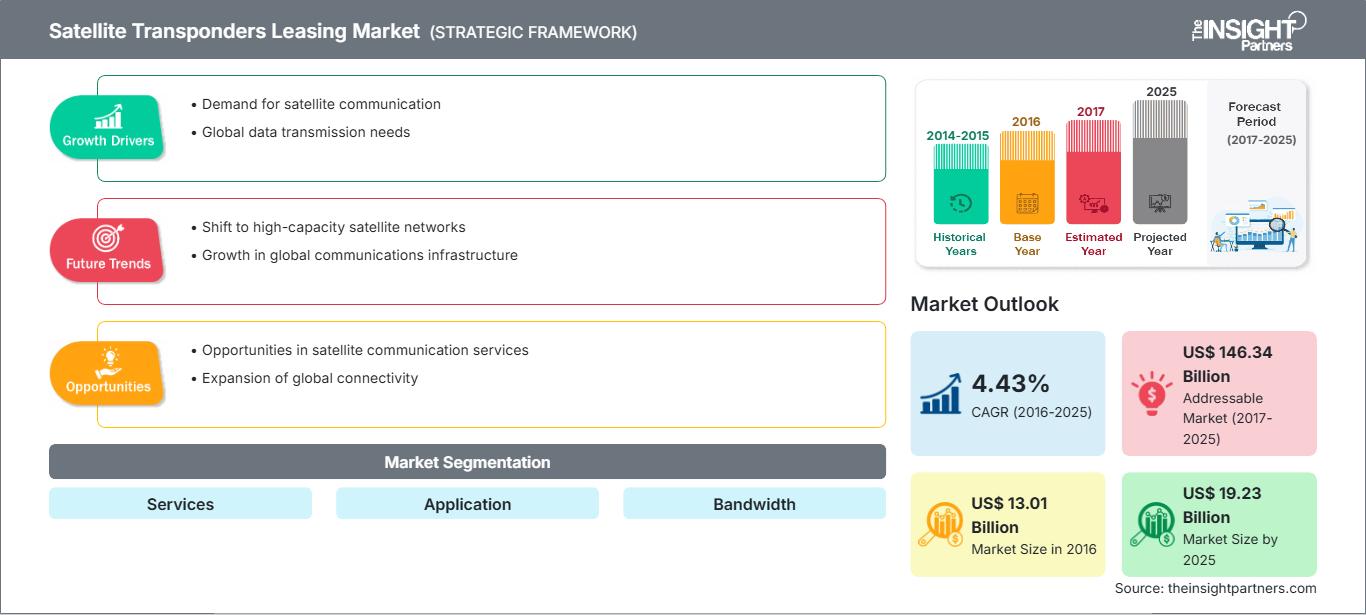

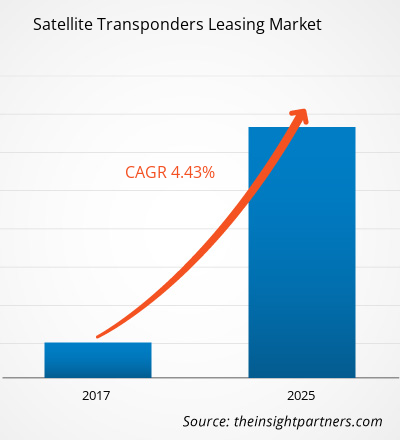

The satellite transponders leasing market is expected to grow from US$ 13.01 Bn in 2016 to US$ 19.23 Bn by 2025 at a CAGR of 4.43% between 2016 and 2025.

The satellite transponders leasing market is anticipated to grow in terms of both coverage and capability as Ka-band and Ku-band frequencies pertain to fuel the market growth, moreover, the rising number of subscriber updates and new subscribers are also expected to drive the global satellite transponders market. Furthermore, owing to the present technological advancements in satellite communications several new applications of satellite transponders are expected to emerge. These satellites are accounted to be potent enough to compete against their rivalry; Digital Subscriber Line (DSL) broadband in terms their performance. All these factors are expected to fuel the global satellite transponders leasing market during the forecast period.

Market Insights

Expansion in the Ku-band applications to generate new opportunities for the communication satellite transponders leasing market

Live broadcasting and video distribution are some of the major applications of Ku-band satellites, also they are used for several data services including, VSAT services, broadband connectivity, mobile back haul, aeronautical, and maritime services. In this highly connected world, all these applications are considered critical for the functioning of a company/firm. In fact, Ku-band is the chief spectrum utilized by mobility networks in order to deliver broadband connectivity in the area where terrestrial networks cannot reach, viz., over the ocean and in the troposphere. The Ku-band captures approximately 40% market in terms of bandwidth. The demand for Ku-band transponders is anticipated to propel owing to the increasing vogue of satellite TVs specifically in the developing economies, which is further supported by HD (High Definition) and demand for other similar bandwidth applications. Evolution of 3D channels that consume higher bandwidth and require 50% more capacity is expected to offer a new thrust to the Ku-band satellite transponders market. Followed by Ku-Band is the C-band transponders that hold the largest market share presently, but is expected to foresee a steady fall during the forecast period, losing its prominence to the Ku and other similar bandwidths. Hence, this expansion in the Ku-band applications is expected to generate new opportunities for the satellite transponders leasing market.

Transponders leasing as services to dominate the global service segment of satellite transponders leasing market

Since past one to two years the global satellite transponders market has witnessed approximately 4.3-4.5% of rise in leased transponders demand. This is project to increase further due to snowballing cost of transponders throughout the globe. Looking at the satellite transponders leasing market, Europe is noted to be the costliest region followed by Australia and New Zealand. Whereas, South Asia offers the lowest leasing rates, which is why Asia Pacific is considered to be the most promising region for the satellite transponders leasing market in upcoming years. Recently, a Korean satellite company KT SAT signed a transponder leasing agreement with a Mongolian satellite TV operator, the service provider KT SAT has affiliated leasing of four transponder, which would fulfil the purpose of offering DTH services to the Mongolian companies that are being initiated in the coming year. Whereas, DDISH TV company is anticipated to benefit through KT SATs services in 2017. The leasing of communication satellite transponders is highly dependent upon adoption of HD video broadcasting and a widespread of High Dynamic Range (HDR) Applications. Although, leasing services are expected to lead the satellite transponders leasing market with a relatively highest market share, which is subjected to fluctuation depending upon revision of satellite transponders purchase cost and total cost of launching a satellite and it maintenance.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Satellite Transponders Leasing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market initiative was observed as the most adopted strategy in global satellite transponders leasing market. Few of the recent strategies by some of the players in satellite transponders leasing market landscape are listed below-

- 2016: GlobalSat Licenses Inmarsat Ka, L-band Services throughout Mexico

- 2016: MVS USA Updates Satcom Network with Eye on Cybersecurity

- 2016: O3b, Ozonio Bring Broadband to another Amazonian City in Brazil

- 2016: African Schools Set to Benefit from New Gazprom-Gilat Deal

- 2016: Indonesia Builds Broadband Access in Underserved Areas with Newtec

The regional trends and factors influencing the Satellite Transponders Leasing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Satellite Transponders Leasing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Satellite Transponders Leasing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2016 | US$ 13.01 Billion |

| Market Size by 2025 | US$ 19.23 Billion |

| Global CAGR (2016 - 2025) | 4.43% |

| Historical Data | 2014-2015 |

| Forecast period | 2017-2025 |

| Segments Covered | By ServicesBy ApplicationBy Bandwidth |

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Satellite Transponders Leasing Market Players Density: Understanding Its Impact on Business Dynamics

The Satellite Transponders Leasing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Satellite Transponders Leasing Market top key players overview

Global Satellite Transponders Leasing- Market Segmentation

By Services

- Protected

- Unprotected

- Preemptable

By Application

- Government & military

- Telecom

- Commercial

- Research & Development

- Navigation

- Remote Sensing

By Bandwidth

- Ku- Band

- Ka- Band

- C-Band

- Others (S, L, X & K)

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- Russia

- France

- Germany

- U.K

- Luxembourg

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- Japan

- Rest of APAC

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- Israel

- UAE

- Rest of MEA

- South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Company Profiles

- Intelsat

- SES

- Eutelsat

- Telesat

- SingTel Optus

- MEASAT satellite systems

- Asia Broadcast Satellite

- Arabsat

- ISRO

- China Satellite Communications Co.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For