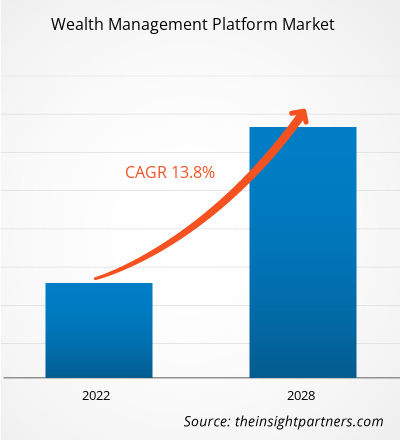

The wealth management platform market is expected to grow from US$ 3,710.4 million in 2021 to US$ 9,197.6 million by 2028; it is estimated to grow at a CAGR of 13.8% from 2021 to 2028.

The wealth management platform is specially designed for planning and monitoring financial services, combined with tax and legal advisory, estate planning, personal retail banking services, and investment management. Growing digitalization across various sectors and continuous emphasis on automating the system by financial institutions are focused on developing workflows to simplify the lives of their customers. Financial service providers are progressively implementing open application program interface (API) frameworks to offer their financial services along with third-party products, with the help of bank channels and other digital platforms. The APIs permit the service providers to access each other’s products and services mutually. However, conventional financial advisors are responding to varying preferences of the investors by adopting in-house platforms to meet the growing requirement of clients. Wealth management platforms offer various benefits, such as enriched and streamlined business, increased business processes efficiency via system automation, regulatory requirement compliance, services standardization, Omni channel approach, and excellent user experience. The wealth management software consists of advisor front-office, client reporting, performance and risk analytics, portfolio management, and multichannel client front-end modules. The advancements in technology increased the acceptance of Robo-advisory, which integrates AI and analytics into the system.

Several industries are concentrating on the advancement in their wealth management platforms. The local and federal governments of economies are imposing mandatory regulations and compliances for wealth management activities. Several companies providing wealth management platforms develop advanced and efficient software and solutions by channelizing their primary focus on the development of products.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wealth Management Platform Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wealth Management Platform Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Wealth Management Platform Market

North America has the highest rate of advanced technology adoption due to favorable government policies fostering innovation and enhancing infrastructural abilities. As a result, every factor affecting the region's industrial performance obstructs its economic development. The US has become the world's worst-affected country due to the COVID-19 outbreak, causing governments to impose a number of limitations on industrial, commercial, and public activities in the country to contain the disease's spread. According to the Center for Strategic and International Studies, due to the COVID-19 impact, the US experienced a contraction in GDP. As per the recent World Health Organization (WHO) statistics, presently, the US is the world's worst-affected country due to the COVID-19 outbreak, with the highest number of confirmed cases and deaths. The high number of COVID cases has negatively impacted the country's and region's economies. There has been a decline in overall business activities and growth of various industries operating in the region. Thus, this has affected the revenue of key wealth management platform market players operating in North America. The business shutdowns and cancellation and postponement of product launches across the US, Canada, and Mexico have impacted the adoption of the wealth management platform market in 2020.

Market Insight

Rising Adoption of Robo Advisors in Wealth Management

The financial sector is continually adopting advanced technologies to provide financial services in cheaper and efficient ways. These advanced and creative technologies garnered attention during the global financial crisis of 2007–2008, when strict rules were imposed on conventional banks, and innovations in the IT industry increased the incentives for expanding nonbank and technology-based financial enterprises. For instance, a few technological revolutions in the finance sector comprise mobile payments, ATMs (automated teller machines), and trade finance using blockchain. The technological interruptions in wealth management services consist of Robo-advisors and automated financial advisors designed to compete with human advisors. Robo-advisors advise various investing techniques for goals, such as saving for significant expenses, retirement, and maintaining a stream of income to handle expenses effectively. Advantages of Robo-advisory management wealth services over traditional services, involving human advisory, are easy accessibility, affordability, and the ability to offer their clients the option to obtain financial advice and handle investments at any time, from any place, with the help of an Internet connection. Robo-advisory allows the wealth management platform market players to provide their services at low fees, permitting them to expand into the wealth management platform market.

Deployment Type Segment Insights

The wealth management platform market, by deployment type, is segmented into cloud and on-premises. The cloud hosts the applications offsite; hence, it is hugely adopted by small and medium-sized organizations. Cloud deployment requires limited capital expenditure, enables daily data backup, and allows businesses to pay only for the resources they use. The growing acceptance of this technology across numerous sectors and the increasing requirement of modified business operations are driving the cloud-based wealth management platform market growth.

Advisory Model Segment Insights

The wealth management platform market, based on advisory model, is segmented into human advisory, robo-advisory, and hybrid. The human advisory model develops the financial strategy and configures the robo-advisory model, which then aids in decisions regarding investments and deals based on financial instruments. This operation provides customers with a balance of digital services and access to a human advisor for important investment choices. Furthermore, human advisors do not always have the bandwidth, intellect, or skill to digest data quickly enough to deliver timely interactions. Nevertheless, this model assists investors in dealing with emotionally charged issues, such as deciding whether to support a child's education or arrange for rising healthcare costs for elderly parents.

Business Function Segment Insights

The wealth management platform market, by business function, is segmented into performance management, risk and compliance management, portfolio accounting and trading management, financial advice management, reporting, and others. Portfolio accounting refers to tracking the performance of individual securities in a stock portfolio, evaluating which investments might be increased or decreased, and assessing the portfolio to ensure that it meets the investor's growth expectations. Portfolio accounting and trade management assists high-net-worth (HNW) people in successfully and safely managing their financial assets. Due to the rising number of high-net-worth people worldwide, the wealth management platform market for portfolio accounting, and trade management platforms would continue to grow during the forecast period.

End User Segment Insights

The wealth management platform market, by end user, is segmented into trading & exchange firms, banks, brokerage firms, investment management firms, and others. A routine at investment management firms includes investing money collected from clients and choosing the best available investments on their behalf. All types of investments are associated with certain level of risk factor wherein the firms need to achieve a good return on investment ensuring a bearable risk for clients. Investment management firms typically undertake superlative efforts for creating an investment portfolio for their clients. They face notable challenges in managing wealth due to complex investments, fluctuating markets, intricate organizational structures, and operational difficulties.

The wealth management platform market players focus on new product innovations and developments by integrating advanced technologies and features to compete with the competitors. In January 2022, Broadridge Financial Solutions, Inc. collaborated with Santander Investment S.A. for the live availability of a new Spanish issuer “golden copy” event notification and vote execution service for the Spanish market.

The wealth management platform market, by deployment type, is segmented into cloud and on-premises. The market, based on advisory model, is segmented into human advisory, robo-advisory, and hybrid. The wealth management platform market, by business function, is segmented into performance management, risk and compliance management, portfolio accounting and trading management, financial advice management, reporting, and others. The wealth management platform market, by end user, is segmented into trading & exchange firms, banks, brokerage firms, investment management firms, and others. Based on region, the global wealth management platform market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Wealth Management Platform Market Regional Insights

The regional trends and factors influencing the Wealth Management Platform Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Wealth Management Platform Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wealth Management Platform Market

Wealth Management Platform Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3.71 Billion |

| Market Size by 2028 | US$ 9.2 Billion |

| Global CAGR (2021 - 2028) | 13.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Advisory Model

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Wealth Management Platform Market Players Density: Understanding Its Impact on Business Dynamics

The Wealth Management Platform Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wealth Management Platform Market are:

- Broadridge Financial Solutions, Inc.

- Comarch SA

- FIS Global

- InvestCloud

- Fiserv, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wealth Management Platform Market top key players overview

Wealth Management Platform Market – Company Profiles

- Broadridge Financial Solutions, Inc.

- Comarch SA

- FIS Global

- InvestCloud

- Fiserv, Inc.

- InvestEdge, Inc.

- Profile Software S.A.

- SEI Investments Developments, Inc.

- SS&C Technologies, Inc.

- Temenos Headquarters SA

Frequently Asked Questions

Which region has dominated the wealth management platform market?

In 2020, North America held the largest market share of 36.9% in 2020, followed by Europe and APAC.

Which are the major companies in the wealth management platform market?

The major companies in wealth management platform includes Blackrock, Vanguard, UBS, Fidelity Investment and State Street Global Advisors.

Which advisory Model of location is expected to dominate the market in the forecast period?

The human advisory segment led the wealth management platform with a market share of 51.0% in 2020. It is expected to account for 43.4% of the total market in 2028. The human advisory model develops the financial strategy and configures the robo-advisory model, which then aids in decisions regarding investments and deals based on financial instruments. This operation provides customers with a balance of digital services and access to a human advisor for important investment choices. Furthermore, human advisors do not always have the bandwidth, intellect, or skill to digest data quickly enough to deliver timely interactions. Nevertheless, this model assists investors in dealing with emotionally charged issues, such as deciding whether to support a child's education or arrange for rising healthcare costs for elderly parents.

Which business function is expected to dominate the market in the forecast period?

The portfolio accounting and trading management segment led the wealth management platform with a market share of 35.1% in 2020. Portfolio accounting refers to tracking the performance of individual securities in a stock portfolio, evaluating which investments might be increased or decreased, and assessing the portfolio to ensure that it meets the investor's growth expectations. Portfolio accounting and trade management assists high-net-worth (HNW) people in successfully and safely managing their financial assets. Due to the rising number of high-net-worth people worldwide, the market for portfolio accounting, and trade management platforms would continue to grow during the forecast period.

What are market opportunities for wealth management platform market?

Long-term financial planning is a procedure of aligning the financial capacity of an individual with long-term service goals by financial forecasting. Different governments globally have an overall long-term financial planning process that encourages the discussion of a long-range perspective used by decision-makers. Wealth management tools help minimize financial difficulties by generating long-term and strategic thinking. They are essential for effective communication with external and internal stakeholders. Adoption of Al and analytics provides the analysis phase to provide information that aids in the strategizing and planning. The analysis phase comprises financial and forecasts analysis, often associated with long-term financial planning. It also involves information gathering, trend forecasting, and analysis. These analyses create awareness about long-term financial planning among the masses, which would create lucrative opportunities for the wealth management platform market during the forecast period.

What are reasons behind wealth management platform market growth?

Continual increase in the billionaire population across the globe boosts the number of high-net-worth people (HNWIS) in the region. Asia has nearly the same number of HNWIs as Europe, but Asia is expected to be the fastest-growing HNW area in the next five years, according to Wealth-X. Singapore and Hong Kong are projected to be the region's primary hubs and other nations would import or establish services for HNWs in the region. The regional development and professionalization of services in China are growing at a high pace with the help of government regulations to take benefit from wealth management platform. As per Knight Frank's 13th edition of The Wealth Report, the number of billionaires in APAC is estimated to increase by 27%, exceeding the number of billionaires present in North America (17%) and Europe (18%) in the next four years. As per Knight Frank's forecasts, 8 out of the top 10 countries, by future growth, are in Asia, with Ukraine and Romania taking the remaining spots. India is at the forefront with 39% growth in the number of HNWIs, followed by the Philippines (38%) and China (35%). Independent wealth managers deal explicitly with tax, risk management, and estate planning for managing the wealth of their HNWI customers. Thus, the rising number of HNWI plays a vital role in the growth of the wealth management platform market globally.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Parking Meter Apps Market

- eSIM Market

- Advanced Distributed Management System Market

- Online Exam Proctoring Market

- Electronic Data Interchange Market

- Barcode Software Market

- Maritime Analytics Market

- Cloud Manufacturing Execution System (MES) Market

- Robotic Process Automation Market

- Digital Signature Market

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Wealth Management Platform Market

- Broadridge Financial Solutions, Inc.

- Comarch SA

- FIS Global

- InvestCloud

- Fiserv, Inc.

- InvestEdge, Inc.

- Profile Software S.A.

- SEI Investments Developments, Inc.

- SS&C Technologies, Inc.

- Temenos Headquarters SA

Get Free Sample For

Get Free Sample For