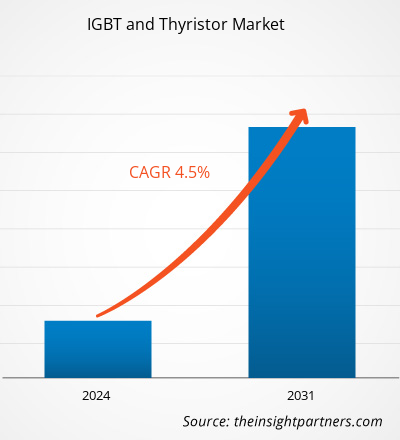

Se espera que el tamaño del mercado global de IGBT y tiristores crezca de US$ 7,20 mil millones en 2023 a US$ 10,24 mil millones en 2031; se anticipa que se expandirá a una CAGR del 4,5% entre 2023 y 2031. Es probable que la creciente demanda de conversión de energía eficiente siga siendo una tendencia clave en el mercado de IGBT y tiristores .

Análisis del mercado de IGBT y tiristores

La adopción de motores eléctricos en aplicaciones industriales, comerciales y residenciales también está impulsando el crecimiento del mercado. Además, el aumento continuo de la demanda de electricidad, impulsado por el aumento de la población, está creando una demanda de dispositivos de conmutación de estado sólido como IGBT y tiristores .

Descripción general del mercado de IGBT y tiristores

Los IGBT (transistores bipolares de puerta aislada) y los tiristores son dos componentes eléctricos clave que se utilizan en diversas industrias. Estos dispositivos cumplen una función importante en la electrónica de potencia y se emplean comúnmente en accionamientos de motores, sistemas de energía renovable y automatización industrial. Comprender estos componentes puede ayudar a las empresas que dependen de equipos y sistemas eléctricos. Un IGBT es un dispositivo semiconductor de alta potencia que combina los beneficios de los MOSFET y los transistores de unión bipolar. Tiene pérdidas de conducción mínimas y velocidades de conmutación rápidas, lo que lo hace excelente para aplicaciones que requieren una regulación de potencia eficiente. Un tiristor es un dispositivo semiconductor de estado sólido que funciona como un interruptor, regulando el flujo de corriente a través de un circuito.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado de IGBT y tiristores

Despliegue de redes inteligentes para favorecer el mercado

La implementación de redes inteligentes está ayudando a impulsar el espectacular crecimiento de los mercados de IGBT (transistores bipolares de puerta aislada) y tiristores . Las redes inteligentes son redes energéticas actualizadas que utilizan tecnología digital sofisticada para aumentar la eficiencia, la confiabilidad y la sostenibilidad del suministro y el consumo de energía. Las redes inteligentes brindan una mayor flexibilidad en la distribución y el consumo de energía, lo que facilita la incorporación de fuentes de energía renovables como la solar y la eólica. Este mayor uso de fuentes de energía renovables es factible porque las redes inteligentes permiten una mayor flexibilidad y gestión, incluso sin la inclusión del almacenamiento de energía.

Adopción de motores eléctricos

El uso de motores eléctricos en aplicaciones industriales, comerciales y residenciales está impulsando los mercados de IGBT (transistores bipolares de puerta aislada) y tiristores . Esta expansión puede atribuirse a varias fuentes, incluidas las medidas gubernamentales para reemplazar la infraestructura eléctrica antigua y el mayor uso de motores eléctricos en una variedad de industrias. Los motores eléctricos se utilizan a menudo en maquinaria industrial, electrodomésticos, sistemas de calefacción, ventilación y aire acondicionado y aplicaciones automotrices, como automóviles eléctricos e híbridos. La necesidad de motores eléctricos ha aumentado como resultado de la mayor demanda de nuevos automóviles, vehículos eléctricos, electrodomésticos y equipos industriales. Además, el uso de motores eléctricos en áreas residenciales para una variedad de aplicaciones domésticas ha contribuido a la expansión del mercado de motores eléctricos.

Análisis de segmentación del informe de mercado de IGBT y tiristores

Segmentos clave que contribuyeron a la derivación del análisis del mercado de IGBT y tiristores: tipo de empaquetado de IGBT, clasificación de potencia de IGBT, aplicación de IGBT y aplicación de tiristor.

- Según el tipo de encapsulado IGBT, el mercado se divide en IGBT discreto y módulo IGBT. El segmento de módulos IGBT tuvo una mayor participación de mercado en 2023.

- Según la potencia nominal de los IGBT, el mercado se divide en bajo, medio y alto. El segmento alto tuvo una mayor participación de mercado en 2023.

- Según la aplicación de IGBT, el mercado se divide en energía y potencia, sistemas de tracción ferroviaria, suministro de energía ininterrumpida, vehículos eléctricos y vehículos eléctricos híbridos, electrónica de consumo y otros. El segmento de energía y potencia tuvo una mayor participación de mercado en 2023.

- Según la aplicación de los tiristores, el mercado se divide en sistemas de transmisión de potencia, controladores de motores, reguladores de luz, sistemas de control de presión, reguladores de nivel de líquido y otros. El segmento de sistemas de transmisión de potencia tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado de IGBT y tiristores por geografía

El alcance geográfico del informe de mercado de IGBT y tiristores se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Oriente Medio y África, y América del Sur/América del Sur y Central. América del Norte dominó el mercado de IGBT y tiristores en 2023. La presencia de grandes parques eólicos y grandes proyectos de energía solar en América del Norte ha contribuido al crecimiento del mercado de IGBT. Los IGBT se utilizan en convertidores de potencia para sistemas de energía renovable, como turbinas eólicas e inversores solares.IGBT and Thyristor market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. North America dominated the IGBT and Thyristor market in 2023. The presence of large wind farms and major solar power projects in North America has contributed to the growth of the IGBT market. IGBTs are used in power converters for renewable energy systems, such as wind turbines and solar inverters.

Perspectivas regionales del mercado de IGBT y tiristores and Thyristor Market Regional Insights

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de IGBT y tiristores durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de IGBT y tiristores en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.IGBT and Thyristor Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses IGBT and Thyristor Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Obtenga datos regionales específicos para el mercado de IGBT y tiristores

Alcance del informe de mercado de IGBT y tiristores

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 7.20 mil millones |

| Tamaño del mercado en 2031 | US$ 10,24 mil millones |

| CAGR global (2023 - 2031) | 4,5% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tipo de embalaje IGBT

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de IGBT y tiristores está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de IGBT y tiristores son:

- ABB Ltd

- Infineon Technologies AG

- Corporación Mitsubishi Electric

- Corporación Electrónica Renesas

- Compañía: ROHM CO., LTD.

- En semiconductores

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de IGBT y tiristoresIGBT and Thyristor Market top key players overview

Noticias y desarrollos recientes del mercado de IGBT y tiristores

El mercado de IGBT y tiristores se evalúa mediante la recopilación de datos cualitativos y cuantitativos posteriores a la investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances del mercado:

- En marzo de 2024, Hitachi Energy alcanzó un hito importante en su tecnología de semiconductores al presentar la primera oblea de 300 mm de la industria para IGBT. Este avance revolucionario abre nuevas oportunidades en varios sectores, incluidos los variadores de frecuencia (VFD), los sistemas de suministro de energía ininterrumpida (UPS), los automóviles eléctricos, los trenes, los aires acondicionados y más.

(Fuente: Hitachi Energy, comunicado de prensa, 2024)

Informe sobre el mercado de IGBT y tiristores: cobertura y resultados

El informe "Tamaño y pronóstico del mercado de IGBT y tiristores (2021-2031)" proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de IGBT y tiristores

Obtenga una muestra gratuita para - Mercado de IGBT y tiristores