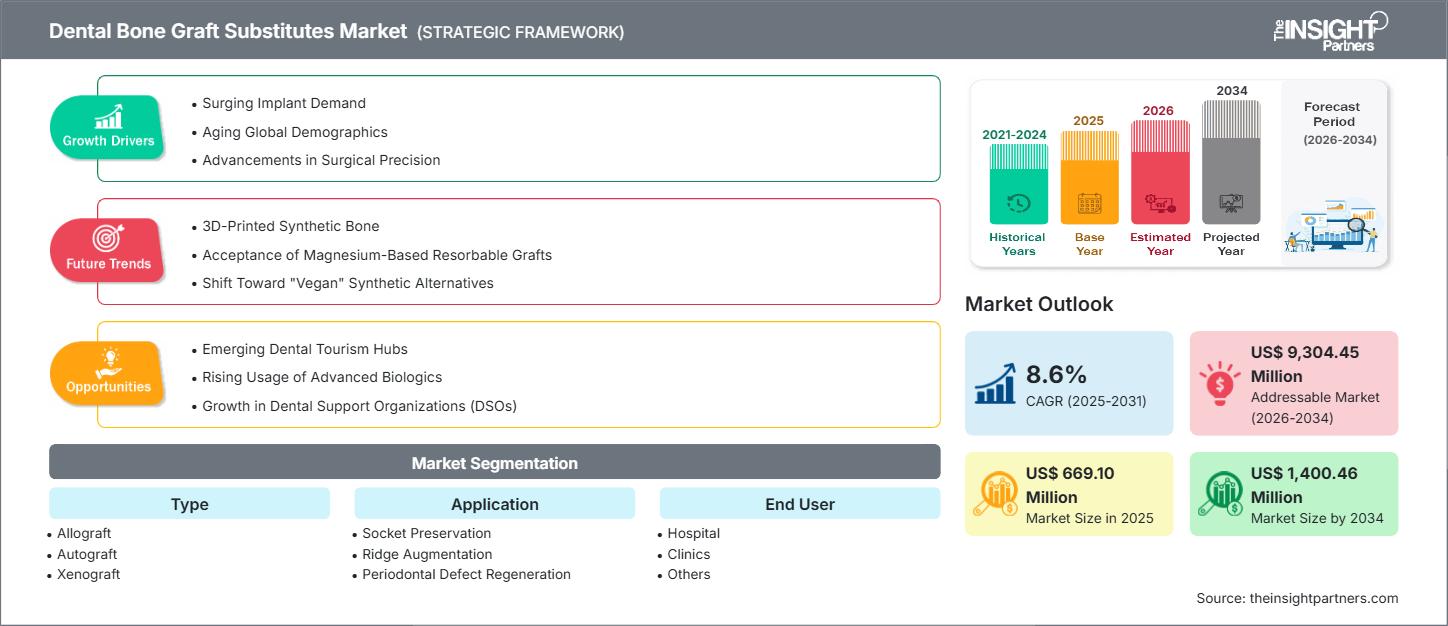

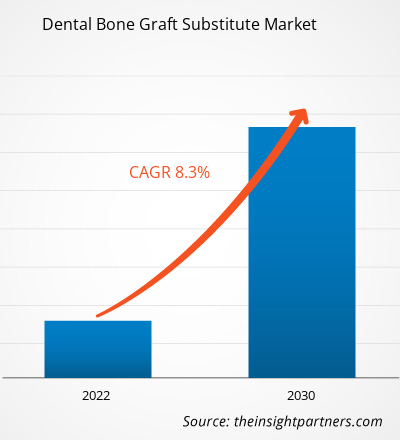

预计到2034年,牙科骨移植替代材料市场规模将从2025年的6.691亿美元增长至14.005亿美元。预计该市场在2026年至2034年期间的复合年增长率将达到8.6%。

牙科骨移植替代材料市场分析

市场增长主要受种植体需求激增、全球人口老龄化以及手术精准度提升的推动。此外,新兴的牙科旅游中心、先进生物制剂的日益普及以及牙科支持组织(DSO)的增长预计也将创造大量机遇。

牙科骨移植替代材料市场概览

牙科骨移植替代材料市场正经历着蓬勃发展。这些材料可用于牙科种植手术、牙周再生以及高度复杂的口腔手术中替代人体骨骼。市场格局正围绕着自体移植、同种异体移植、异种移植和合成移植等不同类型的材料而形成,每种材料在生物相容性、骨传导性和再生能力方面都各具优势。该领域的最新进展包括3D打印支架、联合疗法和生长因子增强型移植材料,这些进展不仅开辟了新的应用领域,而且加快了患者的康复进程,使牙科骨移植替代材料成为现代牙科再生技术的重要组成部分。

根据您的需求定制此报告

获取免费定制服务牙科骨移植替代材料市场:战略洞察

-

获取本报告的主要市场趋势。这份免费样品将包含数据分析,内容涵盖市场趋势、估算和预测等。

牙科骨移植替代材料市场驱动因素和机遇

市场驱动因素:

- 种植牙需求激增:牙科种植体作为牙齿缺失的首选方案越来越被人们接受,这是骨移植替代物需求增加的一个重要因素,因为足够的骨量对于种植牙的成功和长期稳定性至关重要。

- 全球人口老龄化:老年人口的逐渐增加,老年人更容易出现牙齿脱落和牙龈疾病,这是牙齿移植手术日益普及的原因之一,不仅在牙科重建领域,而且在全世界范围内全面恢复口腔健康方面也是如此。

- 手术精准度的提升:引导手术、数字成像和类似技术的结合,使得移植物的精确放置变得更加容易,从而带来更好的临床效果、更短的恢复期,并增加了在牙科手术中使用精密骨移植替代物的次数。

市场机遇:

- 新兴牙科旅游中心:在提供经济高效且高质量医疗保健的地区,医疗和牙科旅游的兴起催生了对更多骨移植手术的需求。

- 先进生物制剂的应用日益广泛:将生长因子、干细胞和生物活性分子整合到骨移植材料中,可显著提高再生手术的效果。因此,在牙科手术中采用先进生物制剂为牙科行业的发展提供了巨大的机遇。

- 牙科支持组织 (DSO) 的发展:DSO 的持续发展导致牙科诊所合并、流程统一化以及种植牙和植牙手术数量的增加。

牙科骨移植替代材料市场报告细分分析

牙科骨移植替代材料市场被划分为不同的细分市场,以便更清晰地了解其运作方式、增长潜力以及最新趋势。以下是行业报告中常用的标准细分方法:

按类型:

- 同种异体移植:同种异体移植是牙科和外科领域常用的方法,它利用的是捐献者的人体骨组织。同种异体移植具有良好的生物相容性和临床可靠性,因此被广泛应用于牙槽嵴增高、牙槽窝保存和牙周组织再生,并且其加工工艺和安全性也得到了提升。

- 自体移植:自体移植是指使用患者自身的骨骼,具有最高的生物活性,但也会在供体部位造成最严重的疼痛和不适,因此临床医生为了舒适和方便,会寻求其他替代方案。

- 异种移植:异种移植通常取自牛或猪,由于其结构与人类骨骼相似,已在全球范围内得到认可,并在牙槽窝保存和种植部位发育方面表现出了强大的作用。

- 合成骨移植:合成移植材料由工程生物材料制成,例如羟基磷灰石和生物活性玻璃,提供了一种易于获得、无感染性且可定制特性的解决方案。

- 其他:其他类别包括复合材料以及创新型生物或工程移植材料,这些材料利用生长因子来支持复杂的再生,从而提供更好的临床效果。

按申请方式:

- 插座保护

- 牙槽嵴增高术

- 牙周缺损再生

- 种植体骨再生

- 其他的

最终用户:

- 医院

- 诊所

- 其他最终用户

每个最终用户在操作、安全和法规方面都有不同的需求,这些需求反过来又会影响他们的产品选择、临床工作流程和程序规程。

按地理位置:

- 北美

- 欧洲

- 亚太地区

- 拉美

- 中东和非洲

牙科骨移植替代物市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2025年市场规模 | 6.691亿美元 |

| 到2034年市场规模 | 14.0046亿美元 |

| 全球复合年增长率(2025-2034 年) | 8.6% |

| 史料 | 2021-2024 |

| 预测期 | 2026-2034 |

| 涵盖部分 |

按类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

牙科骨移植替代材料市场参与者密度:了解其对业务动态的影响

牙科骨移植替代材料市场正快速增长,这主要得益于终端用户需求的不断增长,而终端用户需求的增长又源于消费者偏好的转变、技术的进步以及对产品益处的认知度提高等因素。随着需求的增长,企业不断拓展产品线、创新以满足消费者需求并把握新兴趋势,这些都进一步推动了市场增长。

按地域划分的牙科骨移植替代物市场份额分析

由于全球牙科疾病负担日益加重,亚太地区的牙科骨移植替代材料市场预计将迎来最快增长。拉丁美洲、中东和非洲等新兴市场为牙科器械供应商提供了许多尚未开发的拓展机遇。

随着经济增长和医疗保健支出增加,牙科骨移植替代材料市场在不同地区呈现不同的增长趋势,这提高了牙科手术的可及性。以下是各地区市场份额和趋势的概述:

1. 北美洲

- 市场份额:占据全球市场相当大的份额

-

关键驱动因素:

- 强大的临床应用、先进的牙科护理基础设施和高种植体需求是增长的主要驱动力,而创新、报销支持和临床医生对先进移植技术的偏好是维持市场强劲扩张的主要因素。

- 趋势:对优质骨移植替代物的偏好是由植入物普及率高和先进再生技术的应用所驱动的。

2. 欧洲

- 市场份额:由于早期采用牙科骨移植替代材料,因此占据相当大的市场份额。

-

关键驱动因素:

- 良好的牙科服务、人口老龄化和严格的监管标准是推广应用的主要因素;种植牙手术的增加和对微创骨移植解决方案的偏好是市场稳步发展的主要因素。

- 趋势:微创植发的需求不断增长,以及对高质量标准的坚持,都影响着产品的普及。

3. 亚太地区

- 市场份额:增长最快的地区,市场份额逐年上升

-

关键驱动因素:

- 牙科旅游业的快速发展、口腔保健意识的提高、中产阶级的壮大以及种植牙数量的增加,都是推动市场需求增长的因素;中国、印度和东南亚是市场接受度较高的地区。

- 趋势:牙科旅游业的快速发展和口腔医疗保健服务的普及促进了植骨替代物的使用。

4. 南美洲和中美洲

- 市场份额:市场份额稳步增长

-

关键驱动因素:

- 牙科服务的改善、种植牙需求的增加以及更多私人诊所的建立,都促进了市场的增长。

- 趋势:牙科植入数量不断增加,私人诊所不断扩张。

5. 中东和非洲

- 市场份额:市场份额较小,但增长迅速

-

关键驱动因素:

- 更好的牙科基础设施、对专科护理的更多投资以及对先进移植材料的更高认识是市场增长缓慢的主要驱动因素,尤其是在海湾合作委员会 (GCC) 国家和城市地区。

- 趋势:对现代化牙科基础设施的投资促进了先进骨移植解决方案的使用。

牙科骨移植替代材料市场参与者密度:了解其对业务动态的影响

市场密度高,竞争激烈

由于登士柏西诺德公司、盖斯特利希制药公司、ZimVie公司和士卓曼控股公司等老牌企业的存在,竞争十分激烈。区域性和利基市场企业也加剧了竞争格局。

激烈的竞争促使企业通过提供以下服务来脱颖而出:

- 高级安全功能

- 增值服务,例如分析和预测性维护、实时运营分析和安装

- 竞争性定价模式

- 强大的客户支持和便捷的集成

机遇与战略举措

- 企业加大研发投入,推动检测技术的创新。这也有助于提高检测技术的灵敏度和特异性,从而解决不同地区特定的口腔健康问题。

- 制造商可能会专注于本地生产,以降低成本并加强供应链,尤其是在印度等大批量市场。

研究过程中分析的其他公司:

- 博蒂斯生物材料有限公司

- NovaBone Products LLC

- 胶原蛋白基质公司

- RTI外科

- Graftys SA

- 丹蒂姆有限公司

- Maxigen Biotech Inc.

- REGEdent AG

- Unicare Biomedical, Inc.

- Neoss有限公司

牙科骨移植替代材料市场新闻及最新进展

- Orthofix宣布其用于脊柱和骨科手术的先进生物活性合成移植物OsteoCove获得510k许可并全面上市:2023年10月,Orthofix Medical Inc.正式推出先进生物活性合成移植物OsteoCove。该移植物有膏状和条状两种规格。

- ZimVie 宣布近期推出 RegenerOss CC 同种异体移植颗粒和 RegenerOss 骨移植塞:2023 年 4 月,ZimVie 公司在北美推出了 RegenerOss CC 同种异体移植和 RegenerOss 骨移植塞,用于各种牙科应用。

牙科骨移植替代材料市场报告涵盖范围和成果

《牙科骨移植替代材料市场规模及预测(2021-2034)》报告对以下领域进行了详细的市场分析:

- 牙科骨移植替代材料市场规模及预测,涵盖全球、区域和国家层面的所有细分市场。

- 牙科骨移植替代材料市场趋势,以及驱动因素、制约因素和关键机遇等动态因素。

- 详细的PEST和SWOT分析

- 牙科骨移植替代材料市场分析,涵盖关键趋势、全球和区域框架、主要参与者、法规和近期市场发展动态。

- 牙科骨移植替代物市场的行业格局和竞争分析,包括市场集中度、热力图分析、主要参与者和最新发展动态

- 公司详细概况

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 牙科骨移植替代物市场

获取免费样品 - 牙科骨移植替代物市场