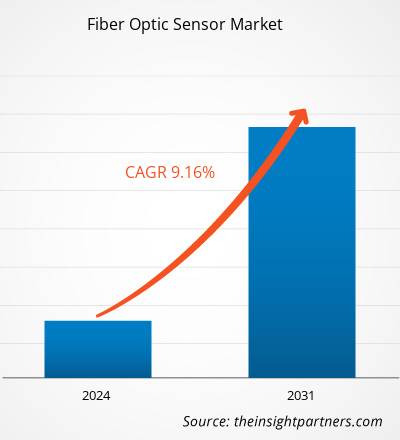

Se proyecta que el tamaño del mercado de sensores de fibra óptica alcance los 6.760 millones de dólares estadounidenses para 2031, frente a los 3.610 millones de dólares estadounidenses de 2024. Se espera que el mercado registre una tasa de crecimiento anual compuesta (TCAC) del 9,7 % entre 2025 y 2031. Es probable que la miniaturización y la portabilidad impulsen nuevas tendencias en el mercado en los próximos años.

Análisis del mercado de sensores de fibra óptica

La detección por fibra óptica es una tecnología que se utiliza para medir cambios químicos, deformación, temperatura, campos eléctricos y magnéticos, presión, desplazamiento, rotación, radiación, nivel de líquido, caudal, intensidad lumínica y vibraciones. Un sensor de fibra óptica es un dispositivo que utiliza fibra óptica para detectar cambios en el entorno (llamados sensores intrínsecos) o para transportar señales desde un sensor remoto a un equipo de procesamiento (llamados sensores extrínsecos). Estos diminutos sensores se utilizan comúnmente en la teledetección debido a varias ventajas. No requieren energía eléctrica en el punto de detección y una sola fibra puede soportar múltiples sensores. Estas ventajas los hacen rentables y eficientes para monitorear operaciones a largas distancias. Los sensores de fibra óptica son duraderos y pueden operar en temperaturas extremas. Al no transportar electricidad, también funcionan bien en áreas con alta interferencia eléctrica, alto voltaje o materiales inflamables; esto los hace ideales para su uso en industrias como la del petróleo y el gas, la construcción, la industria aeroespacial y la atención médica.

Descripción general del mercado de sensores de fibra óptica

El auge de las aplicaciones en el sector del petróleo y el gas y la creciente demanda de monitorización de la salud estructural (SHM) en diferentes sectores son los factores clave que impulsan el mercado de sensores de fibra óptica. Estos sensores desempeñan un papel crucial en la mejora de la seguridad y la eficiencia en edificios, tuberías y sistemas de transporte. Industrias como la del petróleo y el gas, la energía y las telecomunicaciones también están adoptando estas tecnologías de detección para optimizar el rendimiento y la fiabilidad. A medida que más industrias avanzan hacia la automatización y los sistemas más inteligentes, se prevé un crecimiento constante del mercado global de sensores de fibra óptica en los próximos años. El desarrollo de las ciudades inteligentes y el crecimiento del sector de las energías renovables generarán oportunidades lucrativas en el mercado en un futuro próximo.

Recibirá personalización de cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

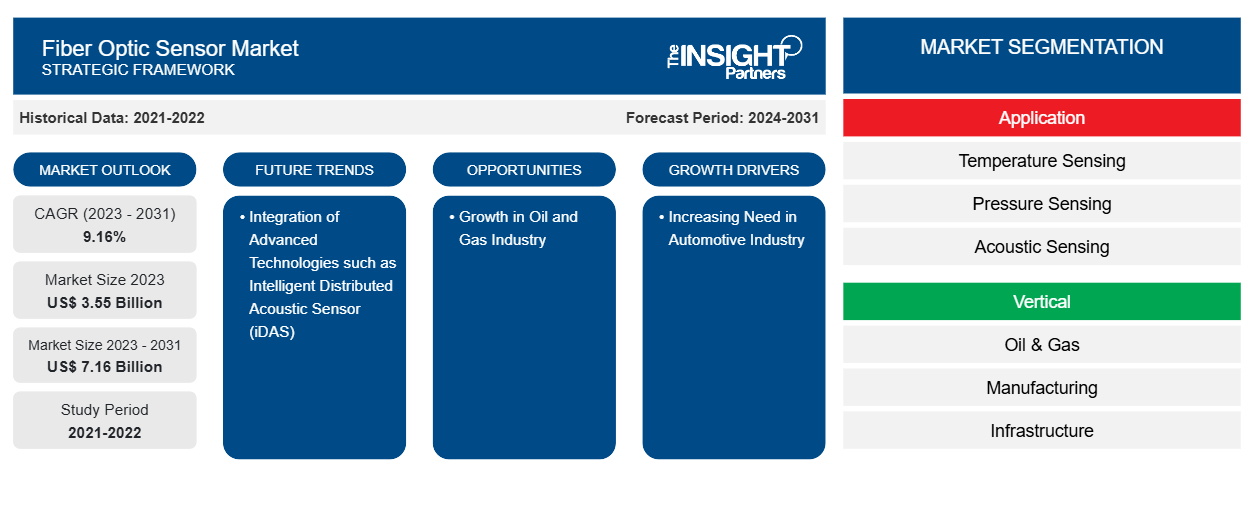

Mercado de sensores de fibra óptica: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de sensores de fibra óptica

Creciente demanda de monitoreo de la salud estructural

Existe un enfoque creciente en la seguridad de la infraestructura y el monitoreo en tiempo real en todo el mundo, lo que impulsa la demanda de sistemas avanzados de monitoreo de la salud estructural (SHM). Con la expansión de las ciudades modernas y el envejecimiento de la infraestructura, existe una necesidad constante de detectar señales tempranas de daños o fallas en estructuras como puentes, túneles, presas y edificios. Los sistemas tradicionales, como las galgas extensométricas resistivas, a menudo presentan deficiencias en términos de durabilidad, precisión a largo plazo y adaptabilidad. Los sensores de fibra óptica se han consolidado como una alternativa superior a los sistemas de monitoreo tradicionales, ofreciendo beneficios como diseño compacto, resistencia a la corrosión y tolerancia a interferencias electromagnéticas. Además, su capacidad para integrarse directamente en las estructuras está aumentando su popularidad. Estas cualidades los hacen ideales para el SHM a largo plazo, incluso en entornos desafiantes. Estos sensores pueden medir con precisión parámetros físicos clave como la deformación, la temperatura, la vibración y la inclinación, que son esenciales para mantener la integridad y seguridad de la infraestructura.

Para abordar la creciente demanda, las empresas del mercado de sensores de fibra óptica están obteniendo inversiones para escalar sus tecnologías. Por ejemplo, Sentea, una empresa derivada de imec y proveedora de sistemas de lectura para sensores de fibra óptica, logró recaudar aproximadamente US$2,6 millones (EUR2,3 millones) en 2021 para expandir su negocio. El anuncio de esta inversión se realizó en octubre de 2021. Con el respaldo de inversores como Finindus, PMV, QBIC II y Fidimec, la iniciativa de expansión de Sentea se centra en el avance de la tecnología fotónica integrada para permitir la detección de fibra óptica a gran escala en aplicaciones de ingeniería civil, petróleo y gas, energías renovables y medicina. Estas inversiones reflejan el creciente potencial para la implementación de la tecnología de detección de fibra óptica en aplicaciones SHM, impulsando así el crecimiento del mercado de sensores de fibra óptica.

Desarrollo de Ciudades Inteligentes

El gobierno indio lanzó la Misión 100 Ciudades Inteligentes el 25 de junio de 2015 con el objetivo de desarrollar 100 ciudades en todo el país con infraestructura moderna, un entorno limpio y sostenible, y una mejor calidad de vida mediante el uso de soluciones inteligentes. Esta iniciativa promueve el desarrollo urbano integral (social, económico, físico e institucional) mediante un programa financiado por el gobierno central con aproximadamente 6400 millones de dólares estadounidenses (48 000 millones de rupias indias) de financiación central, que se complementa con fondos estatales y otras fuentes, como las asociaciones público-privadas (APP). La misión busca crear modelos replicables de crecimiento urbano sostenible e inclusivo que otras ciudades puedan seguir. En la Unión Europea (UE), NetZeroCities apoya la misión "100 Ciudades Climáticamente Neutras e Inteligentes para 2030" como parte del programa Horizonte Europa.

A medida que las ciudades inteligentes se expanden, la necesidad de herramientas de monitoreo avanzadas, como los sensores de fibra óptica, seguirá creciendo. Estos sensores pueden proporcionar datos en tiempo real y funcionar bien en entornos hostiles, además de ofrecer una larga duración. Pueden usarse para monitorear puentes, carreteras, túneles, edificios, tuberías de agua y sistemas de energía. Por ejemplo, pueden detectar grietas en puentes, fugas en tuberías o cambios de temperatura en las redes eléctricas, lo que ayuda a las autoridades municipales a tomar medidas antes de que los problemas se agraven. Estos sensores también pueden usarse en sistemas de tráfico inteligente, redes inteligentes y edificios inteligentes, donde ayudan a mejorar el rendimiento y la seguridad. Por lo tanto, el auge de las ciudades inteligentes ofrece una oportunidad lucrativa para el mercado de sensores de fibra óptica, ya que estos sensores ayudan a crear sistemas conectados y eficientes.

Análisis de segmentación del informe de mercado de sensores de fibra óptica

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de sensores de fibra óptica son el tipo de detección, el usuario final y la aplicación.

- Según el tipo de detección, el mercado de sensores de fibra óptica se segmenta en detección de temperatura, detección de presión, detección acústica, detección de tensión, entre otros. El segmento de detección de temperatura tuvo la mayor participación de mercado en 2024.

- Según el usuario final, el mercado de sensores de fibra óptica se segmenta en petróleo y gas, manufactura, infraestructura, aeroespacial y defensa, energía y servicios públicos, entre otros. El segmento de petróleo y gas tuvo la mayor participación de mercado en 2024.

- Según su aplicación, el mercado de sensores de fibra óptica se segmenta en monitoreo de cables de alta tensión o alta potencia, monitoreo de tuberías , aplicaciones upstream, detección de incendios en activos críticos, aplicaciones CCS/CCUS, entre otras. El segmento "Otros" tuvo la mayor participación de mercado en 2024.

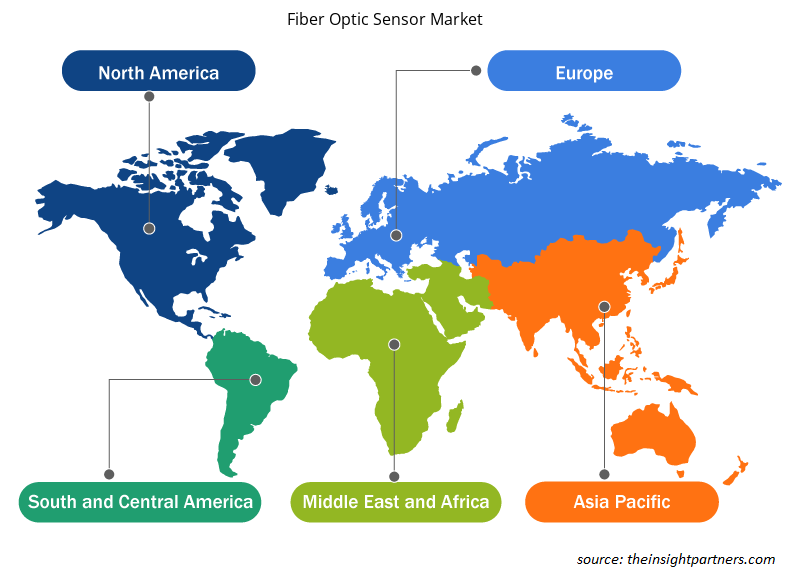

Análisis de la cuota de mercado de los sensores de fibra óptica por geografía

El alcance geográfico del informe de mercado de sensores de fibra óptica se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Oriente Medio y África, y América del Sur y Central. Asia Pacífico tuvo una cuota de mercado significativa en 2024.

Perspectivas regionales del mercado de sensores de fibra óptica

Los analistas de Insight Partners han explicado detalladamente las tendencias y los factores regionales que influyen en el mercado de sensores de fibra óptica durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de sensores de fibra óptica en Norteamérica, Europa, Asia Pacífico, Oriente Medio y África, y Sudamérica y Centroamérica.

- Obtenga los datos regionales específicos para el mercado de sensores de fibra óptica

Alcance del informe de mercado de sensores de fibra óptica

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2024 | US$ 3.61 mil millones |

| Tamaño del mercado en 2031 | US$ 6.76 mil millones |

| CAGR global (2025-2031) | 9,7% |

| Datos históricos | 2021-2023 |

| Período de pronóstico | 2025-2031 |

| Segmentos cubiertos |

Por tipo de detección

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de sensores de fibra óptica: comprensión de su impacto en la dinámica empresarial

El mercado de sensores de fibra óptica está en rápido crecimiento, impulsado por la creciente demanda del usuario final debido a factores como la evolución de las preferencias del consumidor, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades del consumidor y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de empresas o compañías que operan en un mercado o sector en particular. Indica cuántos competidores (actores del mercado) hay en un mercado determinado en relación con su tamaño o valor total.

Las principales empresas que operan en el mercado de sensores de fibra óptica son:

- Baumer Holding AG

- Pepperl+Fuchs SE

- Wenglor Sensoric GmbH

- Corporación NEC

- Proximion AB

- Corporación OMRON

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de sensores de fibra óptica

Noticias y desarrollos recientes del mercado de sensores de fibra óptica

El mercado de sensores de fibra óptica se evalúa mediante la recopilación de datos cualitativos y cuantitativos tras la investigación primaria y secundaria, que incluye importantes publicaciones corporativas, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances del mercado:

Wenglor presentó el amplificador de fibra óptica P1XD, diseñado específicamente para aplicaciones en espacios reducidos. Los modelos de la serie P1XD2 ofrecen opciones de integración flexibles, lo que permite que el amplificador funcione de forma independiente o como parte de un sistema en red, ya sea como maestro o subordinado. (Fuente: Wenglor, comunicado de prensa, diciembre de 2024)

Honeywell (NASDAQ: HON) y Civitanavi Systems (EURONEXT MILAN: CNS) han lanzado una nueva unidad de medición inercial para clientes comerciales y de defensa en todo el mundo. La familia HG2800 consta de unidades de medición inercial de bajo ruido, gran ancho de banda, alto rendimiento y grado táctico, diseñadas para apuntamiento, estabilización y navegación de corta duración en aeronaves comerciales y militares, entre otras aplicaciones. (Fuente: Honeywell, comunicado de prensa, septiembre de 2023)

Informe de mercado sobre sensores de fibra óptica: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de sensores de fibra óptica (2021-2031)" ofrece un análisis detallado del mercado que abarca las siguientes áreas:

- Tamaño del mercado de sensores de fibra óptica y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de sensores de fibra óptica, así como dinámicas del mercado como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallado

- Análisis del mercado de sensores de fibra óptica que cubre las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama industrial y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de sensores de fibra óptica.

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de sensores de fibra óptica

Obtenga una muestra gratuita para - Mercado de sensores de fibra óptica