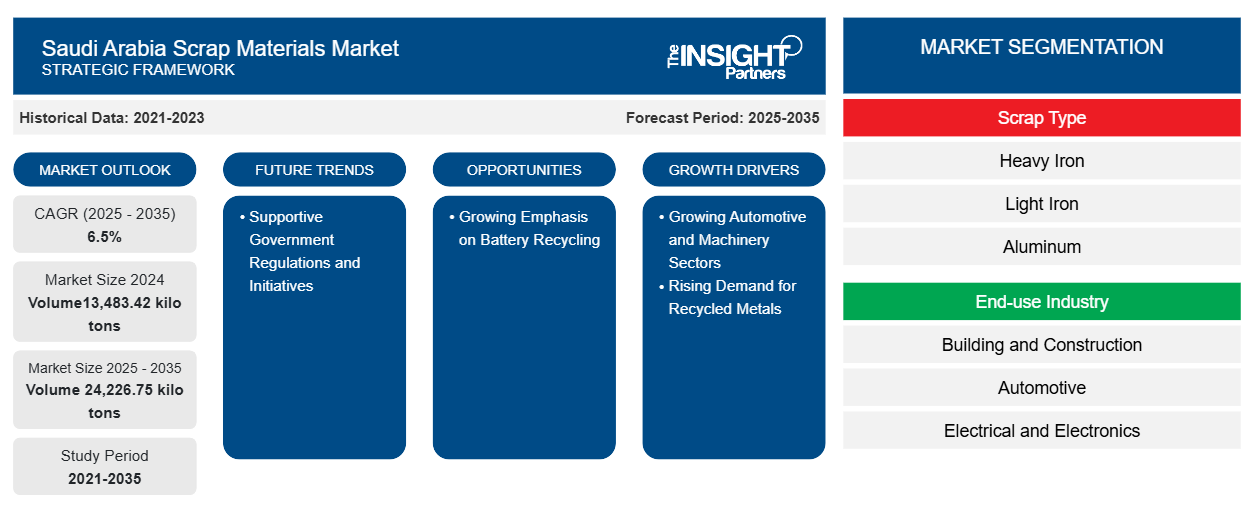

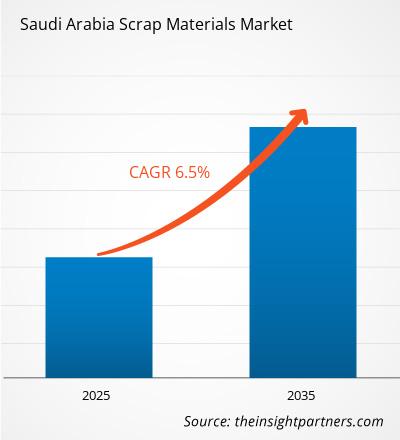

The Saudi Arabia scrap materials market is expected to attain a volume of 24.23 million tons by 2035 from 13.48 million tons in 2024, registering a CAGR of 6.5% during 2025–2035. The growing emphasis on battery recycling is likely to bring new trends into the market during the forecast period.

Saudi Arabia Scrap Materials Market Analysis

The development of the local automotive industry involving electric vehicle production and traditional automobile assembly generates a significant amount of scrap metal, including aluminum, steel, and copper. These materials are generated from waste, defective parts, and end-of-life vehicles. The country’s growing focus on sustainability and circular economy has encouraged companies to prioritize recycling automotive scrap. Thus, the growing automotive and machinery sectors boost the Saudi Arabia scrap materials market growth. Moreover, supportive government regulations and initiatives are expected to create lucrative opportunities for the Saudi Arabia scrap materials market during the forecast period.

Saudi Arabia Scrap Materials Market Overview

The Saudi Arabia scrap materials market encompasses a vast array of recyclable materials, including ferrous and nonferrous metals, paper, plastic, glass, and other waste materials. These scrap materials serve a crucial purpose in the industrial ecosystem, providing a sustainable source of raw materials for various industries. The scrap materials are sourced from a diverse range of origins, such as construction and demolition activities, manufacturing processes, and household waste outputs. The Saudi Arabian scrap materials market has experienced significant growth in recent years, driven by the government's initiatives to promote sustainable development and reduce waste. The government has implemented regulations and policies to encourage the recycling of scrap materials, reducing landfills in the country. The growing demand for scrap materials is largely driven by the construction industry, which requires large quantities of raw materials for infrastructure development projects. Additionally, the rapid industrialization and urbanization in the country have led to an increase in waste generation, providing a vast supply of scrap materials.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Saudi Arabia Scrap Materials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Saudi Arabia Scrap Materials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Saudi Arabia Scrap Materials Market Drivers and Opportunities

Rising Demand for Recycled Metals

The shift toward green production methods and adoption of alternatives to virgin raw materials has raised the popularity of recycled metals in multiple sectors such as construction, automotive, machinery, and electronics. The surge in mega-projects, infrastructure development, and industrial expansion is further fueling the demand for recycled metals. As per the Bureau of International Recycling, Saudi Arabia has a well-established recycling industry, with several plants and facilities across the country focused on collecting, processing, and recycling nonferrous metals. With future projects planned on implementing green initiatives, Saudi Arabia is committed to enhancing its recycling efforts as part of its Vision 2030 program. The rise in construction activities, infrastructure projects, and industrial expansion have increased the demand for steel, aluminum, and copper, making industries seek cost-effective and sustainable alternatives such as scrap metals. According to the International Trade Administration, Saudi Arabia is building smart cities (such as NEOM, Red Sea, Qiddiya, Waad Alshamal, and SPARK) and aims to become the most connected and digitized country by 2030. Additionally, the steel industry is one of the significant consumers of recycled metals, as it is increasingly integrating scrap into its production processes to reduce energy consumption and carbon emissions. The growing recycling initiatives and investments in modern processing facilities have made metal recycling efficient and economically viable. Therefore, the rising demand for recycled metals drives the Saudi Arabia scrap materials market.

Supportive Government Regulations and Initiatives

Various government bodies and organizations in Saudi Arabia are focused on establishing policies and legislations to promote sustainable economic practices and recycling/reusing materials to achieve carbon neutrality goals by 2050. The adoption of recycled materials has grown among customers due to rising environmental concerns. In January 2024, Saudi Arabia’s Ministry of Environment announced a comprehensive plan to recycle nearly 95% of the country’s waste. This initiative is anticipated to contribute ~US$ 31.99 billion to Saudi Arabia’s gross domestic product and aims to generate over 100,000 employment opportunities in the country. Moreover, sustainability-focused initiatives, such as the Green Saudi Initiative, align with Vision 2030’s objectives, pushing for increased efficiency in resource utilization and waste reduction. The country is also working toward integrating best practices in recycling, adopting advanced processing techniques, and fostering collaborations with global companies in the recycling domain. Therefore, supportive government regulations and initiatives are expected to create lucrative opportunities for the Saudi Arabia scrap materials market during the forecast period.

Saudi Arabia Scrap Materials Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Saudi Arabia scrap materials market analysis are scrap type and end-use Industry.

- Based on scrap type, the market is segmented into heavy iron, light iron, aluminum, copper, plastics, batteries, tires, glass, wood, large vehicles, small vehicles, and gas cylinder. The plastics segment is further sub-segmented into polyethylene, polypropylene, polyethylene terephthalate, polyvinyl chloride, and others. The light iron segment held the largest share of the market in 2024.

- In terms of end-use Industry, the market is segmented into building and construction, automotive, electrical and electronics, packaging, consumer goods, aerospace and defense, and others. The building and construction segment dominated the market in 2024.

Saudi Arabia Scrap Materials Market Share Analysis by Geography

The geographical scope of the Saudi Arabia scrap materials market is mainly divided into Riyadh, Jeddah, Dammam, Jubail, Madinah, Al Kharj, Mecca, and the Rest of Saudi Arabia.

Jeddah, a port city, is an important hub for scrap imports and exports. The city’s industrial activities generate high amounts of ferrous and nonferrous metal scrap and paper and plastic wastes. The city held a significant share of the Saudi Arabia scrap materials market in 2024. The automotive and marine industries in Jeddah contribute to significant vehicle scrap. In June 2024, Reviva, a subsidiary of the Saudi Investment Recycling Company Group, signed an agreement to establish a plant for recycling marine and industrial waste at Jeddah Islamic Port. The project was valued at US$ 8 million for the development of an area of 10,000 sq. m. The collaboration between Mawani (Saudi Ports Authority) and Reviva is expected to boost the country’s waste management efforts as part of Saudi Vision 2030 in the coming years.

Saudi Arabia Scrap Materials Market Report Scope

Report Attribute

Details

Market size in 2024

Volume13,483.42 kilo tons

Market Size by 2035

Volume 24,226.75 kilo tons

CAGR (2025 - 2035) 6.5%

Historical Data

2021-2023

Forecast period

2025-2035

Segments Covered

By Scrap Type - Heavy Iron

- Light Iron

- Aluminum

- Copper

- Plastics

- Batteries

- Tires

- Glass

- Wood

- Large Vehicles

- Small Vehicles

- Gas Cylinder

By End-use Industry - Building and Construction

- Automotive

- Electrical and Electronics

- Packaging

- Consumer Goods

- Aerospace and Defense

Regions and Countries Covered

Saudi Arabia - Riyadh

- Jeddah

- Dammam

- Jubail

- Madinah

- Al Kharj

- Mecca

- Rest of Saudi Arabia

Market leaders and key company profiles

- SCG International Corp Co Ltd

- Aboura Metals FZCO

- Four Season FZE

- SJ Iron and Metals Co

- Bissan Co Ltd

- PGI Group

- Gulf Union Trading Co

- Sohum Steel Scrap

- Arab Recycling Co

- Middle East Scrap Co

Saudi Arabia Scrap Materials Market Players Density: Understanding Its Impact on Business Dynamics

| Report Attribute | Details |

|---|---|

| Market size in 2024 | Volume13,483.42 kilo tons |

| Market Size by 2035 | Volume 24,226.75 kilo tons |

| CAGR (2025 - 2035) | 6.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2035 |

| Segments Covered |

By Scrap Type

|

| Regions and Countries Covered | Saudi Arabia

|

| Market leaders and key company profiles |

|

The Saudi Arabia Scrap Materials Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Saudi Arabia Scrap Materials Market top key players overview

Saudi Arabia Scrap Materials Market News and Recent Developments

The Saudi Arabia scrap materials market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A recent key development in the market is mentioned below:

- Brazilian steel company Gerdau acquired the assets of the American Dales Recycling Partnership, a scrap recycler in the US, for US$ 60 million. The deal includes land, inventory, and fixed assets related to operations in Tennessee, Kentucky, and Missouri. (Source: Gerdau, Press Release, September 2024)

- Veolia and the Saudi Investment Recycling Company (SIRC) signed a Memorandum of Understanding (MoU) to manage organic, industrial, and hazardous waste at a regional and national level in accordance with the Vision 2030 program. (Source: Veolia, News Letter, January 2024)

Saudi Arabia Scrap Materials Market Report Coverage and Deliverables

The " Saudi Arabia Scrap Materials Market Size and Forecast (2021–2035)" report provides a detailed analysis of the market covering below areas:

- Saudi Arabia scrap materials market share and forecast at regional and country levels for all the key market segments covered under the scope

- Saudi Arabia scrap materials market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Saudi Arabia scrap materials market covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Saudi Arabia scrap materials market

- Detailed company profiles

Frequently Asked Questions

What are the future trends of the Saudi Arabia scrap materials market?

Which city dominated the Saudi Arabia scrap materials market in 2024?

What are the driving factors impacting the Saudi Arabia scrap materials market?

What would be the estimated volume of the Saudi Arabia scrap materials market by 2035?

Which are the leading players operating in the Saudi Arabia scrap materials market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For