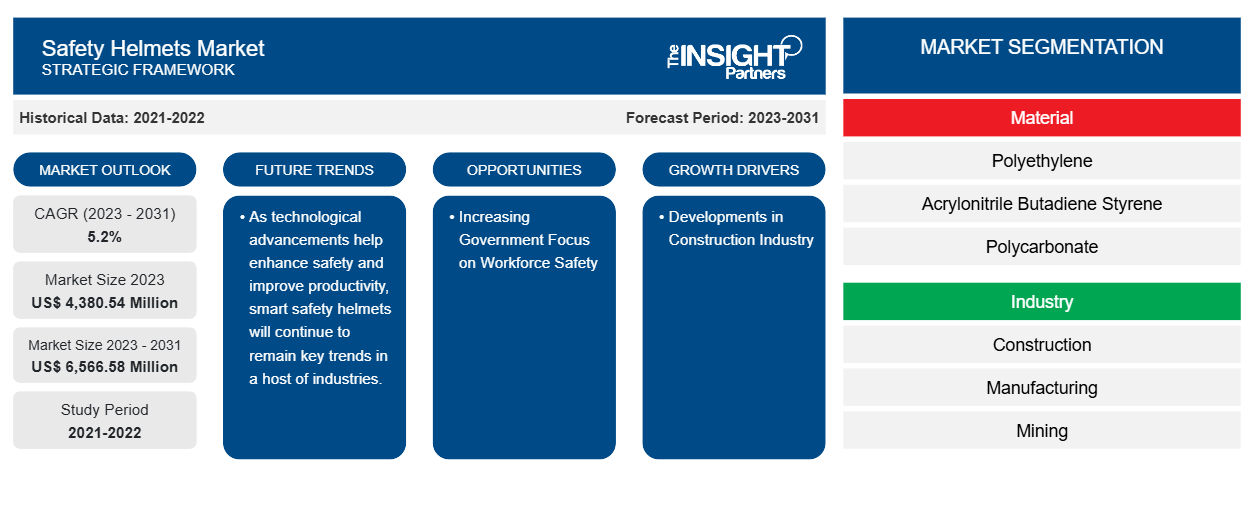

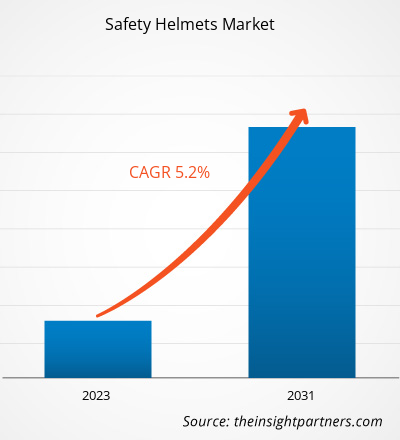

The safety helmets market size is projected to reach US$ 6,566.58 million by 2031 from US$ 4,380.54 million in 2023. The market is expected to register a CAGR of 5.2% during 2023–2031. As technological advancements help enhance safety and improve productivity, smart safety helmets will continue to remain key trends in a host of industries.

Safety Helmets Market Analysis

Labor-intensive industries mandate the incorporation of proper workforce safety measures to mitigate the level of risks; if ignored, it can lead to various hazardous situations that can impact the overall project timeline and operational efficiency. Therefore, safety measures are highly emphasized to avoid any unwanted challenges related to workforce health and safety.

Growing urbanization and rising population promote the construction industry growth, which subsequently delivers a positive impact on the safety helmet market. The increasing advancements in the oil & gas sector for fueling oil production and mining excavations and the rising number of wind farms for power generation also drive the safety helmet market expansion.

Safety Helmets Market Overview

The acceptance of safety helmets has intensified over the years as a basic necessity for protecting the workforce. The industries that demand workers to operate in heights or high-risk environments are propelling the demand for safety helmets globally. Likewise, the mining and telecommunication industries invest a substantial amount in safety measures, which, in turn, accelerate the need for safety helmets. The growing government initiatives and the integration of stern regulations to incorporate high standards of workforce safety measures are other major growth drivers of the safety helmet market at the global level. The safety helmet market outlook continues to be positive as these helmets are well-positioned to serve the safety requirements of end-user industries such as construction, manufacturing, oil & gas, utilities, telecommunication, and mining.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Safety Helmets Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Safety Helmets Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Safety Helmets Market Drivers and Opportunities

Developments in Construction Industry

As the construction industry expands and evolves, the requirement for safe operation becomes crucial. There is an increase in various types of infrastructural development projects, such as commercial complexes, residential buildings, and industrial facilities. Each project needs a workforce for construction, repair, maintenance, and renovation. Rapid urbanization and population outburst drive the requirement for new housing, commercial spaces, and infrastructure. For instance, Saudi Arabia is anticipated to become one of the largest construction sites in the world, with approximately ~US$ 1.1 trillion of investment in infrastructure and real estate projects. These infrastructure and real estate development projects include King Salman Park, Neom Super City, Diriyah Gate, The Red Sea Projects, and Jeddah Central and Jeddah Economic City Projects.

As cities develop, the construction of high-rise buildings and large-scale projects demands safety measures for safe and efficient construction. Unique projects with challenging architectural designs or specific requirements require custom-designed safety measures. For instance, in March 2023, the Canadian Kelowna City Council stated authorization for funding US$ 90 million for the expansion project of the Kelowna Airport terminal. Also, in 2022, the Government of India started its projects to build 220 airports by the end of 2025. The growing infrastructure development and real estate progress, including commercial, residential, and mixed-use projects, drive the demand for safety tools, including helmets, during construction and maintenance activities.

Increasing Government Focus on Workforce Safety

The growing instances of occupational accidents are one of the prime factors that hinder the smooth operation of any construction project. The proper workforce management and growing adoption of standard safety measures to prevent workplace mishaps are anticipated to favor the safety helmet market globally. Governments of several nations are focusing highly on workforce safety regulations to avoid accidents. The Occupational Safety and Health Act of 1970 mentioned proper working standards and conditions to ensure workforce safety. The Health and Safety Executive (HSE), The Health and Safety at Work Act 1974, also describes the measures to prevent work-related injury, ill health, and death. In India, workplace safety is primarily managed by the Factories Act (1948) and the Mines Act (1952). Furthermore, numerous other laws, policies, regulations, and guidelines are related to specialized industries and sectors. Thus, the growing government initiatives and the introduction of strict regulations to protect workforce safety measurements are anticipated to offer lucrative opportunities for the safety helmet market during the forecast period.

Safety Helmets Market Report Segmentation Analysis

Key segments that contributed to the derivation of the safety helmets market analysis are material and industry.

- Based on material, the safety helmet market is segmented into polyethylene, acrylonitrile butadiene styrene, polycarbonate, and others. Among these, polyethylene held the largest share in 2023, owing to its increasing demand in the growing construction sector.

- In terms of industry, the market is categorized into construction, manufacturing, mining, and others. Among these, the construction sector acquired the largest share in 2023 due to the significant demand for safety helmets at residential and commercial construction projects across the world.

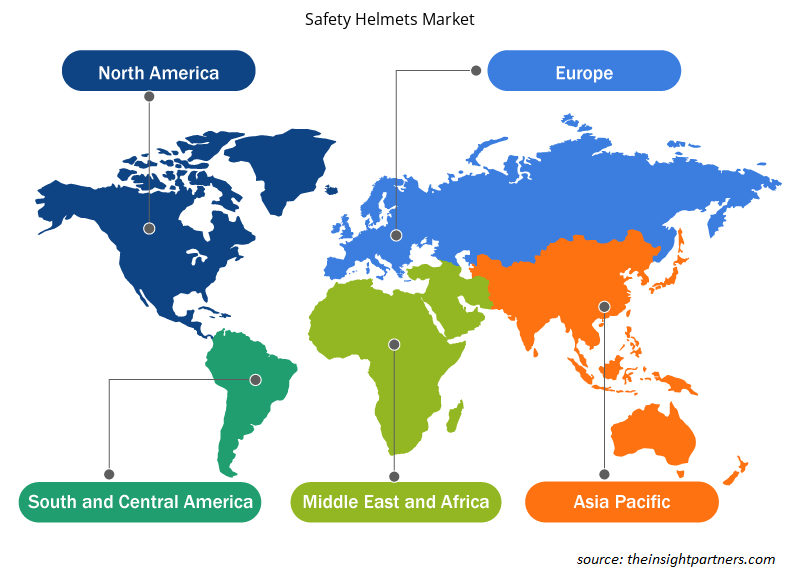

Safety Helmets Market Share Analysis by Geography

The geographic scope of the safety helmets market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America.

Asia Pacific dominated the safety helmets market in 2023; it will continue to dominate the market during the forecast period due to factors such as growing developments in the construction sector, rising government focus on infrastructure development, increasing demand for renovation and repair work, and rapid urbanization. China, India, and Japan hold prominent positions in the safety helmet market in Asia Pacific.

Safety Helmets Market Regional Insights

The regional trends and factors influencing the Safety Helmets Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Safety Helmets Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Safety Helmets Market

Safety Helmets Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4,380.54 Million |

| Market Size by 2031 | US$ 6,566.58 Million |

| Global CAGR (2023 - 2031) | 5.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

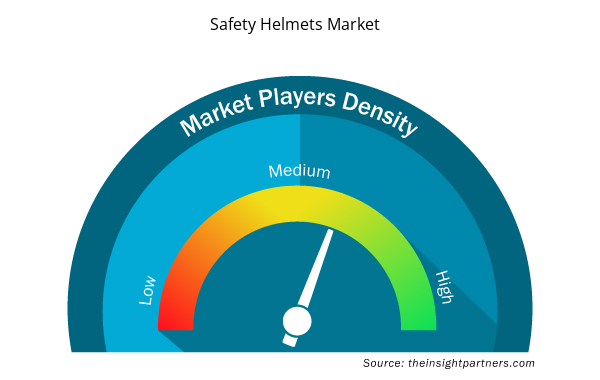

Safety Helmets Market Players Density: Understanding Its Impact on Business Dynamics

The Safety Helmets Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Safety Helmets Market are:

- 3M Co

- Honeywell International Inc

- MSA Safety Inc

- Centurion Safety Products Ltd

- Concord Helmet & Safety Products Private Limited

- JSP Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Safety Helmets Market top key players overview

Safety Helmets Market News and Recent Developments

The safety helmets market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the safety helmets market are listed below:

- STUDSON, a safety helmet developer that recently launched the first-of-its-kind Full Brim ANSI Type II Safety Helmet, announced the completion of a US$ 2.48 million funding round and a strategic collaboration with Blaklader, one of Europe’s largest producers of workwear. (Source: STUDSON, Company Press Release, March 2024)

- Lakeland Industries, Inc. (NASDAQ:LAKE) (the "Company" or "Lakeland"), a leading global manufacturer of protective clothing for industry, healthcare and first responders on the federal, state and local levels, announced today the acquisition of New Zealand-based Pacific Helmets NZ Limited ("Pacific") in an all-cash transaction valued at approximately $8.5 million subject to post-closing adjustments and customary holdback provisions. (Source: STUDSON, Company Press Release, November 2023)

Safety Helmets Market Report Coverage and Deliverables

The “Safety Helmets Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Safety helmets market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Safety helmets market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Safety helmets market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the safety helmets market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Material Type, End-user Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Who are the major vendors in the safety helmets market?

3M, Centurion Safety Products Ltd., Concord Helmet & Safety Product Private Limited, Polison Corporation, Honeywell International Inc., JSP Limited, Pyramex, and Schuberth are the key market players operating in the global safety helmets market.

What is the future trend for the safety helmets market?

Growing adoption of advanced materials drives the market growth. Safety measures are being revolutionized with the use of advanced materials to address challenges associated with workforce safety. Advanced lightweight materials such as polyamide, polyethylene, nylon, and Acrylonitrile Butadiene Styrene can improve the strength-to-weight ratios of safety helmets in order to ensure long-term performance and resistance to wear and tear.

Which region to dominate the safety helmets market in the forecast period?

The Asia Pacific safety helmets market is segmented into China, India, South Korea, Australia, and the Rest of Asia Pacific. The increasing developments in commercial and industrial spheres are among the prime reasons accelerating the safety helmet market growth in North America. The US dominates the market for safety helmets in North America. The rising focus on worker safety and health for proper project completion in manufacturing and construction sites is fueling the demand for safety helmets in the region.

What are market opportunities for the safety helmets market?

Increasing government focus on workforce safety drives the market growth. The growing instances of occupational accidents are one of the prime factors that hinder the smooth operation of any construction project. The proper workforce management and growing adoption of standard safety measures to prevent workplace mishaps are anticipated to favor the safety helmet market globally.

What are reasons behind the safety helmets market growth?

Increasing developments in the construction industry drives the market growth. As the construction industry expands and evolves, the requirement for safe operation becomes crucial. There is an increase in various types of infrastructural development projects, such as commercial complexes, residential buildings, and industrial facilities. Each project needs a workforce for construction, repair, maintenance, and renovation. Rapid urbanization and population outburst drive the requirement for new housing, commercial spaces, and infrastructure.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Safety Helmets Market

- 3M Co.

- Centurion Safety Products Ltd.

- Concord Helmet & Safety Product Private Limited

- Polison Corporation

- Honeywell International Inc.

- JSP Limited

- Pyramex

- Schuberth

- VOSS-HELME GmbH & Co. KG

- Uvex Arbeitsschutz GmbH

Get Free Sample For

Get Free Sample For