Contract Research Organization Market Analysis and Forecast by Size, Share, Growth, Trends 2031

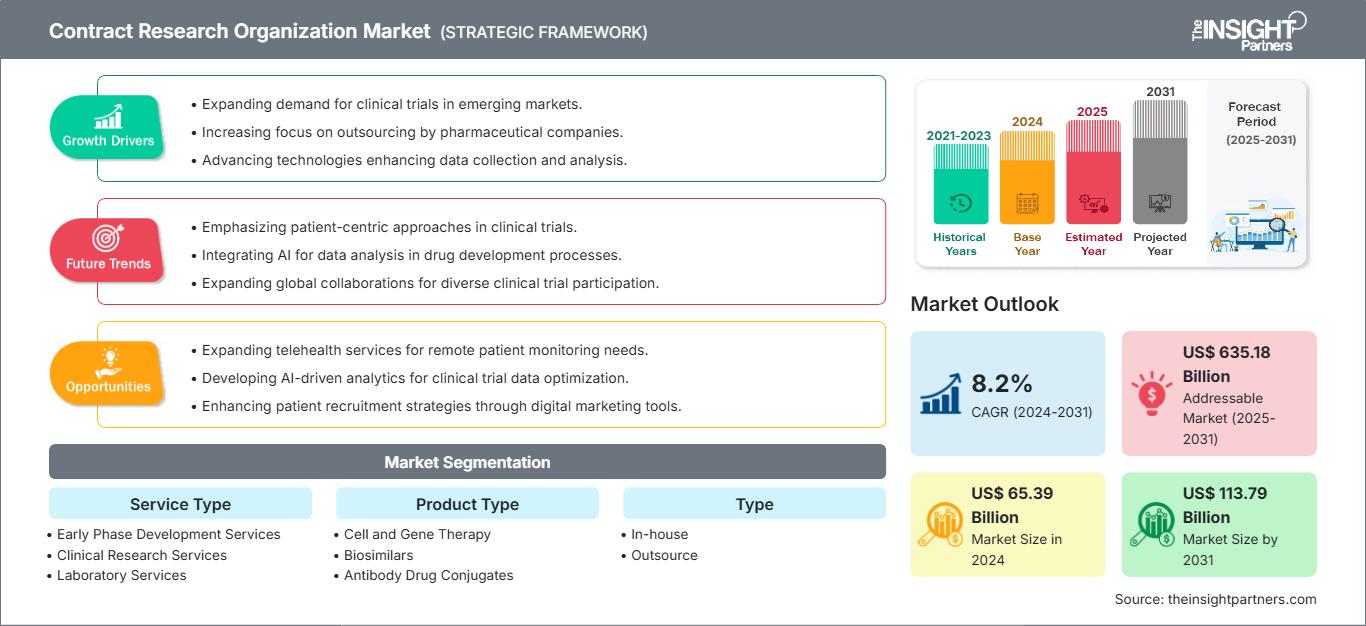

Contract Research Organization Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Early Phase Development Services, Clinical Research Services, Laboratory Services, and Post-Approval Services), Product Type (Cell and Gene Therapy, Biosimilars, Antibody Drug Conjugates, and Others), Type (In-house and Outsource), Application (Oncology, Neurology, Cardiology, Infectious Diseases, Metabolic Disorder, Nephrology, Respiratory, Dermatology, Ophthalmology, Hematology, and Others), End User (Pharmaceutical and Biotech Companies, Medical Device Companies, Academic and Research Institutes, and Others) and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Mar 2025

- Report Code : TIPBT00002008

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 371

The contract research organization market size is projected to reach US$ 113.79 billion by 2031 from US$ 65.39 billion in 2024. The market is estimated to register a CAGR of 8.2% during 2024–2031. The sustainability initiatives are likely to bring new trends to the market in the coming years.

Contract Research Organization Market Analysis

The global contract research organization (cro) market is experiencing significant growth momentum as pharmaceutical and biotechnology companies increasingly leverage external partners for research and development assistance. This not only increases efficiency but also offers access to technical expertise that is in short supply and increasing specialized expertise, which aid in managing the changing market landscape.

Contract Research Organization Market Overview

According to the data provided by the National Library of Medicine (NLM), ~52,000 new studies were registered with NLM (ClinicalTrials.gov) in 2020, which increased to ~58,000 in 2023. In January 2023, the NLM reported 38,837 active clinical trials in the US and 105,172 active trials worldwide. According to the European Medicine Agency, in the European Union (EU), ~4,000 clinical trials are authorized annually, of which ~60% of clinical trials are associated with the pharmaceutical industry. An increasing number of clinical trials for developing different effective treatments due to the rising prevalence of chronic diseases globally is fueling the growth of the global CRO market. With bigger sample sizes, diversified patient demographics, and multiple study sites, clinical trials are becoming more complex.

Managing the various aspects of trials, from oncology research to vaccine development, can overwhelm sponsors. CROs enhance trial efficiency and productivity while handling day-to-day research activities that may be impractical or costly for drug developers to conduct in-house, including trial design, bioanalytical testing, and regulatory consultation. The growing investments and collaborations by market players to enhance clinical trials are fueling the growth of the market. In February 2025, the Society for Clinical Research Sites (SCRS) and Fortrea, a leading CRO, announced that Fortrea will sponsor the SCRS Collaborate Forward working group to enhance collaboration in clinical research. This group, made up of 16 global impact partner organizations, aims to reduce administrative burdens in clinical research by developing best practices. Their focus is on enhancing transparency and collaboration to improve site sustainability and trial efficiency, ultimately benefiting patients.

Therefore, the growing number of clinical trials is expected to boost the demand for CRO services to carry out complex studies at lower costs during the forecast period.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONContract Research Organization Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Contract Research Organization Market Drivers and Opportunities

Increased Outsourcing of R&D Bolsters Market Growth

The Contract Research Organization (CRO) industry is growing strongly across the globe, owing to rising outsourcing of research and development (R&D) operations in pharmaceutical, biotechnology, and medical device firms. With the healthcare sector becoming increasingly competitive and innovation-driven, firms are under tremendous pressure to speed up drug discovery. Contracting R&D to CROs enables companies to access their specialized expertise, sophisticated infrastructure, and global connectivity without significant investments. CROs offer full-service solutions, from preclinical research to clinical trials, regulatory affairs, and post-marketing surveillance, and thus help sponsors concentrate on their core competencies. In addition, the increasing complexity of clinical trials due to the commonality of chronic diseases, orphan diseases, and personalized medicine has raised the demand for niche CROs with specialized knowledge and technological capacities. Syngene has a dedicated research facility BBRC for Amgen, Baxter, and Bristol-Myers Squibb for specialist discovery, development, and manufacturing facilities in Bangalore.

Discovery CROs are forming long-term strategic partnerships with pharmaceutical and biotechnology companies, academic institutions, and other CROs. These collaborations can involve co-developing drugs, joint ventures, or preferred provider agreements, allowing both parties to leverage each other’s strengths. In November 2024, Novotech, a global full-service clinical CRO, formed a long-term partnership with Beijing Biostar Pharmaceuticals Co., Ltd. This collaboration was aimed to advance clinical research by utilizing Novotech’s expertise to support Biostar’s clinical development plans for novel therapeutics.

Such partnerships can significantly reduce the time required to bring a drug to market, accelerating the process by months compared to traditional outsourcing. It typically takes 10 to 15 years and over US$ 2.5 billion to develop a single drug, with most costs arising from the discovery and development phases in the US. By sharing expertise, resources, and technologies, these collaborations foster innovation, help mitigate risks, and distribute research costs.

Therefore, the market is well positioned for continued growth due to rising dependence on R&D outsourcing to achieve efficiency, save costs, and get life-saving drugs to patients more quickly.

Expansion of Biologics and Biosimilars to Create Growth Opportunities

Biologics—encompassing products such as monoclonal antibodies, recombinant proteins, and gene therapies—have become integral to the treatment of complex, chronic, and life-threatening conditions, including cancer, autoimmune diseases, and rare genetic disorders. As patents for originator biologics continue to expire, the biosimilars market is experiencing rapid growth. These follow-on biologics are developed to be highly similar to their reference products in terms of safety, efficacy, and quality, but they offer a more cost-effective alternative. According to key findings from a report published by IQVIA in February 2025 on biosimilars void in the US, 118 biologics are expected to lose patent protection during 2025–2034. Thus, focus on the development of more of these therapeutics will likely increase with the expiration of patents for several high-revenue biologic drugs. Moreover, the rising global demand for affordable healthcare solutions is amplifying the emphasis on biosimilars, especially in cost-sensitive markets such as Asia Pacific and Latin America.

The contract research organization (CRO) market is poised for significant expansion, driven largely by the accelerating development of biologics and biosimilars. Given the inherent complexity, high cost, and regulatory demands of biologic and biosimilar development, pharmaceutical and biotechnology companies outsource R&D functions to CROs in order to mitigate risk, reduce operational costs, and accelerate time-to-market. This trend is especially pronounced among small to mid-sized biopharmaceutical companies, which often lack in-house infrastructure or expertise for large-scale biologic development. CROs that invest in specialized capabilities—such as bioanalytical testing, immunogenicity assessment, regulatory compliance, and biologic-specific clinical trial design—are well-positioned to capitalize on this opportunity. CROs are expanding their biologics-focused service offerings, building strategic partnerships, and integrating digital platforms and AI-powered analytics to improve R&D outcomes.

Contract Research Organization Market Report Segmentation Analysis

Key segments that contributed to the derivation of the contract research organization market analysis are service type, product type, type, application, and end user.- Based on service type, the contract research organization market is segmented into early phase development services, clinical research services, laboratory services, and post-approval services. The clinical research services segment held the largest share of the contract research organization market in 2024, and it is expected to register a significant CAGR during 2024–2031.

- By product type, the market is categorized into cell and gene therapy, biosimilars, antibody drug conjugates, and others. The biosimilars segment held the largest share of the contract research organization market in 2024.

- Based on type, the contract research organization market is bifurcated into in-house and outsource. The outsource segment held a larger share of the contract research organization market in 2024, and it is expected to register a significant CAGR during 2024–2031.

- By application, the market is categorized into oncology, neurology, cardiology, infectious diseases, metabolic disorders, nephrology, respiratory, dermatology, ophthalmology, hematology, and others. The oncology segment held the largest share of the contract research organization market in 2024.

- Based on end user, the contract research organization market is segmented into pharmaceutical and biotech companies, medical device companies, academic and research institutes, and others. The pharmaceutical and biotech companies segment held the largest share of the contract research organization market in 2024, and it is expected to register a significant CAGR during 2024–2031.

Contract Research Organization Market Share Analysis by Geography

The geographic scope of the contract research organization market report is mainly divided into five major regions: North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America. The growth in North America is characterized by growing demand for contract research organizations by the healthcare market players, growing support from the government to provide cost-effective healthcare service, increasing strategic developments by the contract research organization players to enhance services, and a growing healthcare industry that demands frameworks and guidelines based on the real-world data for their business models. The US is the largest market for contract research organizations. It is estimated to continue its dominancy owing to the presence of leading contract research organizations. This well-established healthcare industry provides a broader scope for contract research organizations and a growing shift toward outsourcing R&D and clinical trial services.

Contract research organizations are crucial to the biotechnology, pharmaceutical, and medical device industries owing to their offering of outsourced research services that help accelerate the typically prolonged and complicated drug development process. Due to the need for quicker drug development and technical developments, the landscape for contract research organizations in the US is evolving quickly. The regulatory environment heavily impacts the operation of contract research organizations. Initiatives such as real-time assessment, which permits simultaneous data assessment during clinical trials, have been established by the US FDA. Contract research organizations manage and evaluate data in real time related to this change. A growing number of clinical trials are being conducted owing to increasing investments in research and development in the country. According to an article published in the United States National Library of Medicine in May 2023, 437,533 clinical trials were registered in 221 countries in 2023, an increase from 399,499 in 2022, among which 140,492 (31%) were registered in the US. Contract research organizations help lower the risks of trial delays and regulatory obstacles by assisting pharmaceutical businesses in navigating this environment.

Contract Research Organization

Contract Research Organization Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 65.39 Billion |

| Market Size by 2031 | US$ 113.79 Billion |

| Global CAGR (2024 - 2031) | 8.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Contract Research Organization Market Players Density: Understanding Its Impact on Business Dynamics

The Contract Research Organization Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Contract Research Organization Market News and Recent Developments

The Contract Research Organization Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the market are listed below:- Thermo Fisher Scientific Launched International CorEvitas Clinical Registry in Adolescent Alopecia Areata. The registry was made active in both Europe and the US. The first patient was enrolled in Europe. This marked the 12th independent registry from CorEvitas, which was part of the PPD clinical research division of Thermo Fisher Scientific. It complemented an existing CorEvitas registry that focused on adult AA, launched in 2023. (Source: Thermo Fisher Scientific, Company Website, February 2025)

- Julius Clinical Research announced a majority recapitalization by Ampersand Capital Partners (Ampersand). The investment and partnership with Ampersand enables the Company to expand its scientific and therapeutic expertise as well as build its geographic footprint in Europe and North America to accelerate the growth of its CRO services. (Source: Julius Clinical Research, Company Website, November 2023).

Contract Research Organization Market Report Coverage and Deliverables

The "Contract Research Organization Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:- Contract research organization market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Contract research organization market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Contract Research Organization Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the contract research organization market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For