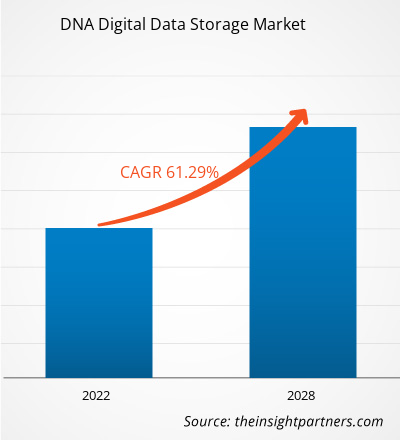

Se espera que el tamaño del mercado de almacenamiento de datos digitales de ADN alcance los 4236,43 millones de dólares estadounidenses para 2034, desde los 96,53 millones de dólares estadounidenses en 2025. Se anticipa que el mercado registre una CAGR del 64,9 % durante 2026-2034.

Análisis del mercado de almacenamiento de datos digitales de ADN

El mercado del almacenamiento de datos basado en ADN se encuentra en rápida expansión, impulsado por el crecimiento exponencial de la generación de datos digitales y las limitaciones de los medios de almacenamiento tradicionales. Las tecnologías de síntesis, secuenciación, codificación y corrección de errores de ADN están avanzando, lo que permite un almacenamiento duradero, de alta densidad y a largo plazo. Industrias como la biotecnología, la salud, los medios de comunicación y el entretenimiento, los archivos gubernamentales y los centros de datos a gran escala exploran cada vez más el almacenamiento de ADN como una solución de archivo de alta densidad de última generación. El mercado aún es incipiente, pero muestra un alto potencial de crecimiento.

Descripción general del mercado de almacenamiento de datos digitales de ADN

El almacenamiento digital de datos de ADN permite convertir información digital binaria en secuencias de nucleótidos de ADN, sintetizarlas, almacenarlas en un medio estable y recuperarlas mediante secuenciación/decodificación. Gracias a su extrema densidad de datos, alta durabilidad y bajos requisitos de energía y mantenimiento para el almacenamiento de archivos, el ADN ofrece una alternativa atractiva a los medios electrónicos/ópticos convencionales.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de almacenamiento de datos digitales de ADN: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de almacenamiento de datos digitales de ADN

Factores impulsores del mercado

- El crecimiento explosivo de la generación de datos digitales en todo el mundo está poniendo a prueba las tecnologías de almacenamiento convencionales y creando demanda de soluciones de almacenamiento a largo plazo y de densidad ultra alta.

- Avances en la síntesis/secuenciación de ADN, algoritmos de codificación/decodificación y corrección de errores, que permiten soluciones prácticas de almacenamiento de ADN.

- Necesidad de almacenamiento de archivos a largo plazo (décadas a siglos) en sectores como los medios de comunicación, el gobierno, la investigación y la atención médica: el ADN ofrece ventajas en cuanto a estabilidad y longevidad.

Oportunidades de mercado

- A medida que el almacenamiento de ADN se expanda, surgirán nuevos servicios de comercialización de modelos de implementación de almacenamiento de ADN locales y en la nube. Por ejemplo, el almacenamiento de ADN en la nube ofrece escalabilidad y acceso remoto para usuarios de archivos.

- Soluciones de archivo específicas de la industria (por ejemplo, archivos de medios y entretenimiento, datos genómicos y biotecnológicos, registros gubernamentales), casos de uso de alto valor donde las ventajas del almacenamiento de ADN justifican un costo superior.

- Asociaciones de ecosistemas entre biotecnología, TI, proveedores de servicios de almacenamiento y plataformas en la nube para integrar el almacenamiento de ADN en las arquitecturas de almacenamiento existentes.

Análisis de segmentación del informe de mercado de almacenamiento de datos digitales de ADN

La cuota de mercado del almacenamiento de datos digitales de ADN se analiza en varios segmentos para comprender mejor su estructura, potencial de crecimiento y tendencias emergentes. A continuación, se presenta el enfoque de segmentación estándar utilizado en la mayoría de los informes del sector:

Por secuenciación:

- Secuenciación de síntesis: determina la secuencia de ADN incorporando secuencialmente nucleótidos complementarios, detectando señales durante la síntesis para un análisis genético preciso y de alto rendimiento.

- Secuenciación de semiconductores iónicos: utiliza chips semiconductores para detectar iones de hidrógeno liberados durante la incorporación de nucleótidos, lo que ofrece una secuenciación rápida y rentable sin detección óptica.

- Secuenciación de terminación de cadena: también llamada secuenciación de Sanger; los fragmentos de ADN terminan en nucleótidos específicos, separados por tamaño, revelando con precisión la secuencia de ADN original.

- Secuenciación por ligadura: determina secuencias de ADN ligando sondas marcadas a secuencias complementarias, lo que permite una detección de secuencias precisa, multiplexada y de alto rendimiento.

- Secuenciación de nanoporos: pasa moléculas de ADN a través de poros a escala nanométrica, detectando cambios de corriente eléctrica y permitiendo una secuenciación de lectura larga en tiempo real con dispositivos portátiles.

Por aplicación:

- Investigación diagnóstica: utiliza la secuenciación de ADN para identificar trastornos genéticos, patógenos o mutaciones, respaldando el diagnóstico clínico, la epidemiología y la investigación de enfermedades.

- Medicina personalizada: adapta los tratamientos médicos en función de la información genética individual, optimizando la eficacia de los medicamentos, la dosis y la terapia para una atención médica de precisión.

Por usuario final:

- Hospitales y clínicas

- Empresas farmacéuticas y biotecnológicas

- Institutos académicos y de investigación

Por geografía:

- América del norte

- Europa

- Asia-Pacífico

- América del Sur y Central

- Oriente Medio y África

Perspectivas regionales del mercado de almacenamiento de datos digitales de ADN

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de almacenamiento de datos digitales de ADN durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de almacenamiento de datos digitales de ADN en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de almacenamiento de datos digitales de ADN

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2025 | US$ 96,53 millones |

| Tamaño del mercado en 2034 | US$ 4.236,43 millones |

| CAGR global (2026-2034) | 64,9% |

| Datos históricos | 2021-2024 |

| Período de pronóstico | 2026-2034 |

| Segmentos cubiertos |

Por secuenciación

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de almacenamiento de datos digitales de ADN: comprensión de su impacto en la dinámica empresarial

El mercado del almacenamiento de datos digitales de ADN está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de almacenamiento de datos digitales de ADN

Análisis de la cuota de mercado del almacenamiento de datos digitales de ADN por geografía

Norteamérica alberga el mayor mercado de almacenamiento de datos digitales de ADN. Estados Unidos fue el mercado más importante de almacenamiento de datos digitales de ADN y se prevé que crezca gracias a factores como la transformación de la atención médica digital, el aumento de las inversiones y los avances tecnológicos. Se prevé que la región de Asia Pacífico registre el mayor crecimiento en este mercado. En Japón, India y Corea del Sur, se prevé un crecimiento del mercado gracias a las continuas actividades de investigación relacionadas con el almacenamiento de datos digitales de ADN y la penetración de la tecnología en la región.

El mercado de almacenamiento de datos digitales de ADN muestra una trayectoria de crecimiento diferente en cada región debido a factores como la presencia de proveedores de servicios de almacenamiento de datos digitales de ADN, las inversiones activas y la innovación empresarial relacionada con el almacenamiento de datos de ADN. A continuación, se presenta un resumen de la cuota de mercado y las tendencias por región:

1. América del Norte

- Cuota de mercado: posee la mayor participación en el mercado de almacenamiento de datos de ADN debido a una sólida infraestructura de biotecnología y TI y una gran inversión en investigación.

- Factores clave: Alta adopción de tecnologías de almacenamiento emergentes; presencia de empresas líderes en síntesis y secuenciación de ADN; fuerte inversión en almacenamiento de archivos y centros de datos.

- Tendencias: Asociaciones entre gigantes tecnológicos y empresas de biotecnología; implementaciones piloto de almacenamiento de archivos de ADN; enfoque en casos de uso de archivos empresariales y gubernamentales

2. Europa

- Cuota de mercado: significativa, pero algo por detrás de América del Norte; un sólido ecosistema de investigación en biotecnología y genómica respalda el crecimiento.

- Factores clave: Apoyo regulatorio para la preservación de datos y la innovación biotecnológica; instituciones de investigación europeas que impulsan la I+D en materia de almacenamiento de ADN.

- Tendencias: Colaboraciones transfronterizas; enfoque en la preservación a largo plazo de datos culturales y patrimoniales utilizando almacenamiento de ADN.

3. Asia-Pacífico

- Cuota de mercado: Región emergente, a menudo citada como de más rápido crecimiento debido a los volúmenes de datos digitales en rápida expansión, sectores de biotecnología activos en China, India, Japón y Corea del Sur.

- Factores clave: Creciente economía digital, aumento de la investigación en genómica y biotecnología, iniciativas gubernamentales para la infraestructura digital.

- Tendencias: Están surgiendo la adopción en grandes proyectos de archivo, proyectos piloto de almacenamiento de ADN basados en la nube y capacidades de síntesis de ADN local.

4. América del Sur y Central

- Cuota de mercado: más pequeña, pero con potencial de crecimiento a medida que los volúmenes de datos digitales crecen y el archivo se vuelve importante.

- Factores clave: inversión emergente en infraestructura y nube; potencial para servicios de archivo de ADN subcontratados por proveedores globales.

- Tendencias: Adopción de soluciones de archivo por parte de empresas de medios y contenidos; asociaciones con proveedores globales de servicios de almacenamiento de ADN.

5. Oriente Medio y África

- Cuota de mercado: En una etapa temprana de adopción, pero existen oportunidades en archivos gubernamentales, preservación del patrimonio cultural y almacenamiento de datos de alta seguridad.

- Factores clave: iniciativas nacionales de transformación digital, interés en tecnología de última generación y voluntad de adoptar soluciones de almacenamiento innovadoras.

- Tendencias: Programas piloto de archivo de ADN; inversiones de fondos soberanos en sistemas de almacenamiento de datos a prueba de futuro.

Densidad de actores del mercado de almacenamiento de datos digitales de ADN: comprensión de su impacto en la dinámica empresarial

El mercado del almacenamiento de datos digitales de ADN está experimentando una competencia cada vez mayor debido a la presencia de importantes proveedores globales de tecnología, junto con actores emergentes de nicho y startups especializadas. Las empresas innovan activamente para fortalecer su posición en el mercado y satisfacer la creciente demanda de plataformas inteligentes para la toma de decisiones en todos los sectores.

El panorama competitivo está impulsando a los proveedores a diferenciarse a través de:

- Colaboraciones y asociaciones entre empresas tecnológicas y de biotecnología para integrar el almacenamiento de ADN en la infraestructura de datos.

- Centrarse en la reducción de costos, la mejora del rendimiento, la corrección de errores y las capacidades de acceso aleatorio para el almacenamiento de ADN.

- Modelos de servicio y alianzas estratégicas con grandes proveedores de centros de datos/nube.

Oportunidades y movimientos estratégicos

- El almacenamiento de ADN irá evolucionando gradualmente más allá de la investigación/proyecto piloto hacia servicios de archivo comerciales. Las empresas de medios de comunicación, los gobiernos y las grandes empresas serán pioneras en adoptarlo.

- Los proveedores de la nube están integrando el almacenamiento de ADN como una capa de archivo escalonada, ofreciendo almacenamiento a muy largo plazo con un costo de mantenimiento mínimo.

- Fusiones y adquisiciones, asociaciones estratégicas y acuerdos de licencia entre empresas de síntesis biotecnológica y proveedores de infraestructura de datos para escalar las capacidades de almacenamiento de ADN.

- Abordar las barreras actuales (costo, acceso aleatorio, velocidad de escritura/lectura) desbloqueará una adopción más amplia y creará nuevos modelos comerciales.

Las principales empresas que operan en el mercado de almacenamiento de datos digitales de ADN son:

- Illumina, Inc

- Twist Bioscience

- Tecnologías Agilent, Inc.

- Ensamblajes moleculares

- Corporación Cuántica

- CATALOGAR

- Corporación Microsoft

- Iridia, Inc

- F. HOFFMANN-LA ROCHE LTD

- Guión de ADN

- Evonetix.

Descargo de responsabilidad: Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

Noticias y desarrollos recientes del mercado de almacenamiento de datos digitales de ADN

- Por ejemplo, el 1 de octubre de 2015, Illumina, Inc. anunció el lanzamiento de BioInsight, una nueva unidad de negocio dentro de Illumina, desarrollada para satisfacer la demanda de la industria de conocimientos biológicos más profundos, impulsada por la necesidad de investigadores y compañías farmacéuticas de acceder e interpretar datos multiómicos a escala cada vez mayor. Al aunar las fortalezas de Illumina en secuenciación, análisis de datos, software e inteligencia artificial, BioInsight brindará a clientes y socios soluciones para identificar dianas farmacológicas, comprender las vías biológicas, descubrir nuevos mecanismos patológicos y generar la próxima generación de conocimientos biológicos. Esta iniciativa refleja el compromiso de Illumina de ofrecer soluciones innovadoras para el avance de la ciencia y la atención médica, e impulsa el crecimiento sostenible a largo plazo de la compañía.

- El 5 de mayo de 2025, Twist Bioscience Corporation, una empresa de capital de crecimiento y valor de mediana capitalización en el segmento de ciencias biológicas del sector de la atención médica, anunció que la empresa ha escindido su aplicación de tecnología de almacenamiento de datos de ADN como una empresa independiente, denominada Atlas Data Storage (“Atlas”).

Informe de mercado sobre almacenamiento de datos digitales de ADN: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de almacenamiento de datos digitales de ADN (2021-2034)" ofrece un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado de almacenamiento de datos digitales de ADN y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de almacenamiento de datos digitales de ADN, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallado

- Análisis del mercado de almacenamiento de datos digitales de ADN que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y de la competencia, que abarca la concentración del mercado, el análisis de mapas de calor, los actores principales y la evolución reciente del mercado de almacenamiento de datos digitales de ADN. Perfiles detallados de las empresas.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de almacenamiento de datos digitales de ADN

Obtenga una muestra gratuita para - Mercado de almacenamiento de datos digitales de ADN