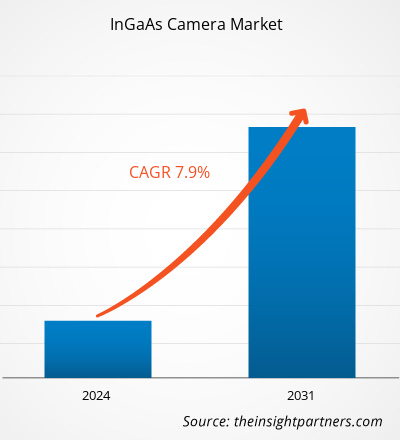

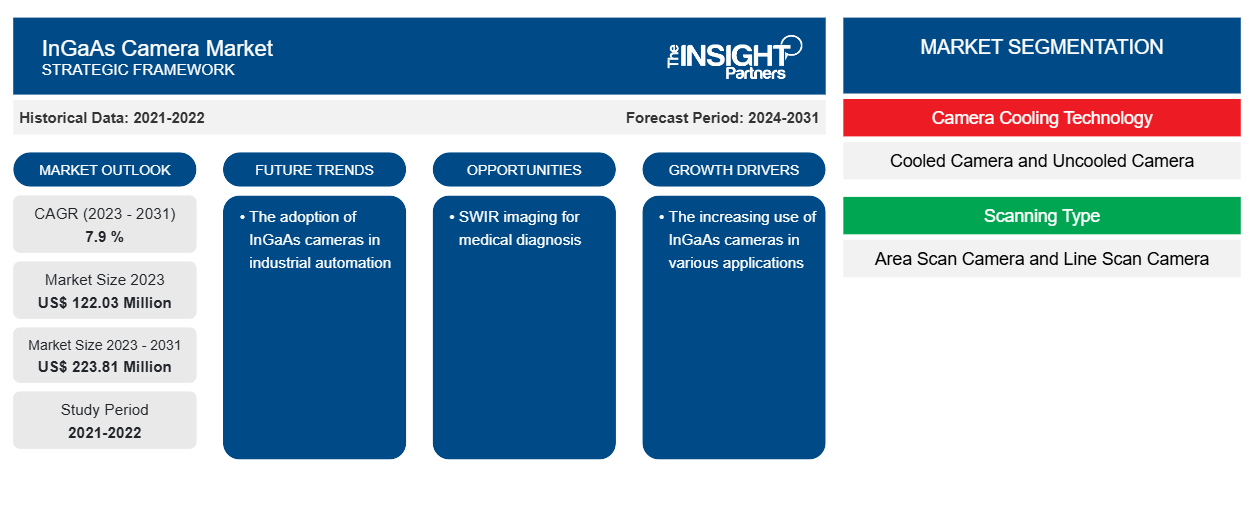

Se prevé que el tamaño del mercado de cámaras InGaAs alcance los 223,81 millones de dólares en 2031, frente a los 122,03 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 7,9 % durante el período 2023-2031. Es probable que la adopción de cámaras InGaAs en la automatización industrial siga siendo una tendencia clave en el mercado.

Análisis del mercado de cámaras InGaAs

El crecimiento del mercado de cámaras InGaAs se atribuye al aumento del uso de estas cámaras en diversas aplicaciones, como la automatización industrial y el diagnóstico médico . Una cámara SWIR puede evitar esto y, por lo tanto, garantizar un proceso de producción sin problemas. Por lo tanto, el aumento del uso de cámaras InGaAs en diversas aplicaciones está impulsando el mercado de cámaras InGaAs. También se analizan las técnicas de imágenes SWIR, como las imágenes hiperespectrales SWIR para aplicaciones biomédicas y un sistema microscópico holográfico digital de banda ancha (VIS + SWIR) basado en un novedoso sensor de imágenes de puntos cuánticos (QD). Por lo tanto, el aumento del uso de cámaras InGaAs en diversas aplicaciones está impulsando el mercado.

Descripción general del mercado de cámaras InGaAs

Los sensores InGaAs se utilizan por su relevancia en las ciencias físicas y biológicas y requieren una alta sensibilidad en el rango de longitud de onda de 900 a 1700 nm, conocido como infrarrojo de onda corta (SWIR). Algunos sensores InGaAs pueden medir hasta 2500 nm debido a los cambios en la composición del material. Aunque las cámaras CCD basadas en silicio poseen una sensibilidad en el rango de UV a NIR, las propiedades de brecha de banda del silicio impiden que estos CCD tengan una sensibilidad suficiente por encima de los 1100 nm. Las cámaras InGaAs tienen una brecha de banda menor, lo que hace que este material sea el material preferido para aplicaciones en la región de infrarrojos de onda corta (SWIR).

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de cámaras InGaAs

El uso creciente de cámaras InGaAs en diversas aplicaciones

La inspección de cristales y lingotes de silicio (también conocidos como ladrillos) es una de las aplicaciones más populares de las cámaras InGaAs en el sector de los semiconductores. La capacidad de ver en silicio en un rango de longitud de onda superior a 1150 nm proporciona a las cámaras InGaAs una solución adecuada para la detección de inclusiones, como impurezas dentro de un cristal o lingote, que pueden acumularse durante el proceso de producción. Las impurezas son críticas cuando se observan los lingotes en obleas delgadas con una cadena de diamante. Si la cadena golpea un elemento, como un pequeño trozo de metal, la cadena excepcionalmente cara puede romperse. No solo genera un costo reemplazar una cadena, sino que también conduce a una menor productividad y menores ganancias. Una cámara SWIR puede evitar esto y, por lo tanto, garantizar un proceso de producción sin problemas. Por lo tanto, el aumento del uso de cámaras InGaAs en varias aplicaciones está impulsando el mercado de cámaras InGaAs.

Imágenes SWIR para diagnóstico médico

La obtención de imágenes SWIR se utiliza en el diagnóstico médico. Se analizan las técnicas en desarrollo basadas en la luz SWIR, incluida la fabricación y el uso de nanopartículas SWIR como agentes fototérmicos y nanotermómetros luminiscentes, y los avances recientes en la estructura, el diseño y las aplicaciones biomédicas relacionadas con SWIR de las nanopartículas dopadas con tierras raras (REDN). Las REDN se encuentran entre los emisores SWIR más luminosos y biocompatibles. También se analizan las técnicas de obtención de imágenes SWIR, como la obtención de imágenes hiperespectrales SWIR para aplicaciones biomédicas y un sistema microscópico holográfico digital de banda ancha (VIS+SWIR) basado en un novedoso sensor de imágenes de puntos cuánticos (QD). Por lo tanto, el aumento del uso de cámaras InGaAs en diversas aplicaciones está impulsando el mercado.

Informe de mercado de cámaras InGaAs Análisis de segmentación

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de cámaras InGaAs son la tecnología de enfriamiento de la cámara, el tipo de escaneo y la aplicación.

- Según la tecnología de refrigeración de la cámara, el mercado de cámaras InGaAs se divide en cámaras refrigeradas y cámaras sin refrigeración. El segmento de software tuvo una mayor participación de mercado en 2023.

- Por tipo de escaneo, el mercado se segmenta en cámaras de escaneo de área y cámaras de escaneo lineal.

- Por aplicación, el mercado está segmentado en militar y defensa, automatización industrial e investigación científica.

Análisis de la cuota de mercado de cámaras InGaAs por geografía

El alcance geográfico del informe del mercado de cámaras InGaAs se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur y Central.

La región APAC domina el mercado de cámaras InGaAs. Se espera que la creciente demanda de adopción de automatización en las industrias, pruebas no destructivas y la creciente adopción de aplicaciones de visión artificial impulsen el crecimiento del mercado de cámaras InGaAs durante el período de pronóstico.

Perspectivas regionales del mercado de cámaras InGaAs

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de cámaras InGaAs durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de cámaras InGaAs en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de cámaras InGaAs

Alcance del informe de mercado de cámaras InGaAs

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 122,03 millones |

| Tamaño del mercado en 2031 | US$ 223,81 millones |

| CAGR global (2023 - 2031) | 7,9 % |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por tecnología de enfriamiento de cámara

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de cámaras InGaAs está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de cámaras InGaAs son:

- Fotónica de Hamamatsu KK

- Tecnologías de visión aliadas GmbH

- Nuevas tecnologías de imagen

- Instrumentos Pembroke LLC

- Polytec GmbH

- Raptor Photonics limitada

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de cámaras InGaAs

Noticias y desarrollos recientes del mercado de cámaras InGaAs

El mercado de cámaras InGaAs se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de una investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de cámaras InGaAs:

- Hamamatsu Photonics, un proveedor líder de tecnología y productos fotónicos de vanguardia, presentó una nueva cámara InGaAs con sensibilidad en la región del espectro visible al infrarrojo cercano, de 400 nm a 1700 nm. (Fuente: Hamamatsu Photonics, comunicado de prensa, febrero de 2024).

- BlueVision Ltd., Japón lanzó una nueva cámara de escaneo de línea SWIR 1K llamada BV-C3110, que es un sensor InGaAs 1K completamente nuevo en abril de 2021 (Fuente: BlueVision Ltd, comunicado de prensa, abril de 2021)

Informe sobre el mercado de cámaras InGaAs: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de cámaras InGaAs (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de cámaras InGaAs y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de cámaras InGaAs, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado de cámaras InGaAs que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de cámaras InGaAs

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de cámaras InGaAs

Obtenga una muestra gratuita para - Mercado de cámaras InGaAs