Steel Wire Market Size, Share, and Analysis by 2031

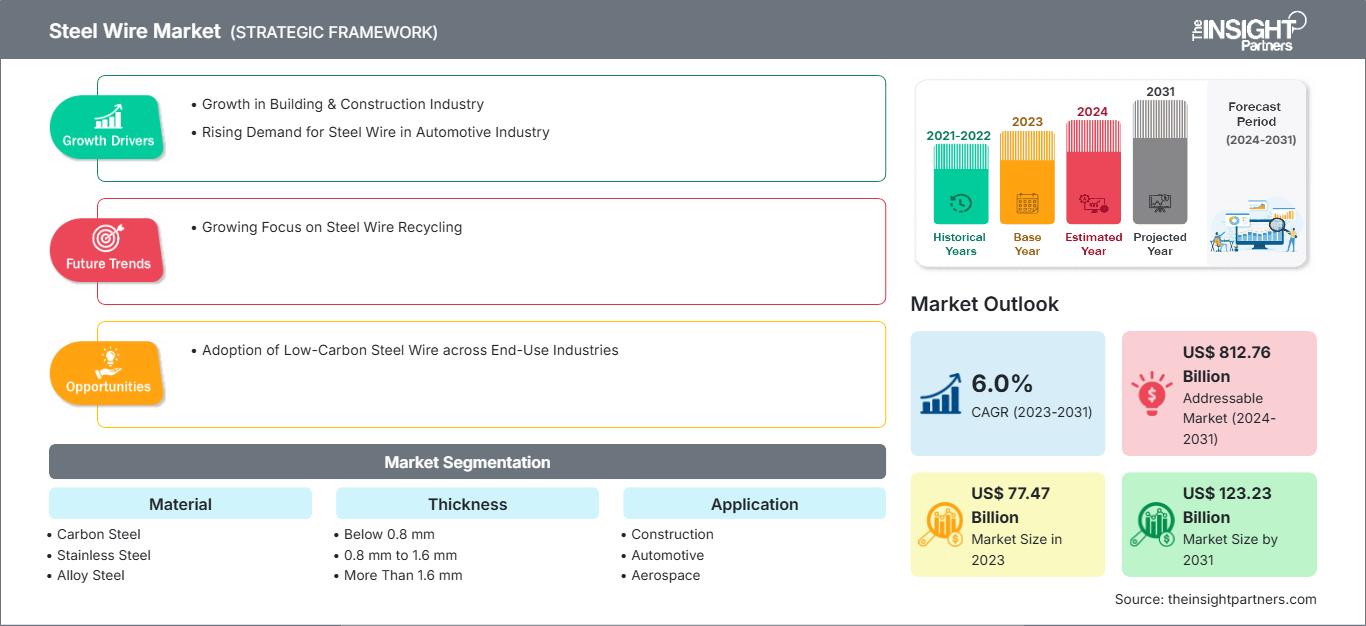

Steel Wire Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material (Carbon Steel, Stainless Steel, and Alloy Steel), Thickness (Below 0.8 mm, 0.8 mm to 1.6 mm, and More Than 1.6 mm), Application (Construction, Automotive, Aerospace, Mining, Marine, Agriculture, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Jun 2024

- Report Code : TIPRE00011060

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 203

The steel wire market size is projected to reach US$ 123.23 billion by 2031 from US$ 77.47 billion in 2023. The market is expected to register a CAGR of 6.0% during 2023–2031. Enormous developments in the construction industry due to population outburst and electrification of automobiles are the current transformative trends in the steel wire market.

Steel Wire Market Analysis

Steel wire mesh is used in concrete reinforcement of slabs and walls in residential and commercial construction. In infrastructure development projects, engineered steel wire mesh is used in building bridges and barriers. With notable investments in infrastructure projects, the steel wire market is gaining pace. Further, as low-carbon steel is considerably robust and durable, it is a preferred material for constructing buildings that are exposed to extreme weather conditions. With the growing trend toward sustainability, the adoption of low-carbon steel has increased across various sectors to minimize environmental impact. Thus, the adoption of low-carbon steel wire across end-use industries is expected to create potential growth opportunities for the market in the coming years.

Steel Wire Market Overview

Steel wire is extensively used to fabricate steel wire mesh, steel wire rope, and cables, among others. It is manufactured from several materials, such as carbon steel, alloy steel, and stainless steel. Stainless steel is a low-cost, corrosion-resistant material with high durability. Wires made of stainless steel are highly adaptable for different applications as they are available in various sizes and shapes. Further, carbon steel is an alloy consisting of carbon and iron. Carbon steel wire is produced by drawing hot rolled rods through smaller dies. The drawing process hardens the steel, making it stronger. Alloy steel is made of carbon and alloying materials such as manganese, chromium, nickel, molybdenum, and vanadium. The alloy steel wire manufacturing process includes melting raw material in an electric arc furnace. Moreover, steel wire is highly utilized in construction applications due to its versatility. It provides strength, durability, and safety to buildings and structures.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSteel Wire Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Steel Wire Market Drivers and Opportunities

Rising Demand for Steel Wire in Automotive Industry

The automotive industry is experiencing robust growth owing to technological advancements and a surge in preference for SUVs, crossovers, and other light trucks. According to the report released by the European Automobile Manufacturers’ Association (ACEA) in January 2023, car production in North America increased by 10.3%, reaching 10.4 million units in 2022 compared to 2021. Similarly, passenger car production in South Korea grew by 7.6%, reaching 3.4 million units in the same period. The report published by the ACEA stated that global passenger car production accounted for 68 million units in 2022, recording a rise of 7.9% compared to 2021.

As per the data of the Organisation Internationale des Constructeurs d'Automobiles (OICA), North America and South & Central America recorded a production of over 16.1 million commercial and passenger cars in 2021; the figure has grown by 10%, registering more than 17.7 million commercial and passenger cars in 2022. A few automotive companies are investing heavily in automobile manufacturing to increase production and overall sales. According to the International Energy Agency's annual Global Electric Vehicle Outlook, over 10 million electric cars were sold worldwide in 2022, and the sales are projected to grow by 35% and reach 14 million in 2023. Steel wire has a distinct range of applications in the automotive industry, including springs, cables, suspension components, and other wiring components. Steel wire is used for the fabrication of components such as bumper, seating frames, steering wheels, and cables. Thus, the rising demand for steel wire in the automotive industry fuels the market growth.

Adoption of Low-Carbon Steel Wire across End-Use Industries

Low-carbon steel offers several advantages such as strength and durability in cold temperatures. The global transition toward sustainability has encouraged the adoption of low-carbon steel in various industries, thereby minimizing environmental issues. Low-carbon steel wires are widely used in the fabrication of springs, wire mesh, reinforcement, partition panels, cables, and material handling applications. Low-carbon steel wires are also used in bridges, decking, and balconies for structural construction. Also, in the aerospace industry, it is utilized for manufacturing landing gear struts. In the automotive industry, it is used for the fabrication of car components. In March 2024, Nucor Corporation announced a new agreement with Mercedes-Benz to supply low-carbon steel for the automaker’s production plant in Alabama, US. This is the latest agreement in a series of deals signed between the automaker and Mercedes-Benz, including the agreements for the Alabama-based plant with Steel Dynamics and H2 Green Steel (a Swedish startup) to supply low-carbon steel for vehicles in Europe. Thus, the adoption of low-carbon steel wire across end-use industries is expected to create numerous opportunities for the steel wire market growth during the forecast period.

Steel Wire Market Report Segmentation Analysis

Key segments that contributed to the derivation of the steel wire market analysis are material, thickness, and application.

- Based on material, the steel wire market is categorized into stainless steel, carbon steel, and alloy steel. The carbon steel segment held the largest market share in 2023.

- By thickness, the market is categorized into below 0.8 mm, 0.8 mm to 1.6 mm, and more than 1.6 mm. The 0.8 mm to 1.6 mm segment held the largest share in the market in 2023.

In terms of application, the market is segmented into construction, automotive, aerospace, mining, marine, agriculture, and others. In 2023, the construction segment dominated the market.

Steel Wire Market Share Analysis by Geography

The geographic scope of the steel wire market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In 2023, Asia Pacific dominated the steel wire market share. As per the International Trade Administration, total investment in China’s infrastructure during the 14th Five-Year Plan period (2021–2025) is anticipated to reach ~US$ 4.2 trillion. Also, in 2022, the National Development and Reform Commission (NDRC) and the Ministry of Transport of China unveiled the National Highway Network Planning document focused on the construction of an efficient, green, intelligent, and secure modern highway network, which is expected to be completed by 2035. The plan also involves the construction of a 461,000 km highway—including 162,000 km of expressways. In the building & construction industry, stainless steel wire is used in anchoring buildings and lifting heavy loads, constructing bridges, and suspending scaffolding systems. Thus, the development in the building & construction industry is expected to boost the steel wire market in Asia Pacific in the coming years.

Europe held the second-largest share in the steel wire market in 2023. Norway is a major exporter of natural gas, with an export value of crude, condensate, and natural gas reported as US$ 181.12 billion in 2022, as per the Ministry of Energy and the Norwegian Offshore Directorate. As per the US Energy Information Administration, Europe was the major export destination for US crude oil exports by volume in 2023. The rising imports of crude oil from the US to European countries are further driving maritime transportation and shipping activities. Steel wire is used in the fabrication of steel wire ropes, which have a broad range of applications in various industries. In the oil & gas industry, steel wire ropes are used to increase productivity on rigs and minimize downtime. It is used in deep water mooring, offshore cranes and winches, and drilling. Therefore, growing marine, construction, and automotive industries in Europe are anticipated to boost the demand for steel wires during the forecast period.

Steel Wire

Steel Wire Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 77.47 Billion |

| Market Size by 2031 | US$ 123.23 Billion |

| Global CAGR (2023 - 2031) | 6.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Steel Wire Market Players Density: Understanding Its Impact on Business Dynamics

The Steel Wire Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Steel Wire Market News and Recent Developments

The steel wire market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the steel wire market are listed below:

- Ovako signed a partnership deal with FNsteel to reduce carbon intensity in wire rod production across Europe. (Source: Ovako, Press Release, April 2024)

- Tata Steel announced its merger with Indian Steel & Wire Products. With this merger, it has combined seven subsidiaries for synergies, efficiency, and cost reduction. (Source: Tata Steel, Press Release, February 2023)

- Schnitzer Steel Industries launched GRN Steel, a line of net zero carbon products from its Cascade Steel manufacturing operations. (Source: Schnitzer Steel Industries, Press Release, March 2022)

- JSW Steel acquired Neotrex Steel, an under-construction project for Low-Relaxation Pre-Strussed Concrete strands, from Everbest Consultancy Services. (Source: JSW Steel, Company Website, March 2021)

Steel Wire Market Report Coverage and Deliverables

The “Steel Wire Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Steel wire market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Steel wire market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Steel wire market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the steel wire market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For