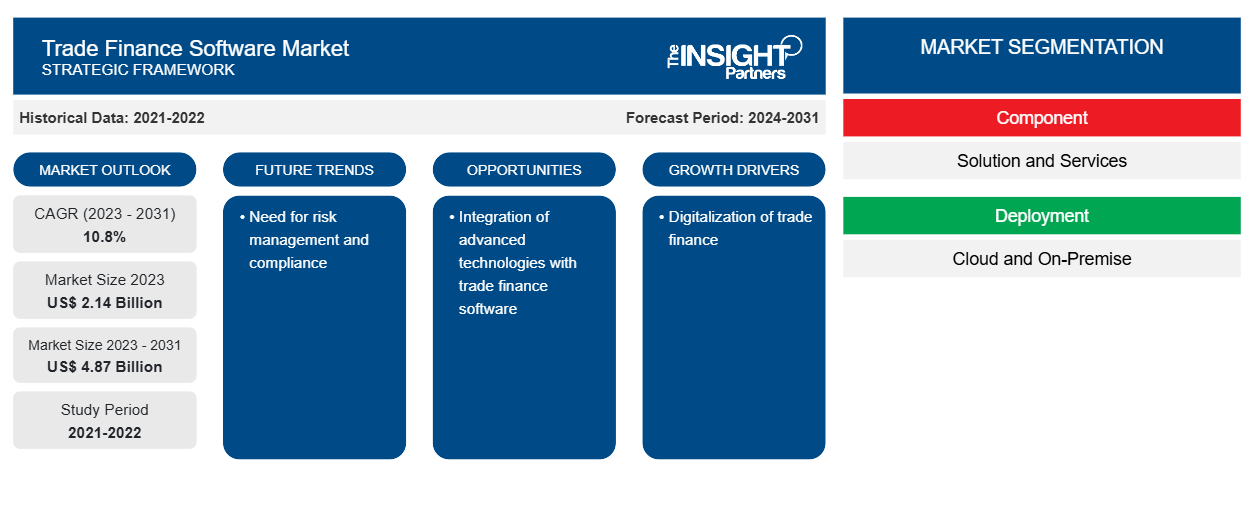

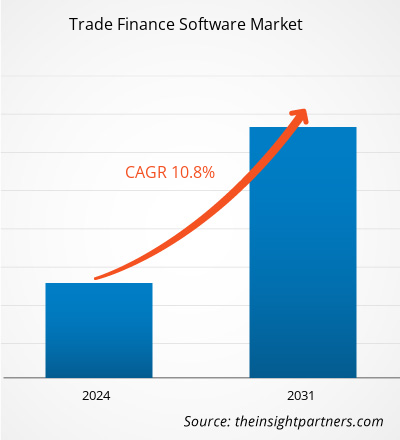

贸易融资软件市场规模预计将从 2023 年的 21.4 亿美元增至 2031 年的 48.7 亿美元。预计 2023-2031 年该市场的复合年增长率将达到 10.8%。数字化程度的提高和基于云的技术的采用可能仍是贸易融资软件市场的主要趋势。

贸易融资软件市场分析

贸易融资流程日益数字化是推动贸易融资软件市场增长的主要因素。随着效率的提高和成本的降低,电子文档和基于云的贸易融资解决方案正日益取代传统的纸质方法,从而促进市场增长。

贸易融资软件市场概览

对透明度和遵守国际贸易法规的需求推动了具有实时监控和报告功能的软件解决方案的采用。贸易融资软件市场专注于提供满足不断变化的国际贸易需求的尖端解决方案,随着全球贸易格局不断变化以及企业寻求更安全、更高效的贸易融资业务,贸易融资软件市场有望进一步扩张。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

贸易融资软件市场:战略洞察

-

获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

贸易融资软件市场驱动因素和机遇

贸易融资数字化利好市场

随着各行各业的公司意识到他们需要尖端解决方案来加快和改善其国际贸易业务,市场正在大幅扩张。这个市场包括用于改进和自动化贸易融资程序的软件程序,例如供应链融资、合规管理、发票保理和信贷管理。由于贸易交易的复杂性和数量不断增加,组织已转向贸易融资软件来减少手动和耗时的任务、提高准确性并最大限度地降低与国际贸易相关的风险,这进一步导致市场参与者采用贸易融资软件。例如,2023 年 11 月,全球金融软件应用程序和市场提供商 Finastra 宣布国际企业银行 CQUR Bank 已与 Finastra 合作,以实现其技术战略。通过实施 Finastra 市场领先的解决方案、贸易创新和企业渠道,CQUR Bank 为其企业客户提供了一个新的在线银行门户,以实现无缝的用户体验,引入了新的数字工作流程,并提供主机到主机的集成解决方案。

风险管理与合规需求

对改进风险管理和合规性的需求日益增长,这是推动贸易融资软件市场增长的另一个因素。贸易融资软件提供复杂的工具,例如欺诈检测、反洗钱(AML) 检查以及遵守贸易法律和制裁,以跟踪和降低与国际贸易相关的风险。随着公司和金融机构试图在保持法律和监管合规性的同时应对国际贸易挑战,对这些软件解决方案的需求不断增长。

贸易融资软件市场报告细分分析

有助于得出贸易融资软件市场分析的关键部分是组件、部署、企业规模和最终用途。

- 根据组件,市场分为解决方案和服务。解决方案部分在 2023 年占据了更大的市场份额。

- 根据部署,市场分为云和本地。云部分在 2023 年占据了更大的市场份额。

- 根据企业规模,市场分为大型企业和中小型企业。预计中小型企业的复合年增长率最高。

- 根据最终用途,市场分为银行、贸易商和其他。银行部门在 2023 年占据了更大的市场份额。

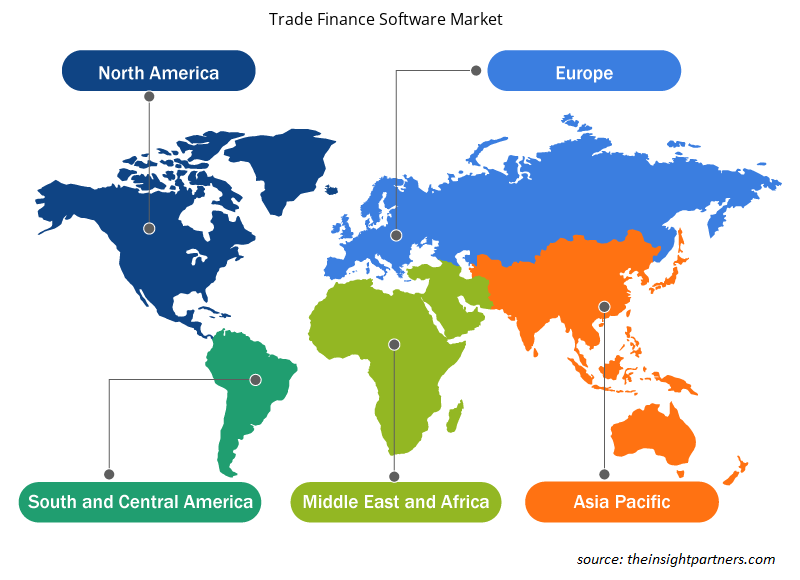

贸易融资软件市场份额(按地区)分析

贸易融资软件市场报告的地理范围主要分为五个地区:北美、亚太地区、欧洲、中东和非洲、南美/南美和中美洲。

就收入而言,北美在 2023 年占据了最大的贸易融资软件市场份额。北美是技术解决方案的早期采用者,这导致其市场份额飙升。中小企业采用基于云的技术推动了市场增长。银行数字化的飙升进一步要求贸易融资软件,从而推动了北美贸易融资市场份额的增长。

贸易融资软件市场区域洞察

Insight Partners 的分析师已详细解释了预测期内影响贸易融资软件市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的贸易融资软件市场细分和地理位置。

- 获取贸易融资软件市场的区域特定数据

贸易融资软件市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2023 年的市场规模 | 21.4亿美元 |

| 2031 年市场规模 | 48.7 亿美元 |

| 全球复合年增长率(2023 - 2031) | 10.8% |

| 史料 | 2021-2022 |

| 预测期 | 2024-2031 |

| 涵盖的领域 |

按组件

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

贸易融资软件市场参与者密度:了解其对业务动态的影响

贸易融资软件市场正在快速增长,这得益于最终用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在贸易融资软件市场运营的主要公司有:

- CGI公司

- 康马奇公司

- IBSFINtech

- ICS 金融系统有限公司

- MITech - 让直观的科技 SA

- 新根软件技术有限公司

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 获取贸易融资软件市场顶级关键参与者概览

贸易融资软件市场新闻和最新发展

贸易融资软件市场通过收集一手和二手研究后的定性和定量数据进行评估,其中包括重要的公司出版物、协会数据和数据库。以下是市场发展情况的列表:

- 2022 年 9 月,全球领先的数字转型产品提供商 Newgen Software 在孟买客户会议上推出了全球首个低代码贸易融资平台。贸易融资是一个复杂的过程,因为它涉及大量文书工作、多个利益相关者和合规要求。Newgen 全面、可配置且面向未来的贸易融资平台可帮助银行实现无纸化并简化其端到端贸易流程,同时确保遵守国内和国际法规。(来源:CXOtoday,新闻稿,2022 年)

- 2024 年 2 月,全球金融软件应用程序和市场提供商 Finastra 和全球数字转型咨询和集成商 Tesselate 宣布推出端到端预打包服务,以实现更快、更轻松的贸易融资数字化。由 Finastra Trade Innovation 和 Corporate Channels 提供支持的 Tegula Trade Finance as a Service 使美国银行能够实现手动流程自动化并适应新需求,从而缩短上市时间和价值。通过 Finastra 的 FusionFabric.cloud,银行还可以无缝集成使用人工智能、区块链和自动化工具等最新技术的金融科技应用程序。(来源:Finastra,新闻稿,2024 年)

贸易融资软件市场报告范围和交付成果

“贸易融资软件市场规模和预测(2021-2031)”报告对市场进行了详细分析,涵盖以下领域:

- 范围内所有主要细分市场的全球、区域和国家层面的市场规模和预测

- 市场动态,如驱动因素、限制因素和关键机遇

- 未来主要趋势

- 详细的 PEST/波特五力分析和 SWOT 分析

- 全球和区域市场分析涵盖关键市场趋势、主要参与者、法规和最新市场发展

- 行业格局和竞争分析,涵盖市场集中度、热点图分析、知名参与者和最新发展

- 详细的公司简介

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 贸易融资软件市场

获取免费样品 - 贸易融资软件市场