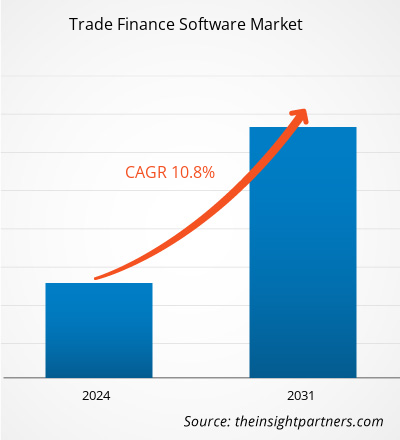

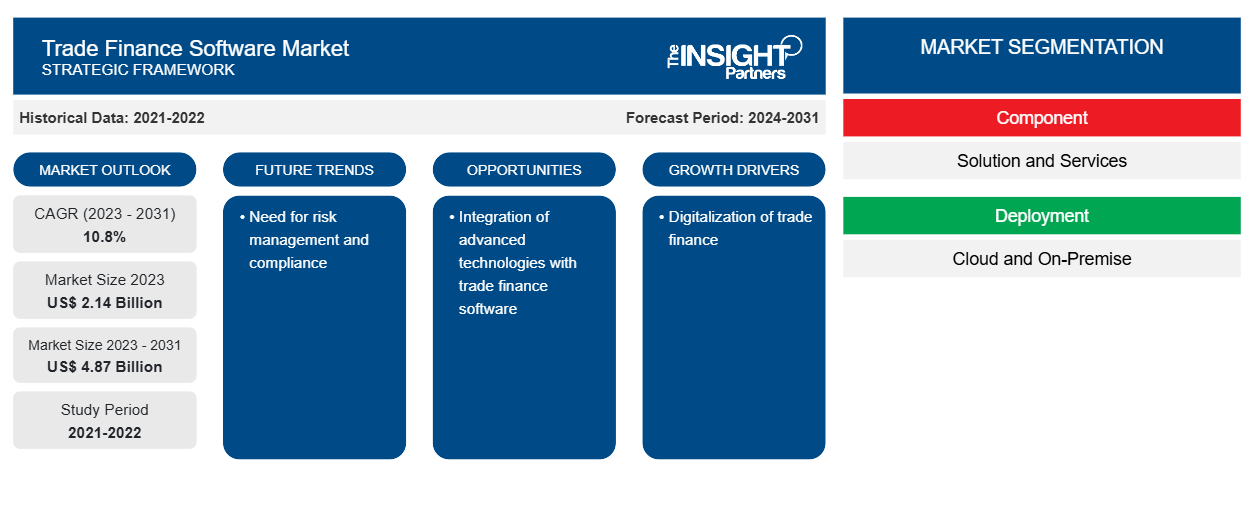

Le marché des logiciels de financement du commerce devrait atteindre 4,87 milliards de dollars d'ici 2031, contre 2,14 milliards de dollars en 2023. Le marché devrait enregistrer un TCAC de 10,8 % en 2023-2031. La numérisation croissante et l'adoption de technologies basées sur le cloud devraient rester les principales tendances du marché des logiciels de financement du commerce.

Analyse du marché des logiciels de financement du commerce

La numérisation croissante des processus de financement du commerce est un facteur majeur de croissance du marché des logiciels de financement du commerce. Avec une efficacité accrue et des coûts réduits, la documentation électronique et les solutions de financement du commerce basées sur le cloud remplacent de plus en plus les méthodes traditionnelles sur papier, contribuant ainsi à la croissance du marché.

Aperçu du marché des logiciels de financement du commerce

Le besoin de transparence et de respect des réglementations commerciales internationales a conduit à l'adoption de solutions logicielles dotées de fonctions de surveillance et de reporting en temps réel. En mettant l'accent sur la fourniture de solutions de pointe qui répondent aux besoins changeants du commerce international, le marché des logiciels de financement du commerce est prêt à connaître une nouvelle expansion à mesure que le paysage commercial mondial continue de changer et que les entreprises recherchent des opérations de financement du commerce plus sûres et plus efficaces.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des logiciels de financement du commerce

La numérisation du financement du commerce pour favoriser le marché

Alors que les entreprises de divers secteurs se rendent compte qu'elles ont besoin de solutions de pointe pour accélérer et améliorer leurs opérations de commerce international, le marché connaît une expansion significative. Ce marché comprend des logiciels conçus pour améliorer et automatiser les procédures de financement du commerce , telles que le financement de la chaîne d'approvisionnement, la gestion de la conformité, l'affacturage des factures et la gestion du crédit. Les organisations se sont tournées vers les logiciels de financement du commerce pour réduire les tâches manuelles et chronophages, améliorer la précision et minimiser les risques associés au commerce international en raison de la complexité et du volume croissants des transactions commerciales, ce qui conduit à l'adoption de logiciels de financement du commerce par les acteurs du marché. Par exemple, en novembre 2023, Finastra, un fournisseur mondial d'applications logicielles financières et de marchés, a annoncé que CQUR Bank, une banque d'entreprise internationale, s'était associée à Finastra pour mettre en œuvre sa stratégie technologique. Avec la mise en œuvre des solutions leaders du marché de Finastra, Trade Innovation et Corporate Channels, CQUR Bank offre à ses clients d'entreprise un nouveau portail bancaire en ligne pour une expérience utilisateur transparente, a introduit de nouveaux flux de travail numériques et fournit des solutions d'intégration d'hôte à hôte.

Nécessité de gestion des risques et de conformité

Le besoin croissant d’une meilleure gestion des risques et d’une meilleure conformité est un autre facteur qui stimule la croissance du marché des logiciels de financement du commerce. Les logiciels de financement du commerce offrent des outils sophistiqués, tels que la détection des fraudes, les contrôles anti-blanchiment d’argent (AML) et le respect des lois et sanctions commerciales, pour suivre et réduire les risques liés au commerce international. Le besoin de ces solutions logicielles ne cesse de croître à mesure que les entreprises et les institutions financières tentent de gérer les défis du commerce international tout en maintenant la conformité légale et réglementaire.

Analyse de segmentation du rapport sur le marché des logiciels de financement du commerce

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des logiciels de financement du commerce sont les composants, le déploiement, la taille de l’entreprise et l’utilisation finale.

- En fonction des composants, le marché est segmenté en solutions et services. Le segment des solutions détenait une part de marché plus importante en 2023.

- En termes de déploiement, le marché est segmenté en cloud et sur site. Le segment cloud détenait une part de marché plus importante en 2023.

- En fonction de la taille de l'entreprise, le marché est segmenté en grandes entreprises et en PME. Le segment des PME devrait connaître le TCAC le plus élevé.

- En fonction de l'utilisation finale, le marché est segmenté en banques, commerçants et autres. Le segment des banques détenait une part de marché plus importante en 2023.

Analyse des parts de marché des logiciels de financement du commerce par zone géographique

La portée géographique du rapport sur le marché des logiciels de financement du commerce est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud/Amérique du Sud et centrale.

En termes de chiffre d'affaires, l'Amérique du Nord représentait la plus grande part de marché des logiciels de financement du commerce en 2023. L'Amérique du Nord est l'un des premiers pays à adopter des solutions technologiques, ce qui explique sa part de marché en plein essor. L'adoption de technologies basées sur le cloud par les PME entraîne une croissance du marché. La numérisation croissante des banques exige en outre des logiciels de financement du commerce, ce qui stimule la part de marché du financement du commerce en Amérique du Nord.digitalization in the banks further demands trade finance software, which drives North America trade finance market share.

Aperçu régional du marché des logiciels de financement du commerce

Les tendances et facteurs régionaux influençant le marché des logiciels de financement du commerce tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des logiciels de financement du commerce en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des logiciels de financement du commerce

Portée du rapport sur le marché des logiciels de financement du commerce

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 2,14 milliards de dollars américains |

| Taille du marché d'ici 2031 | 4,87 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 10,8% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par composant

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des logiciels de financement du commerce : comprendre son impact sur la dynamique des entreprises

Le marché des logiciels de financement du commerce connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des logiciels de financement du commerce sont :

- CGI Inc

- Comarch SA

- IBSFINtech

- SYSTÈMES FINANCIERS ICS LTÉE

- MITech – Make Intuitive Tech SA

- Newgen Software Technologies Ltd.

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des logiciels de financement du commerce

Actualités et développements récents du marché des logiciels de financement du commerce

Le marché des logiciels de financement du commerce est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent des publications d'entreprise importantes, des données d'association et des bases de données. Voici une liste des évolutions du marché :

- En septembre 2022, Newgen Software, l'un des principaux fournisseurs mondiaux de produits de transformation numérique, a lancé la première plateforme de financement du commerce low-code au monde lors de la réunion des clients à Mumbai. Le financement du commerce est un processus complexe car il implique beaucoup de paperasse, de multiples parties prenantes et des exigences de conformité. La plateforme de financement du commerce complète, configurable et évolutive de Newgen aide les banques à se passer du papier et à rationaliser leurs processus commerciaux de bout en bout tout en garantissant la conformité aux réglementations nationales et internationales. (Source : CXOtoday, communiqué de presse, 2022)

- En février 2024, Finastra, fournisseur mondial d'applications et de places de marché de logiciels financiers, et Tesselate, cabinet de conseil et intégrateur mondial en transformation numérique, ont annoncé le lancement d'un service pré-packagé de bout en bout pour une numérisation plus rapide et plus facile du financement du commerce. Tegula Trade Finance as a Service, optimisé par Finastra Trade Innovation et Corporate Channels, permet aux banques américaines d'automatiser les processus manuels et de s'adapter aux nouvelles demandes avec un délai de commercialisation et une valeur plus rapides. Grâce à FusionFabric.cloud de Finastra, les banques peuvent également intégrer de manière transparente des applications fintech qui utilisent les dernières technologies telles que l'intelligence artificielle, la blockchain et les outils d'automatisation. (Source : Finastra, communiqué de presse, 2024)

Rapport sur le marché des logiciels de financement du commerce : couverture et livrables

Le rapport « Taille et prévisions du marché des logiciels de financement du commerce (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille du marché et prévisions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Principales tendances futures

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché mondial et régional couvrant les principales tendances du marché, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des logiciels de financement du commerce

Obtenez un échantillon gratuit pour - Marché des logiciels de financement du commerce