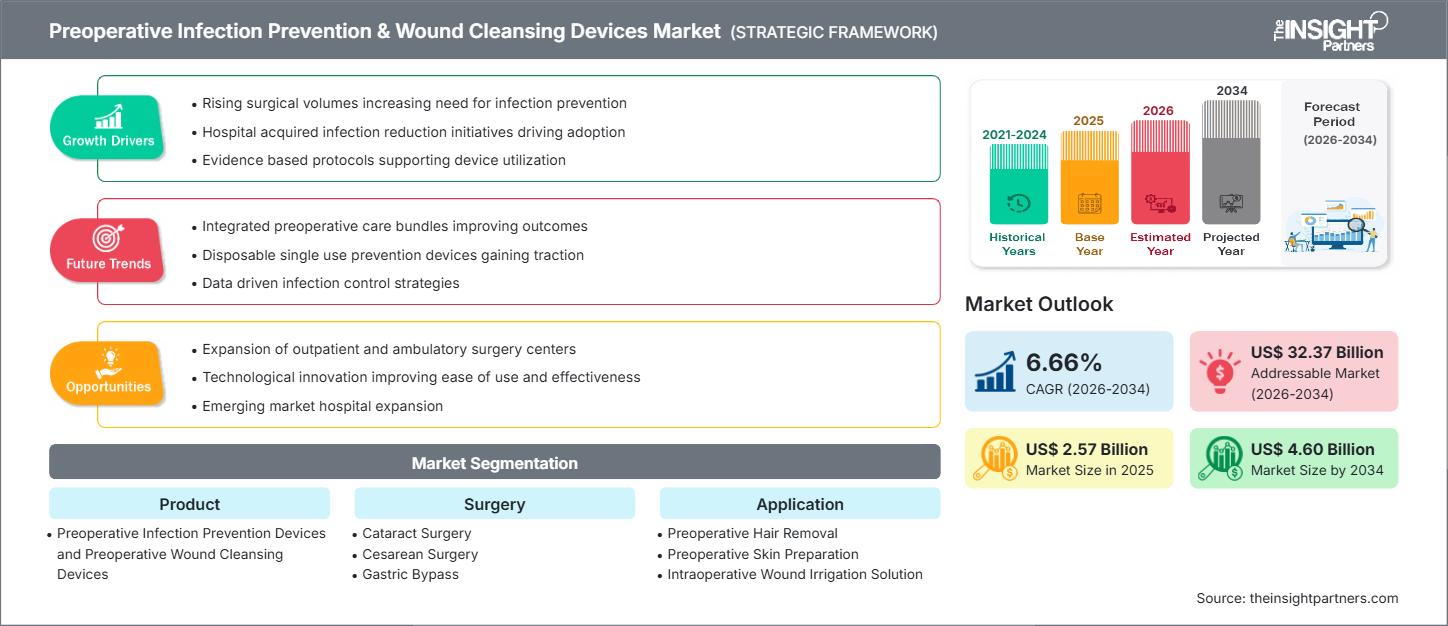

Preoperative Infection Prevention & Wound Cleansing Devices Market Size & Emerging Trends 2034

Preoperative Infection Prevention & Wound Cleansing Devices Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Preoperative Infection Prevention Devices and Preoperative Wound Cleansing Devices), Surgery (Cataract Surgery, Cesarean Surgery, Gastric Bypass, Appendectomy, Colectomy and Colostomy, Esophagectomy, Biopsy, Cholecystectomy, Mastectomy, Cosmetic Surgery, and Others), and Application (Preoperative Hair Removal, Preoperative Skin Preparation, Intraoperative Wound Irrigation Solution, and Others)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00029801

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

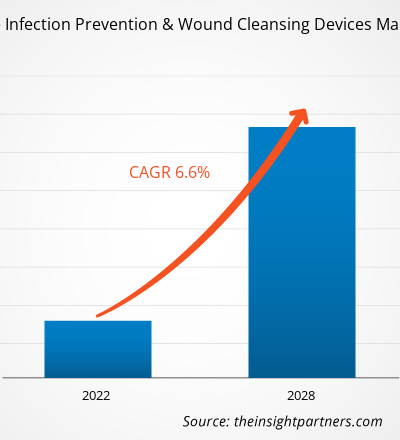

The preoperative infection prevention & wound cleansing devices market size is expected to reach US$ 4.60 billion by 2034 from US$ 2.57 billion in 2025. The market is anticipated to register a CAGR of 6.66% during 2026–2034.

Preoperative Infection Prevention & Wound Cleansing Devices Market Analysis

The Preoperative Infection Prevention & Wound Cleansing Devices Market is expanding strongly, driven by the increasing volume of surgical procedures worldwide and the critical focus on reducing Surgical Site Infections (SSIs). SSIs are a significant source of patient morbidity, mortality, and economic burden on healthcare systems. This environment has intensified the demand for effective preoperative skin preparation, hair removal, and intraoperative wound irrigation solutions. Technological advancements, such as the introduction of sterile antiseptic solutions combining agents like chlorhexidine gluconate and isopropyl alcohol for enhanced antimicrobial efficacy, are fueling market growth. Furthermore, the shift towards minimally invasive surgeries and outpatient/ambulatory surgical centers (ASCs), where stringent infection control protocols are paramount, is boosting the adoption of single-use and disposable devices. The market is poised for continued strong growth as healthcare systems globally invest in comprehensive infection control protocols.

Preoperative Infection Prevention & Wound Cleansing Devices Market Overview

The purpose of Preoperative Infection Prevention & Wound Cleansing Devices is to significantly reduce the microbial load on the patient's skin before surgery and cleanse the surgical site during the procedure, thereby minimizing the risk of Surgical Site Infections (SSIs). These devices and products are integral components of mandatory antiseptic protocols in nearly all healthcare procedures. The market encompasses various products, from chemical antiseptic solutions to physical cleansing devices. The products help in achieving compliance with international guidelines that emphasize standardized, evidence-based practices for infection control. Healthcare institutions are increasingly adopting comprehensive infection control protocols that integrate multiple products to ensure streamlined and effective workflows, supporting a culture of safety and improving patient confidence in surgical outcomes.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPreoperative Infection Prevention & Wound Cleansing Devices Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Preoperative Infection Prevention & Wound Cleansing Devices Market Drivers and Opportunities

Market Drivers:

- Rising Incidence of Hospital-Acquired Infections (HAIs) and SSIs: The high rate of HAIs, particularly SSIs (which account for nearly 22% of all HAIs), is fueling the urgent need for effective preventive measures to safeguard patients and mitigate the high costs associated with treating these complications.

- Increasing Volume of Surgical Procedures Globally: The growing global burden of chronic diseases, an aging population, and rising rates of conditions like diabetes and obesity are leading to a continuous increase in the number of surgical and trauma procedures, directly driving demand for pre- and post-operative infection control products.

- Stringent Regulatory Guidelines and Compliance: Global regulatory bodies like the FDA and EMA are increasing their emphasis on infection control. Compliance with these standards is often linked to financial incentives and accreditation, forcing healthcare facilities to invest in high-quality, approved prevention devices and solutions.

Market Opportunities:

- Technological Advancements in Devices and Formulations: The development of innovative products, such as next-generation antiseptic solutions, wireless wound imaging devices for early infection detection, and advanced wound cleansing systems, presents a major opportunity for market differentiation and growth.

- Growing Trend of Ambulatory Surgical Centers (ASCs) and Outpatient Settings: The shift of surgical procedures from traditional hospitals to ASCs and outpatient settings, often favored for cost-effectiveness and patient privacy, is driving the demand for specialized, often single-use, devices and streamlined infection control kits tailored to these environments.

- Focus on Customized and Patient-Specific Solutions: There is a rising demand for formulations and devices tailored to specific surgery types (e.g., orthopedic vs. cosmetic) and patient skin conditions. Companies that can invest in personalized solutions stand to gain a competitive advantage by addressing precise clinical needs.

Preoperative Infection Prevention & Wound Cleansing Devices Market Report Segmentation Analysis

The Preoperative Infection Prevention & Wound Cleansing Devices Market share is analyzed across various segments to provide a clearer understanding of its structure and growth potential. Below is the standard segmentation approach used in most industry reports:

By Product:

- Preoperative Infection Prevention Devices

- Preoperative Wound Cleansing Devices

By Surgery:

- Cataract Surgery

- Cesarean Surgery

- Gastric Bypass

- Appendectomy

- Colectomy and Colostomy

- Esophagectomy

- Biopsy

- Cholecystectomy

- Mastectomy

- Cosmetic Surgery

By Application:

- Preoperative Hair Removal

- Preoperative Skin Preparation

- Intraoperative Wound Irrigation Solution

By Geography:

- North America

- Europe

- Asia-Pacific

- South & Central America

- Middle East & Africa

Preoperative Infection Prevention & Wound Cleansing Devices Market Regional Insights

The regional trends and factors influencing the Preoperative Infection Prevention & Wound Cleansing Devices Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Preoperative Infection Prevention & Wound Cleansing Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Preoperative Infection Prevention & Wound Cleansing Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 2.57 Billion |

| Market Size by 2034 | US$ 4.60 Billion |

| Global CAGR (2026 - 2034) | 6.66% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Preoperative Infection Prevention & Wound Cleansing Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Preoperative Infection Prevention & Wound Cleansing Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Preoperative Infection Prevention & Wound Cleansing Devices Market top key players overview

Preoperative Infection Prevention & Wound Cleansing Devices Market Share Analysis by Geography

North America is a dominant region in the Preoperative Infection Prevention & Wound Cleansing Devices Market, primarily driven by a well-developed healthcare infrastructure, high healthcare expenditure, and the early adoption of advanced infection control technologies. Asia-Pacific is projected to be the fastest-growing regional market due to factors such as the increasing number of surgical procedures, rapidly improving healthcare infrastructure in countries like China and India, and rising government initiatives focused on infection control awareness.

Below is a summary of market trends by region:

North America

- Market Share: Holds the largest market share, driven by robust IT and healthcare infrastructure.

- Key Drivers: High number of surgical procedures, stringent regulatory compliance for SSI prevention, and the presence of key market players who invest heavily in R&D.

- Trends: Focus on advanced formulations (e.g., combining CHG and Alcohol) and the adoption of advanced disposable devices.

Europe

- Market Share: Significant market share, driven by strong adherence to infection control guidelines.

- Key Drivers: European regulatory emphasis on patient safety, high awareness of HAIs, and government-backed initiatives for standardized surgical protocols.

- Trends: Growth in the use of specialized antiseptic solutions and disposable drapes.

Asia Pacific

- Market Share: Fastest-growing regional market, fueled by expansion in countries like China, India, and Southeast Asia.

- Key Drivers: Mounting healthcare expenditure, increasing surgical volumes, expanding geriatric population, and improving healthcare infrastructure.

- Trends: Rapid adoption of advanced technologies for wound care and infection prevention, and growing awareness among surgeons and hospitals.

South and Central America

- Market Share: Emerging region with moderate growth.

- Key Drivers: Increased digital marketing adoption across e-commerce and entertainment sectors, Expansion of affordable cloud-based AI solutions by global tech providers.

- Trends: Modernization of digital infrastructure supporting social analytics platforms, with Brazil being a major contributor to regional growth.

Middle East and Africa

- Market Share: Emerging market with strong growth potential.

- Key Drivers: Major national digital and AI strategies fostering innovation in social engagement.

- Trends: Increasing integration of AI chatbots and community management systems.

Preoperative Infection Prevention & Wound Cleansing Devices Market Players Density: Understanding Its Impact on Business Dynamics

The market is characterized by a moderate concentration, with a few large global firms influencing nearly 60% of the market. Competition is intense, driving innovation and strategic collaborations. Vendors differentiate themselves through continuous R&D and product innovation focused on:

- Developing new formulations with fast-acting, persistent antimicrobial properties that also minimize skin irritation.

- Offering comprehensive procedural kits that bundle all necessary infection prevention and wound cleansing supplies for specific surgeries to streamline hospital workflows and ensure protocol adherence.

- Innovating in product application, such as new applicator designs for antiseptic solutions or advanced features in disposable surgical clippers.

Opportunities and Strategic Moves

- Mergers and Acquisitions (M&A): Large players actively acquire smaller, innovative startups to quickly integrate specialized technologies (e.g., advanced antiseptic solutions, novel wound cleansers) into their existing portfolios.

- Strategic Partnerships: Collaborating with large hospital networks, surgical centers, and distributors is crucial for securing and expanding market presence and brand loyalty.

- R&D Investment: Companies invest significant resources into research to target improvements in efficiency, safety, and antimicrobial effectiveness, thereby strengthening their product credibility and clinical relevance.

Major Companies Operating in the Preoperative Infection Prevention & Wound Cleansing Devices Market Are:

- Cardinal Health Inc

- 3M Co

- Bactiguard AB

- Becton Dickinson and Co

- Getinge AB

- bioMerieux SA

- Medline Industries Inc

- Dynarex Corp

- Careon Healthcare Solutions Pvt Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

Preoperative Infection Prevention & Wound Cleansing Devices Market News and Recent Developments

- For instance, on November 24, 2025, BD, a leading global medical technology company, announced the launch of the BD Surgiphor™ Surgical Wound Irrigation System in Europe. The system is the first of its kind to receive Conformité Européenne (CE) approval and is now available in select European countries.

- In January 2024, Medline, the market leader in skin care, announced the latest addition to its advanced wound care portfolio, the OptiView® Transparent Dressing with HydroCore™ Technology. This first-of-its-kind wound dressing features an innovative, clear design that allows caregivers to quickly and easily inspect, monitor, and blanch skin with the dressing in place.

- In April 2023, 3M Health Care announced the introduction of its new FDA-approved 3M™ SoluPrep™ S Sterile Antiseptic Solution, chlorhexidine gluconate, and isopropyl alcohol Patient Preoperative Skin Preparation. The product has been shown to provide fast-acting, broad-spectrum antimicrobial activity and persistence in healthy human volunteers for at least 96 hours post-prep.

- In March 2023, Bactiguard announced the launch of its wound care offering in the UK and Ireland, in collaboration with Quintess Medical and their partner, full-service medical sales and distribution firm GS Medical. The collaboration will not only bring Bactiguard’s Wound Care product range to even more patients and end-users, but also further strengthen Bactiguard’s position in the wound care market.

Preoperative Infection Prevention & Wound Cleansing Devices Market Report Coverage and Deliverables

The "Preoperative Infection Prevention & Wound Cleansing Devices Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Preoperative Infection Prevention & Wound Cleansing Devices Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Preoperative Infection Prevention & Wound Cleansing Devices Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Preoperative Infection Prevention & Wound Cleansing Devices Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Preoperative Infection Prevention & Wound Cleansing Devices Market. Detailed company profiles.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For