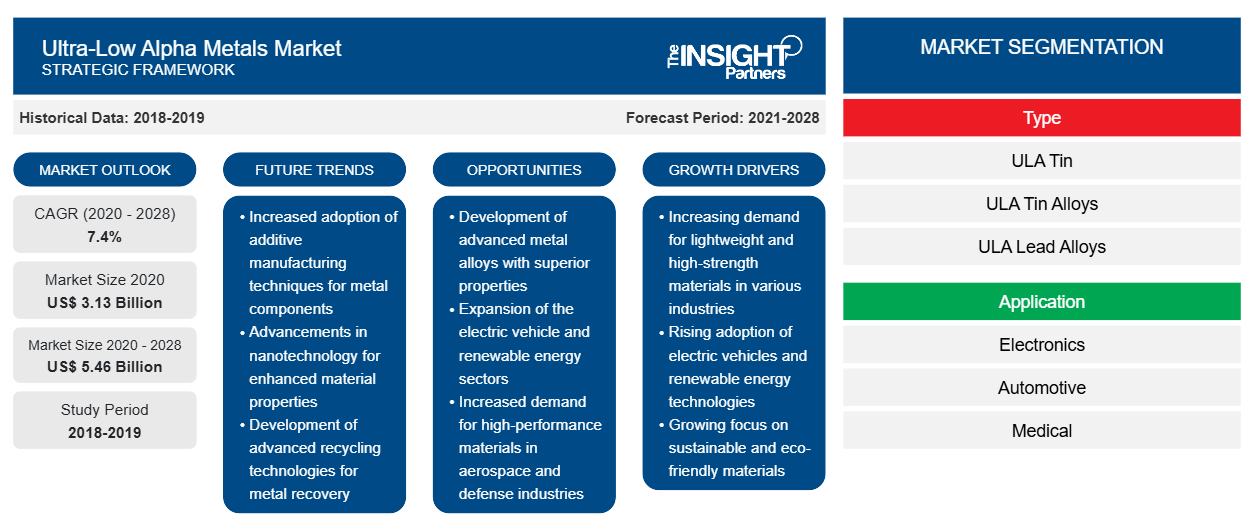

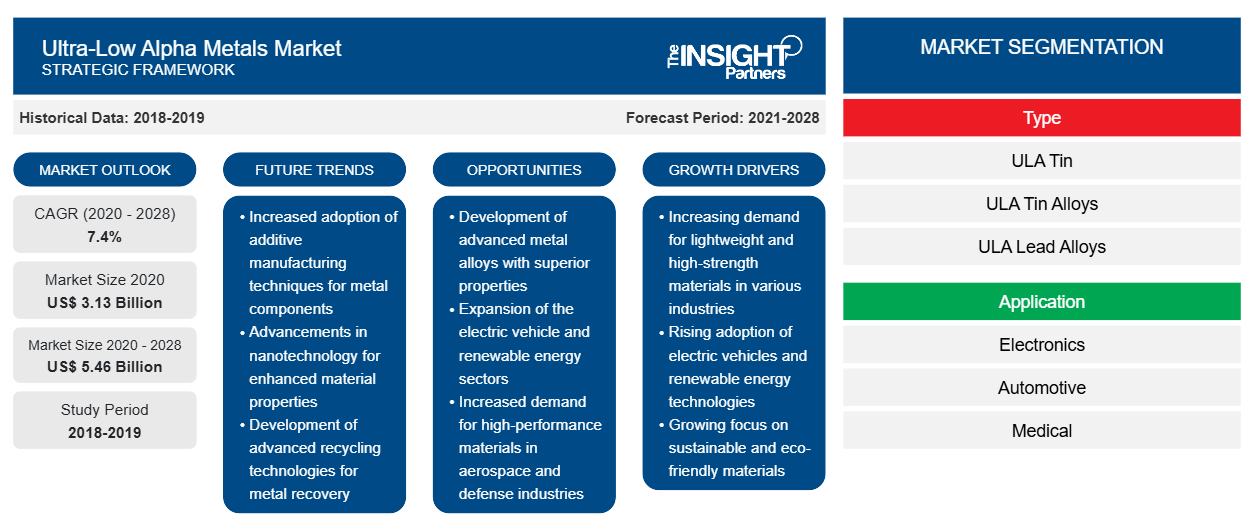

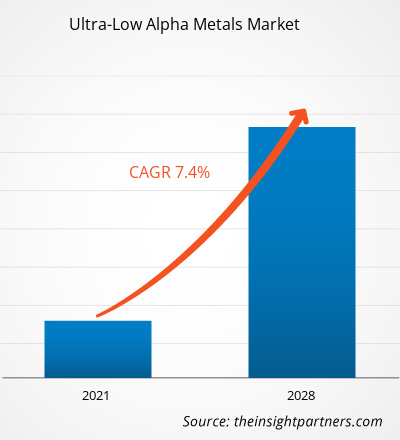

[Research Report] The ultra-low alpha metals market was valued at US$ 3,125.00 million in 2020 and is projected to reach US$ 5,461.78 million by 2028; it is expected to grow at a CAGR of 7.4% from 2021 to 2028.

Ultra-low alpha metals are majorly used in solder bumping in the electronics industry. The strict government regulations on the use of hazardous substances in electronic equipment drive the growth of the ultra-low alpha metals market. However, the volatility in the prices of the raw materials impedes market growth.

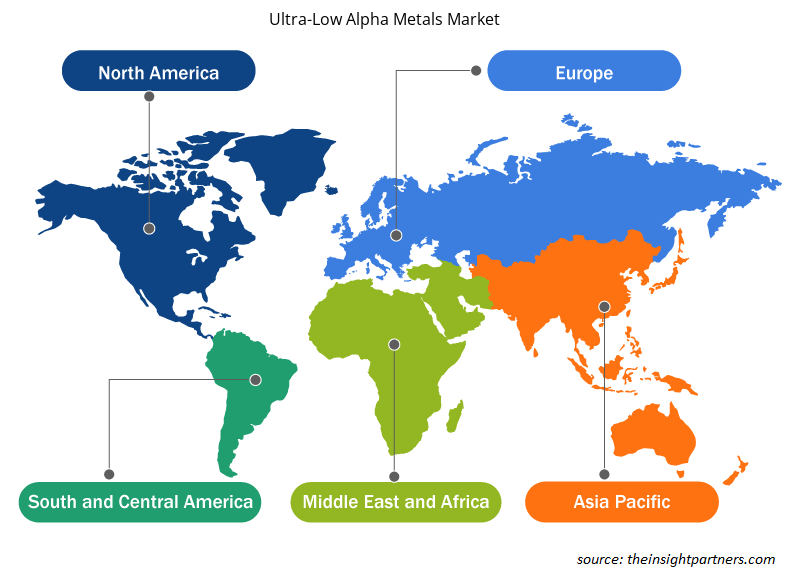

In 2020, Asia Pacific contributed to the largest share in the global ultra-low alpha metals market. The market growth in the region is primarily attributed to the presence of strong industrial base with prominent manufactures. High demand for ultra-low alpha metals from applications such as electronics, automotive, and medical backed by the significantly growing end-use industrial bases is stimulating the growth of the ultra-low alpha metals market in the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ultra-Low Alpha Metals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ultra-Low Alpha Metals Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Ultra-Low Alpha Metals Market

The ongoing COVID-19 pandemic has drastically altered the status of the chemicals & materials sector and negatively impacted the growth of the ultra-low alpha metals market. The implementation of measures to combat the spread of the novel coronavirus has aggravated the situation and declined the demand for industrial metals and materials. The operations of industries have been impacted amid the pandemic, which has ultimately disturbed the delivery cycle and increased import–export tariff. The sudden distortion in operational efficiencies and disruptions in the value chains are attributed to the sudden closure of national and international boundaries and the temporarily closure of manufacturing bases due to indefinite lockdowns and temporary quarantines, which have hampered the growth of the market during the pandemic. The restrictions on supply chain with volatility in raw material pricing and sourcing due to initial weeks of lockdown have disturbed the industrial products and processes. Also, the focus on the just-in-time production is another concerning factor hindering market growth. However, as the economies are planning to revive their operations, the demand for ultra-low alpha metals is expected to rise globally in the coming years. The increasing demand for advanced industrial materials due to the growth of various end-use industries, such as electronics, aerospace & defense, automotive, medical, and telecommunication, is also expected to drive the growth of the market in the coming years. Further, significant investments by prominent manufacturers in the advancement of ultra-low alpha lead-free alloys would fuel the growth of the ultra-low alpha metals market during the forecast period.

Market Insights

Rise in Concerns Toward Soft Error Issue to Fuel Ultra-Low Alpha Metals Market Growth

The expanding demand for high density and low power product requirements has propelled the concept of reducing the dimensions and operating voltages of modern electronic devices. The constant scaling of complementary metal-oxide-semiconductor device technologies has led to miniaturization and shrinkage in the operating voltage of the device transistors. However, the concept has opened new challenges, both from the technology and materials point of view. One such issue is soft error, the temporary malfunction of the device, which is caused by the radiation of high-energy alpha particles. One of the primary sources of alpha particle radiation is the solders which are significantly deployed for joining components in the packaging. Hence, the growing concern toward the soft error issue has led to an increase in demand for ultra-low alpha metals.

Type Insights

Based on type, the global ultra-low alpha metals market is segmented into ULA tin, ULA tin alloys, ULA lead alloys, ULA lead-free alloys and others. The ULA lead-free alloys and others segment led the market in 2020. With the growing investments in research and development activities, manufacturers are coming up with the advanced forms of products, which could meet specific industry requirements. Similarly, manufacturers have introduced ULA lead-free alloys that is composed of a significantly low proportion of lead (i.e., 0.1%) or no lead at all. The demand for ultra-low alpha lead-free soldering alloys is rising due to the growing concerns toward the environment.

Application Insights

Based on application, the global ultra-low alpha metals market is segmented into electronics, automotive, medical, telecommunication, and others. The electronics segment led the market in 2020. It is imperative to deploy the use of alloys and metals that could hold an ultra-low alpha grade when engaged in electronic applications. The use of ultra-low alpha metals helps to dodge any malfunctioning caused due to soft errors in electronics devices. Additionally, the significant reduction in the size of devices, along with the installation of solder materials close to the sensitive locations in electronic devices, generates the need for ultra-low alpha metals. There is a rise in demand for ultra-low alpha metals in the production of consumer electronics.

A few of the key players operating in the global ultra-low alpha metals market are MITSUBISHI MATERIALS Corporation; Teck Resources Limited; Advanced Manufacturing Services (AMS) Ltd; Pure Technologies; Honeywell International Inc.; DUKSAN Hi-Metal Co., Ltd; and MacDermid Alpha Electronics Solutions.

Report Spotlights

- Progressive industry trends in the ultra-low alpha metals market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the ultra-low alpha metals market from 2019 to 2028

- Estimation of global demand for ultra-low alpha metals

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the ultra-low alpha metals market

- Assistance in decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the ultra-low alpha metals market size at various nodes

- Detailed overview and segmentation of the market, as well as the ultra-low alpha metals industry dynamics

- Size of the ultra-low alpha metals market in various regions with promising growth opportunities

Ultra-Low Alpha Metals Market Regional Insights

The regional trends and factors influencing the Ultra-Low Alpha Metals Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Ultra-Low Alpha Metals Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Ultra-Low Alpha Metals Market

Ultra-Low Alpha Metals Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 3.13 Billion |

| Market Size by 2028 | US$ 5.46 Billion |

| Global CAGR (2020 - 2028) | 7.4% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Ultra-Low Alpha Metals Market Players Density: Understanding Its Impact on Business Dynamics

The Ultra-Low Alpha Metals Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Ultra-Low Alpha Metals Market are:

- Mitsubishi Materials Corporation

- Teck Resources Limited

- Advanced Manufacturing Services (AMS) Ltd

- Pure Technologies

- Honeywell International Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Ultra-Low Alpha Metals Market top key players overview

Global Ultra-Low Alpha Metals Market

By Type

- ULA tin

- ULA tin alloys

- ULA lead alloys

- ULA lead-free alloys and others

By Application

- Electronics

- Automotive

- Medical

- Telecommunication

- Others.

Company Profiles

- MITSUBISHI MATERIALS Corporation

- Teck Resources Limited

- Advanced Manufacturing Services (AMS) Ltd

- Pure Technologies

- Honeywell International Inc.

- DUKSAN Hi-Metal Co., Ltd

- MacDermid Alpha Electronics Solutions

Frequently Asked Questions

Based on application, why electronics segment accounted for the largest share in the global ultra-low alpha metals market?

Based on application, the ultra-low alpha metals market is categorized into electronics, automotive, medical, telecommunication and others. The electronics segment accounted for the largest market share in 2020. The implementation of the legislations such as RoHS (Restriction of the use of certain Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) have led to growing adoption of Pb-free ultra-low alpha metals in production of electronic products. The primary alloys categorized as leadfree ultra-low alpha solders are Sn-Ag and Sn-Ag-Cu as well as alloy systems composed of Bi, Sb and others. The growing concern towards alpha emission along with rising focus towards environment has led to the inclination towards lead free alloys. However, in current scenario, several development activities have been oriented towards development of Pb-free solder with an aim to meet up the manufacturability and reliability expectation from the industries

Can you list some of the major players operating in the global ultra-low alpha metals market?

The major players operating in the global ultra-low alpha metals market are MITSUBISHI MATERIALS Corporation; Teck Resources Limited; Advanced Manufacturing Services (AMS) Ltd; Pure Technologies; Honeywell International Inc.; DUKSAN Hi-Metal Co., Ltd; MacDermid Alpha Electronics Solutions; among many others.

Which region held the largest share of the global ultra-low alpha metals market?

In 2020, Asia Pacific held the largest share of the global ultra-low alpha metals market. The demand for ultra-low alpha metals is rising in the region due to factors such as the significant growth in chemical, automotive, oil and gas, aerospace and defense, and other such industries. The region encompasses an ample amount of opportunities for the growth of the market attributable to the rapid industrial development along with significant rise in foreign direct investments and increasing expenditure towards research and development activities which are altogether expected to diversify the application base of ultra-low alpha metals has also led to market growth. Further, the rapid development of manufacturing base backed by improved economic activities and better investment opportunities is also promoting the growth of ultra-low alpha metals in regional market. China is dominating the regional market, followed by other countries such as Japan, India, South Korea and other countries.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Ultra-Low Alpha Metals Market

- Mitsubishi Materials Corporation

- Teck Resources Limited

- Advanced Manufacturing Services (AMS) Ltd

- Pure Technologies

- Honeywell International Inc.

- DUKSAN Hi-Metal Co., Ltd

- MacDermid Alpha Electronics Solutions

Get Free Sample For

Get Free Sample For