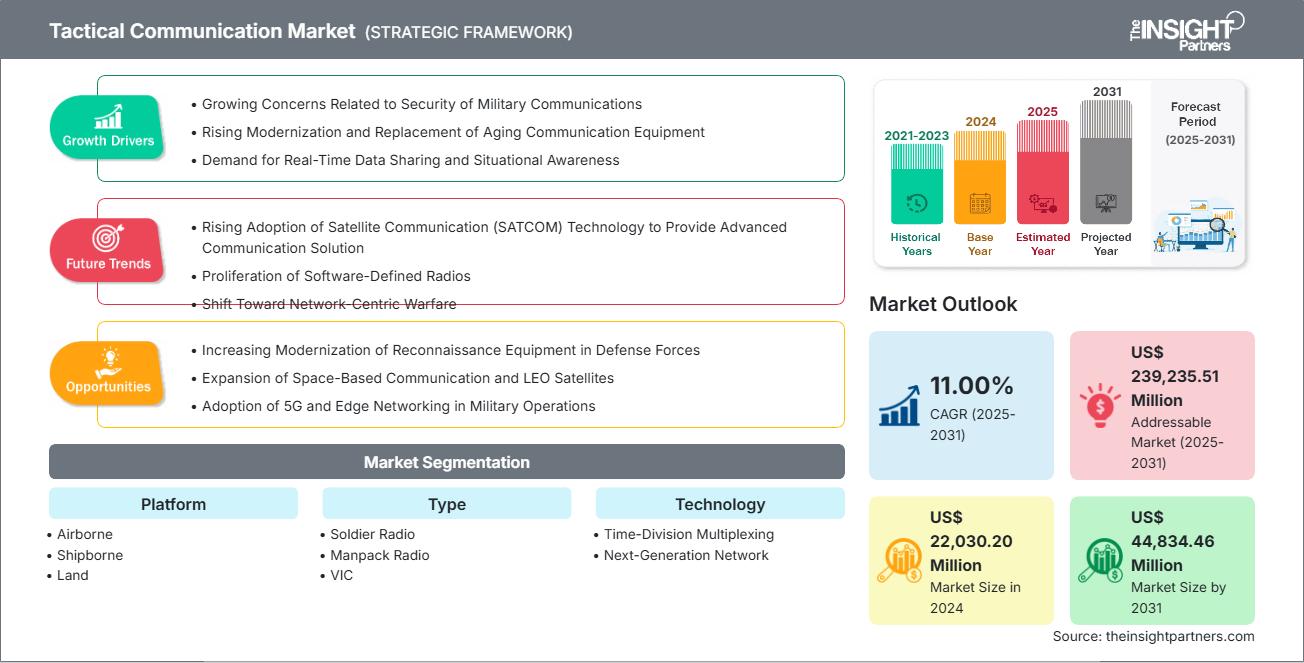

战术通信市场规模预计将从 2024 年的 220.302 亿美元增至 2031 年的 448.3446 亿美元。预计 2025-2031 年期间该市场的复合年增长率为 11.00%。

战术通信市场分析

国防战术通信涉及在战场等具有挑战性的环境中,在军事单位和指挥中心之间传输关键的实时信息。它对于态势感知、指挥控制以及任务成功至关重要。受地缘政治紧张局势的推动,全球国防现代化和支出不断增加,导致战术通信市场正在显著增长。人工智能增强型通信工具、5G 网络和无人系统等新兴技术的日益融合,正在扩展战术通信能力。此外,开发和部署人工智能驱动的认知无线电以实现更高效的频谱管理和通信适应性,以及增强型宽带和 5G-NTN(非地面网络),从而支持高带宽情报、监视和侦察 (ISR) 应用,这些都是市场中的一些机遇。

战术通信市场概览:

战术通信是一种军事通信设备,用于在战场上(尤其是在战斗期间)将信息(包括命令和军事情报)从一个指挥部、人员或地点传递到另一个指挥部、人员或地点。信息可以通过多种形式传达,例如口头、书面、视频或音频。战术通信系统 (TCS) 对部队至关重要,因为它们能够克服各种挑战,提供集成、安全、高度可靠且可用的通信服务。这些挑战包括恶劣的环境条件、有限的频谱、时间关键和非线性通信要求、设备故障、网状网络部分损坏以及对手或事件的干扰。战术通信用于军事作战行动、陆基军事行动以及机载和海军通信。战术通信系统对于在战斗期间安全可靠地交换实时军事情报和命令至关重要。

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

战术通信市场:战略洞察

-

获取此报告的顶级关键市场趋势。此免费样品将包括数据分析,从市场趋势到估计和预测。

战术通信市场驱动因素和机遇

市场驱动因素:

日益升级的现代化和老化通信设备的更换

陆军未来司令部专注于网络现代化。这些新功能旨在提升陆军在高端作战中与实力相近的对手竞争的能力和韧性。陆军正在推行一系列为期两年的能力建设,以实现其网络目标。据陆军介绍,每套能力建设都包含多项设计目标,包括统一网络、共享作战环境、联合互操作性/联盟可访问性以及指挥所机动性/生存能力。国防通信涵盖武装部队为有序作战、军事监视、指挥和控制所需的信息和数据传输。此外,通信依赖于由物理组件和软件组成的复杂而庞大的网络,以便跨越地理边界向个人传输信息。为了确保数据传输和网络基础设施的安全,不断发展的通信技术(例如高频和超高频通信卫星通信 (SATCOM))正在取代传统的战术通信系统。

美国陆军使用“作战人员信息网络-战术”项目(WIN-T)在战场上提供安全的语音和数据通信,无需固定基础设施。此外,美国军方正在构建联合全域指挥与控制系统(JADC2),这是一个完整、统一且可互操作的无线网络系统。它将把所有军事领域的传感器连接到一个单一的网络中,包括陆军、空军、海军、太空部队和海军陆战队。现代化的兴起正鼓励战术通信市场参与者通过替换传统通信设备来扩大其新通信设备的产量。

市场机会:

加强国防军侦察装备现代化

提高系统可靠性对于一个国家采购机载通信设备至关重要。先进的硬件组件有助于收集图像并将其分发到多个国防平台,例如作战车辆和指挥中心。商用和军用机载监视系统已经发展并持续改进。此外,卫星受限且竞争激烈的战场环境依赖于先进、安全的超视距 (BLoS) 通信。这些监视雷达被部署在关键位置以提高探测率。低误报率的现代机载监视系统鼓励存在边境冲突、安全、安保等问题的国家为军用车辆、应急车辆、指挥所以及任何其他需要高质量机组内和网络间音频通信的情况进行设计,这正在扩大战术通信市场的增长。在军事领域,快速的技术进步正在孕育颠覆性技术。例如,2024 年,BAE 系统公司与美国海军签订了一份价值 8500 万美元的生产合同,以供应额外的网络战术通用数据链 (NTCDL) 系统。它使操作员能够从多个来源发送和接收实时情报、监视和侦察数据,并通过单独或独立的网络交换命令和控制信息。这些系统有利于在多个平台(包括空中、水面、水下和便携式设备)上实时传输语音、数据、图像和全动态视频。根据该合同,美国海军航空母舰上的安装工作已经开始,并计划整合到即将服役的星座级护卫舰中。该市场的一些主要参与者是 BAE 系统公司(英国)、Leonardo SpA(意大利)和洛克希德马丁(美国)。这些参与者正在为无人机(UAV)平台提供战术通信系统。因此,军用无人机的进步,加上无人机通信设备供应商的进步,正在导致战术通信市场出现显著的增长趋势,为市场参与者提供了机会。

战术通信市场报告细分分析

战术通信市场细分有助于详细了解其运营情况、增长机会和新兴趋势。以下是大多数行业报告中使用的标准细分方法:

按平台:

-

空降

机载平台用于收集极其详细的图像,并方便在任何时间在地球表面几乎任何区域收集数据。机载战术平台包括战斗机、运输机、直升机以及遥控飞行器 (RPV) 或无人机 (UAV)。有效的机载通信是 21 世纪作战中最关键的能力之一。 -

舰载

舰载战术通信包括舰对舰通信和舰对岸通信,利用舰载设备、岸站、卫星等实现海上通信。 -

土地

与从飞机或卫星传感器收集的数据(即用于地面观测)相比,地面平台用于记录和传达有关表面的详细信息。 -

水下

水下通信涉及在水面以下发送和接收数据,通常是在具有挑战性的条件下。

按类型:

-

士兵电台

单兵无线电是国防部队为在战场和其他区域与陆军人员进行高效通信而采用的个人战术设备。SS(士兵系统)领域的单兵无线电支持作战通信 (CC) 模式、电子战 (EW) 模式以及无特征低截获概率/低探测概率 (LPI/LPD) 模式。

-

背负式收音机

背负式无线电是一种双通道无线电,能够同时传输数据和语音通信。这些无线电的工作频谱为2至512兆赫,输出功率为20瓦;或512兆赫至2.5千兆赫,输出功率为10瓦。 -

车载对讲无线电(VIC)

车载对讲无线电(VIC)是一套可靠且现代化的作战车辆系统。该系统为乘员提供对讲服务。 -

高容量数据无线电(HCDR)

作为鲍曼通信系统的一部分,高容量数据无线电 (HCDR) 是英国政府在近期数字无线电 (NTDR) 基础上开发的。HCDR 是一种安全的宽带超高频 (UHF) 无线电系统,工作频率在 225 至 450 MHz 之间,可提供基于 IP 的自主管理互联网骨干网功能,无需依赖移动或固定通信基础设施。 -

其他的

战术通信市场的另一个细分领域包括视频通信设备和坚固耐用的通信设备。随着武装部队人员数量的增长,视频会议正成为国防部不可或缺的工具。

按技术分类:

- 时分复用 (TDM)

- 下一代网络(NGN)

按应用:

- 情报、监视与侦察

- 战斗

- 指挥与控制

按地域划分:

- 北美

- 欧洲

- 亚太地区

- 中东和非洲

- 南美洲

亚太地区的战术通信市场预计将实现最快的增长。这一增长主要受现代化、国防开支增加、地缘政治紧张局势以及技术进步的推动。

战术通信市场区域洞察

Insight Partners 的分析师已详尽阐述了预测期内影响战术通信市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的战术通信市场细分和地理分布。

战术通信市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2024年的市场规模 | 220.302亿美元 |

| 2031年的市场规模 | 448.3446亿美元 |

| 全球复合年增长率(2025-2031) | 11.00% |

| 史料 | 2021-2023 |

| 预测期 | 2025-2031 |

| 涵盖的领域 |

按平台

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

战术通信市场参与者密度:了解其对业务动态的影响

战术通信市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的不断变化、技术进步以及对产品优势的认知度不断提高。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取战术通信市场顶级关键参与者概览

战术通信市场份额(按地区)分析

预计未来几年亚太地区将增长最快。南美、中东和非洲等新兴市场也为战术通信提供商提供了许多尚未开发的扩张机会。

由于国防开支高、国防现代化和技术创新,各地区战术通信市场的增长情况有所不同。以下是各地区市场份额和趋势的摘要:

1. 北美

-

市场份额:

由于国防预算雄厚、重视现代化以及通信技术创新,在战术通信市场占据主导地位。 -

关键驱动因素:

- 高国防开支

- 现代化与网络中心战

- 对安全和实时通信的需求

- 技术创新

- 公私伙伴关系与合作

-

趋势:

- 越来越多地采用软件定义无线电和卫星集成来扩展战场连接。

- 5G 和私有 LTE 网络的出现,实现了更快、更可靠的通信。

2.欧洲

-

市场份额:

由于战略防御现代化、技术进步等,规模庞大且增长迅速。 -

关键驱动因素:

- 地缘政治紧张局势加剧,需要增强国防能力。

- 强调北约部队之间的互操作性。

- 正在进行的国防现代化计划。

- 各种军事行动对安全通信系统的需求。

-

趋势:

- 指挥和控制系统在协调多国军事行动中起主导作用。

- 欧洲武装部队采用人工智能集成通信系统。

- 推动欧洲战术通信行业的可持续发展、法规遵从性和数字化转型。

-

3. 亚太地区

-

市场份额:

受现代化、国防开支增加、地缘政治紧张和技术进步推动,该地区成为增长最快的地区 -

关键驱动因素:

- 国防预算和现代化不断增加

- 地缘政治紧张局势

- 数字化和先进技术

- 需要安全、实时的通信

-

趋势:

从模拟通信网络过渡到数字通信网络,并提高系统的安全性和加密性。

4.中东和非洲

-

市场份额:

发展中市场,特定领域的认知度不断提高且有选择性采用 -

关键驱动因素:

- 国防现代化程度的提高和对网络中心战的日益关注使得联网士兵和军事平台之间能够实现实时信息共享。

- 集成软件定义无线电、便携式卫星通信系统和安全频率等先进通信技术,以改善战场连通性

- 对卫星通信(SATCOM)技术的需求不断增长

- 反叛乱行动需要弹性、安全和移动的通信系统

-

趋势:

- 开发便携式战术卫星通信系统,以增强战斗态势感知。

- 向下一代网络技术和数字信号处理过渡,以提高通信质量并减少沟通错误。

- 基于 IP 的无线电网络、低延迟网状通信和人工智能驱动的认知无线电的重要性日益增加。

5.南美洲

-

市场份额:

新兴市场受益于国防现代化和加强区域合作等。 -

关键驱动因素:

- 国防预算和现代化计划的扩大

- 安全和边境管制重点

- 在充满挑战的环境中需要可靠的通信

- 区域合作与联合军事演习

-

趋势:

- 多频通信系统因其灵活性和处理各种任务需求的能力而得到部署。

- 更加重视互操作性标准,以支持联合任务和区域安全联盟。

- 供应商正在积极展示能力并参与试点计划,以展示其在边境安全、禁毒和灾难响应方面的实际好处。

战术通信市场参与者密度:了解其对业务动态的影响

市场密度高,竞争激烈

由于英国航宇系统公司、通用动力公司、铱星通信公司、诺斯罗普·格鲁曼公司、RTX 公司、泰雷兹公司、Ultra Electronics Holdings Ltd、ViaSat 公司、空中客车公司和 L3 Harris Technologies 公司等老牌企业的存在,竞争十分激烈。

这种激烈的竞争促使公司通过提供以下产品脱颖而出:

- 新产品发布

- 人工智能与网络安全的融合

机遇与战略举措

- 注重本土发展和区域合作

- 战略合作和伙伴关系以扩大其产品组合、地理范围和技术能力。

在战术通信市场运营的主要公司有:

- BAE系统公司

- 通用动力公司

- 铱星通信公司

- 诺斯罗普·格鲁曼

- RTX公司

- 泰雷兹

- 超电子控股有限公司

- ViaSat公司

- 空客

- L3 哈里斯技术公司

免责声明:以上列出的公司没有按照任何特定顺序排列。

研究过程中分析的其他公司:

- Savox Communications(芬兰)

- 大卫·克拉克公司(美国)

- CEOTRONICS AG(德国)

- INVISIO(丹麦)

- Bharat Electronics Limited (BEL)(印度)

- Rolta公司(印度)

- Terma集团(丹麦)

- 亨索尔特股份公司(德国)

战术通信市场新闻和最新发展

- 2025年8月,通用动力英国任务系统公司与供应商GRC公司合作,将八套Scytale卫星通信系统整合到英国陆军的核心Bowman系统中。该系统采用多平台、多承载卫星通信,并将Scytale卫星通信技术集成为“机会部署承载器”(DBoO),将总部与分散作战的用户连接起来,从而在战术边缘实现便捷、安全的通信。

- 2024年2月,全球领先的语音和数据卫星通信提供商铱星通信公司(Iridium Communications Inc.)宣布,韩国国防部(MOD)已采用铱星通信网络,用于其军事行动的战略部署。韩国陆军将利用全套铱星产品和服务来增强作战能力,包括为士兵提供实时位置跟踪功能。

战术通信市场报告覆盖范围和交付成果

《战术通信市场规模和预测(2021-2031)》报告对以下领域进行了详细的市场分析:

- 战术通信市场规模以及全球、区域和国家层面涵盖的所有关键细分市场的预测

- 战术通信市场趋势以及市场动态,例如驱动因素、限制因素和关键机遇

- 详细的 PEST 和 SWOT 分析

- 战术通信市场分析涵盖主要市场趋势、全球和区域框架、主要参与者、法规和最新市场发展

- 行业格局和竞争分析,涵盖市场集中度、热图分析、知名参与者以及战术通信市场的最新发展

- 详细的公司简介

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 战术通信市场

获取免费样品 - 战术通信市场