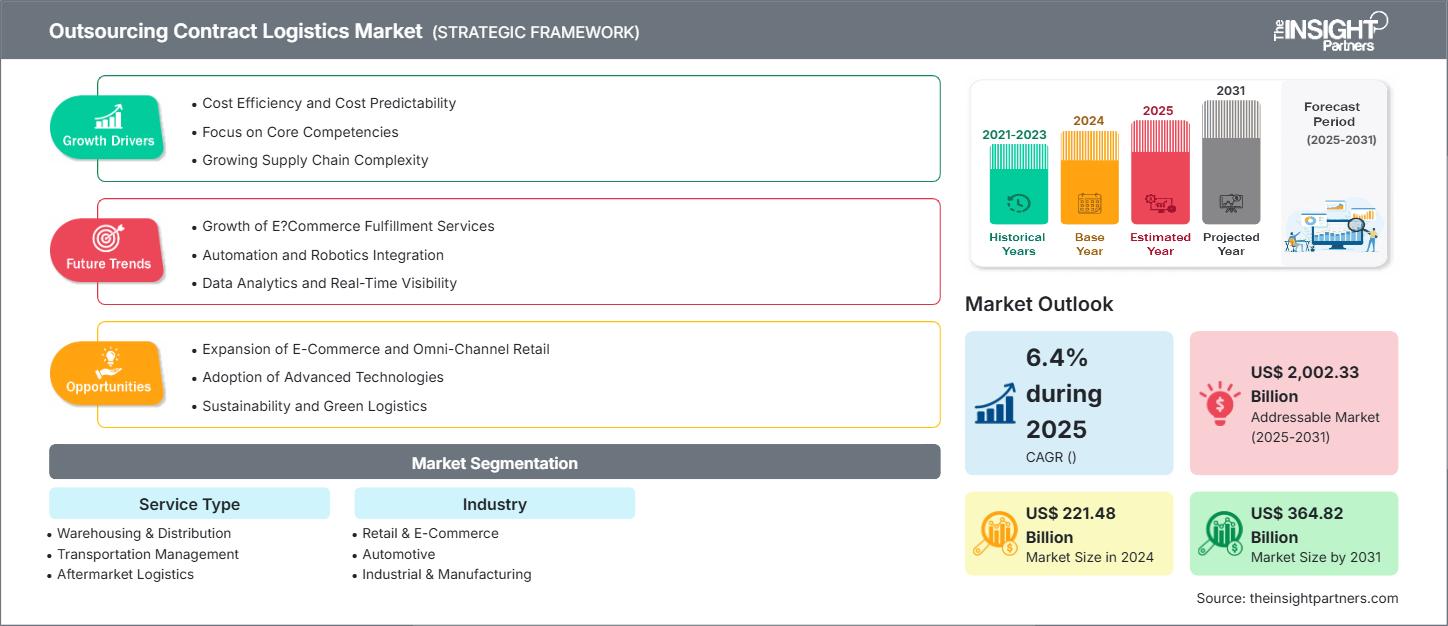

Outsourcing Contract Logistics Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Warehousing & Distribution, Transportation Management, Aftermarket Logistics, and Others), By Industry (Retail & E-Commerce, Automotive, Industrial & Manufacturing, Pharma & Healthcare, Consumer Goods & Electronics, Aerospace & Defense, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jan 2026

- Report Code : TIPRE00042185

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 190

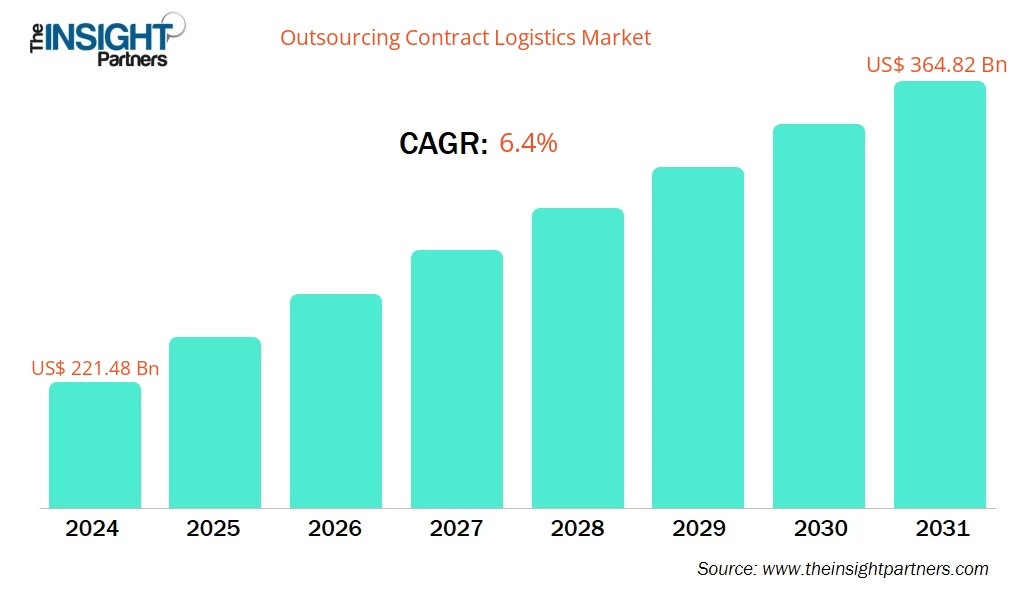

The outsourcing contract logistics market size was US$ 221.48 billion in 2024 and is expected to reach US$ 364.82 billion by 2031. The outsourcing contract logistics market size is estimated to register a CAGR of 7.6% during 2025–2031.

Outsourcing Contract Logistics Market Analysis

Outsourced contract logistics (OCL) is the delegation of logistics functions to third-party providers who manage and execute integrated logistics on behalf of a company. Typically, inbound and outbound transportation, warehousing, inventory management, and order fulfillment are covered. Furthermore, value, added operations such as packaging, assembly, and reverse logistics may be included. The aim of outsourcing such functions is to enable a company to concentrate on its core business while benefiting from the skills, facilities, and technology of a professional logistics provider.

Outsourcing Contract Logistics Market Overview

The worldwide chain logistics industry has expanded remarkably in the past few years as a result of the intricacies of the supply chain, the process of globalization, and unsurprisingly, the increasing customer expectations for quicker and more adaptable delivery. Corporations in various sectors such as retail, e-commerce, automotive, consumer goods, electronics, and pharmaceuticals are turning to third-party logistics providers to manage their operations efficiently, lessen their operational burdens, and raise their service levels. One of the most prominent characteristics of this market is its wide range of services, which are tailored and unique to different industries. The top providers not only offer solutions but also integrate technology, use specialized infrastructure, and combine their know-how to provide complete end-to-end services.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOutsourcing Contract Logistics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Outsourcing Contract Logistics Market Drivers and Opportunities

Market Drivers:

- Cost Efficiency and Cost Predictability: Outsourcing logistics helps a company change fixed costs into variable costs, which means that the company spends less money on capital and takes less financial risk. Contract logistics providers, on the other hand, can take advantage of economies of scale, offer stable prices, and allow customers to scale up or down in a flexible way, thus enabling firms to limit their costs and at the same time keep a high level of efficiency in an environment that is not stable.

- Focus on Core Competencies : Logistics outsourcing allows enterprises to focus on the core activities that matter most, such as innovation and marketing. A specialized provider will be in charge of the complicated part of the supply chain, relying on industry expertise and best practices, unlocking internal resources, enhancing agility, and enabling companies to stay competitive even if they do not directly manage logistics operations.

- Growing Supply Chain Complexity: The complexities of supply chains have been caused by globalization as well as the omni-channel demand. Contract logistics providers are ready to handle these complexities by offering a full range of services, advanced technology, and a well-established network, being a perfect match for cross-border and multi-channel operations management and meeting customer expectations for speed, visibility, and reliability.

Market Opportunities:

- Expansion of E-Commerce and Omni-Channel Retail : The growth of e-commerce and omni-channel retail continues to drive the demand for outsourced logistics. Contract logistics providers allow companies to meet customer expectations, handle peak demand, and remain competitive in the changing retail markets by providing scalable fulfillment, cutting-edge technology, and efficient last-mile delivery.

- Adoption of Advanced Technologies: Advanced technologies present opportunities for contract logistics providers to raise efficiency and visibility. Automation, AI, IoT, and data analytics enhance accuracy, forecasting, and decision-making, thus allowing clients to enjoy high-performance logistics without making a heavy technology investment.

- Sustainability and Green Logistics: Sustainability leads to an increasing demand for green logistics solutions. Contract logistics providers help to achieve environmental goals by implementing route optimization, energy-efficient warehouses, and low-emission transport. Outsourcing is a way for companies to reduce their carbon footprint and obtain a competitive advantage without making a major capital investment.

Outsourcing Contract Logistics Market Report Segmentation Analysis

The outsourcing contract logistics market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in industry reports:

By Service Type:

- Warehousing & Distribution: Outsourced warehousing and distribution encompasses storage, fulfillment, and value-added services. This segment, mainly influenced by the volatility of e-commerce, is one that essentially turns fixed costs into variable ones and simultaneously provides features such as scalable capacity, advanced warehouse management systems (WMS), automation, and service levels under control.

- Transportation Management: Activities of an outsourced transportation management include carrier sourcing, route planning, freight auditing, and last-mile delivery. By the use of transportation management systems (TMS) and carrier networks, third-party logistics providers (3PLs) decrease freight costs, enhance dependability, and offer flexible capacity for complicated, high-volume, or cross-border shipment flows.

- Aftermarket Logistics: Aftermarket logistics is the fastest-growing segment among the outsourced ones, and it comprises spare parts, returns, repairs, and refurbishment. 3PLs guarantee the achievement of high service levels through the implementation of specialized IT and the optimization of inventory. This factor makes them the backbone of automotive and electronics industries. Moreover, they facilitate sustainability through the means of repair and recycling.

- Others: The others segment refers to value-added and knowledge-intensive services such as customs, postponement, consulting, control towers, and analytics. Even though the revenue of the segment is relatively small, it is of strategic importance as it facilitates the end, to, end outsourcing process, provides better visibility, and advanced planning without the necessity of building internal capabilities.

By Industry:

- Retail & E-Commerce

- Automotive

- Industrial & Manufacturing

- Pharma & Healthcare

- Consumer Goods & Electronics

- Aerospace & Defense

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The regional trends and factors influencing the Outsourcing Contract Logistics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Outsourcing Contract Logistics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Outsourcing Contract Logistics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 221.48 Billion |

| Market Size by 2031 | US$ 364.82 Billion |

| Global CAGR () | 6.4% during 2025 |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Outsourcing Contract Logistics Market Players Density: Understanding Its Impact on Business Dynamics

The Outsourcing Contract Logistics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Outsourcing Contract Logistics Market Share Analysis by Geography

The outsourcing contract logistics market has different shares across various regions, with North America and Europe leading due to their mature supply chains. However, Asia Pacific is the fastest-growing region as its growth is attributed to e-commerce expansion, manufacturing growth, and increasing demand for technology, enabling logistics solutions that are scalable.

Below is a summary of market share and trends by region:

1. North America

- Market Share: Largest market—especially in the US—due to strong industrial growth.

- Key Drivers:

- Strong e-commerce, retail, and manufacturing demand for scalable 3PL solutions.

- Nearshoring to Mexico is increasing cross-border outsourced logistics

- Trends: Technology-led outsourcing

2. Europe

- Market Share: Large and mature outsourced logistics market, strong in Germany, the UK, France, and Benelux

- Key Drivers:

- Complex regulatory environment favoring specialist 3PLs.

- High cross-border trade and multi-country distribution needs.

- Trends: Sustainability-driven outsourcing

3. Asia Pacific

- Market Share: Fastest-growing regional market driven by rapid industrialization and vehicle manufacturing dominance

- Key Drivers:

- Rapid e-commerce and manufacturing growth in China, India, and Southeast Asia.

- SMEs are increasingly outsourcing logistics to avoid high capex

- Trends: Shift from basic transport outsourcing to advanced, technology-enabled contract logistics

4. Middle East and Africa

- Market Share: Emerging outsourced contract logistics market, centered on GCC and South Africa.

- Key Drivers:

- Economic diversification and trade hub development

- Expansion of free zones, ports, and regional distribution centers

- Trends: Growing reliance on international 3PLs and localized fulfillment networks.

5. South America

- Market Share: Developing outsourced logistics market, led by Brazil and Chile.

- Key Drivers:

- Growth in automotive, agribusiness, and consumer goods

- Rising need to reduce logistics complexity and costs

- Trends: Increased partnerships between local providers and global contract logistics firms.

Outsourcing Contract Logistics Market Players Density: Understanding Its Impact on Business Dynamics

Medium Market Density and Competition

The competitive landscape is shaped by established players such as Deutsche Post AG, FedEx Corp, GXO Logistics Inc., and United Parcel Service Inc. Regional and niche players are also contributing across different regions.

This high level of competition urges companies to stand out by offering:

- Sustainable network design: Redesigning outsourced warehouse and transportation networks to lower energy consumption, emissions, and process losses, thus helping clients meet their ESG and regulatory requirements.

- Implementing unified WMS, TMS, and control towers that are IoT sensor, telematics, and analytics-enabled to provide real-time visibility, condition monitoring, and predictive maintenance for multi-client, outsourced fleets.

- Creating micro, fulfillment centers and modular, scalable warehouse designs that can be quickly deployed in existing or brownfield sites, thereby allowing faster onboarding, peak, season scaling, and omnichannel responsiveness for clients.

Opportunities and Strategic Moves

- Ecosystem partnerships: Contract logistics providers are collaborating with automation, robotics, AI, and IoT vendors. As a result, they are developing smart, multi-client warehouses, digital control towers, and integrated logistics hubs that are easily replicable across customer networks.

- 3PLs are implementing modular, pre, pre-engineered automation solutions such as shuttle systems, AS/RS, robotic picking, and packing cells to facilitate quick customer onboarding, scalable capacity, and flexible reconfiguration of their outsourced facilities.

- When combined with AI and advanced analytics, this data is used as a base for predictive maintenance, dynamic labor and slotting optimization, demand-driven capacity planning, and continuous performance improvement, thus service reliability, uptime, and cost efficiency for outsourced logistics clients are enhanced.

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Nippon Express Co Ltd.

- GEODIS SA

- Ryder System Inc.

- CMA CGM SA

- DSV AS

- Kuehne + Nagel International AG

Outsourcing Contract Logistics Market News and Recent Developments

- GXO Logistics announced an agreement - GXO Logistics, Inc. announced the signing of a multi-year agreement with Sky Italia, Italy's leading media & entertainment company, and a European entertainment leader. The agreement involves managing Sky's supply chain from the GXO warehouse in Colleferro, where Sky's Business Core products (decoders and routers) and the Glass line (Smart TV) will be stored, as well as all the merchandising related to the Sky brand and TV series.

- FedEx announced the opening of new stations - Federal Express Corporation (FedEx) announced the opening of a new station in Brest. Thanks to its prime location near the city center, this new infrastructure, the result of an investment of more than US$700,000, strengthens FedEx's strategic position in the region. It enables faster and more efficient collection and delivery operations throughout northern Brittany.

Outsourcing Contract Logistics Market Report Coverage and Deliverables

The "Outsourcing Contract Logistics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Outsourcing contract logistics market size and forecast at global, regional, and country levels for all the key segments covered under the scope

- Outsourcing contract logistics market trends, as well as dynamics such as drivers, restraints, and opportunities

- Detailed PEST and SWOT analysis

- Outsourcing contract logistics market analysis covering key trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the outsourcing contract logistics market

- Detailed company profiles

Frequently Asked Questions

2. Talent Shortages and Workforce Turnover

3. Technology Integration Complexity

4. Data Security and Cyber Risks.

1. Growth of E‑Commerce Fulfillment Services

2. Automation and Robotics Integration

3. Data Analytics and Real‑Time Visibility

4. Sustainability and Green Logistics.

2. Focus on Core Competencies

3. Growing Supply Chain Complexity

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For