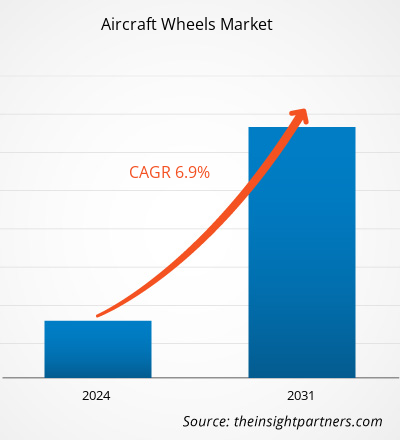

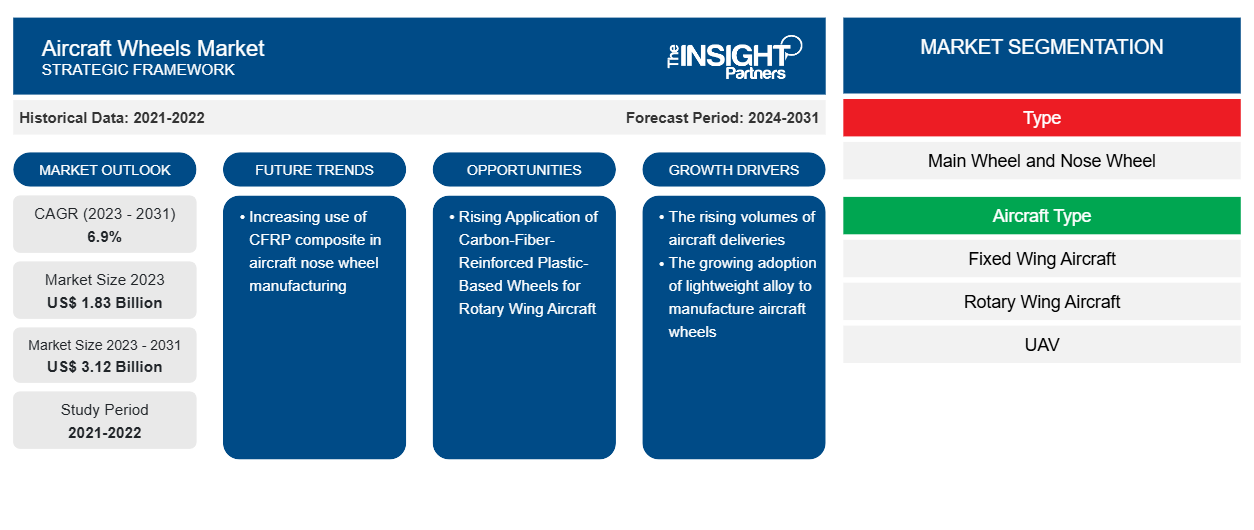

Le marché des roues d'avion devrait atteindre 3,12 milliards USD d'ici 2031, contre 1,83 milliard USD en 2023. Le marché devrait enregistrer un TCAC de 6,9 % au cours de la période 2023-2031. L'utilisation croissante de composites CFRP dans la fabrication de roues avant d'avion devrait rester une tendance clé du marché.CAGR of 6.9% during 2023–2031. Increasing use of CFRP composite in aircraft nose wheel manufacturing is expected to remain a key trend in the market.

Analyse du marché des roues d'avion

En raison de l'introduction du composite renforcé de fibres de carbone, les fabricants de roues d'avion utilisent largement ce matériau pour concevoir et fabriquer une roue avant d'avion. Le matériau est connu pour sa rigidité et sa résistance élevées, ce qui le rend compatible avec une roue avant d'avion. De plus, le matériau composite est plus léger que l'alliage d'aluminium et de magnésium. Par conséquent, la roue à base de plastique renforcé de fibres de carbone (PRFC) devrait réduire la densité de masse d'un avion. Cela entraînera une consommation de carburant plus faible et l'avion pourra être exploité de manière économique. En outre, l'autonomie ou la charge utile peuvent être augmentées. À l'heure actuelle, les fabricants de roues d'avion développent des roues d'avion en composite PRFC. Par exemple, Fraunhofer LBF utilise le composite PRFC pour développer des roues avant d'un avion Airbus A320. Par conséquent, dans les années à venir, les fabricants de roues d'avion devraient utiliser de plus en plus de matériaux PRFC pour fabriquer des roues avant d'avion. Par conséquent, l'augmentation de l'utilisation du matériau composite PRFC pour la fabrication de roues avant d'avion devrait augmenter parmi les fabricants de roues d'avion et devenir une tendance future.CFRP) based wheel is expected to reduce the mass density of an aircraft. This will result in lower fuel consumption and the aircraft can be operated economically. Also, the range or payload can be increased. At present, aircraft wheel manufacturers are developing aircraft wheels made of CFRP composite. For instance, Fraunhofer LBF is using the CFRP composite to develop nose wheels for an Airbus A320 aircraft. Hence, in the coming years, aircraft wheel manufacturers are expected to use CFRP material increasingly to manufacture aircraft nose wheels. Hence, the rise in use of CFRP composite material for manufacturing aircraft nose wheels are anticipated to grow among aircraft wheel manufacturers and become future trend.

Aperçu du marché des roues d'avion

L'écosystème du marché des roues d'avion comprend les parties prenantes suivantes : fournisseurs de matières premières et de composants, fabricants de roues d'avion, constructeurs d'avions et utilisateurs finaux. Les fabricants de roues d'avion achètent des matières premières et des composants tels que l'acier, l'aluminium et l'alliage de magnésium et des composants tels que des écrous et des boulons, entre autres, auprès des fournisseurs de matières premières et de composants. Les fabricants de roues d'avion assemblent les matières premières et les composants et les produisent en produits finis. Ces fabricants sont les principaux acteurs du marché des roues d'avion et détiennent une part importante du marché donné. Parmi les acteurs importants qui opèrent sur le marché, on trouve Honeywell International Inc. ; Safran SA ; Parker Hannifin Corporation ; Raytheon Technologies Corporation ; et Matco Manufacturing Inc., entre autres. En outre, ces fabricants fournissent des roues d'avion à des constructeurs d'avions tels qu'Airbus, Boeing, Dassault Aviation, Bombardier, Lockheed Martin Corporation et d'autres pour les montages en ligne de roues. En outre, les fabricants de roues d'avion vendent les roues à des fournisseurs de modernisation de roues tels que Lufthansa Technik, AAR Corporation et TP Aerospace, entre autres. Ces fournisseurs de modernisation achètent des roues d'avion pour les compagnies aériennes et effectuent la modernisation des roues lors des services de maintenance, de réparation et de révision (MRO) des avions.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des roues d'avion

Adoption croissante d'alliages légers pour la fabrication de roues d'avion

Les roues d'avion conventionnelles sont fabriquées en alliages de magnésium. Cependant, à l'époque moderne, les fabricants explorent de plus en plus les matériaux légers pour fabriquer des roues d'avion afin d'obtenir une grande durabilité et une faible maintenance. De plus, une roue d'avion en alliages légers aide un constructeur aéronautique à atteindre un niveau optimal d'efficacité énergétique en réduisant une partie du poids de l'avion. Ainsi, à la suite de nouveaux développements technologiques dans les roues d'avion, les fabricants utilisent largement divers types d'alliages d'aluminium pour rendre les roues légères et avec une meilleure résistance à la corrosion. Par exemple, UTC Aerospace Systems (UTAS) explore un alliage d'aluminium à base d'argent pour développer une roue d'avion. La résistance des nouvelles roues en aluminium à base d'argent devrait augmenter d'environ 20 %. En outre, le nouvel alliage d'aluminium à base d'argent devrait augmenter la tolérance aux dommages d'environ 70 % en raison de sa rigidité et de sa résistance améliorée à la corrosion. La variante en aluminium à base d'argent est également susceptible d'alléger la roue d'avion et de réduire les temps d'arrêt pour maintenance. Par conséquent, l'adoption croissante d'alliages légers pour fabriquer des roues d'avion stimule la croissance du marché des roues d'avion.UTAS) is exploring a silver-based aluminum alloy to develop an aircraft wheel. The strength of new wheels made of silver-based aluminum is expected to increase by about 20%. In addition, the new silver-based

Utilisation croissante des roues en plastique renforcé de fibres de carbone pour les aéronefs à voilure tournante

Actuellement, la majorité des roues d’hélicoptères sont fabriquées à partir de matériaux en alliage léger métallique, tels que l’aluminium ou le magnésium. Cependant, les roues en plastique renforcé de fibres de carbone (PRFC) pèsent environ 30 à 40 % de moins que les roues en alliage d’aluminium ou de magnésium. Les roues en PRFC devraient offrir une meilleure résistance à la corrosion et une meilleure performance en matière de bruit, de vibrations et de dureté (NVH). De plus, ces roues sont plus rigides et ont une meilleure résistance à la fatigue, ce qui prolongera leur durée de vie. Les fabricants ont déjà commencé à concevoir des roues à base de PRFC pour les aéronefs à voilure tournante. Par exemple, en janvier 2021, Carbon ThreeSixty, une société de fabrication de roues d’avion basée au Royaume-Uni, a commencé à développer des roues à base de PRFC pour les aéronefs à voilure tournante. L’entreprise devrait achever la conception des roues dans les 18 prochains mois. Ces roues composites seront également interchangeables avec les roues existantes pour les rendre adaptées aux applications de modernisation. Par conséquent, avec l’introduction de roues en plastique renforcé de fibres de carbone dans les aéronefs à voilure tournante, le marché devrait prospérer davantage dans les années à venir avec la possibilité de pénétrer les roues des aéronefs à voilure tournante.CFRP) are ~30%–40% less in weight than aluminum or magnesium alloy wheels. CFRP wheels are expected to offer improved corrosion resistance and noise, vibration, and harshness (NVH) performance. Also, these wheels are stiffer with improved fatigue life, which will extend their life. Manufacturers have already initiated the designing of CFRP-based wheels for rotary wing aircraft. For instance, in January 2021, Carbon ThreeSixty, a UK-based aircraft wheels manufacturing company, began to develop CFRP-based wheels for rotary wing aircraft. The company is expected to complete the wheel designing in the next 18 months. These composite wheels will also be interchangeable with existing wheels to make them suitable for retrofit applications. Hence, with the introduction of carbon-fiber-reinforced plastic-based wheels in rotary wing aircraft, the market is expected to flourish further in the coming years with an opportunity to penetrate the rotary wing aircraft wheels.

Analyse de segmentation du rapport sur le marché des roues d'avion

Le segment clé qui a contribué à la dérivation de l’analyse du marché des roues d’avion est le type, le type d’avion, le type d’ajustement et l’utilisateur final.

- En fonction du type, le marché des roues d'avion est segmenté en roue principale et roue avant. Le segment de la roue principale détenait une part de marché plus importante en 2023.

- En fonction du type d'avion, le marché des roues d'avion est segmenté en avions à voilure fixe, avions à voilure tournante et drones. Le segment des avions à voilure fixe détenait une part de marché plus importante en 2023.UAV. The fixed wing aircraft segment held a larger market share in 2023.

- En fonction du type d'ajustement, le marché des roues d'avion est segmenté en montage en ligne et en modernisation. Le segment de montage en ligne détenait une part de marché plus importante en 2023.

- En fonction de l'utilisateur final, le marché des roues d'avion est segmenté en deux segments : commercial et militaire. Le segment commercial détenait une part de marché plus importante en 2023.

Analyse des parts de marché des roues d'avion par zone géographique

La portée géographique du rapport sur le marché des roues d’avion est principalement divisée en cinq régions : Amérique du Nord, Europe, Asie-Pacifique, Moyen-Orient et Afrique et Amérique du Sud.

L'Amérique du Nord a dominé le marché en 2023, suivie des régions Asie-Pacifique et Europe. En outre, l'Asie-Pacifique devrait connaître le TCAC le plus élevé dans les années à venir. En outre, l'Asie-Pacifique devrait dépasser le marché nord-américain des roues d'avion dans les années à venir. La Chine représentait la plus grande part de marché sur le marché des roues d'avion en Asie-Pacifique en 2023 ; tandis que l'Inde devrait connaître le TCAC le plus élevé dans les années à venir. La croissance rapide de l'industrie aéronautique et la demande accrue de services aériens de passagers ont alimenté les services aériens commerciaux dans le pays. Ainsi, il existe un énorme potentiel et d'énormes opportunités de créer des coentreprises et des collaborations dans le secteur aérospatial en Inde pour former des installations MRO. Ainsi, une concentration majeure sur la fabrication d'avions et l'augmentation des services aériens commerciaux à travers l'Inde devraient propulser la croissance du marché des roues d'avion à travers le pays dans les années à venir.

Aperçu régional du marché des roues d'avion

Les tendances et facteurs régionaux influençant le marché des roues d’avion tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des roues d’avion en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des roues d'avion

Portée du rapport sur le marché des roues d'avion

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 1,83 milliard de dollars américains |

| Taille du marché d'ici 2031 | 3,12 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 6,9% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par type

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des roues d'avion : comprendre son impact sur la dynamique commerciale

Le marché des roues d'avion connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des roues d'avion sont :

- Raytheon Technologies Corporation

- Honeywell International Inc

- Société Parker Hannifin

- Groupe Safran

- Beringer Aero USA

- Lufthansa Technik

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des roues d'avion

Actualités et développements récents du marché des roues d'avion

Le marché des roues d'avion est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements sur le marché des roues d'avion sont énumérés ci-dessous :

- Safran Landing Systems a inauguré, sur son site de Vélizy-Villacoublay (France), un laboratoire entièrement rénové dédié aux tests de ses roues et freins carbone, et équipé d’un nouveau banc d’essai. L’entreprise aura investi au total 10 millions d’euros pour mener à bien cet ambitieux projet. (Source : Safran, Communiqué de presse, avril 2024)

- Bauer, leader mondial des équipements de test et de support pour composants aéronautiques, a annoncé la création d'une division dédiée aux équipements de roues et de freins. (Source : Bauer Inc, communiqué de presse, avril 2024)

Rapport sur le marché des roues d'avion : couverture et livrables

Le rapport « Taille et prévisions du marché des roues d’avion (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché des roues d'avion aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le champ d'application

- Tendances du marché des roues d'avion ainsi que la dynamique du marché telles que les facteurs déterminants, les contraintes et les opportunités clés

- Analyse PEST détaillée

- Analyse du marché des roues d'avion couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents pour le marché des roues d'avion

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des roues d'avion

Obtenez un échantillon gratuit pour - Marché des roues d'avion