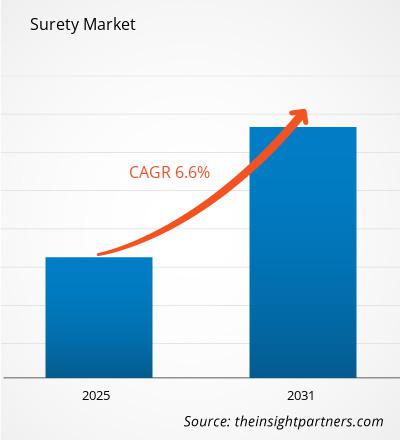

The surety market was valued at US$ 20.26 billion in 2024 and is projected to reach US$ 31.85 billion by 2031; it is expected to register a CAGR of 6.6% during 2025–2031. Growing digitalization and increasing focus on sustainable development are likely to remain a key surety market trend.

Surety Market Analysis

The global surety market is experiencing stable growth, driven by increasing demand for risk mitigation in construction, infrastructure development, and commercial projects. A surety bond serves as a financial guarantee that contractual obligations will be met, offering protection to project owners, suppliers, and governments against contractor default or non-performance.

The construction industry remains the largest consumer of surety bonds, with ongoing infrastructure investments, public-private partnerships, and regulatory requirements fueling demand. Additionally, sectors such as energy, transportation, and manufacturing are increasingly adopting surety solutions to manage project risks and ensure compliance.

Surety Market Overview

Surety is financial guarantees or bonds, a pledge to be liable for another's debt, default, or failure. It is a three-party agreement in which one party (the surety) guarantees the performance or obligations of another (the principal) to a third party (the obligee). A surety functions as an assurance that a person or organization will accept responsibility for meeting financial commitments if the debtor defaults and is unable to pay. The party that guarantees the debt is known as the surety or guarantor. Sureties can be obtained by issuing surety bonds, which are legal contracts that require one party to pay if the other fails to live up to the arrangement. These bonds are highly used by the construction, real estate, finance, and transportation industries to safeguard the oblige against the principal's noncompliance. Rising awareness of the importance of contractual security, particularly in emerging markets, is also contributing to market expansion. Government regulations mandating the use of surety bonds for public projects further support market growth in regions such as North America and Europe. Meanwhile, technological advancements in underwriting and claims processing—through automation and data analytics—are improving efficiency and customer experience.

However, challenges such as fluctuating economic conditions, credit risk exposure, and low awareness in developing regions may limit growth potential. Still, with global infrastructure projects on the rise and an increasing emphasis on financial assurance, the surety market is expected to grow steadily over the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surety Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Surety Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Surety Market Drivers and Opportunities

Digital Transformation in Bonding Processes is Driving the Market

Digital transformation has emerged as a pivotal catalyst in reshaping operational frameworks across various industries, and the bonding sector is no exception. The transition from conventional paper-based systems to fully digitized platforms is revolutionizing how bonding operations are conducted. This shift not only streamlines processes such as bond applications, approvals, and issuances but also significantly reduces the overhead costs traditionally associated with manual paperwork and administrative inefficiencies.

The adoption of digital solutions in bonding operations facilitates enhanced accuracy, transparency, and speed, which are critical in an industry where timely approvals can impact project schedules and cash flow. By automating routine tasks and enabling real-time tracking, digital platforms empower businesses to minimize human errors and accelerate decision-making processes. Consequently, these improvements translate into cost savings and higher operational productivity.

Middle-market construction companies, in particular, stand to gain substantial benefits from embracing digital bonding technologies. These organizations often face resource constraints and complex regulatory requirements, which can render traditional paper-based bonding processes cumbersome and time-consuming. Digital platforms offer these firms an opportunity to reduce the administrative burden associated with bond submissions, allowing their teams to focus more on core construction activities rather than bureaucratic paperwork. Moreover, the enhanced efficiency offered by digital bonding solutions can shorten bond application turnaround times, facilitating faster project mobilization and improved client satisfaction. This agility can be a critical differentiator in a competitive market where speed and reliability are paramount. In addition, digital platforms often include integrated compliance checks and automated alerts, which help mitigate risks by ensuring all bond requirements are met without delay.

From a broader market perspective, the growing regulatory emphasis on transparency and accountability is further propelling the adoption of digital bonding systems. Governments and financial institutions increasingly mandate electronic documentation and traceability to enhance oversight and reduce fraud. This regulatory backdrop creates a favorable environment for technology providers to innovate and expand their offerings. Additionally, advancements in cloud computing, blockchain, and artificial intelligence are opening new avenues for enhancing digital bonding platforms. Cloud-based solutions provide scalable, secure access to bonding records anytime and anywhere, while blockchain technology ensures immutable and verifiable transaction histories. Meanwhile, AI-powered analytics enable predictive insights, optimizing risk assessment and decision-making. In conclusion, the ongoing digital transformation within the bonding industry is driving a paradigm shift from labor-intensive, paper-reliant methods to streamlined, technology-driven processes. For middle-market construction companies and other stakeholders, adopting these digital platforms represents a strategic imperative to improve operational efficiency, reduce costs, and maintain competitive advantage in an evolving marketplace.

Growing Use of Advanced Technologies

Technology will become increasingly crucial in the surety industry. Surety organizations are heavily investing in advanced technologies such as artificial intelligence, blockchain, and big data analytics to streamline and improve their operations. For instance, blockchain is used to streamline surety bond issuance and claims processing, while big data analytics can help uncover possible hazards and fraud. Thus, significant benefits offered by advanced technologies are creating lucrative opportunities in the market during the forecast period.

Surety Market Report Segmentation Analysis

Key segment that contributed to the derivation of the surety market analysis are bond type.

Based on bond type, the surety market is divided into contract surety bond, commercial surety bond, fidelity surety bond, and court surety bond. The contract surety bond segment held the largest market share in 2023.

Surety Market Share Analysis by Geography

The geographic scope of the surety market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In terms of revenue, North America accounted for the largest surety market share due to the growing industrialization and increasing number of small businesses in the US and Canada. These countries have a strong economy and favorable support from the government in promoting and establishing start-ups is boosting the market. Surety bonds are highly adopted by small businesses to obtain contracts to assure their customer that the particular work will be performed and completed on time. Surety bonds, issued by surety businesses, are required for a variety of governmental and commercial transactions. The growing number of small enterprises in the North American construction industry, together with the presence of a significant number of surety market participants in the US and Canada, is predicted to drive the surety market.

Surety Market Regional Insights

The regional trends and factors influencing the Surety Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Surety Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Surety Market

Surety Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 20.26 Billion |

| Market Size by 2031 | US$ 31.85 Billion |

| Global CAGR (2025-2031) | 6.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Bond Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Surety Market Players Density: Understanding Its Impact on Business Dynamics

The Surety Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Surety Market are:

- Crum & Forster

- CNA Financial Corp

- The Travelers Companies Inc

- Liberty Mutual Holding Co Inc

- The Hartford Insurance Group, Inc.

- Chubb Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Surety Market top key players overview

Surety Market News and Recent Developments

The surety market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the surety market are listed below:

- Core Specialty Insurance Holdings, Inc., a property and casualty insurer, will acquire American Surety in a stock and cash transaction, forming a Bond, Credit, and Guarantee subsegment alongside Specialty Casualty, Property & Short-Tail, and Fronted Programs. This acquisition deal is expected to be completed in Q1 2024. (Source: Core Specialty Insurance Holdings, Inc., Press Release, 2023)

Surety Market Report Coverage and Deliverables

The “Surety Market Size and Forecast (2023–2031)” report provides a detailed analysis of the market covering below areas:

- Surety market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Surety market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Frequently Asked Questions

Which are the key players holding the major market share of global surety market?

The key players, holding majority shares, in global surety market includes Liberty Mutual Insurance Company; The Travelers Indemnity Company; CNA FINANCIAL CORPORATION; CHUBB LIMITED; and The Hartford.

What are the future trends of the global surety market?

Rise in digitalization, automation, and other technological advancements is the future trends of the global surety market.

What are the driving factors impacting the global surety market?

Increase in adoption of public-private partnerships for infrastructure development, need for restoration of aging infrastructure, and proliferation of insurance industry are the driving factors impacting the global surety market.

What will be the global surety market size by 2031?

The global surety market is expected to reach US$ 31.85 billion in the year 2031.

Which region is holding the major market share of global surety market?

The North America held the largest market share in 2024, followed by Europe and APAC.

What is the estimated market size for the global surety market in 2024?

The global surety market was valued at US$ 20.26 billion in 2024 and is expected to grow at a CAGR of 6.6% during 2025–2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Mobile Wallet and Payment Market

- Insurance Third-Party Administrator Market

- Trade Credit Insurance Market

- Contactless Payments Market

- Revenue Assurance for BFSI Market

- Voice-based Payments Market

- Aviation Fuel Card Market

- Mobile Phone Insurance Market

- Blockchain Market

- Middle Office Outsourcing Market

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Surety Market

- Crum & Forster

- CNA Financial Corp

- The Travelers Companies Inc

- Liberty Mutual Holding Co Inc

- The Hartford Insurance Group, Inc.

- Chubb Ltd

- Credendo

- Great American Insurance Company

- Atradius NV

- IAT Insurance Group

Get Free Sample For

Get Free Sample For