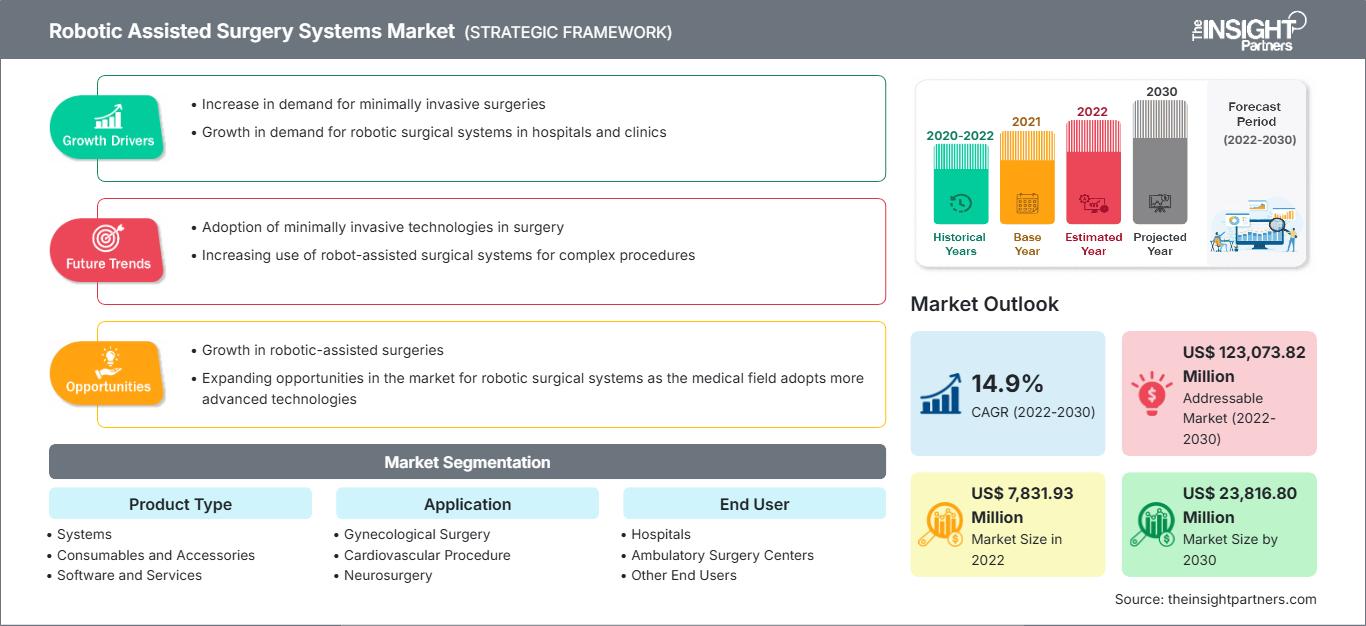

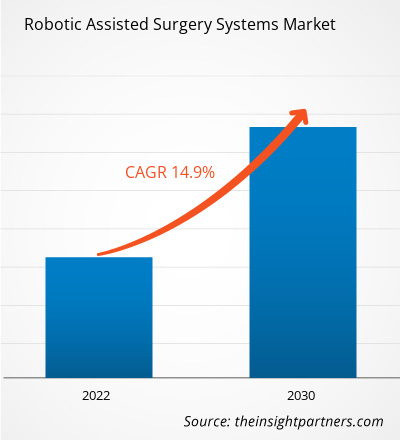

[研究报告] 机器人辅助手术系统市场规模预计将从2022年的78.3193亿美元增长到2030年的238.1680亿美元;预计2022年至2030年期间的复合年增长率为14.9%。

市场洞察和分析师观点:

机器人辅助手术系统市场涵盖一系列技术先进的手术平台,这些平台集成了机器人、成像和导航系统,可帮助外科医生以更高的精度和控制力执行微创手术。这些系统旨在增强手术能力,改善患者预后,并最大限度地减少传统手术技术的侵入性。机器人辅助手术系统值得注意的优势包括增强的灵活性、三维可视化和震颤过滤,使外科医生能够以卓越的精度和可操作性执行复杂的手术。这些系统通常使他们能够进入难以触及的解剖区域,从而减少创伤并加快患者康复时间。此外,将机器人技术融入手术可最大限度地降低并发症风险并减少输血需求,最终有助于改善术后效果。

增长动力与挑战:

越来越多的研究探索机器人辅助手术的优势和功能,预计将在未来几年推动市场发展。2022 年 9 月,名古屋市立大学 (NCU) 医学研究生院的一个团队进行了一项研究,比较了机器人辅助、荧光透视引导和超声引导下经皮肾镜取石术 (PCNL) 的肾通路。该研究结果证明了革命性的机器人设备的安全性和易用性,这可能会减轻外科医生的培训负担,并使更多医院能够开展 PCNL 手术。这种方法利用人工智能驱动的机器人技术,可能为同类外科手术的自动化打开大门,从而加快手术进程并降低并发症的风险。

慢性病病例的增加和微创手术的日益普及进一步有利于机器人辅助手术系统市场。据《印度教徒报》 2022 年 8 月发布的消息,印度海得拉巴的阿波罗健康城已完成 500 多例机器人辅助妇科手术。2022 年 11 月,美敦力公司的全资子公司印度美敦力私人有限公司和德里的 Venkateshwar 医院宣布,使用 Hugo 机器人辅助手术 (RAS) 系统完成了印度北部首例泌尿科治疗。

另一方面,机器人手术系统的高成本阻碍了医疗服务提供者的财务可行性和运营可持续性。虽然这些系统具有精准度更高、微创性更强、患者康复时间更短等优势,但巨额的前期投资和持续的维护成本使得医疗机构需要谨慎的财务规划和资源配置。此外,手术人员需要接受专门的培训和认证才能操作这些系统,这进一步增加了运营成本,影响了将机器人手术融入现有临床实践的总体可负担性和实用性。机器人手术系统的成本负担可能会影响医疗报销模式和承保决策。使用机器人辅助手术的报销率可能有所不同,而保险公司的承保范围也可能影响采用这些技术的经济可行性。这造成了一个复杂的局面,医疗机构需要权衡机器人手术的临床优势与财务影响,这可能会影响不同医疗体系采用机器人手术的速度和规模。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

机器人辅助手术系统市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

报告细分和范围:

机器人辅助手术系统市场根据产品类型、应用和最终用户进行细分。根据产品类型,市场分为系统、仪器和配件以及服务。根据应用,机器人辅助手术系统市场细分为妇科手术、心血管手术、神经外科、骨科手术、腹腔镜手术、泌尿外科、普通外科等。根据最终用户,市场分为医院、门诊手术中心和其他最终用户。在地域方面,机器人辅助手术系统市场分为北美(美国、加拿大和墨西哥)、欧洲(英国、德国、法国、意大利、西班牙和欧洲其他地区)、亚太地区(中国、日本、印度、韩国、澳大利亚和亚太其他地区)、中东和

根据产品类型,手术机器人细分市场在 2022 年占据了机器人辅助手术系统市场相当大的收入份额。由于全球心血管和癌症发病率激增,预计对执行精确和准确手术的手术机器人的需求将会增加。根据美国癌症协会的《2023 年癌症统计数据》,美国预计将在 2023 年报告 190 万例新的癌症病例。根据澳大利亚健康与福利研究所 (AIHW) 2021 年的报告,估计 2021 年澳大利亚新增癌症病例为 150,800 例。澳大利亚统计局2022年3月的报告指出,2021年估计有4.0%的澳大利亚人(约100万人)患有心脏病。

根据应用,机器人辅助手术系统市场可分为妇科手术、心血管手术、神经外科、骨科手术、腹腔镜手术、泌尿外科、普外科等。预计神经外科领域在2022年至2030年期间的复合年增长率最高。手术机器人在普外科手术中的应用日益增多,以及其相较于传统手术方法的优势,将使整个市场受益。此外,技术的进步和机器人神经外科手术的成功应用预计将在未来几年推动机器人辅助手术系统市场的扩张。根据 SS Innovations Interventional Inc. 的数据,2020 年全球约有 160 万例机器人手术。

按最终用户划分,机器人辅助手术系统市场分为医院、门诊手术中心和其他最终用户。医院在 2022 年占据了市场主导地位,预计在 2022 年至 2030 年期间将实现较高的复合年增长率。医院市场的增长归因于多个经济体医疗成本的上涨。医院利用最新的机器人辅助手术设备提供卓越的护理质量。此外,医生和外科医生也更青睐机器人辅助系统。根据 JAMA 网络发表的一篇论文,机器人辅助手术在整体外科手术中的使用率从 2013 年的 1.8% 飙升至 2019 年的 15.1%。

区域分析:

根据地域划分,机器人辅助手术系统市场分为北美、欧洲、亚太地区、中东和非洲以及南美和中美。北美是该市场增长的最大贡献者。该地区市场的发展归因于美国自动化手术器械的使用日益增多以及下一代医疗保健系统的采用。此外,与患者群体相比,美国外科医生和医疗专业人员的缺乏预计将有利于机器人辅助手术系统市场。糖尿病、癌症和心血管疾病等慢性疾病的患病率不断上升,推动了美国对机器人辅助手术系统的需求。

与传统手术相比,微创手术日益普及,这有利于机器人辅助手术系统市场的发展。据美敦力公司 (Medtronic plc) 称,2022 年 12 月,Hugo 在美国招募了首位患者,扩大了其机器人辅助手术 (RAS) 系统的临床试验范围。此外,2022 年,北卡罗来纳州达勒姆市杜克大学医院的一位医生实施了机器人辅助前列腺切除术。

由于患者人数不断增长以及先进自动化手术器械的使用日益增多,预计亚太地区机器人辅助手术系统市场将在 2022 年至 2030 年期间以最快的复合年增长率增长。此外,预计未来该地区市场的增长将受益于现代医疗设施的扩张和公众对尖端医疗技术优势的认识的提高。亚太地区各国政府正努力建设先进的医疗保健基础设施,吸引着国际企业在该地区投资建设自动化仪器研发中心。中国在亚太地区机器人辅助手术系统市场中占据最大份额,预计印度将在2022年至2030年期间创下最高复合年增长率。中国手术机器人行业的企业利用特殊的审批途径,加快了创新医疗产品的监管审批,从而缩短了产品上市时间。此外,越来越多专注于手术机器人的医疗科技公司在中国涌现。近年来,健嘉机器人和Hurwa与专注于骨科手术机器人的国内公司TINAVI合作,进入中国市场开发手术机器人解决方案。北京政府为TINAVI机器人辅助脊柱、髋关节和膝关节手术提供报销。

机器人辅助手术系统

机器人辅助手术系统市场区域洞察The Insight Partners 的分析师已详尽阐述了预测期内影响机器人辅助手术系统市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的机器人辅助手术系统市场细分和地域分布。

机器人辅助手术系统市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2022 | US$ 7,831.93 Million |

| 市场规模 2030 | US$ 23,816.80 Million |

| 全球复合年增长率 (2022 - 2030) | 14.9% |

| 历史数据 | 2020-2022 |

| 预测期 | 2022-2030 |

| 涵盖的领域 |

By 产品类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

机器人辅助手术系统市场参与者密度:了解其对业务动态的影响

机器人辅助手术系统市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的不断变化、技术进步以及对产品优势的认知度不断提高。随着需求的增长,企业正在扩展其产品线,不断创新以满足消费者需求,并利用新兴趋势,从而进一步推动市场增长。

- 获取 机器人辅助手术系统市场 主要参与者概述

行业发展与未来机遇:

全球机器人辅助手术系统市场主要参与者采取的各种举措如下:

- 2023年10月,强生医疗科技公司(DePuy Synthes 旗下的骨科业务)推出了 VELYS 机器人辅助解决方案。该解决方案已在德国、比利时和瑞士的全膝关节置换手术中使用。通过此次发布,DePuy Synthes 扩展了其数字手术平台中的联网技术,以满足骨科机器人尚未满足的需求。

- 2022年11月,一家印度医疗科技公司与在纳斯达克上市的美国公司 Avra Medical Robotics 合作。SS Innovations 推出了首款完全“印度制造”的手术机器人 SSI Mantra。它是一种高度发达的手术机器人系统,与市场上的其他系统相比,其功能和应用范围更广。

- 2022 年 11 月,美国 FDA 批准了 Accelus 的 Remi 机器人导航系统软件更新,该系统允许进行腰椎固定手术的外科医生在机器人协助下放置椎弓根螺钉。Accelus 是一家私营医疗技术公司,专注于将微创手术 (MIS) 作为脊柱治疗的标准。

竞争格局和主要公司:

Intuitive Surgical Inc.、Stryker Corporation、Johnson & Johnson Inc.、SRI International Inc.、Accuray Incorporated、Renishaw PLC、Medtronic PLC、Brainlab、Smith & Nephew PLC、Globus Medical 和 Zimmer Biomet 是机器人辅助手术系统市场的杰出参与者。这些公司专注于扩展其产品线,以满足全球不断增长的消费者需求。他们的全球影响力使他们能够为大量客户提供服务,从而扩大他们的市场份额。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 机器人辅助手术系统市场

获取免费样品 - 机器人辅助手术系统市场