Property And Casualty Insurance Market Growth, Analysis, and Forecast by 2031

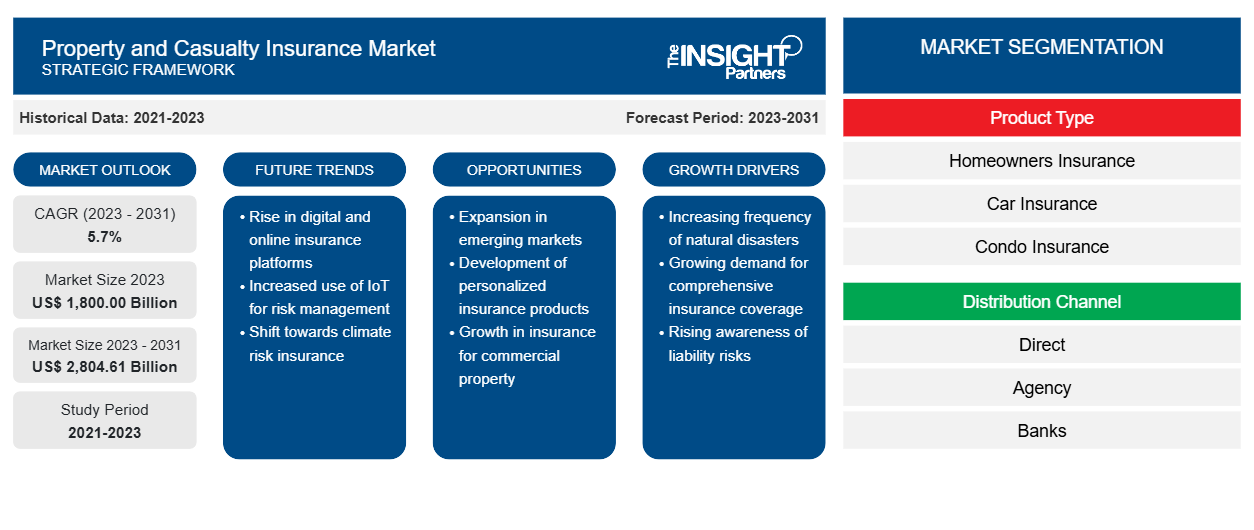

Property and Casualty Insurance Market Size and Forecast (2021-2031), Global and Regional Share, Trends, and Growth Opportunity Analysis: By Product Type (Homeowners Insurance, Car Insurance, Condo Insurance, Renters Insurance, Landlord Insurance, Others); Distribution Channel (Direct, Agency, Banks); and Geography

Historic Data: 2021-2023 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : Mar 2026

- Report Code : TIPRE00039059

- Category : Banking, Financial Services, and Insurance

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

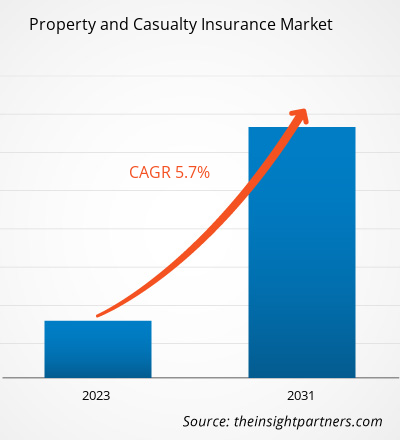

The property and casualty insurance market is projected to grow from US$ 1,800.00 billion in 2023 to US$ 2,804.61 billion by 2031; it is expected to expand at a CAGR of 5.7% from 2023 to 2031. The rise in asset ownership is a fundamental driver boosting the growth of the market. As businesses and individuals accumulate various assets like vehicles, homes, and valuables, the demand for inclusive insurance coverage strengthens. Heightened asset ownership accentuates the requirement for vigorous protection against possible risks, including natural disasters, accidents, and liability concerns. This tendency underlines the critical role of the property and casualty insurance industry in delivering financial security, aligning with the expanding financial portfolios. The market responds dynamically to the increasing need for safeguarding various assets, ensuring complete risk mitigation.

Property and Casualty Insurance Market

Analysis

The property and casualty insurance industry is undergoing technological advancements to improve its services and grip, which comprises the use of digital payments, mobile banking, and groundbreaking financial technologies. These property and casualty insurance market trends enable greater efficiency, accessibility, and convenience for both casualty and property insurance institutions and their clientele. There is an increased emphasis on social impact and sustainability within the property and casualty insurance market. Thus, property and casualty insurance organizations are progressively aligning their operations with environmental, social, and governance (ESG) guidelines. They intend to generate positive social change, encourage responsible loaning practices, and ensure the long-term sustainability of their business operations. Regulatory outlines governing property and casualty insurance are evolving to acclimate to altering market dynamics. Regulatory and government bodies are working towards fostering innovation, financial steadiness, and consumer protection. These regulatory variations intend to create an empowering environment for property and casualty insurance organizations to flourish while protecting the interests of clients.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONProperty and Casualty Insurance Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Property and Casualty Insurance Industry Overview

- The growth of the market depends on numerous factors, including the rise in uncertain catastrophic actions, the digitalization of the insurance and banking industry, and the growing government regulations on obligatory insurance coverage.

- Technological advancements drive the property and casualty insurance market share, progressing essential processes. Artificial intelligence and data analytics improve precision, risk assessment accuracy, and claims effectiveness. Telematics allows usage-based insurance practices, tailoring premiums based on real-time data. Digital platforms modernize customer interactions, making insurance policies more manageable. Adopting technology not only intensifies market competitiveness but also transmutes the property and casualty insurance market landscape, ushering in a novel era marked by improved customer experiences and efficient risk management practices.

- Property and casualty insurers are businesses that offer coverage on benefits as well as accountability insurance for wounds, accidents, and damage to individuals or their possessions. These companies encompass a number of things involving marine insurance, auto insurance, professional accountability insurance, and home insurance. Property and casualty insurers deliver insurance to consumers for probability up to a particular coverage amount negotiable for insurance payments.

Property and Casualty Insurance Market Driver and Opportunities

The digitalization of the insurance industry to Drive the Property and Casualty Insurance Market

- Digitalization has led to significant variations in the insurance industry. Insurance corporations are providing efficient, convenient, and personalized services to their customers. Insurtech businesses leverage progressive technologies to provide advanced insurance services and products that are custom-made to clients' preferences. This empowers customers to effortlessly compare insurance policies and select the one that suits their requirements.

- Insurance firms can use innovative tools to collect and analyze massive amounts of data. With the usage of big data analytics and artificial intelligence (AI), they can deliver targeted and personalized pricing and policies as well as risk management. The usage of online platforms and mobile applications has also transformed the insurance business. Customers can effortlessly access insurance services using their computers or smartphones, which makes the process of managing and buying insurance policies more convenient. These factors are projected to boost the property and casualty insurance market growth during the forecast period.

Property and Casualty Insurance Market Report Segmentation Analysis

- Based on product type, the property and casualty insurance market is segmented into homeowners insurance, car insurance, condo insurance, renters insurance, landlord insurance, and others.

- The direct segment is anticipated to hold a substantial property and casualty insurance market in 2023. Insurance businesses have an improved understanding of customers' preferences and needs, which allows them to deliver personalized services. This aids them in generating strong relationships with their customers and establishing trust. These factors are projected to drive the direct business segment during the forecast period.

Property and Casualty Insurance Market Regional Analysis

The scope of the market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is projected to hold prominent property and casualty insurance market share in 2022. The presence of an affluent and large high-income group is boosting the growth of the market in North America. This has generated a substantial demand for insurance products, especially casualty and property insurance. The high level of adoption and innovation of progressive technologies are also propelling the growth of the regional market. Insurers are employing progressive technologies to develop novel products to improve customer experience and operational efficiency. The governing environment in North America is also contributing to the property and casualty insurance market growth in the region. The regulatory framework in the region is intended to protect consumers and ensure impartial market competition among insurers. Therefore, regulators work closely with insurance businesses to promote market steadiness, consumer protection, and financial reliability. Such factors will boost the growth of the market in the North America region during the forecast period.

Property and Casualty Insurance Market Regional InsightsThe regional trends and factors influencing the Property and Casualty Insurance Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Property and Casualty Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Property and Casualty Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,800.00 Billion |

| Market Size by 2031 | US$ 2,804.61 Billion |

| Global CAGR (2023 - 2031) | 5.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Property and Casualty Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Property and Casualty Insurance Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Property and Casualty Insurance Market top key players overview

The "Property and Casualty Insurance Market Analysis" was carried out based on product type, distribution channel, and geography. In terms of product type, the market is segmented into homeowners insurance, car insurance, condo insurance, renters insurance, landlord insurance, and others. Based on the distribution channel, the market is segmented into direct, agency, and banks. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Property and Casualty Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the property and casualty insurance market. A few recent key market developments are listed below:

- In November 2023, Chubb announced a new insurance product catering to customers in the United Kingdom, precisely designed for the media industry. The media insurance offering includes tailored coverages, spanning media liability, cyber, property, casualty, and legal expenses. Each coverage option is discretionary, allowing customers the flexibility to modify their insurance plans according to their individual preferences and needs.

(Source: Chubb, Company Website)

- In July 2023, Allianz Global Corporate & Specialty, in collaboration with the commercial insurance segment of regional Allianz Property & Casualty, started operations under the unified name "Allianz Commercial." This unified business entity serves as a single go-to-market platform, providing inclusive insurance solutions tailored for mid-sized businesses, large enterprises, and specialized risk.

(Source: Allianz Global, Company Website)

- In February 2022, Everbridge, Inc. and Brown & Brown revealed an advanced product, the first of its kind, designed to empower property and casualty insurance clients. This groundbreaking offering enables proactive advanced alerts regarding events that could affect insured properties. It goes beyond providing recommendations on actions that can be taken to minimize costs, mitigate disruption, and address potential threats to personal safety.

(Source: Everbridge, Inc., Company Website)

Property and Casualty Insurance Market Report Coverage & Deliverables

The market report "Property and Casualty Insurance Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For