Southeast Asia Redistribution Layer Material Market Analysis, Size, and Share by 2030

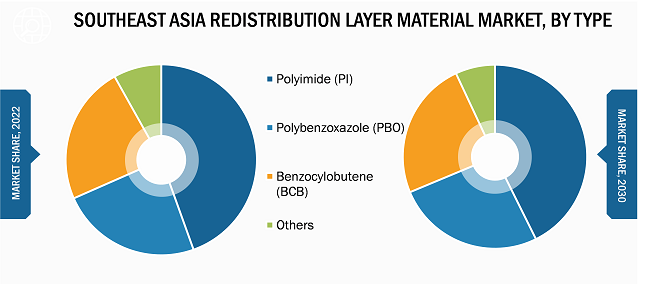

Southeast Asia Redistribution Layer Material Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Polyimide (PI), Polybenzoxazole (PBO), Benzocylobutene (BCB), and Others) and Application (Fan-Out Wafer Level Packaging (FOWLP) and 2 5D/3D IC Packaging [High Bandwidth Memory (HBM), Multi-Chip Integration, Package on Package (FOPOP), and Others])

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Oct 2023

- Report Code : TIPRE00030090

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 117

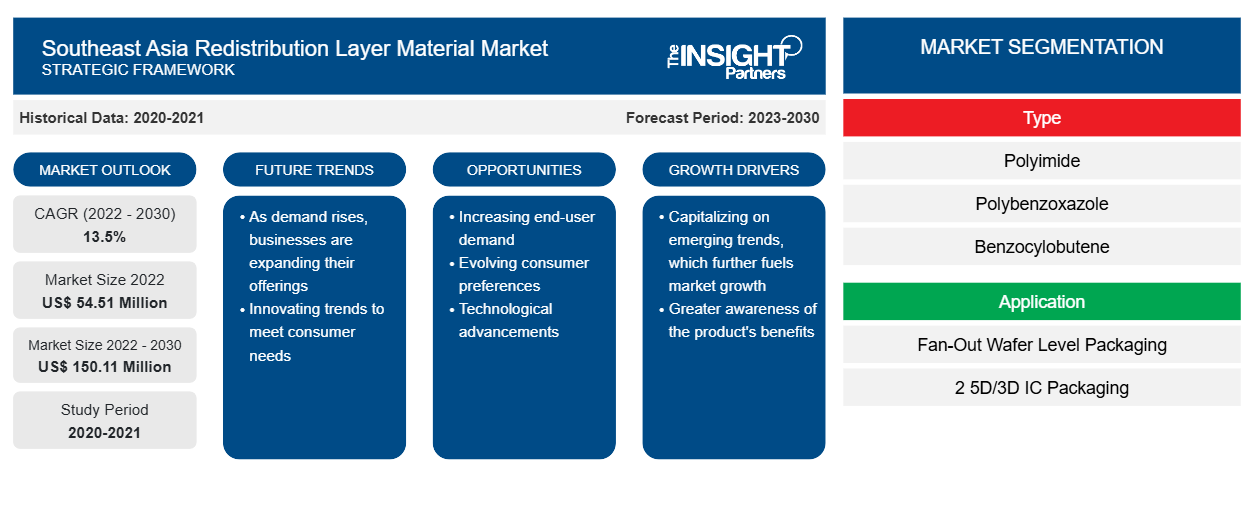

The Southeast Asia redistribution layer material market is expected to grow from US$ 54.51 million in 2022 to US$ 150.11 million by 2030; it is expected to register a CAGR of 13.5% from 2022 to 2030.

MARKET ANALYSIS

The redistribution layer (RDL) in semiconductor manufacturing is a crucial element in advanced integrated circuits (ICs) such as microprocessors, memory chips, and system-on-chips (SoC) devices. RDL is responsible for routing and redistributing signals from the core of the chip to the external pins and between different layers within the chips. Typically, RDL materials are thin films of conductive materials such as copper, aluminum, or their alloys. Copper is commonly used due to its excellent electrical conductivity. Several other budding packaging technologies play a key role in the heterogeneous integration of devices. The growing demand for AI-based equipment and tools is significantly impacting the redistribution layer material market. The quest for more advanced AI capabilities necessitates the development of more compact and densely integrated hardware components. Redistribution layer materials (RDL) are fundamental in enabling the miniaturization of semiconductor packages, which is essential to accommodate the increasing complexity of AI devices. As AI systems become more sophisticated, the demand for smaller and more efficient components grows. In addition, AI applications are known for their voracious appetite for high-performance computing, which inherently generates substantial heat. Efficient thermal management is paramount to ensure the reliability and longevity of AI hardware. RDL materials play a crucial role by enhancing thermal conductivity and heat dissipation properties. As AI equipment becomes more powerful and heat-intensive, the demand for advanced RDL materials that can effectively address these thermal challenges escalates. This has surged the demand for new innovations and trends in advanced packaging technology. This Southeast Asia redistribution layer material market trend is driving the market growth.

GROWTH DRIVERS AND CHALLENGES

Artificial Intelligence (AI) systems are intricate and typically involve multiple chips, sensors, and processors that must communicate seamlessly to process and analyze data in real-time. The demand for improved connectivity and signal integrity within AI hardware is ever-increasing. RDL materials are pivotal in facilitating high-speed data transmission and ensuring that various components in AI systems work harmoniously. As AI applications span diverse industries, from healthcare to autonomous vehicles, the need for RDL materials capable of maintaining robust connections becomes even more apparent. Moreover, the AI landscape is characterized by rapid evolution and customization. Different industries have unique requirements for AI hardware solutions, necessitating flexibility in design and configuration. RDL materials enable manufacturers to tailor semiconductor packages to meet these specific demands. This customization capability drives the adoption of RDL materials, empowering AI equipment manufacturers to create specialized hardware optimized for various applications. The rapid economic growth and industrial development in Southeast Asia also drive increased investment in AI technology. This growth includes the development of smart cities, autonomous vehicles, and industry 4.0 initiatives, all of which rely on AI-based tools and equipment. As these initiatives gain momentum, the demand for RDL materials as a foundation element in semiconductor packaging grows in tandem. Thus, the escalating demand for AI-based equipment and tools is fostering the Southeast Asia redistribution layer material market growth.

Fluctuations in raw material prices pose a significant challenge to the growth of the Southeast Asia redistribution layer material market. These price swings can have a far-reaching impact on the industry, affecting production costs, pricing strategies, and overall market stability. One of the key issues is the dependency on imported raw materials. Many essential components for redistribution lay materials, such as specialized polymers, metals, and chemicals, are often sourced from international suppliers. As global commodity markets fluctuate due to various factors such as geopolitical tensions, supply chain disruptions, or market speculation, the prices of these crucial raw materials can become highly volatile. These factors hamper the Southeast Asia redistribution layer material market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSoutheast Asia Redistribution Layer Material Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The " Southeast Asia Redistribution Layer Material Market Analysis to 2030" is a specialized and in-depth study with a significant focus on the redistribution layer material market trends and growth opportunities in Southeast Asia. The report aims to provide an overview of the Southeast Asia redistribution layer material market with detailed market segmentation by type and application. The Southeast Asia redistribution layer material market has witnessed high growth in the recent past and is expected to continue this trend from 2022 to 2030. The report provides key statistics on the consumption of redistribution layer material in Southeast Asia. In addition, the report provides a qualitative assessment of various factors affecting the redistribution layer material market performance in Southeast Asia. The report also includes a comprehensive analysis of the leading players in the Southeast Asia redistribution layer material market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

Ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the Southeast Asia redistribution layer material market, which helps understand the entire supply chain and various factors affecting the Southeast Asia redistribution layer material market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SEGMENTAL ANALYSIS

The Southeast Asia redistribution layer material market is bifurcated on the basis of type and application. Based on type, the Southeast Asia redistribution layer material market is segmented into polyimide (PI), polybenzoxazole (PBO), benzocylobutene (BCB), and others. On the basis of application, the Southeast Asia redistribution layer material market is categorized into Fan-Out Wafer Level Packaging (FOWLP) and 2 5D/3D IC packaging (High Bandwidth Memory (HBM), multi-chip integration, Package on Package (FOPOP), and others). Based on application, the 2 5D/3D IC packaging segment accounted for a significant share of the Southeast Asia redistribution layer material market. The increased costs of lithography steps and wafer processing in general at the next-generation silicon nodes are driving the industry to find alternatives to improve the performance and functionality of electronic devices.

The need to integrate disparate technologies such as logic, memory, RF, and sensors in small form factors is driving the industry toward 3D integration as a solution. Currently, the industry faces severe challenges in terms of increasing memory requirements in booming application areas such as AI, machine learning, and the data center. These factors are anticipated to drive the Southeast Asia redistribution layer material market for the 2 5D/3D IC packaging segment from 2022 to 2030.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REGION ANALYSIS

Based on geography, the Southeast Asia redistribution layer material market is segmented into Indonesia, Singapore, Malaysia, Taiwan, Thailand, Vietnam, and the Rest of Southeast Asia. Taiwan was estimated to be ~US$ 30 million in 2022. Taiwan is renowned as a global electronics manufacturing hub, home to numerous semiconductor companies, original equipment manufacturers (OEMs), and electronic assembly facilities. The presence of these manufacturing entities generates substantial demand for redistribution layer materials, as these materials are essential for semiconductor packaging and interconnection in various electronic devices. Thus, as the country progresses and industrializes, the demand for redistribution layer material is expected to remain strong, which is expected to boost the Southeast Asia redistribution layer material market growth from 2022 to 2030. Malaysia is expected to register a CAGR of approximately 14% from 2022 to 2030. Malaysia has established itself as a significant hub for electronic manufacturing in Southeast Asia. The presence of numerous multinational corporations and electronics assembly facilities has led to increased demand for redistribution layer materials. These materials are essential for advanced semiconductor packaging, a critical component of electronics manufacturing. In addition, redistribution layer materials enable the miniaturization of electronic components, allowing manufacturers to create smaller, more feature-rich devices, including smartphones, tablets, and wearables. As consumer preferences drive this trend, the demand for redistribution layer materials rises.

Indonesia is forecasted to be valued at ~US$ 14 million in 2030. Indonesia can be considered one of the biggest emerging markets for redistribution layer material in Southeast Asia. The country has recorded rapid GDP growth in recent years due to the growing start-up ecosystem. Various consumer apps and fintech have been dominating the country's start-up ecosystem and are increasing innovation in new areas, such as IoT, as start-ups seek new opportunities.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

The report provides a detailed overview of the Southeast Asia redistribution layer material market.

In December 2021, Samsung Electronics announced that it had begun mass producing the industry’s smallest, 14-nanometer (nm) DRAM based on extreme ultraviolet (EUV) technology. It increased the number of EUV layers to five to deliver an advanced DRAM process for its DDR5 solutions. By applying five EUV layers to its 14nm DRAM, it has achieved the highest bit density while enhancing the overall wafer productivity by ~20%.

In June 2022, ASE Technology Holding Co Ltd introduced VIPack, an advanced packaging platform designed to enable vertically integrated package solutions. VIPack represents ASE’s next generation of 3D heterogeneous integration architecture that extends design rules and achieves ultra-high density and performance. The platform leverages advanced redistribution layer (RDL) processes, embedded integration, and 2.5D and 3D technologies to help customers achieve unprecedented innovation when integrating multiple chips within a single package.

IMPACT OF COVID-19 PANDEMIC

The Southeast Asia redistribution layer material market witnessed growth before the onset of the COVID-19 pandemic due to rising demand for semiconductors from consumer electronics products such as smartphones and computers. However, the pandemic adversely affected the chemicals & materials industry, resulting in the shutdown of manufacturing facilities, challenges in procuring raw materials, and restrictions on logistic operations. The unprecedented rise in the number of COVID-19 cases across the country and the subsequent lockdown of numerous manufacturing facilities negatively influenced the growth of the Southeast Asia redistribution layer material market. Further, the overall disruptions in manufacturing processes and research and development activities restrained the Southeast Asia redistribution layer material market growth.

The market started reviving in 2021 due to the government's significant measures, such as vaccination drives. The growing demand for redistribution layer materials from the semiconductor industry is propelling the Southeast Asia redistribution layer material market growth. Moreover, various players in the region are seeking more investment opportunities as businesses gain confidence in stabilizing economies and increasing demand, thereby providing the impetus for the Southeast Asia redistribution layer material market growth.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Advanced Semiconductor Engineering, Inc.; Amkor Technology; Fujifilm Corporation; DuPont; Infineon Technologies AG; NXP Semiconductors; Samsung Electronics Co., Ltd; Shin-Etsu Chemical Co., Ltd; SK Hynix Inc; and Jiangsu Changjiang Electronics Technology Co., Ltd are a few of the major players operating in the Southeast Asia redistribution layer material market.

Southeast Asia Redistribution Layer Material Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 54.51 Million |

| Market Size by 2030 | US$ 150.11 Million |

| CAGR (2022 - 2030) | 13.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Southeast Asia

|

| Market leaders and key company profiles |

|

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For