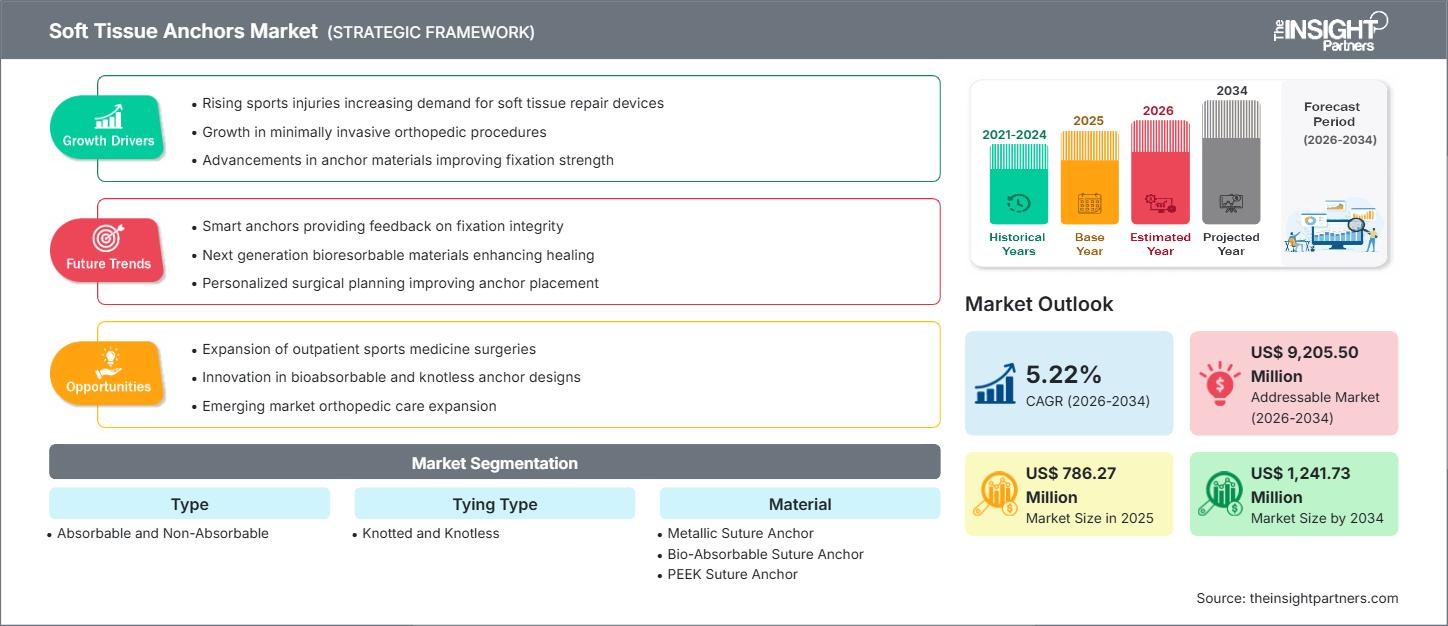

Soft Tissue Anchors Market Trends & Growth Outlook 2034

Soft Tissue Anchors Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Absorbable and Non-Absorbable), Tying Type (Knotted and Knotless), Material (Metallic Suture Anchor, Bio-Absorbable Suture Anchor, PEEK Suture Anchor, Bio-Composite Suture Anchor, and Other), and End User (Hospital, Clinic, Emergency Medical Service, and Other)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00024412

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

The Soft Tissue Anchors Market size is expected to reach US$ 1,241.73 million by 2034, up from US$ 786.27 million in 2025. The market is anticipated to register a Compound Annual Growth Rate (CAGR) of 5.22% during the forecast period 2026–2034.

Soft Tissue Anchors Market Analysis

The global soft tissue anchors market forecast indicates steady growth, mainly driven by the accelerating incidence of worldwide sports injuries and pathologies of the ligament and tendon, such as rotator cuff tears and ACL reconstructions. Constant technological advancements within the design of anchors, including those toward knotless constructs and double-loaded sutures that allow for superior biomechanical fixation strength and reproducible results, strongly support market expansion. Additionally, the increasing adoption of minimally invasive arthroscopic procedures across specialty orthopedic centers drives the demand for innovative, materials-based solutions like bio-composites, PEEK, and absorbable polymers, leading to quicker patient recovery and enhanced biological integration.

Soft Tissue Anchors Market Overview

Soft tissue anchors are sophisticated implantable orthopedic devices employed in the secure fixation of soft tissues, like ligaments, tendons, and joint capsules, directly to the underlying osseous structure. These devices have become important components in various surgical interventions across major joints, including but not limited to the shoulder, knee, hip, elbow, and foot & ankle. The market offers various configurations to suit particular surgical needs and ensure better fixation, such as absorbable and nonabsorbable materials and knotted and knotless designs. With strong competitive dynamics and continuous R&D focus from leading orthopedic companies, soft tissue anchors are fundamental to modern sports medicine, ensuring optimal tissue-to-bone healing and functional patient restoration.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSoft Tissue Anchors Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Drivers and Opportunities

Market Drivers

- Rising Global Incidence of Musculoskeletal Injuries: Growth in sports participation and aging populations maintaining active lifestyles are increasing the volume of soft tissue injuries, driving demand for reliable fixation solutions.

- Preference for Minimally Invasive Arthroscopic Surgery: As health systems favor treatments that minimize morbidity and reduce hospital stays, anchors will continue to be adopted in minimally invasive procedures.

- Technology in Materials and Fixation Mechanics: Bio-composite materials, PEEK, and absorbable polymers enhance the longevity and biocompatibility of fixation. Knotless techniques and suture tape constructs improve surgical workflow and outcomes.

Market Opportunities

- Expansion into Emerging Economies: Growing orthopedic hospital capacity and increased public health investment present significant opportunities for market penetration and adoption of advanced suture anchor technologies.

- Surgeon Education Programs: Targeted training initiatives on advanced knotless constructs and revision fixation techniques can drive product utilization and improve clinical outcomes.

- Strategic Product Bundling: Combining suture anchors with complementary offerings such as suture tapes, biological augmentation products, and surgical navigation systems enhances value propositions and supports integrated surgical solutions.

Soft Tissue Anchors Market Report Segmentation Analysis

The soft tissue anchors market share is analyzed across several segments to provide detailed insights into product preference, technological adoption, and end-user consumption patterns. The standard segmentation is as follows:

By Type

- Absorbable Anchors: Biocompatible polymers that degrade over time, minimizing implant interference.

- Non-Absorbable Anchors: Permanent fixation using materials like PEEK or metal, preferred for high-tension or revision surgeries.

By Tying Type

- Knotted

- Knotless

By Material

- Metallic Suture Anchor

- Bio-Absorbable Suture Anchor

- PEEK Suture Anchor

- Bio-Composite Suture Anchor

By End User

- Hospitals

- Clinics

- Emergency Medical Services

By Geography

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Soft Tissue Anchors Market Regional Insights

The regional trends and factors influencing the Soft Tissue Anchors Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Soft Tissue Anchors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Soft Tissue Anchors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 786.27 Million |

| Market Size by 2034 | US$ 1,241.73 Million |

| Global CAGR (2026 - 2034) | 5.22% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Soft Tissue Anchors Market Players Density: Understanding Its Impact on Business Dynamics

The Soft Tissue Anchors Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Soft Tissue Anchors Market top key players overview

Soft Tissue Anchors Market Share Analysis by Geography

The soft tissue anchors market demonstrates varied growth trajectories across regions, influenced by healthcare spending, prevalence of sports medicine centers, and orthopedic reimbursement policies.

North America

- Market Share: Largest globally, driven by advanced sports medicine infrastructure and strong presence of major manufacturers.

- Key Drivers: Favorable reimbursement, specialized orthopedic practices, high consumer awareness.

- Trends: Rapid adoption of knotless and bio-composite anchors.

Europe

- Market Share: Significant share due to robust public healthcare and arthroscopic adoption.

- Key Drivers: Medical education initiatives, demand for long-term fixation, cost-efficiency.

- Trends: Integration of advanced fixation systems in rotator cuff and ligament procedures.

Asia-Pacific

- Market Share: Fastest-growing region due to healthcare investments.

- Key Drivers: Expansion of hospitals, rising disposable income, government support.

- Trends: High growth for absorbable and knotless devices in China and India.

South & Central America

- Market Share: Emerging market with digital health adoption.

- Key Drivers: Access to arthroscopic equipment, public-private partnerships.

- Trends: Adoption of cost-effective anchor solutions by small-to-medium providers.

Middle East & Africa

- Market Share: Developing market with strong growth potential.

- Key Drivers: Infrastructure expansion, rising sports participation.

- Trends: Standardizing orthopedic centers for complex soft tissue repairs.

Soft Tissue Anchors Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

The soft tissue anchors market is characterized by intense competition driven by strong R&D investments from globally recognized orthopedic industry leaders. Major companies, including Arthrex, Stryker, and Johnson & Johnson (DePuy Synthes), continually strive to differentiate their offerings in this crowded landscape.

This competitive environment pushes vendors to innovate strategically through:

- Developing next-generation knotless and all-suture anchor designs for optimized surgical efficiency and faster healing.

- Focusing on innovative material science, specifically bio-composites and enhanced PEEK materials, to improve integration and minimize biological reaction.

- Offering comprehensive product sets that include anchors, suture tapes, and single-use disposable kits to support streamlined arthroscopic procedures.

- Investing heavily in surgeon training and medical education initiatives to promote the adoption of their specific fixation systems.

Opportunities and Strategic Moves

- Acquire or partner with smaller innovative firms specializing in biological coatings or tissue augmentation to create integrated repair solutions.

- Leverage proprietary material technology to secure premium pricing and market exclusivity in high-volume reconstruction procedures.

Major Companies operating in the Soft Tissue Anchors Market are:

- Smith & Nephew Plc.

- CONMED Corporation

- Johnson & Johnson Services, Inc. (DePuy Synthes)

- Zimmer Biomet

- Arthrex, Inc.

- Stryker Corporation

- Medtronic

- Cook Medical LLC

- Aju Pharm Co., Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

Soft Tissue Anchors Market News and Recent Developments

- Smith & Nephew Plc launched the Q‑FIX Knotless All‑Suture Anchor on July 7, 2025, offering superior fixation strength and ultra-low displacement for shoulder, hip, and foot & ankle procedures. The anchor is available with suture tape and ULTRABRAID options.

- CONMED Corporation introduced the AlternatiV+ Max Knotless Anchor, a biodegradable twist-in anchor with a PEEK tip compatible with the BioBrace scaffold, designed for soft tissue repair across the shoulder, elbow, foot & ankle, and knee.

Soft Tissue Anchors Market Report Coverage and Deliverables

The "Soft Tissue Anchors Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Soft Tissue Anchors Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Soft Tissue Anchors Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Soft Tissue Anchors Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Soft Tissue Anchors Market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For