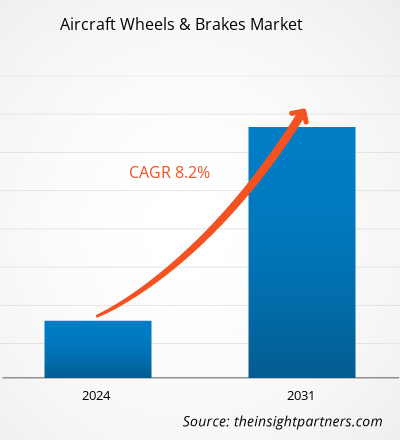

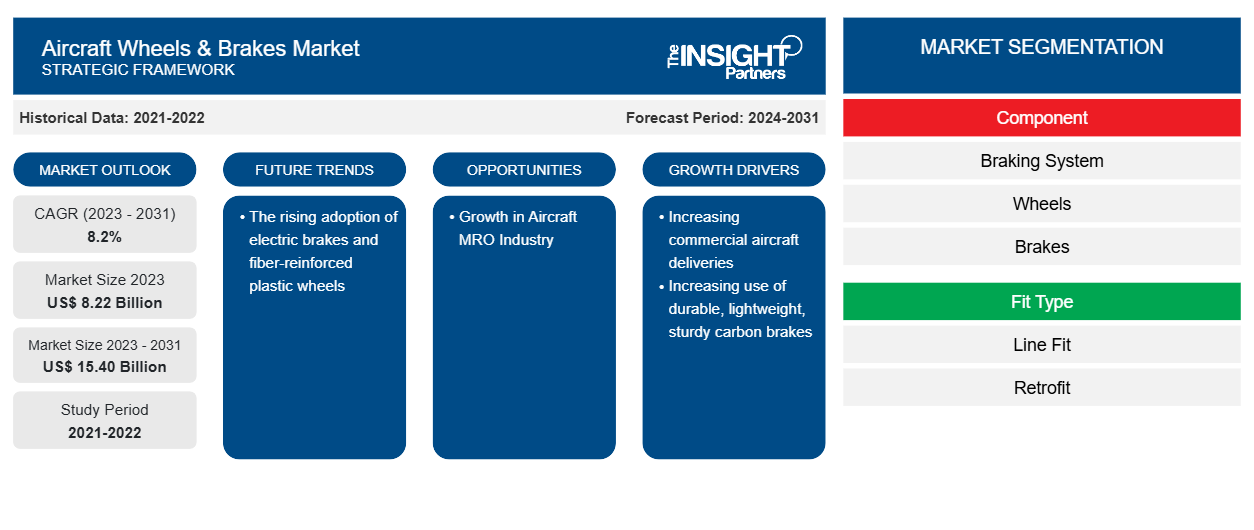

Se proyecta que el tamaño del mercado de ruedas y frenos para aeronaves alcance los 15.400 millones de dólares estadounidenses en 2031, frente a los 8.220 millones de dólares estadounidenses en 2023. Se espera que el mercado registre una CAGR del 8,2 % durante el período 2023-2031. Es probable que la creciente adopción de frenos eléctricos y ruedas de plástico reforzado con fibra siga siendo una tendencia clave en el mercado.CAGR of 8.2% during 2023–2031. The rising adoption of electric brakes and fiber-reinforced plastic wheels is likely to remain a key trend in the market.

Análisis del mercado de ruedas y frenos para aeronaves

El mercado de ruedas y frenos para aeronaves está dominado principalmente por actores bien establecidos como Honeywell International Inc, Parker Hannifin Corporation, Safran Group y Crane Aerospace & Electronics, entre otros. La demanda de ruedas y frenos entre los fabricantes de aeronaves está aumentando fuertemente. Sin embargo, la mayoría de los contratos se adjudican a actores bien establecidos. Además, la fabricación de estas ruedas y frenos requiere el cumplimiento de varias normas establecidas por la autoridad reguladora. Esto implica la obtención de varias certificaciones e inversiones significativas en I+D, lo que restringe la entrada de nuevos actores en el campo. Por lo tanto, la amenaza para el negocio de nuevos participantes es alta en el escenario actual; sin embargo, con el aumento del volumen de producción de aeronaves, se prevé la aparición de nuevos actores. Se espera que esto reduzca la amenaza para los nuevos participantes, ya que varios fabricantes de aeronaves pequeños o medianos adquirirían sus ruedas y frenos de nuevos participantes que ofrecen ruedas y frenos de tecnología avanzada a un precio competitivo.Hannifin Corporation, Safran Group, and Crane Aerospace & Electronics among others. The demand for wheels and brakes among aircraft manufacturers is strongly increasing. However, most of the contracts are awarded to well-established players. Additionally, the manufacturing of these wheels and brakes requires compliance with several standards set by the governing authority. This involves obtaining various certifications and significant investments in R&D, which restricts the entrance of the new players in the field. Thus, the threat to business of new entrants is high in the current scenario; however, with the rise in aircraft production volume, the emergence of new players is foreseen. This is expected to lower the threat to new entrants as several smaller or mid-sized aircraft manufacturers would be procuring their wheels and brakes from new entrants offering advanced technology wheels and brakes at a competitive price.

Descripción general del mercado de ruedas y frenos para aeronaves

El ecosistema del mercado de ruedas y frenos de aeronaves comprende las siguientes partes interesadas: proveedores de materias primas y componentes, fabricantes de ruedas y frenos de aeronaves, fabricantes de aeronaves y usuarios finales. Los fabricantes de ruedas y frenos de aeronaves adquieren materias primas y componentes como acero, aluminio, aleación de magnesio y materiales de fibra de carbono, entre otros, y los componentes como sensores y actuadores, entre otros, provienen de varios proveedores de materias primas y componentes. Los fabricantes de ruedas y frenos de aeronaves ensamblan materias primas y componentes y producen un producto terminado. Los fabricantes de ruedas y frenos de aeronaves trabajan en conjunto con las autoridades de aviación, los proveedores de materias primas, los fabricantes de aeronaves y los usuarios finales. Algunos de los actores destacados que operan en el mercado son Collins Aerospace, Honeywell International Inc, Safran Group y Parker Hannifin Corporation, entre otros. Además, los fabricantes de aeronaves adquieren ruedas y frenos de los actores mencionados anteriormente y los instalan en la flota de aeronaves a través de la actividad de ajuste de línea. Finalmente, los usuarios finales, como las compañías aéreas, las fuerzas armadas de varios países y los proveedores de servicios MRO, adquieren contratos para la actividad MRO de ruedas y frenos de aeronaves. Los proveedores de servicios MRO adquieren continuamente ruedas y frenos de los actores del mercado para poder ofrecer continuamente sus servicios a la creciente demanda de MRO de ruedas y frenos de aeronaves.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Perspectivas regionales del mercado de ruedas y frenos para aeronaves

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de ruedas y frenos para aeronaves durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de ruedas y frenos para aeronaves en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de ruedas y frenos de aeronaves

Alcance del informe de mercado de ruedas y frenos para aeronaves

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 8,22 mil millones |

| Tamaño del mercado en 2031 | US$ 15.40 mil millones |

| CAGR global (2023 - 2031) | 8,2% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por componente

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de ruedas y frenos para aeronaves está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de ruedas y frenos para aeronaves son:

- Beringer Aero

- Aeroespacial Collins

- Compañía: Honeywell International Inc.

- Meggitt PLC

- Corporación Parker Hannifin

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de ruedas y frenos de aeronaves

Noticias y desarrollos recientes del mercado de ruedas y frenos para aeronaves

El mercado de ruedas y frenos para aeronaves se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de ruedas y frenos para aeronaves:

- Safran Landing Systems ha inaugurado en su planta de Vélizy-Villacoublay (Francia) un laboratorio totalmente renovado, dedicado a probar sus ruedas y frenos de carbono, y equipado con un nuevo banco de pruebas. La empresa habrá invertido un total de 10 millones de euros para llevar a cabo este ambicioso proyecto. El resultado es un entorno de trabajo responsable y la promesa de reforzar la capacidad de Safran para desarrollar y cualificar frenos de mayor rendimiento, más duraderos y competitivos, así como para seguir el ritmo de la aceleración de la producción de sus clientes. Esto se aplica a casi todos los segmentos de la aviación civil, militar y de negocios. (Fuente: Safran, Nota de prensa, abril de 2024)

- Parker-Hannifin Corporation (NYSE: PH, “Parker”), líder mundial en tecnologías de control y movimiento, anunció hoy que ha completado la transacción previamente anunciada para vender su división de ruedas y frenos para aeronaves, ubicada en Avon, Ohio, en los Estados Unidos, a Kaman Corporation (NYSE: KAMN). Kaman, con sede en Bloomfield, Connecticut, es un fabricante líder de componentes y materiales para los mercados aeroespacial y de defensa, industrial y médico. (Fuente: Parker-Hannifin Corporation, comunicado de prensa, septiembre de 2022)

Informe sobre el mercado de ruedas y frenos de aeronaves: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de ruedas y frenos para aeronaves (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de ruedas y frenos de aeronaves y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de ruedas y frenos para aeronaves, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter

- Análisis del mercado de ruedas y frenos de aeronaves que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de ruedas y frenos para aeronaves

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de ruedas y frenos para aeronaves

Obtenga una muestra gratuita para - Mercado de ruedas y frenos para aeronaves