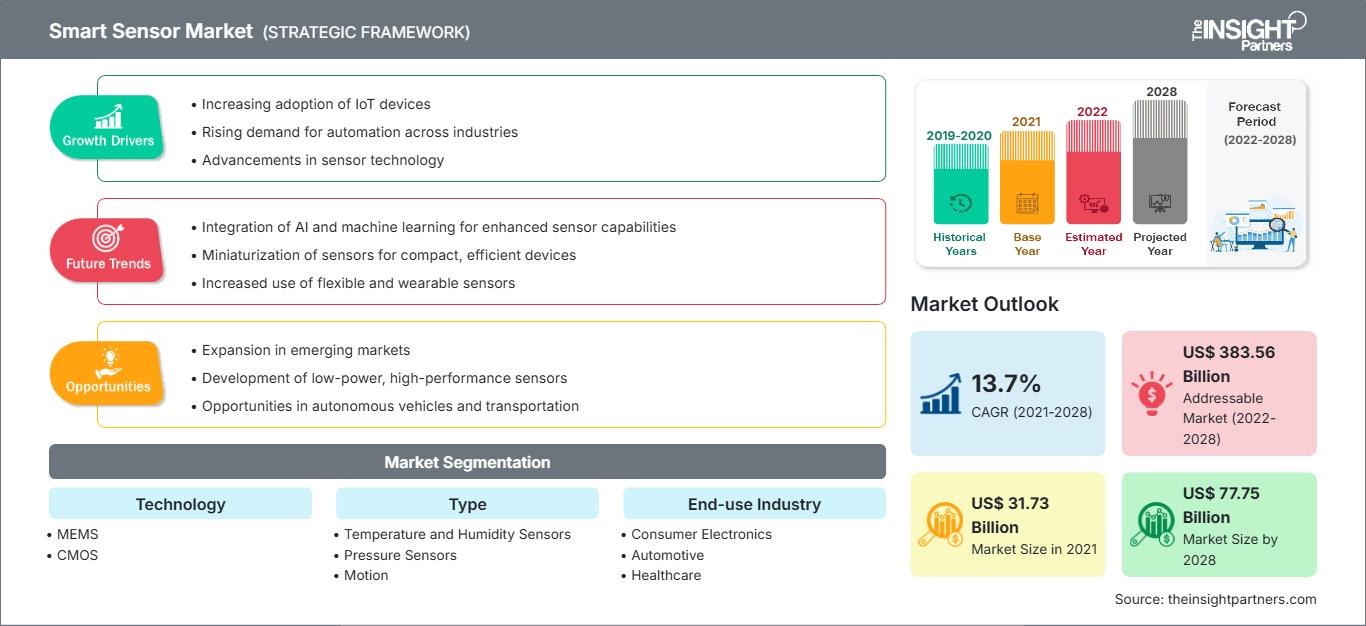

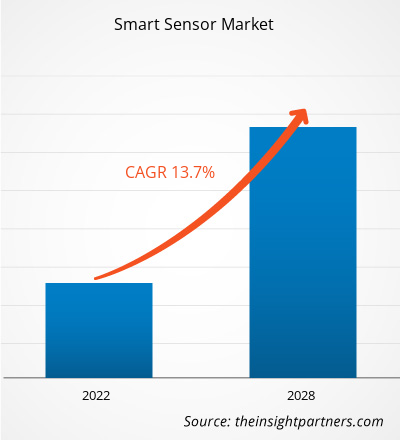

Der Markt für intelligente Sensoren soll von 31.731,1 Millionen US-Dollar im Jahr 2021 auf 77.747,6 Millionen US-Dollar im Jahr 2028 wachsen. Das Wachstum wird zwischen 2021 und 2028 auf durchschnittlich 13,7 % pro Jahr geschätzt.

Intelligente Sensoren sind schneller und genauer als herkömmliche Sensoren. Diese Sensoren sind kleiner und verbrauchen weniger Strom als herkömmliche Sensoren. Der Einsatz intelligenter Sensortechnologie in IoT-basierten Geräten und Unterhaltungselektronik sowie ihre Anwendung in den Bereichen Luft- und Raumfahrt & Verteidigung, Automobilindustrie, Biomedizin & Gesundheitswesen, Industrieautomation, Gebäudeautomation, Unterhaltungselektronik, Bildung, Robotik, Landwirtschaft und Transport haben in den letzten Jahren großes Interesse geweckt. Die zunehmende Nutzung intelligenter Sensoren in allen Anwendungen ist ein Schlüsselfaktor für die wachsende Größe des Marktes für intelligente Sensoren.

Angesichts zunehmender Sicherheitsbedenken steigt die Nachfrage nach intelligenten Sensoren in der Unterhaltungselektronik, was sich auf den Markt für intelligente Sensoren auswirkt. In der Heimautomatisierung kommen verschiedene Sensoren zum Einsatz, beispielsweise IR-Sensoren mit Nachtsicht, Geräuschsensoren oder Mikrofone sowie intelligente Toiletten. Unternehmen integrieren verschiedene Funktionen in ihre intelligenten Sensoren, beispielsweise automatische Reinigung, automatische Spülung, Tanklecküberwachung, Wasserüberlaufschutz und Gesundheitsüberwachung. Lichter und Ventilatoren können mit einem automatischen System gesteuert werden, das Infrarot- oder Bewegungssensoren verwendet.

Darüber hinaus erlebt mit dem sich ändernden Lebensstil und dem neuen modernen Lebensstandard die Nachfrage nach modularen Küchen mit integrierter Heimautomatisierung ein exponentielles Wachstum, was sich positiv auf den Markt für intelligente Sensoren auswirkt. Hersteller entwickeln Geräte auf Basis synthetischer Sensoren zur Überwachung von Vibrationen, Küchengeräuschen, Licht, Gas, Temperatur, Wärme sowie elektromagnetischer Temperatur und Lärm, wodurch der Markt für intelligente Sensoren wächst. Analog Devices, Inc. bietet beispielsweise HMC1126 GaAs pHEMT-Sensoren an. Es handelt sich um einen rauscharmen Verstärker, der in einem Bereich von 400 MHz bis 52 GHz arbeitet und in verschiedenen Anwendungen eingesetzt wird, beispielsweise in Mikrowellenradios, Very Small Aperture Terminals (VSATs), Testgeräten und in der 5G-Kommunikation.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

Markt für intelligente Sensoren: Strategische Einblicke

-

Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst Datenanalysen, die von Markttrends bis hin zu Schätzungen und Prognosen reichen.

Intelligente Sensortechnologie hat zu rasanten technologischen Fortschritten bei Smartphones und tragbaren Geräten geführt. Automobilhersteller verlangen zunehmend nach intelligenten Sensoren, um Sicherheit und Komfort zu verbessern. Der Einsatz drahtloser Technologie zur Überwachung und Steuerung von Sicherheitsgeräten mit intelligenten Sensoren wird immer üblicher. Inmitten von COVID-19 bieten der starke Anstieg der Nachfrage nach tragbaren Geräten mit intelligenten Sensoren, die anhaltende staatliche Unterstützung für umweltfreundliches Bauen und vorausschauende Wartung lukrative Möglichkeiten für Akteure auf dem Markt für intelligente Sensoren.

Die zunehmende Verbreitung von Smartphones hat das Wachstum des Marktes für intelligente Sensoren erheblich vorangetrieben. Zu den intelligenten Sensoren gehören gängige Sensoren wie Bewegungs-, Positions-, Umgebungslicht-, Beschleunigungs- und Gyroskopsensoren. SAR-Sensoren (Specific Absorption Rate) verbessern die Konnektivität für eine breite Palette drahtloser Technologien, wie z. B. 5G Sub-6/4G/WLAN in Smartphones, Tablets und Laptops. SEMTECH, ein führender Halbleiterhersteller, bietet die Sensoren PerSeTM Connect, PerSe Connect Pro und PerSe Control an, die in verschiedenen Anwendungen wie Smartphones, Laptops, Tablets und Wearables eingesetzt werden können.

Viele Unternehmen entwickeln neue und fortschrittliche intelligente Sensoren, die Mikrocontroller in einem einzigen Gehäuse vereinen. Moderne Technologien wie KI (Künstliche Intelligenz) und IoT ermöglichen diese Kombination auf kleinem Raum. Beispielsweise kann der BHA250 von Bosch Sensortec einen 32-Bit-Mikrocontroller mit einem 14-Bit-Beschleunigungssensor in einem 2,2 x 2,2 x 0,95 mm3 großen Gehäuse kombinieren. Darüber hinaus hat das Unternehmen TE Connectivity Sensoren mit Steckverbindern integriert, um Funktionalität auf kleinem Raum zu vereinen. Diese Entwicklungen in der intelligenten Sensortechnologie wirken sich positiv auf das Wachstum des Marktes für intelligente Sensoren aus. Mit dem Wachstum der Unterhaltungselektronikbranche, beispielsweise bei intelligenten Getränkeautomaten, intelligenten Hausautomationssystemen, einfachen Computern, digitalen Assistenten (wie Alexa) und tragbaren Geräten, ist die Nachfrage nach intelligenten Sensoren auf dem Markt für intelligente Sensoren gestiegen. Traditionelle Konsumgüter wie Laptops, Smartphones und Fernseher übertreffen weiterhin die Erwartungen, da die Verbraucher weiterhin neue und aufkommende Produkte wie Wearables, sprachgesteuerte Smart-Lautsprecher und Smart-Home-Geräte annehmen.

Laut mehreren Studien werden in den kommenden Jahren zig Milliarden IoT-Geräte mit dem Internet verbunden sein, was große Auswirkungen auf den Markt für intelligente Sensoren haben wird. COVID-19 treibt die Strategien für urbane Resilienz und digitale Transformation voran, während sich Stadtverwaltungen an eine neue Realität anpassen.

Auswirkungen der COVID-19-Pandemie auf den Markt für intelligente Sensoren

Das Auftreten von COVID-19 hat die Notwendigkeit, die digitale Infrastruktur für die Fernüberwachung von Patienten nutzbar zu machen und einzusetzen, in den Fokus gerückt. Aufgrund der langsamen Entwicklung aktueller Virustests und Impfstoffe wurde festgestellt, dass ein größerer Bedarf an einer robusteren Krankheitserkennung und Überwachung der Gesundheit von Einzelpersonen und der Bevölkerung besteht, wozu tragbare Sensoren beitragen könnten. Obwohl diese Technologie bereits zur Korrelation physiologischer Messwerte mit dem täglichen Leben und der menschlichen Leistungsfähigkeit genutzt wurde, ist ihre Anwendung zur Vorhersage des Auftretens von COVID-19 weiterhin notwendig.

Die wachsende Nachfrage nach energiesparenden Geräten treibt die Nachfrage nach intelligenten Sensoren im nordamerikanischen Markt für intelligente Sensoren in die Höhe. Unternehmen steigen auf energieeffiziente Geräte und Produkte um, da das veränderte Szenario energieeffiziente Geräte und Produkte erfordert. Darüber hinaus ist die Nachfrage nach Sensoren im Markt für intelligente Sensoren in zahlreichen Branchen gestiegen, da strenge staatliche Vorschriften gelockert wurden, was in der Automatisierungsbranche zunehmend an Bedeutung gewinnt. Darüber hinaus wird die Nachfrage nach Sensoren im Automobilsektor durch den Wunsch getrieben, das Durchschnittsgewicht eines Autos zu reduzieren. Leichte Autos tragen sowohl zur Kraftstoffeffizienz als auch zur Energieoptimierung bei.

Markt für intelligente Sensoren

Die Analysten von The Insight Partners haben die regionalen Trends und Faktoren, die den Markt für intelligente Sensoren im Prognosezeitraum beeinflussen, ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die geografische Lage in Nordamerika, Europa, dem asiatisch-pazifischen Raum, dem Nahen Osten und Afrika sowie Süd- und Mittelamerika erörtert.Umfang des Marktberichts zum Thema intelligente Sensoren

| Berichtsattribut | Einzelheiten |

|---|---|

| Marktgröße in 2021 | US$ 31.73 Billion |

| Marktgröße nach 2028 | US$ 77.75 Billion |

| Globale CAGR (2021 - 2028) | 13.7% |

| Historische Daten | 2019-2020 |

| Prognosezeitraum | 2022-2028 |

| Abgedeckte Segmente |

By Technologie

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Dichte der Marktteilnehmer für intelligente Sensoren: Verständnis ihrer Auswirkungen auf die Geschäftsdynamik

Der Markt für intelligente Sensoren wächst rasant. Die steigende Nachfrage der Endnutzer ist auf Faktoren wie veränderte Verbraucherpräferenzen, technologische Fortschritte und ein stärkeres Bewusstsein für die Produktvorteile zurückzuführen. Mit der steigenden Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um den Bedürfnissen der Verbraucher gerecht zu werden, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

- Holen Sie sich die Markt für intelligente Sensoren Übersicht der wichtigsten Akteure

Marktsegmentierung für intelligente Sensoren

Der Markt für intelligente Sensoren ist technologisch in MEMS, CMOS und Sonstige unterteilt. Im Jahr 2021 war das MEMS-Segment marktführend. Nach Typ ist der Markt für intelligente Sensoren in Temperatur- und Feuchtigkeitssensoren, Drucksensoren, Bewegungssensoren, Positionssensoren und Sonstige unterteilt. Im Jahr 2021 hatte das Segment der Temperatur- und Feuchtigkeitssensoren den größten Marktanteil. Nach Endverbraucherbranche ist der Markt für intelligente Sensoren in Unterhaltungselektronik, Automobilindustrie, Gesundheitswesen, Fertigung, Einzelhandel und Sonstige unterteilt.

Analog Devices Inc., Infineon Technologies Inc., STMicroelectronics, TE Connectivity, Microchip Technologies, NXP Semiconductor, Siemens AG, ABB Ltd., Robert Bosch GmbH und Honeywell International gehören zu den wichtigsten Akteuren auf dem Markt für intelligente Sensoren. Darüber hinaus wurden mehrere andere Akteure analysiert, um die Gesamtdynamik des globalen Marktes für intelligente Sensoren zu verstehen.

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Verwandte Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - Markt für intelligente Sensoren

Kostenlose Probe anfordern für - Markt für intelligente Sensoren