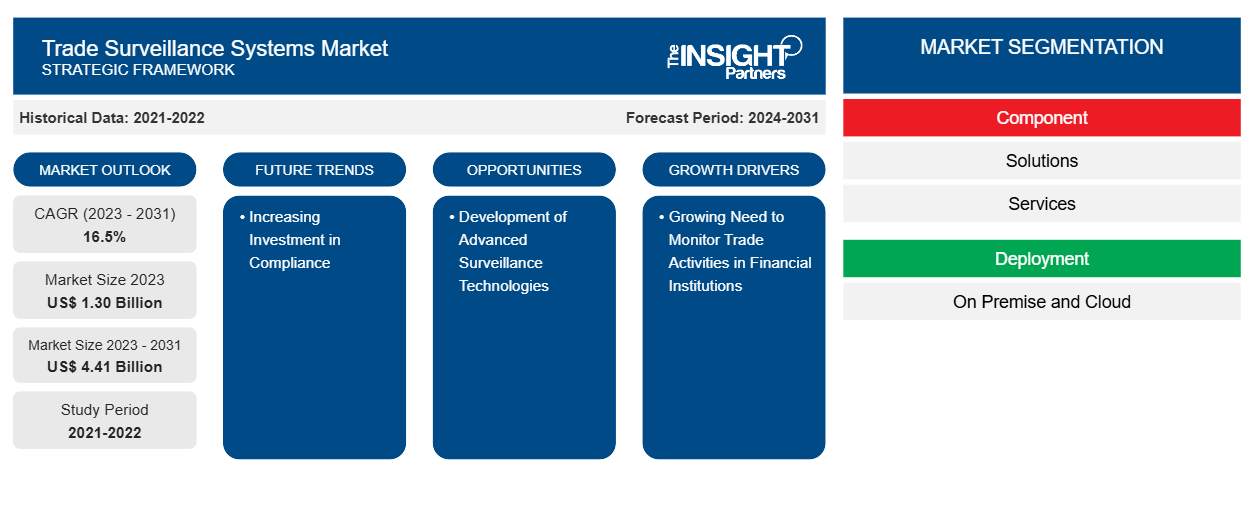

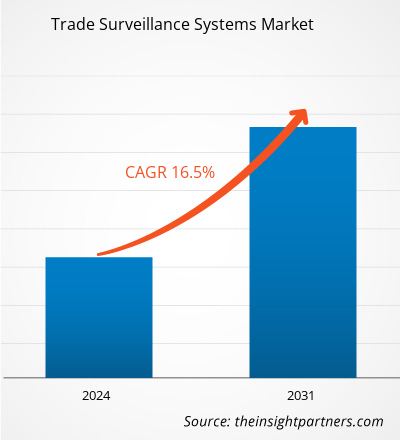

The trade surveillance systems market size is projected to reach US$ 4.41 billion by 2031 from US$ 1.30 billion in 2023. The market is expected to register a CAGR of 16.5% during 2023–2031. Increasing investment in compliance is likely to remain a key trend in the market.

Trade Surveillance Systems Market Analysis

Driven by various factors and offering a host of opportunities, the trade surveillance systems market is growing and evolving fast. One of the largest opportunities that trade surveillance systems can capture is advanced surveillance technologies, such as AI-based pattern recognition and machine learning algorithms. AI technologies today help financial institutions analyze vast amounts of trading data in real-time and easily identify suspicious trading patterns and probable cases of market abuse. It will also benefit the market through the growth in the importance of holistic surveillance solutions with integrated markets and communications surveillance, coupled with the imposition of laws and regulations on financial institutions to improve organizational security and privacy.

Trade Surveillance Systems Market Overview

Trade surveillance systems are full-scale technological solutions used by financial institutions and regulatory bodies to monitor, detect, and prevent market misuse, insider trading, and other misconducts within financial markets. Such systems use advanced technologies like Artificial Intelligence, Machine Learning, and Big Data Analytics to scan reams of trading data in real-time for irregular trading patterns, probable breaches of regulations, and other suspicious activities. These are sophisticated algorithms-based systems that enable organizations to detect, in advance, any likely breaches of compliance and take their respective measures for the maintenance of market integrity, fairness of trading practices, and standards of regulations. Besides, trade surveillance systems contribute to financial markets in a very significant way by boosting investor confidence and bringing about transparency for the creation of a safe, ethical environment for trading.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Trade Surveillance Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Trade Surveillance Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Trade Surveillance Systems Market Drivers and Opportunities

Growing Need to Monitor Trade Activities in Financial Institutions

One major driver of the trade surveillance systems market is the growing need to monitor trade activities in financial institutions. This requirement can trace its roots to various factors underlining the role of effective trade surveillance in the financial sectors. It is in this regard that financial regulators in different parts of the world are putting more emphasis on trade surveillance as one of the measures for detecting and deterring financial fraud, insider trading, and market manipulation. It is in this strict regulatory landscape that advanced surveillance solutions to help regulated firms comply with the new regulatory requirements. For example, Nasdaq, Inc. offers a market surveillance product called SMARTS that assists individual exchange regulatory agencies and brokers in monitoring trading activities across multiple markets and asset classes. The CME Group has a market surveillance team within its exchange that identifies, monitors, and reviews trader positions and transactions. Third-party providers of software platforms and analytics, such as IBM with its Surveillance Insight for Financial Services and Thomson Reuters with its Accelus Market Surveillance, now Connected Risk from Refinitiv, help in customization and setting up comprehensive surveillance capabilities for other major exchanges such as NYSE Euronext

Development of Advanced Surveillance Technologies

Advanced surveillance technologies, including artificial intelligence-based pattern recognition and machine learning algorithms, open huge opportunities for the trade surveillance systems market. Such advanced technologies are capable of analyzing vast reams of trading data in real-time and allow financial institutions to effectively detect suspicious trading patterns and probable cases of market abuse. However, the high costs of implementation can be a big put-off, especially for smaller financial institutions. For example, the cost of setting up a state-of-the-art trade surveillance system is normally so prohibitively expensive that it would be hard for any small brokerage firm to afford the upfront investment necessary to competently address regulatory compliance and market integrity issues as larger firms do. This creates a disparity in the market, whereby more financially powerful and larger institutions have better opportunities to use state-of-the-art surveillance technologies. At the same time, their smaller peers lag due to the inability to afford such expenses.

Trade Surveillance Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the trade surveillance systems market analysis are component, deployment, and organization size.

- Based on component, the market is bifurcated into solutions and services. The solutions segment held a significant market share in 2023.

- In terms of deployment, the market is segmented into on-premises and cloud. The on-premises segment held a significant market share in 2023.

- Based on organization size, the market is bifurcated into SMEs and large enterprises. The large enterprises segment held a significant market share in 2023.

Trade Surveillance Systems Market Share Analysis by Geography

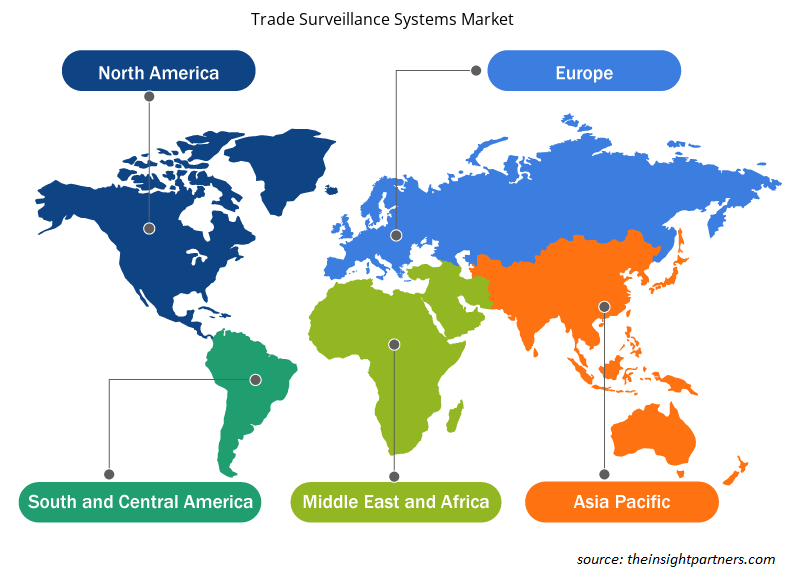

The geographic scope of the trade surveillance systems market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The trade surveillance systems market exhibits significant regional variations and opportunities. North America is expected to hold a significant position in the market, driven by well-established trading services and a high risk of fraud and manipulation. It is crucial to establish robust trade surveillance systems. Additionally, the region's high adoption of cloud-based surveillance systems and stringent government regulations further augment market growth.

Trade Surveillance Systems Market Regional Insights

The regional trends and factors influencing the Trade Surveillance Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Trade Surveillance Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Trade Surveillance Systems Market

Trade Surveillance Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.30 Billion |

| Market Size by 2031 | US$ 4.41 Billion |

| Global CAGR (2023 - 2031) | 16.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Trade Surveillance Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Trade Surveillance Systems Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Trade Surveillance Systems Market are:

- ACA Group

- Aquis Exchange

- B-Next

- CRISIL Limited

- FIS Global

- Nasdaq Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Trade Surveillance Systems Market top key players overview

Trade Surveillance Systems Market News and Recent Developments

The trade surveillance systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the trade surveillance systems market are listed below:

- ION, a global provider of trading, analytics, treasury, and risk management solutions for capital markets, commodities, and treasury management, announces that LookOut has won the Risk Technology Awards 2023 Trade Surveillance Product of the Year. Created by LIST, an ION company, LookOut is a multi-compliance solution for trade and market surveillance, regulatory reporting, and business analytics designed for investment firms (buy-side and sell-side) and trading venues.

(Source: ION, Press Release, July 2023)

Trade Surveillance Systems Market Report Coverage and Deliverables

The “Trade Surveillance Systems Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Trade surveillance systems market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Trade surveillance systems market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Trade surveillance systems market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the trade surveillance systems market

- Detailed company profiles

Frequently Asked Questions

What is the expected CAGR of the trade surveillance systems market?

The market is projected to record a CAGR of 16.5% during 2023–2031.

What would be the estimated value of the trade surveillance systems market by 2031?

The market is expected to reach a value of US$ 4.41 billion by 2031.

Which are the leading players operating in the trade surveillance systems market?

ACA Group, Aquis Exchange, B-Next, CRISIL Limited, FIS Global, Nasdaq Inc., OneMarketData LLC, Scila AB, SIA S.P.A., and Software AG are key players in the market.

What are the future trends of the trade surveillance systems market?

Increasing investment in compliance is a key trend in the market.

What are the driving factors impacting the trade surveillance systems market?

The growing need to monitor trade activities in financial institutions is driving the market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Parking Meter Apps Market

- eSIM Market

- Advanced Distributed Management System Market

- Online Exam Proctoring Market

- Electronic Data Interchange Market

- Barcode Software Market

- Maritime Analytics Market

- Cloud Manufacturing Execution System (MES) Market

- Robotic Process Automation Market

- Digital Signature Market

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

Get Free Sample For

Get Free Sample For