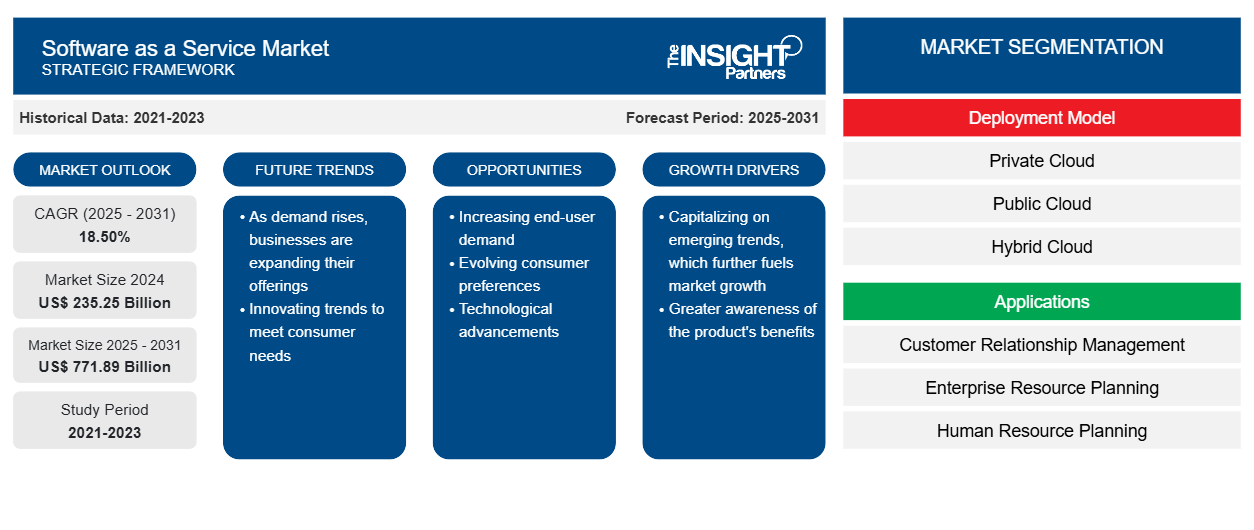

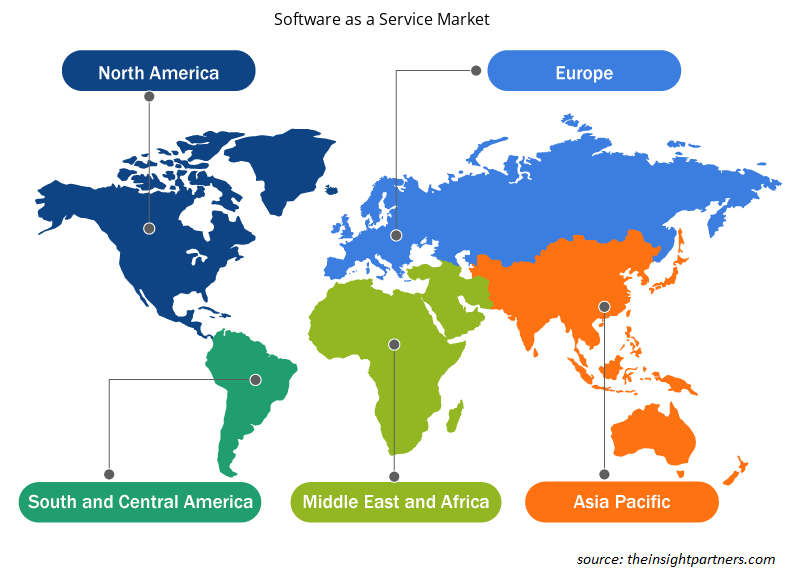

The software as a service market is expected to grow from US$ 167.53 billion in 2022 to US$ 462.94 billion by 2031; it is anticipated to grow at a CAGR of 18.5% from 2022 to 2031.

SaaS applications have the potential to cater services to small, medium, and large enterprises efficiently. Organizations today are growing rapidly, and they require operations to scale up as per the demand. With the ease in scalability feature offered by the SaaS model, many organizations seem to adopt the SaaS model for their various operations, be it managing their IT infrastructure, financial management, human capital management, asset monitoring, or any other useful domain. Adopting such a modular structure that can scale up the IT infrastructure, storage, computing, fabric, and virtualization in a single architecture is being rapidly adopted across the globe, offering lucrative business opportunities to the global software as a service market players. The flexibility offered by SaaS models gives a competitive advantage to companies by quickly adjusting to customers' demands and making the necessary changes in operations efficiently. High efficiency has become a prerequisite for leading companies today, and the deployment of SaaS models gives them the power to be flexible and efficient. The tools utilized by SaaS vendors are typically more robust and up-to-date than those available to most local organizations. These factors are influencing the software as a service market growth.

Also, SaaS vendors make use of redundant servers to back up data. Thus, in case of any malfunction in the cloud, users are automatically redirected to a backup server without any performance issues. Furthermore, SaaS vendors perform regular data backups. Since there is a single version of the software, more vendor resources are typically directed to identifying issues/bugs and the related patches/fixes required to address those concerns. These factors are further propelling the software as a service market growth.

SaaS is an advanced technology transforming traditional on-premise software systems into a modern cloud-based solution globally. Along with reduced efforts of running a process and installing and purchasing software, it also helps an organization minimize costs and maximize revenue. Consequently, private organizations worldwide have understood the potential behind these services and come up with cloud-based services. These factors are boosting the growth of the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Software as a Service Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Software as a Service Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

With the growing concerns for security and privacy of data, private cloud deployment model was developed but that proved to be very costly. All the data of organizations cannot be mission critical and sensitive. Various type of data demands for varying levels of security. The flexibility of storing less critical data over public cloud while mission critical data over hybrid cloud makes it highly attractive for organizations to adopt. Banking sector that has to store large amounts of sensitive data is the most benefitted business segment due to the introduction of hybrid cloud deployment model. Hybrid cloud model is thus expected to grow at a rapid pace during the forecast period, offering lucrative growth opportunities to the hybrid software as a service market share.

Regional Analysis of Software as a Service Market

From the regional perspective, North America held the largest share of the global software as a service market in 2021. With the increasing customer demand for high-quality products and services, North American companies are constantly innovating to serve their customers in the best possible way. This is increasing the demand for solutions such as CRM and ERP. Additionally, the presence of SaaS vendors such as Microsoft Corporation, Amazon Web Services, Symantec Corporation, IBM, ORACLE, ADP LLC, Workday, and Google across the region is further contributing to the rapid growth of the market.

Software as a Service Market Regional Insights

The regional trends and factors influencing the Software as a Service Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Software as a Service Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Software as a Service Market

Software as a Service Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 235.25 Billion |

| Market Size by 2031 | US$ 771.89 Billion |

| Global CAGR (2025 - 2031) | 18.50% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Deployment Model

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Software as a Service Market Players Density: Understanding Its Impact on Business Dynamics

The Software as a Service Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Software as a Service Market are:

- Google, Inc.

- Oracle Corporation

- Amazon.com, Inc.

- Salesforce.com, Inc.

- Fujitsu Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Software as a Service Market top key players overview

Market Insights – Software as a Service Market

Application-Based Insights

Based on application, the software as a service market is segmented into customer relationship management (CRM), enterprise resource planning (ERP), human resource planning (HRP), supply chain management (SCM), and others. The CRM segment accounted for the largest share of the global software as a service market in 2021. With its numerous advantages, SaaS CRM has successfully changed organizations' perceptions about how front-office software systems are used and controlled. Particularly for CRM, the SaaS applications provide various benefits like best-in-place infrastructure without the need for capital expenditure, lesser implementation and integration times with existing systems, software upgrades without any significant bottleneck, consistent system uptime, and 24/7 staffing. It actively tracks and manages customer information, captures customer emails, simplifies repetitive tasks, and delivers instant insights and recommendations. As the business grows, CRM helps in customizing functions. According to Salesforce—one of the prominent CRM providers—the solutions on an average help their clients enhance their sales by 30%, and there is a 40% increase in customer satisfaction. These factors are further contributing to the growth of the segment.

Players operating in the software as a service market are mainly focused on developing advanced and efficient products.

- In December 2022, Microsoft Corporation announced its 10-year partnership with LSEG to offer data analytics and cloud infrastructure solutions.

- In November 2022, shadow announced the launch of its new cloud storage service named shadow drive.

The software as a service market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), Middle East & Africa, and South America. In 2021, North America led the market with a substantial revenue share, followed by Europe. Further, Asia Pacific is expected to register the highest CAGR in the software as a service market from 2022 to 2031.

The key global software as a service market players include ADP LLC, Amazon.com Inc, Google Inc, IBM Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com Inc, SAP SE, Fujitsu Limited, and Workday Inc.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Parking Meter Apps Market

- eSIM Market

- Advanced Distributed Management System Market

- Online Exam Proctoring Market

- Electronic Data Interchange Market

- Barcode Software Market

- Maritime Analytics Market

- Cloud Manufacturing Execution System (MES) Market

- Robotic Process Automation Market

- Digital Signature Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Software as a Service (SaaS) Market

- Google, Inc.

- Oracle Corporation

- Amazon.com, Inc.

- Salesforce.com, Inc.

- Fujitsu Ltd.

- Workday, Inc.

- ADP, LLC

- IBM Corporation

- SAP SE

- Microsoft Corporation

Get Free Sample For

Get Free Sample For