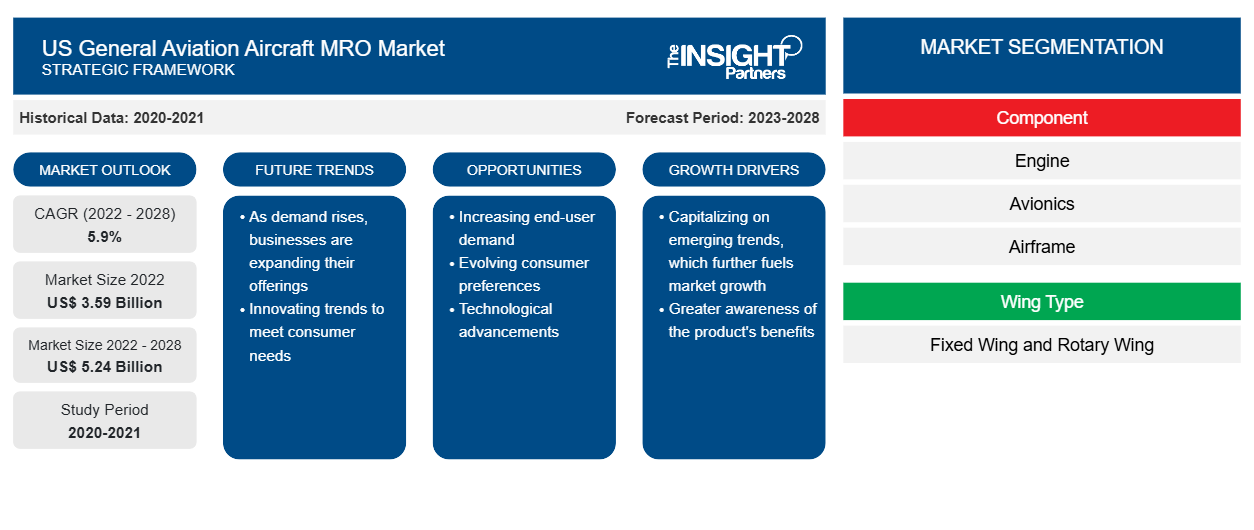

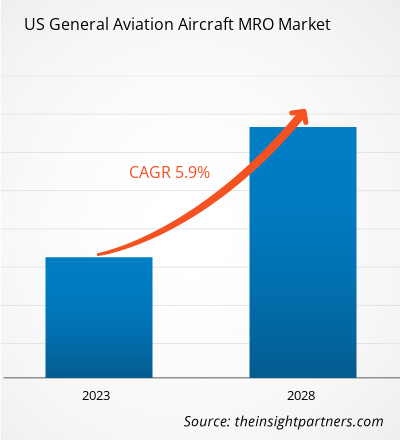

The general aviation aircraft MRO market in US is expected to grow from US$ 3.59 billion in 2022 to US$ 5.24 billion by 2028; it is estimated to register a CAGR of 5.9% from 2022 to 2028.

In the aviation industry, MRO services play an important role in assuring the durability, safety, and profitability of airlines. In addition, businesses are working on adopting new and trending technologies, which will help them digitalize their business processes. Advanced technologies such as blockchain improve processes in MRO organizations. Blockchain technology has massive potential in the MRO space. So far, the adoption of this technology has been low; however, soon, it will contribute a considerable share to the overall growth of the general aviation aircraft MRO market. Moreover, with the help of blockchain technology, companies can record the configuration details of MRO components. This makes the documentation process for component manufacturers and MRO service providers effortless. Also, the deployment of this technology enables MRO service providers to offer verifiable documentation regarding the parts they have installed in the aircraft, thereby maintaining transparency in their operations. Various general aviation aircraft MRO market players are opting for blockchain technology. For instance, in March 2021, Government Blockchain Association and Digital Innovation Group formed a joint venture named GBA Aviation & Aerospace Working Group. This joint venture is created to explore the use of blockchain in the aerospace & aviation sector for MRO services, supply chains, and airports. Aviation industry players such as aircraft manufacturers, aircraft MRO service providers, and developers of aviation technology are highly emphasizing on adopting blockchain technology to track their MRO processes. Thus, the adoption of blockchain technology is expected to be a key trend in the general aviation aircraft MRO market growth in the coming years.

US General Aviation Aircraft MRO Market -

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US General Aviation Aircraft MRO Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US General Aviation Aircraft MRO Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on General Aviation Aircraft MRO Market

The sudden outbreak of the pandemic adversely impacted the general aviation aircraft MRO market growth in 2020. According to the National Business Aviation Association (NBAA), several general aviation airports across the US witnessed a decrease in the sale of aviation gasoline and jet fuel to one-tenth of the general fuel earnings in April 2020. Airports that experienced a decline in demand for fuel included Gainesville Municipal Airport (GLE) in Texas, Okeechobee County Airport (OBE) in Florida, and Texas Gulf Coast Regional Airport (LBX). This drop in fuel sales across the airports was directly related to the decrease in general aviation traffic. For instance, according to NBAA, Florida’s Fernandina Beach Airport (FHB) experienced a decrease in demand for charter flights by ~80% in Q1 of 2020. The rapid drop in demand for charter flights across the airport was observed after the New York tri-state order to halt travel plans both domestically and internationally for general aviation passengers to combat the spread of SARS-CoV-2 across the country. These factors negatively impacted the general aviation industry across the US. The significant decrease in demand for charter flights and a complete halt on general aviation travel across the country to combat the spread of the virus further significantly impacted the US general aviation aircraft MRO market negatively.

Market Insights – US General Aviation Aircraft MRO Market

The US general aviation aircraft MRO market is expected to be driven by a rise in air passenger traffic, the need to improve operability and performance, and the requirement for disassembling, replacing, testing, and repairing the various components of the aircraft. Also, owing to the rising number of people interested in sightseeing and skydiving, the demand for those flights is further increasing in the country. Thus, as these airlines are experiencing a significantly higher density of air traveling passengers, the flying hours of each aircraft are increasing, leading to an increase in the frequency of aircraft maintenance. Furthermore, the presence of numerous independent MRO service providers in the country has enabled the airlines to opt for frequent A-checks, B-checks, and C-checks. In addition, the US is home to several aircraft manufacturers, providing various general aviation aircraft. According to the Aircraft Owners and Pilots Association, in 2019, out of ~220,000 civil aircraft registered in the US, 90% were general aviation aircraft. Thus, having such a large fleet of general aviation aircraft will further boost the growth of the general aviation aircraft MRO market in the US.

Wing Type-Based Insights

Based on wing type, the US general aviation aircraft MRO market size is bifurcated into fixed wing and rotary wing. The fixed wing segment accounted for a larger market share in 2021. Currently, the fixed wing segment is experiencing a significant boom owing to the exponential rise in air travel passengers in the US. This is leading to an increase in the number of new aircraft, simultaneously increasing the size of the existing aircraft fleet. The growing fleet size demands regular maintenance and repair activities owing to the need for optimal performance, which is a crucial influential factor for the general aviation aircraft MRO market. Furthermore, various airlines in the US are undertaking initiatives to modernize their existing fleet with advanced technologies. The upward trend in aircraft retrofitting activities is boosting the revenue generation of market players operating in the general aviation aircraft MRO market.

The US general aviation aircraft MRO market size is segmented based on component and wing type. Based on component, the general aviation aircraft MRO market is segmented into engine, avionics, airframe, cabin, landing gear, and others. Based on wing type, the general aviation aircraft MRO market is bifurcated into fixed wing and rotary wing.

Textron Aviation Inc, Safran SA, MTU Aero Engines AG, Honeywell International Inc., and GKN Aerospace Services Limited AG Aero Group are among the key general aviation aircraft MRO market players operating across the US.

The general aviation aircraft MRO market players are mainly focused on the development of advanced and efficient products.

- In 2023, ASL Aviation Holdings and AMETEK MRO AEM announced a new agreement to provide Landing Gear services for ASL's European fleet of next-generation and classic aircraft. The agreement covers the provision of overhaul services and loan gear sets until the end of 2026 and builds on ASL's existing relationship with AEM, which has been an ASL-trusted supplier for many years.

- In 2022, Honeywell International Inc entered a strategic agreement with AMETEK MRO for being the formers authorized engine repair partner in the APAC region. This new licensing agreement will allow Honeywell and AMETEK MRO to penetrate OEM-centric markets in Asia, further serving customers that require OEM-only material by utilizing strategically located facilities in Singapore and the US.

US General Aviation Aircraft MRO Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.59 Billion |

| Market Size by 2028 | US$ 5.24 Billion |

| CAGR (2022 - 2028) | 5.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

|

US General Aviation Aircraft MRO Market Players Density: Understanding Its Impact on Business Dynamics

The US General Aviation Aircraft MRO Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the US General Aviation Aircraft MRO Market top key players overview

Frequently Asked Questions

What is the estimated market size for the US general aviation aircraft MRO market in 2021?

What are the driving factors impacting the US general aviation aircraft MRO market?

• Rise in Implementation of Safety Systems in General Aviation

• Rise in Adoption of Digital Technology in MRO Industry for General Aviation

Which are the key players holding the major market share of US general aviation aircraft MRO market?

Which is the leading component segment in the US general aviation aircraft MRO market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For