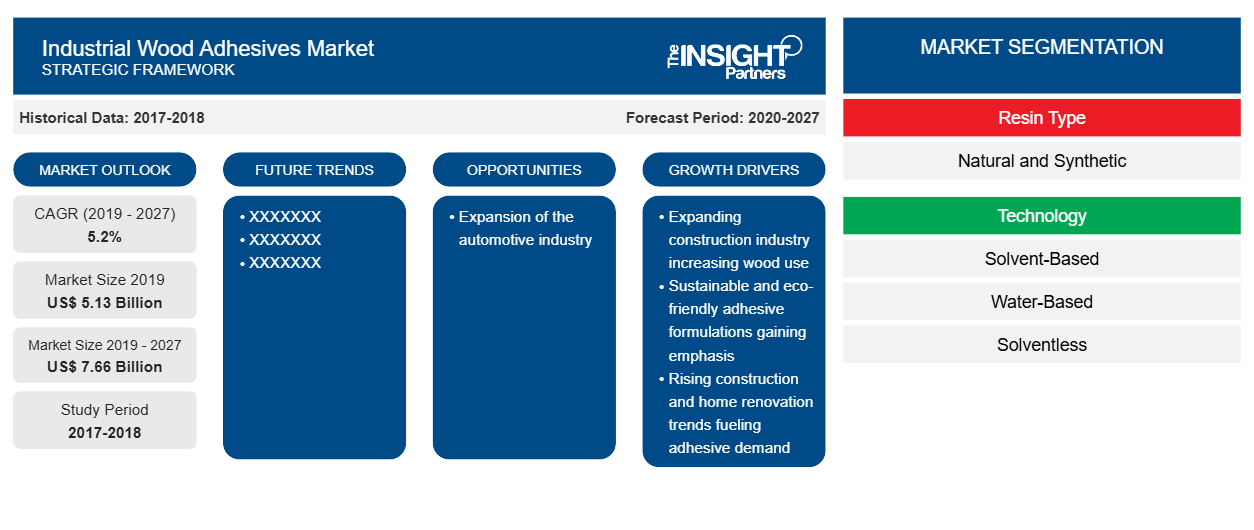

Industrial Wood Adhesives Market Analysis and Opportunities by 2027

Industrial Wood Adhesives Market Forecast to 2027 - Analysis by Resin Type (Natural and Synthetic) and Technology (Solvent-Based, Water-Based, Solventless, and Others)

Historic Data: 2017-2018 | Base Year: 2019 | Forecast Period: 2020-2027- Report Date : Apr 2021

- Report Code : TIPRE00022059

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 147

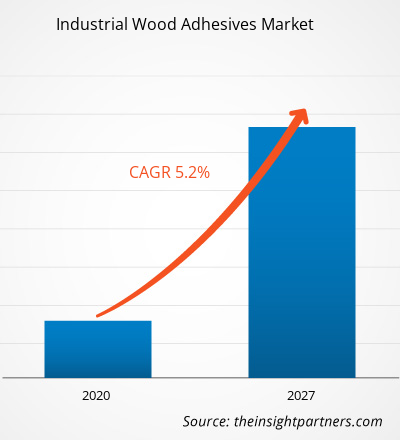

The industrial wood adhesives market was valued at US$ 5,133.8 million in 2019 and is projected to reach US$ 7,656.2 million by 2027; it is expected to grow at a CAGR of 5.2% from 2020 to 2027

Wood adhesive is used to manufacture building materials such as plywood and other laminated veneer products, oriented strandboard, particleboard, laminated beams and timbers, fiberboard, edge- and end jointed products, architectural doors, windows and frames, furniture, floor coverings, ceiling, and wall tiles. The rapidly expanding construction industry is increasing the application of wood, thereby creating scope for industrial wood adhesives.

In 2019, Asia Pacific contributed to the largest share in the global industrial wood adhesives market. Rising demand for wood-based products and increasing consumption of wooden furniture in Asia-Pacific countries are contributing to the growth of the market. Asia Pacific has a substantial share of wood adhesives market in terms of value and volume. Moreover, the region comprises the largest number of wood adhesives producers. A few of the leading companies producing wood adhesives are Henkel AG & Co, Pidilite Industries Ltd, Jubilant Industries Ltd, and Sika AG. Pidilite Industries Ltd is consumer centric and always focuses on quality and innovation. Sika AG is dedicated to maintain the highest quality standards with its products and services. All these companies offer a range of ready-to-use wood adhesives, which are suitable for many wood joinery purposes. They provide products that are very popular and effective in the woodworking industry.

The COVID-19 outbreak pandemic has adversely affected various industries across the world due to lockdowns, travel bans, and business shutdowns. The manufacturing industry is one of the major industries that are suffering serious disruptions such as supply chain breaks, technology events cancellations, and office shutdowns. The lockdown of various plants and factories in leading regions such as North America and South America, Europe, and Asia Pacific is restricting the supply chains and negatively impacting the manufacturing activities, delivery schedules, and various goods sales. In addition, travel bans imposed by countries in North America hindered the business collaborations and partnerships opportunities. All these factors are affecting the construction and manufacturing industries in a negative manner, which is restraining the growth of the industrial wood adhesives market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONIndustrial Wood Adhesives Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Construction and Infrastructural Activities

The construction industry across the world is witnessing a boost in the number of new residential and commercial building constructions. There is a substantial growth in the construction activities across North America. As per the Associated General Contractors of America, Inc., the construction spending of public and private sectors in the US is registered US$ 1.329 trillion during 2018. The rapid development of metropolitan cities is augmenting the demand for commercial construction projects. Stores, offices, hotels, resorts, schools, gymnasiums, libraries, museums, hospitals, and clinics are considered as commercial buildings. The construction and design of commercial building directly impact the ambience of that place and productivity of workers. It is considered that attractive and pleasant working places help increase the productivity of the employees. Hence, office spaces are highly using wooden materials to impart an aesthetic appearance. Moreover, the expansion of the tourism sector across the globe is contributing to commercial construction activities, especially in Asia-Pacific. Domestic and international travelers spend most of the amount on food services and lodging. Therefore, the hotels and resorts construction is witnessing tremendous growth across the world. To gain customer attraction and provide aesthetic beauty, hotels are constructed with wooden floorings, windows, doors, and furniture. Also, tourists are highly attracted to hotels and resorts constructed entirely with wood. Besides aesthetic beauty, wood has various qualities such as environmental friendliness and safety for human health. Wood has low thermal conductivity; hence even in a cold climate, it will always be warm inside a wooden building. Thus, the rising construction activities, and increasing utilization of wooden products in the buildings are propelling the growth of the global industrial wood adhesives market.

Resin Type Insights

In terms of resin type, the global industrial wood adhesives market is bifurcated into natural and synthetic. Synthetic industrial wood adhesives consist of prepolymers or polymers that are synthetized from the petrochemically derived raw materials. These adhesives must be applied in the liquid form to get disperse over the wet surface of the wood. However, the prepolymers can be applied directly if they are available in the liquid form or they can be applied as water solutions. The synthetic polymers when applied as adhesives, are melted, dissolved, or emulsified in a solvent prior to the technology. After being applied, the polymer-based industrial wood adhesives are set by solidification of the melted polymer with the cooling or removal of the solvent through evaporation or adsorption. The natural adhesives are being replaced by synthetic thermosetting resins for the industrial wood panels such as urea formaldehyde (UF) resins, phenol-formaldehyde (PF) resins, and melamine-formaldehyde (MF) resins with better strength and water resistance. High quality and durable panels can be made using such adhesives. Thermoplastic resins are the another sets of synthetic polymers that are used as adhesives. The major industrial wood adhesive in this category is the polyvinyl acetate that is employed for bonding wood panels for the exterior applications. It is used to produce softwood plywood, oriented waferboard, and strandboard. Another synthetic industrial wood resin is the resole resin. When resole resin is used as wood adhesive, it is generally present in aqueous solution that is cured easily with pressure and heat. Even though the synthetic industrial wood adhesives allow economical and efficient utilization of the diverse and ever-changing wood resources, the development of the synthetic resins is being restricted by the non-renewability and the toxicity of the petroleum-based products.

Technology Insights

Based on technology, the global industrial wood adhesives market is segmented into solvent-based, water-based, solventless, and others. The solvent-based segment led the market with the largest share in 2019. The solvent-based adhesives are produced by blending the adhesive material with a suitable solvent for the creation of adhesive polymer solution. Industrial woods have high amount of resistance that makes it easier to stick them. A solvent-based adhesive is highly suitable to be used for wood due to its strong adhesive qualities. The industrial wood adhesives, produced by the employment of this technology, contain an adhesive inside a spreadable or more malleable substance, which makes it easier to apply. The solvent-based adhesive covers places where rigid glues would not be able to cover and be effective. The polymer solution used in this technology for the making of adhesives is able to dry rapidly as the solvent evaporates on the addition of solvent-based adhesives. After the evaporation of the solvent, the adhesive turns stronger and reaches its maximum effectiveness. However, the solvents are generally of petrochemical origin, and thus have a high price volatility owing to the regular fluctuations in the prices of crude oil.

A few key players operating in the global industrial wood adhesives market are H.B.Fuller Company; Henkel AG & Company; KGAA; Ashland; Arkema Group; Sika AG; Pidilite Industries Ltd; Jubilant Industries Ltd; Dow, Inc.; 3M; and Akzo Nobel N.V. Major market players adopt strategies such as mergers and acquisitions, and product launches to increase their geographical presence and consumer base globally.

Report Spotlights

- Progressive industry trends in the global industrial wood adhesives market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the market from 2017 to 2028

- Estimation of the demand for industrial wood adhesives across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and the demand for industrial wood adhesives

- Market trends and outlook coupled with factors driving and restraining the growth of the industrial wood adhesives market

- Decision-making process by understanding strategies that underpin commercial interest with regard to global industrial wood adhesives market growth

- industrial wood adhesives market size at various nodes of market

- Detailed overview and segmentation of the global industrial wood adhesives market as well as its dynamics in the industry

- Industrial wood adhesives market size in various regions with promising growth opportunities

The regional trends and factors influencing the Industrial Wood Adhesives Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Industrial Wood Adhesives Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Industrial Wood Adhesives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 5.13 Billion |

| Market Size by 2027 | US$ 7.66 Billion |

| Global CAGR (2019 - 2027) | 5.2% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Resin Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Industrial Wood Adhesives Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Wood Adhesives Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Industrial Wood Adhesives Market top key players overview

Industrial Wood Adhesives Market, by Resin Type

- Natural

- Synthetic

Industrial Wood Adhesives Market, by Technology

- Solvent-Based

- Water-Based

- Solventless

- Others

Company Profiles

- H.B.Fuller Company

- Henkel AG & Company KGAA

- Ashland

- Arkema Group

- Sika AG

- Pidilite Industries Ltd

- Jubilant Industries Ltd

- Dow, Inc.

- 3M

- Akzo Nobel N.V

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For