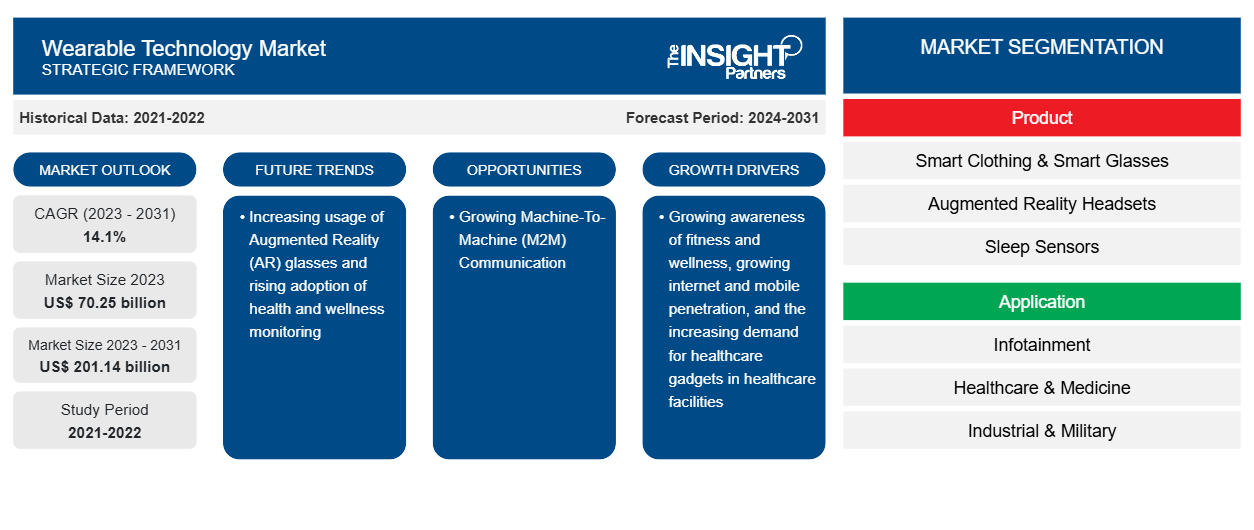

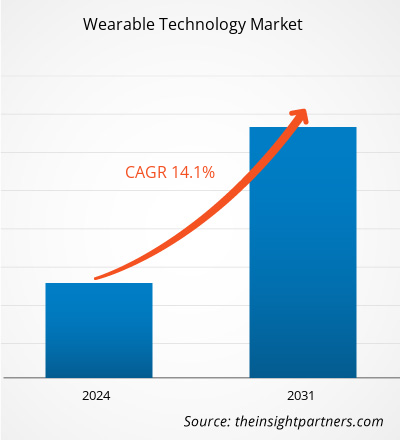

The wearable technology market size is expected to grow from US$ 70.25 billion in 2023 to US$ 201.14 billion by 2031; it is estimated to grow at a CAGR of 14.1% from 2023 to 2031. Increasing usage of Augmented Reality (AR) glasses and rising adoption for health and wellness monitoring are likely to remain key wearable technology market trends.

Wearable Technology Market Analysis

The wearable technology market has witnessed substantial growth in recent years, driven by technological advancements, growing awareness of fitness and wellness, and the increasing demand for healthcare gadgets in healthcare facilities. Wearable products incorporate advanced features and functionalities to enhance the overall consumer experience. One of the major factors driving the wearable technology market is the growing internet and mobile penetration.

The wearable technology market growth is driven by the growing penetration of smartphones, mobile devices, tablets, and devices used for Machine-to-Machine communications, growing business models, and evolving software ecosystems. Almost all standard wearable devices are paired with smartphones, which have become the primary part of wearable technology user’s day-to-day life. Wearable technology products such as smartwatches are mainly synced with smartphones, helping end-users to check messages and attend calls without taking out their smartphones. Nowadays, companies like Samsung, OnePlus, and others are launching smartphones with corresponding wearable devices to provide end users with enhanced experiences.

Wearable Technology Market Overview

Wearable technology is one of the most well-known advancements, integrating technology with regular accessories, enabling users to make their lives easier. It helps the users in achieving their goals. These wearable devices are projected to benefit the different classes of people in their daily lives. Currently, people are living in a highly connected and networked world. Most of the population globally have internet access and possess mobile devices. People increasingly use mobile devices for various purposes, such as knowledge exploration, communication, shopping, entertainment, etc. In addition, rising urbanization and increasing consumer disposable income are major drivers expected to fuel the adoption of smartphones and wearable devices connected over the internet.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wearable Technology Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wearable Technology Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Wearable Technology Market Drivers and Opportunities

High adoption of wearable technology across various application areas and rising investment by the wearable ecosystem players to Favor Market Growth

Wearable technology encourages enormous potential for process advancement and advancing work effectiveness and efficiency. Wearable technology has wide application areas and can be used in various industries such as retail, medical and healthcare, manufacturing, fitness, etc. In the retail industry, wearable devices improve sales processes, customer experiences, and services. In the manufacturing industry, this technology helps provide hands-free guidance tools, which eventually help enhance the production process and streamline processes, improving the accuracy of information to lessen healthcare costs in medical facilities and centers significantly.

In recent years, several wearable technology market players worldwide and companies working towards delivering innovative and advanced wearable solutions have received high funding from various financial houses and established technology firms. For instance, in June 2023, Dubai-based Endefo, an electronic brand under the Ashtel Group of Companies, announced the plan to invest US$ 24.06 million (Rs 200 crore) in the Indian wearable technology market by the end of 2024.

In addition, according to the Department of Defense (DoD) in April 2023, the DoD is investing in wearable technology that can rapidly detect diseases. In partnership with the private sector, its Defense Innovation Unit (DIU) launched a wearable device that was successful during the pandemic in detecting infections. Now, it plans to expand its technological capabilities and develop advanced products. Moreover, other wearable technology market players have received high investments to develop technologically advanced and innovative wearable solutions further. Hence, the promising benefits of using wearable technology across various application areas and the high level of investment fueling the innovation that is projected to foster the global wearable technology market

Growing Machine-To-Machine (M2M) Communication - An Opportunity in the Wearable Technology Market

Growing machine-to-machine (M2M) communication due to improvements in sensor technology and easily accessible high-speed networks are finding high applications in various sectors, such as manufacturing, electronics, and other sectors. The rise in connected devices and expanding M2M communication affect the development of wearable devices and technologies. A range of wearable devices, such as industrial safety devices and health monitoring devices, are experiencing an optimistic adoption rate, as they offer end users improved real-time actionable data and enhanced operational efficiency of the device.

Wearable Technology Market Report Segmentation Analysis

Key segments that contributed to the derivation of the wearable technology market analysis are the product and application.

- Based on the product, the wearable technology market is segmented into smart clothing & smart glasses, augmented reality headsets, sleep sensors, heart rate monitors, wearable patches, activity monitors, smart watches, continuous glucose monitors, hand-worn terminals, and drug delivery devices and jewelries.

- Based on application, the wearable technology market is segmented into infotainment, healthcare & medicine, industrial & military, fashion & lifestyle, fitness & wellness, and safety & security.

Wearable Technology Market Share Analysis by Geography

- The wearable technology market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Europe and APAC, respectively.

- According to global wearable technology market analysis, North America holds the largest market share. The market is propelled by the spreading awareness of fitness and health, where wearable devices play a crucial role. The declining price of wearable devices, increased adoption among the end users, and increasing competition and advancement in technology make wearable technologies economical. Further, growing demand for several application sectors, such as wearable technology for healthcare, security, and fitness, is fostering the demand for wearable technology in North America.

Wearable Technology Market Regional Insights

Wearable Technology Market Regional Insights

The regional trends and factors influencing the Wearable Technology Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Wearable Technology Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wearable Technology Market

Wearable Technology Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 70.25 billion |

| Market Size by 2031 | US$ 201.14 billion |

| Global CAGR (2023 - 2031) | 14.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Wearable Technology Market Players Density: Understanding Its Impact on Business Dynamics

The Wearable Technology Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wearable Technology Market are:

- Fitbit Inc.

- Xiaomi Inc.

- Apple Inc.

- Garmin Ltd.

- Samsung Electronics Co.

- Adidas Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wearable Technology Market top key players overview

Wearable Technology Market News and Recent Developments

The peer to peer insurance market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the wearable technology market:

- In April 2024, SKLZ, announced the launch of a new wearable tech product that measures speed, agility, and vertical jump, SKLZ Hyper Speed. The SKLZ Hyper Speed combines a sleek wearable tech band and a user-friendly mobile app to accurately measure speed, agility, and vertical jump so that athletes can create their combine in their backyard or on the practice field.

(Source: SKLZ, Press Release)

- In October 2023, Qualcomm partnered with Alphabet's Google to make wearable devices like smartwatches using chips based on RISC-V technology.

(Source: Qualcomm, Press Release)

Wearable Technology Market Report Coverage and Deliverables

The "Wearable Technology Market Size and Forecast (2021-2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Products and Applications

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

The global wearable technology market is expected to grow at a CAGR of 14.1% during 2023 - 2031.

Growing awareness of fitness and wellness, growing internet and mobile penetration, and the increasing demand for healthcare gadgets in healthcare facilities are the major factors driving the wearable technology market.

Increasing usage of Augmented Reality (AR) glasses and rising adoption of health and wellness monitoring are anticipated to play a significant role in the global wearable technology market in the coming years.

The key players holding majority shares in the global wearable technology market are Xiaomi Inc., Apple Inc., Samsung Electronics Co., Adidas Group, and Google Inc.

North America is expected to hold the highest market share in the wearable technology market.

Get Free Sample For

Get Free Sample For