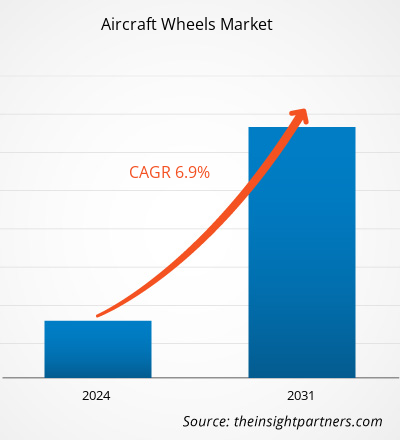

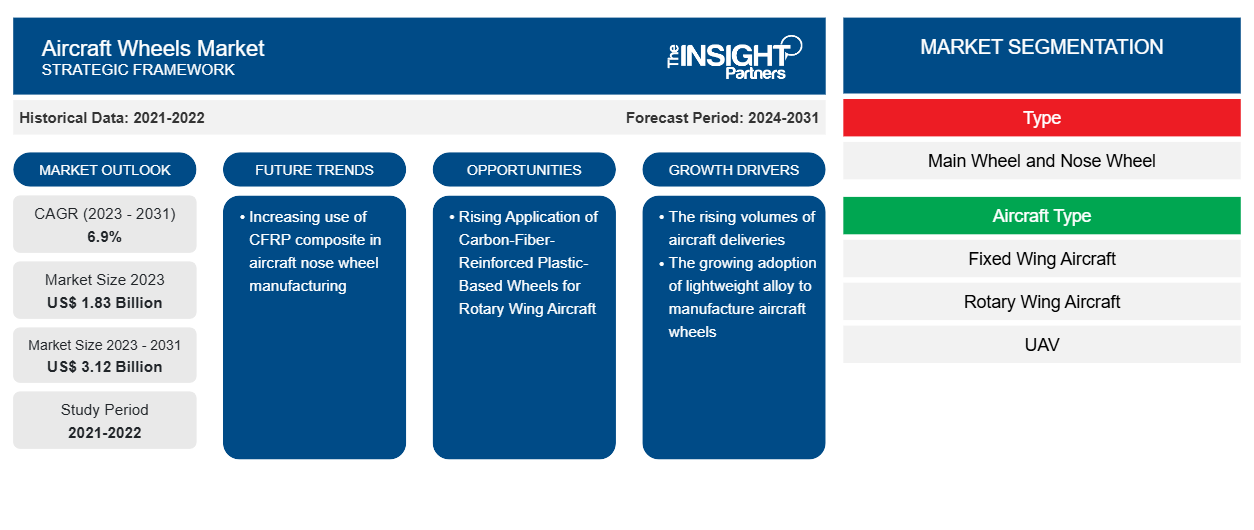

Si prevede che la dimensione del mercato delle ruote per aeromobili raggiungerà i 3,12 miliardi di dollari entro il 2031, rispetto agli 1,83 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 6,9% nel periodo 2023-2031. Si prevede che l'uso crescente del composito CFRP nella produzione di ruote anteriori per aeromobili rimarrà una tendenza chiave nel mercato.

Analisi del mercato delle ruote degli aeromobili

Grazie all'introduzione del composito rinforzato con fibra di carbonio, i produttori di ruote per aeromobili stanno utilizzando ampiamente il materiale per progettare e produrre una ruota anteriore per aeromobili. Il materiale è noto per la sua elevata rigidità e resistenza, che lo rende compatibile con una ruota anteriore per aeromobili. Inoltre, il materiale composito è più leggero dell'alluminio e della lega di magnesio. Quindi, si prevede che la ruota in plastica rinforzata con fibra di carbonio (CFRP) riduca la densità di massa di un aeromobile. Ciò si tradurrà in un minor consumo di carburante e l'aeromobile può essere utilizzato in modo economico. Inoltre, l'autonomia o il carico utile possono essere aumentati. Attualmente, i produttori di ruote per aeromobili stanno sviluppando ruote per aeromobili realizzate in composito CFRP. Ad esempio, Fraunhofer LBF sta utilizzando il composito CFRP per sviluppare ruote anteriori per un aeromobile Airbus A320. Quindi, nei prossimi anni, si prevede che i produttori di ruote per aeromobili utilizzeranno sempre più materiale CFRP per produrre ruote anteriori per aeromobili. Quindi, si prevede che l'aumento dell'uso del materiale composito CFRP per la produzione di ruote anteriori per aeromobili crescerà tra i produttori di ruote per aeromobili e diventerà una tendenza futura.

Panoramica del mercato delle ruote per aeromobili

L'ecosistema del mercato delle ruote per aeromobili comprende i seguenti stakeholder: fornitori di materie prime e componenti, produttori di ruote per aeromobili, produttori di aeromobili e utenti finali. I produttori di ruote per aeromobili si procurano materie prime e componenti come acciaio, alluminio e lega di magnesio e componenti come dadi e bulloni, tra gli altri, vengono procurati dai fornitori di materie prime e componenti. I produttori di ruote per aeromobili assemblano materie prime e componenti e li trasformano in prodotti finiti. Questi produttori sono i principali attori del mercato delle ruote per aeromobili e detengono una quota significativa del mercato dato. Pochi dei principali attori che operano nel mercato sono Honeywell International Inc.; Safran SA; Parker Hannifin Corporation; Raytheon Technologies Corporation; e Matco Manufacturing Inc. tra gli altri. Inoltre, questi produttori forniscono ruote per aeromobili a produttori di aeromobili come Airbus, Boeing, Dassault Aviation, Bombardier, Lockheed Martin Corporation e altri per gli adattamenti in linea delle ruote. Inoltre, i produttori di ruote per aeromobili vendono le ruote a fornitori di retrofitting delle ruote come Lufthansa Technik, AAR Corporation e TP Aerospace tra gli altri. Questi fornitori di servizi di retrofitting acquistano ruote per aeromobili per le compagnie aeree e le montano durante i servizi di manutenzione, riparazione e revisione (MRO) degli aeromobili.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato delle ruote per aeromobili

Crescente adozione di leghe leggere per la produzione di ruote per aeromobili

Le ruote convenzionali per aeromobili sono realizzate in leghe di magnesio. Tuttavia, in tempi moderni, i produttori stanno sempre più esplorando materiali leggeri per realizzare ruote per aeromobili per ottenere una grande durata e una bassa manutenzione. Inoltre, una ruota per aeromobili realizzata in leghe leggere aiuta un produttore di aeromobili a raggiungere un livello ottimale di efficienza del carburante riducendo una parte del peso dell'aeromobile. Pertanto, sulla scia dei nuovi sviluppi tecnologici nelle ruote per aeromobili, i produttori stanno ampiamente utilizzando vari tipi di leghe di alluminio per rendere le ruote leggere e con una migliore resistenza alla corrosione. Ad esempio, UTC Aerospace Systems (UTAS) sta esplorando una lega di alluminio a base di argento per sviluppare una ruota per aeromobili. Si prevede che la resistenza delle nuove ruote realizzate in alluminio a base di argento aumenterà di circa il 20%. Inoltre, si prevede che la nuova lega di alluminio a base di argento aumenterà la tolleranza ai danni di circa il 70% grazie alla sua rigidità e alla migliore resistenza alla corrosione. È anche probabile che la variante in alluminio a base di argento renda la ruota per aeromobili più leggera e riduca i tempi di fermo per manutenzione. Quindi, la crescente adozione di leghe leggere per produrre ruote per aeromobili guida la crescita del mercato delle ruote per aeromobili.UTAS) is exploring a silver-based aluminum alloy to develop an aircraft wheel. The strength of new wheels made of silver-based aluminum is expected to increase by about 20%. In addition, the new silver-based

Crescente applicazione di ruote in plastica rinforzata con fibra di carbonio per aeromobili ad ala rotante

Attualmente, la maggior parte delle ruote degli elicotteri è realizzata in materiali metallici in lega leggera, come alluminio o magnesio. Tuttavia, le ruote realizzate in plastica rinforzata con fibra di carbonio (CFRP) pesano circa il 30%-40% in meno rispetto alle ruote in lega di alluminio o magnesio. Si prevede che le ruote in CFRP offrano una migliore resistenza alla corrosione e prestazioni di rumore, vibrazione e durezza (NVH). Inoltre, queste ruote sono più rigide con una migliore durata della fatica, il che ne prolungherà la durata. I produttori hanno già avviato la progettazione di ruote basate su CFRP per aeromobili ad ala rotante. Ad esempio, a gennaio 2021, Carbon ThreeSixty, un'azienda produttrice di ruote per aeromobili con sede nel Regno Unito, ha iniziato a sviluppare ruote basate su CFRP per aeromobili ad ala rotante. Si prevede che l'azienda completerà la progettazione delle ruote nei prossimi 18 mesi. Queste ruote composite saranno anche intercambiabili con le ruote esistenti per renderle adatte ad applicazioni di retrofit. Pertanto, con l'introduzione di ruote in plastica rinforzata con fibra di carbonio negli aeromobili ad ala rotante, si prevede che il mercato prospererà ulteriormente nei prossimi anni, con l'opportunità di penetrare nel settore delle ruote degli aeromobili ad ala rotante.CFRP) are ~30%–40% less in weight than aluminum or magnesium alloy wheels. CFRP wheels are expected to offer improved corrosion resistance and noise, vibration, and harshness (NVH) performance. Also, these wheels are stiffer with improved fatigue life, which will extend their life. Manufacturers have already initiated the designing of CFRP-based wheels for rotary wing aircraft. For instance, in January 2021, Carbon ThreeSixty, a UK-based aircraft wheels manufacturing company, began to develop CFRP-based wheels for rotary wing aircraft. The company is expected to complete the wheel designing in the next 18 months. These composite wheels will also be interchangeable with existing wheels to make them suitable for retrofit applications. Hence, with the introduction of carbon-fiber-reinforced plastic-based wheels in rotary wing aircraft, the market is expected to flourish further in the coming years with an opportunity to penetrate the rotary wing aircraft wheels.

Analisi della segmentazione del rapporto di mercato delle ruote degli aeromobili

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato delle ruote per aeromobili sono la tipologia, il tipo di aeromobile, il tipo di adattamento e l'utente finale.

- In base al tipo, il mercato delle ruote degli aeromobili è segmentato in ruota principale e ruota anteriore. Il segmento della ruota principale ha detenuto una quota di mercato maggiore nel 2023.

- In base al tipo di aeromobile, il mercato delle ruote per aeromobili è segmentato in aeromobili ad ala fissa, aeromobili ad ala rotante e UAV. Il segmento degli aeromobili ad ala fissa ha detenuto una quota di mercato maggiore nel 2023.UAV. The fixed wing aircraft segment held a larger market share in 2023.

- In base al tipo di adattamento, il mercato delle ruote per aeromobili è segmentato in adattamento lineare e retrofit. Il segmento adattamento lineare ha detenuto una quota di mercato maggiore nel 2023.

- In base all'utente finale, il mercato delle ruote per aeromobili è segmentato in commerciale e militare. Il segmento commerciale ha detenuto una quota di mercato maggiore nel 2023.

Analisi della quota di mercato delle ruote degli aeromobili per area geografica

L'ambito geografico del rapporto sul mercato delle ruote per aeromobili è suddiviso principalmente in cinque regioni: Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud America.

Il Nord America ha dominato il mercato nel 2023, seguito dalle regioni Asia Pacifico ed Europa. Inoltre, è probabile che l'Asia Pacifico assista al CAGR più elevato nei prossimi anni. Inoltre, è probabile che l'Asia Pacifico superi il mercato delle ruote per aeromobili nordamericano nei prossimi anni. La Cina ha rappresentato la quota di mercato maggiore nel mercato delle ruote per aeromobili dell'Asia Pacifico nel 2023; mentre è probabile che l'India assista al CAGR più elevato nei prossimi anni. La rapida crescita del settore dell'aviazione e la crescente domanda di servizi di trasporto passeggeri hanno alimentato i servizi di trasporto aereo commerciale nel paese. Pertanto, vi è un enorme potenziale ed enormi opportunità per creare joint venture e collaborazione nel settore aerospaziale in India per la formazione di strutture MRO. Pertanto, si prevede che un'attenzione importante alla produzione di aeromobili e all'aumento dei servizi di trasporto aereo commerciale in tutta l'India spingerà la crescita del mercato delle ruote per aeromobili in tutto il paese nei prossimi anni.

Approfondimenti regionali sul mercato delle ruote per aeromobili

Le tendenze regionali e i fattori che influenzano il mercato delle ruote per aeromobili durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato delle ruote per aeromobili in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa e Sud e Centro America.

- Ottieni i dati specifici regionali per il mercato delle ruote per aeromobili

Ambito del rapporto di mercato sulle ruote degli aeromobili

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 1,83 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 3,12 miliardi di dollari USA |

| CAGR globale (2023-2031) | 6,9% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per tipo

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità dei player del mercato delle ruote per aeromobili: comprendere il suo impatto sulle dinamiche aziendali

Il mercato delle ruote per aeromobili sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato delle ruote per aeromobili sono:

- Società di tecnologie Raytheon

- Honeywell International Inc

- Società Parker Hannifin

- Gruppo Safran

- Beringer Aero Usa

- Tecnica Lufthansa

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato delle ruote per aeromobili

Notizie e sviluppi recenti sul mercato delle ruote per aeromobili

Il mercato delle ruote per aeromobili viene valutato raccogliendo dati qualitativi e quantitativi dopo la ricerca primaria e secondaria, che include importanti pubblicazioni aziendali, dati associativi e database. Di seguito sono elencati alcuni degli sviluppi nel mercato delle ruote per aeromobili:

- Safran Landing Systems ha inaugurato, presso il suo sito di Vélizy-Villacoublay (Francia), un laboratorio completamente rinnovato, dedicato ai test delle sue ruote e dei suoi freni in carbonio, e dotato di un nuovo banco di prova. L'azienda avrà investito un totale di 10 milioni di euro per realizzare questo ambizioso progetto. (Fonte: Safran, Comunicato stampa, aprile 2024)

- Bauer, leader mondiale nelle apparecchiature di supporto e collaudo dei componenti aeronautici, ha annunciato la creazione di un'unità aziendale dedicata alle apparecchiature per ruote e freni. (Fonte: Bauer Inc, comunicato stampa, aprile 2024)

Copertura e risultati del rapporto sul mercato delle ruote per aeromobili

Il rapporto "Dimensioni e previsioni del mercato delle ruote per aeromobili (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato delle ruote per aeromobili a livello globale, regionale e nazionale per tutti i principali segmenti di mercato coperti dall'ambito

- Tendenze del mercato delle ruote per aeromobili e dinamiche di mercato come driver, restrizioni e opportunità chiave

- Analisi PEST dettagliata

- Analisi del mercato delle ruote per aeromobili che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti per il mercato delle ruote degli aeromobili

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato delle ruote per aeromobili

Ottieni un campione gratuito per - Mercato delle ruote per aeromobili