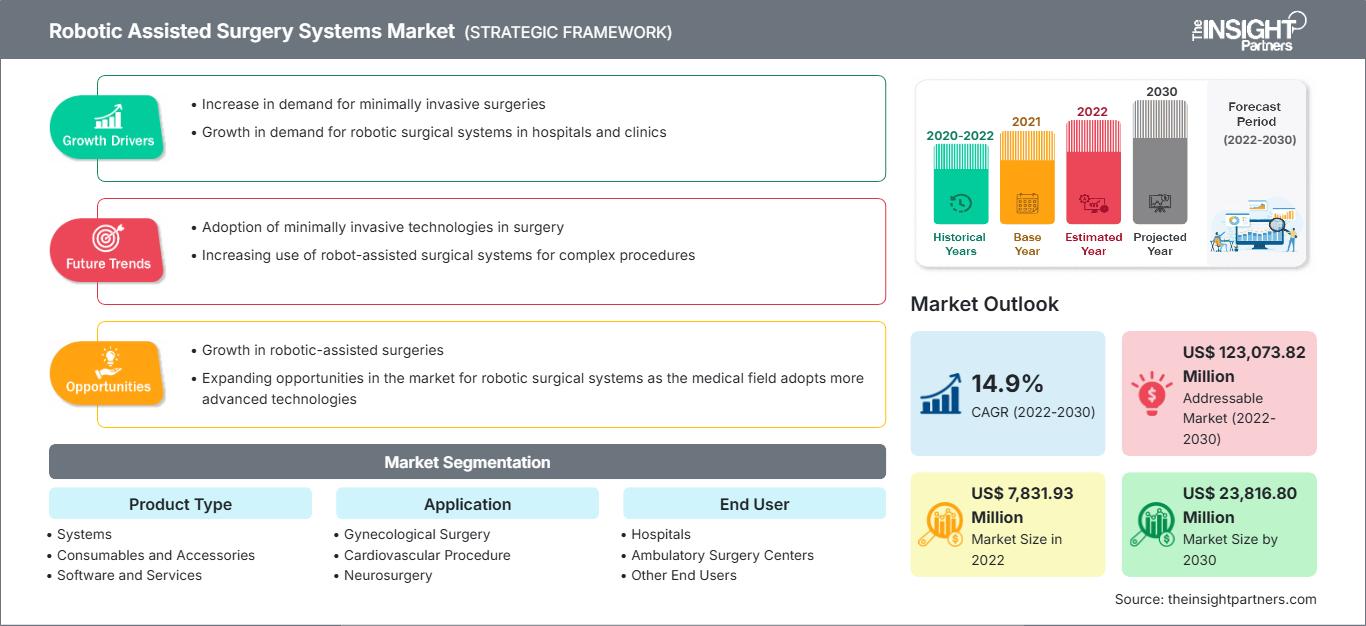

Robotic Assisted Surgery Systems Market Growth and Analysis by 2030

Robotic Assisted Surgery Systems Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type [Systems, Consumables and Accessories, and Software and Services], Application (Gynecological Surgery, Cardiovascular Procedure, Neurosurgery, Orthopedic Surgery, Laparoscopy, Urology, and Other Applications), End User (Hospitals, Ambulatory Surgery Centers, and Other End Users), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Mar 2026

- Report Code : TIPRE00004753

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

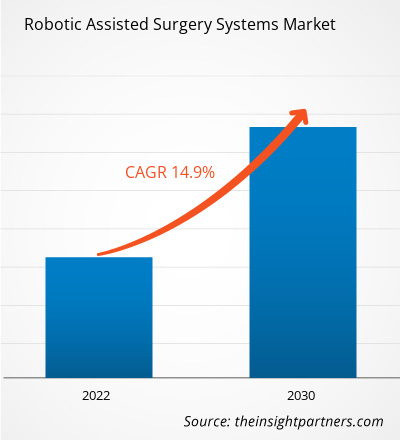

The Robot Assisted Surgical Systems Market size is expected to reach US$ 4,790 million by 2031. The market is anticipated to register a CAGR of 13.8% during 2025–2031.

Market Insights and Analyst View:

The robotic assisted surgery systems market encompasses an array of technologically advanced surgical platforms that integrate robotics, imaging, and navigation systems to assist surgeons in performing minimally invasive procedures with increased precision and control. These systems are designed to enhance surgical capabilities, improve patient outcomes, and minimize theinvasiveness of traditional surgical techniques. The noteworthy benefits of robotic assisted surgery systems include enhanced dexterity, three-dimensional visualization, and tremor filtration, allowing surgeons to perform complex procedures with superior accuracy and maneuverability. These systems often enable them to access difficult-to-reach anatomical areas, leading to reduced trauma and faster patient recovery times. Additionally, the integration of robotics in surgeries minimizes the risk of complications and lowers the need for blood transfusions, ultimately contributing to improved post-operative outcomes.

Growth Drivers and Challenges:

The increasing number of research studies exploring the benefits and capabilities of robotically assisted operations is anticipated to fuel market progress in the coming years. In September 2022, a team from the Graduate School of Medical Sciences, Nagoya City University (NCU), conducted a study comparing robotic-assisted, fluoroscopic-guided, ultrasound-guided renal access for percutaneous nephrolithotomy. The study's findings demonstrate the safety and ease of use of revolutionary robotic devices, which may lessen the training burden on surgeons and enable more hospitals to perform PCNL procedures. This method, which uses robotics driven by artificial intelligence, may open a door to the automation of comparable surgical interventions, in turn, speeding up the process and lowering the risk of complications.

A rise in chronic disease cases and the growing popularity of minimally invasive surgeries further favor the robotic assisted surgical systems market. According to news released by The Hindu in August 2022, Apollo Health City in Hyderabad, India, has completed more than 500 robotically assisted gynecological procedures. In November 2022, India Medtronic Private Limited, a wholly-owned subsidiary of Medtronic plc, and Venkateshwar Hospital in Delhi announced the completion of the first urological treatment in north India with the Hugo robotic assisted surgery (RAS) system.

On the other hand, the high cost of robotic surgical systems hampers the financial viability and operational sustainability of healthcare providers. While these systems offer advantages such as enhanced precision, minimal invasiveness, and reduced patient recovery times, the substantial upfront investment and ongoing maintenance costs necessitate careful financial planning and resource allocation for healthcare facilities. Additionally, the need for specialized training and certification of surgical personnel to operate these systems adds further operational costs, impacting the overall affordability and practicality of integrating robotic surgery into existing clinical practices. The cost burden associated with robotic surgical systems has the potential to influence healthcare reimbursement models and coverage decisions. Reimbursement rates for procedures performed with robotic assistance may vary, and coverage by insurance providers could affect the economic rationale for adopting these technologies. This creates a complex landscape where healthcare facilities need to weigh the clinical advantages of robotic surgery against the financial implications, potentially affecting the pace and scale of adoption across different healthcare systems.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONRobotic Assisted Surgery Systems Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The robotic assisted surgery systems market is segmented on the basis ofproduct type, application, and end user. Based on product type, the market is divided into systems, instruments and accessories, and services. By application, the robotic assisted surgery systems market is segmented into gynecological surgery, cardiovascular, neurosurgery, orthopedic surgery, laparoscopy, urology, general surgery, and others. The market, based on end user, is classified into hospitals, ambulatory surgery centers, and other end users. In terms of geography, the robotic assisted surgery systems market is divided into North America (US, Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on product type, the surgical robot segment held a substantial revenue share of the robotic assisted surgery systems market in 2022. The need for surgical robots to perform precise and accurate procedures is predicted to increase due to the surging global incidence of cardiovascular and cancer disorders. The US is expected to report 1.9 million new cancer cases in 2023, according to the American Cancer Society's Cancer Statistics 2023. As per the Australian Institute of Health and Welfare's (AIHW) 2021 report, the estimated new cases of cancer in Australia in 2021 were 150,800. The March 2022 report from the Australian Bureau of Statistics states that 4.0% of Australians, or 1.0 million people, were estimated to have heart disease in 2021.

Based on application, the robot-assisted surgical systems market is classified into gynecological surgery, cardiovascular, neurosurgery, orthopedic surgery, laparoscopy, urology, general surgery, and others. The neurology sector is expected to record the fastest CAGR during 2022–2030. The increasing usage of surgical robots in general surgeries and the benefits they offer over conventional surgical methods benefit the overall market. Furthermore, improvements in technology and the successful results of robotic neurosurgery are anticipated to propel the expansion of the robot-assisted surgical systems market in the coming years. According to SS Innovations Interventional Inc., approximately 1.6 million robotic surgeries were performed globally in 2020.

By end user, the robot-assisted surgical systems market is segmented into hospitals, ambulatory surgical centers, and other end users. The hospital segment dominated the market in 2022 and is anticipated to register a high CAGR during 2022–2030. The growth of the market for hospitals segment is ascribed to rising healthcare costs across several economies. Hospitals provide superior quality of care by utilizing the latest robotic assisted surgical equipment. Moreover, physicians and surgeons prefer robot-assisted systems. The use of robot-assisted operations in overall surgical procedures surged multifold from 1.8% in 2013 to 15.1% in 2019, according to a paper published in the JAMA network.

Regional Analysis:

Based on geography, the robotic assisted surgery systems market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is the most significant contributor to the growth of this market. The market progress in this region is attributed to the growing use of automated surgical instruments and the adoption of next-generation healthcare systems in the US. Furthermore, the lack of surgeons and medical professionals in the US compared to the patient population is projected to benefit the market for robot-assisted surgical systems. The increased prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disease propels the demand for robot-assisted surgical systems in the US.

The growing popularity of minimally invasive procedures as opposed to conventional operations favors the robotic assisted surgery systems market. In December 2022, Hugo extended the clinical trials of its robotic assisted surgery (RAS) systems in the US by enrolling their first patient, according to Medtronic plc. Further, in 2022,a doctor at Duke University Hospital in Durham, North Carolina, carried out the robotic assisted prostatectomy procedure.

The Asia Pacific robotic assisted surgical systems market is expected to grow at the fastest CAGR during 2022–2030 owing to the growing patient population and rising use of sophisticated automated surgical instruments. Additionally, expanding contemporary healthcare facilities and increasing public awareness of the advantages of cutting-edge medical technologies are anticipated to benefit the market growth in this region in the future. Governments of countries in Asia Pacific are making attempts to establish sophisticated healthcare infrastructure, which is drawing international businesses to invest in the establishment of automated instrument development facilities in this region. China holds the largest share of the robot-assisted surgical systems market in Asia Pacific, and India is expected to record the highest CAGR during 2022–2030. Companies in the surgical robotics business in China have shortened their time to market by taking advantage of a special approval pathway that expedites regulatory approval for innovative medical products. Moreover, an increasingly large number of medtech firms specializing in surgical robotics are emerging in the country. In recent years, JianJia Robots and Hurwa entered the Chinese market to develop surgical robotics solutions alongside TINAVI, a domestic company specializing in orthopedic surgical robots. Beijing reimburses TINAVI robot-assisted surgeries for the spine, hip, and knee.

Robotic Assisted Surgery Systems Market Regional InsightsThe regional trends and factors influencing the Robotic Assisted Surgery Systems Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Robotic Assisted Surgery Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Robotic Assisted Surgery Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX Million |

| Market Size by 2031 | US$ 4,790.40 Million |

| Global CAGR (2025 - 2031) | 13.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Robotic Assisted Surgery Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Robotic Assisted Surgery Systems Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Robotic Assisted Surgery Systems Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating inthe global robotic assisted surgery systems market are listed below:

- In October 2023, Johnson & Johnson MedTech, an orthopedics business of DePuy Synthes, introduced the VELYS Robotic Assisted Solution. The solution has been used in total knee replacement procedures in Germany, Belgium, and Switzerland. With this launch, DePuy Synthes expands the networked technologies within its Digital Surgery Platform to meet unmet demands for orthopedic robots.

- In November 2022, an Indian Medtech business partnered with Avra Medical Robotics, an American company listed on the Nasdaq. The first surgical robot to be entirely "Made in India," SSI Mantra, was introduced by SS Innovations. It is a highly developed surgical robotic system with more capabilities and applications than other systems on the market.

- In November 2022, FDA in the United States approved Accelus's software update for the Remi Robotic Navigation System, which allows surgeons performing lumbar spine fixation to place pedicle screws with robotic assistance. Accelus is a private medical technology company that focuses on the adoption of minimally invasive surgery (MIS) as the standard of care in the spine.

Competitive Landscape and Key Companies:

Intuitive Surgical Inc.,Stryker Corporation, Johnson & Johnson Inc., SRI International Inc., Accuray Incorporated, Renishaw PLC, Medtronic PLC, Brainlab, Smith & Nephew PLC, Globus Medical, and Zimmer Biomet are among the prominent players in the robotic assisted surgery systems market. These companies focus on expanding their offerings to meet the growing consumer demand worldwide. Their global presence allows them to serve a large set of customers, subsequently allowing them to expand their market share.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For