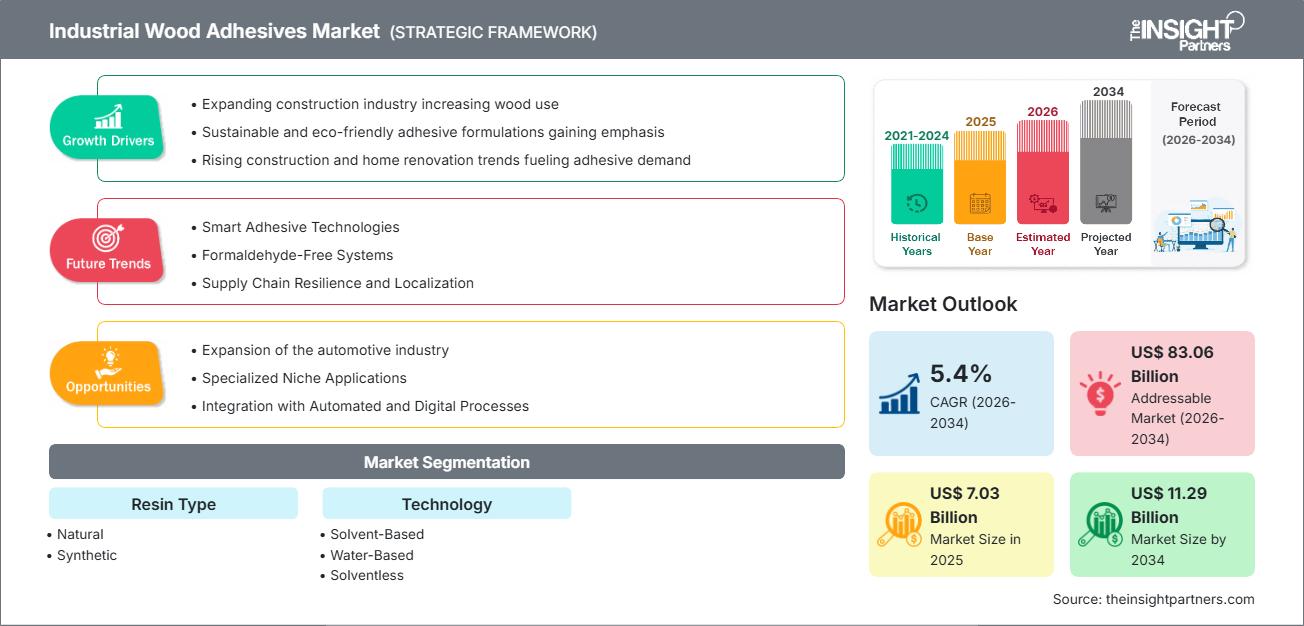

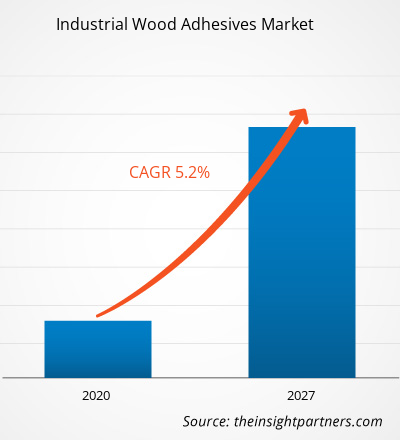

全球工业木材胶粘剂市场规模预计将从2025年的70.3亿美元增长至2034年的112.9亿美元。预计在2026年至2034年的预测期内,该市场将以5.4%的复合年增长率增长。市场的主要驱动因素包括全球建筑行业的快速扩张、对CLT和LVL等工程木制品的需求不断增长,以及对可持续、低VOC(挥发性有机化合物)粘合解决方案的日益重视。此外,有组织的家具零售业的增长、高速自动化木工机械的进步,以及模块化房屋应用中传统机械紧固件越来越多地被高性能化学胶粘剂所取代,预计也将推动市场增长。

工业木材粘合剂市场分析

工业木材胶粘剂市场分析显示,随着监管机构收紧对甲醛排放的限制,市场正朝着“绿色化学”方向进行重大转型。为了保持市场份额,制造商必须优先开发符合LEED和CARB II严格认证标准的生物基树脂和大豆衍生粘合剂。在交叉层压木材(CLT)领域,战略机遇正在涌现,该领域对结构完整性和防潮性的需求为聚氨酯和乳液型聚合物异氰酸酯(EPI)体系的供应商提供了显著的竞争优势。分析还表明,运营成功取决于优化胶粘剂的开放时间和压合周期效率,以满足现代家具工厂的高产量需求。生产商应通过提供定制化的技术支持和集成应用系统来脱颖而出,从简单的商品供应商转型为全面的粘合解决方案提供商。

工业木材粘合剂市场概览

工业木材胶粘剂正从专注于基础粘合转向提供专业、高性能的结构界面。过去,脲醛树脂胶粘剂因其成本优势,在板材生产领域占据主导地位。如今,为了满足不断提高的安全标准,工业木材胶粘剂正朝着先进的水性及无溶剂技术方向发展。工业木材胶粘剂的应用范围广泛,涵盖地板、家具和结构用材等领域,其生产商既包括大型化工集团,也包括专注于特定领域的专业胶粘剂配方商。发达经济体的城市化进程加快以及“自己动手”(DIY)趋势的兴起,推动了对耐用且易于使用的木工胶粘剂的需求。欧洲和北美仍然是技术创新和高标准合规的中心,而亚太地区已巩固其作为全球大众市场木质板材和家具出口生产中心的地位。例如,美国市场的特点是建筑业成熟,对可持续建筑材料的需求强劲。为了符合严格的环境法规,美国国内制造商正越来越多地采用生物基胶粘剂。房屋翻新工程的增加和预制房屋行业的扩张进一步刺激了高性能木工粘合剂的消费。

根据您的需求定制此报告

获取免费定制服务工业木材粘合剂市场:战略洞察

-

获取本报告的主要市场趋势。这份免费样品将包含数据分析,内容涵盖市场趋势、估算和预测等。

工业木材粘合剂市场驱动因素和机遇

市场驱动因素:

- 工程木材在可持续建筑中的应用日益广泛:全球建筑行业正越来越多地用工程木制品(如交叉层压木材 (CLT) 和胶合木)替代传统的钢材和混凝土,以减少碳排放。这一转变的主要驱动力在于,这些结构木材构件完全依赖高强度化学键合来保持稳定性,从而对工业级结构胶粘剂产生了巨大且持续的需求。

- 更严格的甲醛排放法规:为了改善室内空气质量,国际监管机构正在实施更严格的挥发性有机化合物 (VOC) 排放限制,尤其是甲醛排放限制。这种监管压力正推动市场从传统的脲醛树脂向更先进的“绿色”粘合剂(例如水性粘合剂和大豆基粘合剂)转型,迫使制造商升级其产品组合。

- 家具零售业及自动化快速扩张:大规模“组装式”家具生产的兴起,需要高速生产线来满足全球消费者的需求。这推动了快速固化热熔胶和水性胶粘剂市场的发展,这些胶粘剂能够与自动化机械保持同步,无需传统胶粘剂漫长的干燥时间,即可实现即时包装和运输。

市场机遇

- 生物基树脂的开发与商业化:利用木质素、大豆蛋白和淀粉等天然来源开发粘合剂,以满足市场对碳中和建筑材料的需求,蕴藏着巨大的战略机遇。成功实现这些可再生粘合剂规模化生产的公司,能够赢得日益增长的环保意识强的开发商和消费者的青睐,他们愿意为经过认证的可持续产品支付溢价。

- 模块化和预制房屋技术的进步:随着建筑行业向异地模块化制造转型以节省时间和人工成本,快速固化和高抗振性的粘合剂迎来了特殊的应用机遇。这些粘合剂对于确保预制木模块在运输和现场组装过程中保持结构完整性至关重要。

- 拓展至高增长新兴经济体:亚太和中东市场正经历大规模的基础设施建设和工业化进程。在这些地区建立本地生产设施或战略合作伙伴关系,能够让胶粘剂制造商进入高产量制造中心,这些中心由于新城市建设项目而对木质材料的需求激增。

工业木材粘合剂市场报告细分分析

工业木材胶粘剂市场份额按不同细分市场进行分析,以便更清晰地了解其结构、增长潜力和新兴趋势。以下是大多数行业报告中使用的标准细分方法:

按树脂类型:

- 天然:一个新兴的细分市场,专注于可持续性,利用可再生资源为具有环保意识的市场提供低毒性的粘合解决方案。

- 合成树脂:是主要的销量贡献者,涵盖了各种化学配方树脂,这些树脂以其高粘合强度、耐久性和在工业规模上的成本效益而闻名。

按技术分类:

- 水性:领先的技术领域,因其低 VOC 含量、易于清洁以及符合现代安全和环境标准而备受青睐。

- 溶剂型:用于需要快速干燥和高耐受极端环境条件的特定重型应用,尽管监管审查日益严格。

- 无溶剂型:包括热熔胶和 100% 固含量胶在内的高增长领域,可提高自动化生产流程的效率并减少对环境的影响。

- 其他:包括专为高性能木工应用而设计的辐射固化和混合系统等专业技术。

按地理位置:

- 北美

- 欧洲

- 亚太地区

- 南美洲和中美洲

- 中东和非洲

工业木材粘合剂市场区域洞察

已对影响工业木材粘合剂市场的区域趋势进行了重点地区的分析。

工业木材粘合剂市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2025年市场规模 | 70.3亿美元 |

| 到2034年市场规模 | 112.9亿美元 |

| 全球复合年增长率(2026-2034 年) | 5.4% |

| 史料 | 2021-2024 |

| 预测期 | 2026-2034 |

| 涵盖的领域 |

按树脂类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

工业木材胶粘剂市场参与者密度:了解其对业务动态的影响

工业木材胶粘剂市场正快速增长,这主要得益于终端用户需求的不断增长,而终端用户需求的增长又源于消费者偏好的转变、技术的进步以及消费者对产品优势认知的提高。随着需求的增长,企业不断拓展产品线、创新以满足消费者需求,并把握新兴趋势,这些都进一步推动了市场增长。

工业木材粘合剂市场份额地域分析

预计未来几年亚太地区将实现最快增长。南美和中美洲、中东和非洲等新兴市场也为高端胶粘剂生产商和工业木工制造商提供了许多尚未开发的扩张机会。

工业木材胶粘剂市场正经历着一场重大变革,从传统的树脂配方转向高性能、可持续的粘合系统。推动市场增长的因素包括全球工程木结构建筑的蓬勃发展、对低排放家具日益增长的需求以及自动化木工行业的扩张。以下是按地区划分的市场份额和趋势概述:

北美

- 市场份额:在全球市场占据相当大的份额,这得益于住宅建设和先进制造业的复苏。

-

关键驱动因素:

- 为满足严格的室内空气质量标准,市场对不含甲醛和大豆基粘合剂的需求强劲。

- 商业建筑项目中越来越多地采用大尺寸木材和交叉层压木材(CLT)。

- 蓬勃发展的DIY和家居装修文化推动了高性能木胶的零售消费。

- 趋势:向生物基聚氨酯系统进行战略性转变,以及 LEED 等“绿色”建筑认证在木工行业的普及。

欧洲

- 市场份额:在全球市场占据主导地位,以德国、意大利和斯堪的纳维亚半岛的高标准家具产业集群为核心。

-

关键驱动因素:

- 严格的 E0 和 REACH 法规要求使用低毒性和可持续的粘合剂。

- 高度发达的工程木材产业,专门生产结构胶合木和高端橱柜。

- 政府大力支持循环经济倡议和生物炼制原料。

- 趋势:市场参与者整合,并专注于“智能”粘合剂,以方便木制部件的拆卸和回收。

亚太

- 市场份额:规模最大、增长最快的地区,是胶合板、板材和家具出口的全球中心。

-

关键驱动因素:

- 中国、印度和东南亚的大规模基础设施建设和城市住房计划。

- 快速的工业化进程以及全球家具品牌所需的高性价比制造基地的存在。

- 政府支持向高附加值木工行业转型,以满足国际出口安全标准。

- 趋势:对自动化生产线进行大量投资,并从低成本的脲醛树脂向优质水性树脂和热熔树脂技术逐渐过渡。

南美洲和中美洲

- 市场份额:新兴市场,巴西、阿根廷和智利等国的工业木工行业正在不断增长。

-

关键驱动因素:

- 区域林业和纸浆工业向高附加值木制品领域扩展。

- 中产阶级可支配收入的增长,使得他们更偏爱现代、美观的室内装饰。

- 将中小木工企业现代化改造为商业级生产设施。

- 趋势:精品家具品牌的增长以及可持续森林管理认证的逐步实施,影响了粘合剂的选择。

中东和非洲

- 市场份额:一个具有巨大潜力的发展中市场,正在从传统细木工向正规化的工业生产转型。

-

关键驱动因素:

- 该地区极端气候条件对耐用耐热粘合剂的需求量很大。

- 海湾合作委员会国家(例如沙特阿拉伯和阿联酋)的大型“智慧城市”和豪华酒店项目。

- 通过建立本地化工和树脂制造单位,采取战略措施降低进口依赖性。

- 趋势:采用现代冷却和应用技术来管理干旱环境下的粘合剂性能,同时重点关注用于重型结构应用的高强度粘合。

市场密度高,竞争激烈

由于 HBFuller 公司、汉高股份公司、亚什兰公司、阿科玛集团、西卡股份公司、皮迪莱特工业有限公司、朱比利特工业有限公司、陶氏公司和 3M 等老牌领导者的存在,竞争日益激烈,也使得市场格局多样化且快速扩张。

这种竞争环境促使供应商通过以下方式实现差异化:

- 高端化和可持续品牌建设:将粘合剂定位为高性能、环保型建筑的必需品,强调低 VOC 排放、生物基树脂来源以及符合严格的环境认证。

- 专业产品组合:工业木材粘合剂现在已从基本树脂扩展到包括用于船舶木材的湿活化系统、用于室内封边的微发射热熔胶以及用于交叉层压木材 (CLT) 的高强度防火解决方案。

- 技术整合与研发:企业正在管理整个创新链,从专有合成树脂的开发到“智能”应用工具的创建。这确保了工业环境中的精准性,减少了材料浪费,并符合符合道德规范的清洁标签生产标准。

- 先进的循环加工技术:生物填料混合和防潮聚合物化学等新型配方技术有助于生产耐用的木制品,从而支持可持续的建筑实践,并使其更容易拆卸回收。

机遇与战略举措

- 与大型家具中心和自动化供应商合作:通过与亚太和北美市场的大型家具出口商和机器人组装厂建立战略联盟,抓住对快速固化、机器可直接使用的粘合剂的激增需求。

- 引入生物基化学和低排放标准:采用可再生碳含量认证和生命周期评估,以吸引具有环保意识的建筑商和寻求绿色建筑积分的政府主导的基础设施项目。

工业木材粘合剂市场的主要企业有:

- HBFuller公司

- 汉高股份及三合公司

- 阿什兰

- 阿科玛集团

- 西卡股份公司

- 皮迪莱特工业有限公司

- Jubilant Industries Ltd

- 陶氏公司

- 3M

免责声明:以上列出的公司不分先后顺序。

工业木材粘合剂市场新闻及最新动态

- 2025年1月,Kiilto推出了全新的工业木材粘合剂系列,为工程木材行业提供了一系列全面的技术解决方案。Kiilto Pro SW系列专为高性能应用而设计,具有卓越的强度和品质,能够经受数十年的高强度使用。

- 2024年12月,阿科玛完成了对陶氏柔性包装复合胶粘剂业务的收购。陶氏是一家全球领先的生产商,年销售额约为2.5亿美元。这项战略举措显著扩展了阿科玛的工业木材胶粘剂和特种解决方案产品组合,使集团成为高增长的柔性包装和工业复合市场的主导企业。

工业木材粘合剂市场报告涵盖范围和交付成果

《工业木材粘合剂市场规模及预测(2021-2034)》报告对市场进行了详细分析,涵盖以下领域:

- 本报告涵盖全球、区域和国家层面的工业木材粘合剂市场规模及预测,包括所有关键细分市场。

- 工业木材胶粘剂市场趋势,以及市场动态,例如驱动因素、制约因素和主要机遇。

- 详细的PEST和SWOT分析

- 工业木材粘合剂市场分析,涵盖关键市场趋势、全球和区域框架、主要参与者、法规以及近期市场发展动态。

- 工业木材粘合剂市场的行业格局和竞争分析,包括市场集中度、热力图分析、主要参与者和最新发展。

- 公司详细概况

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 工业木材粘合剂市场

获取免费样品 - 工业木材粘合剂市场