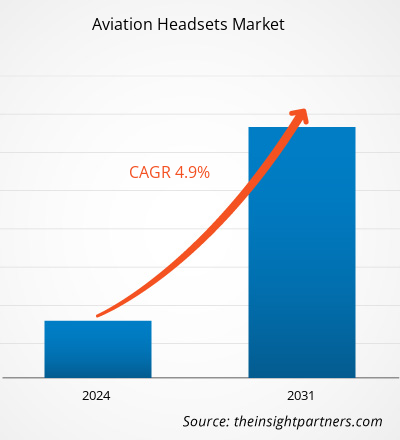

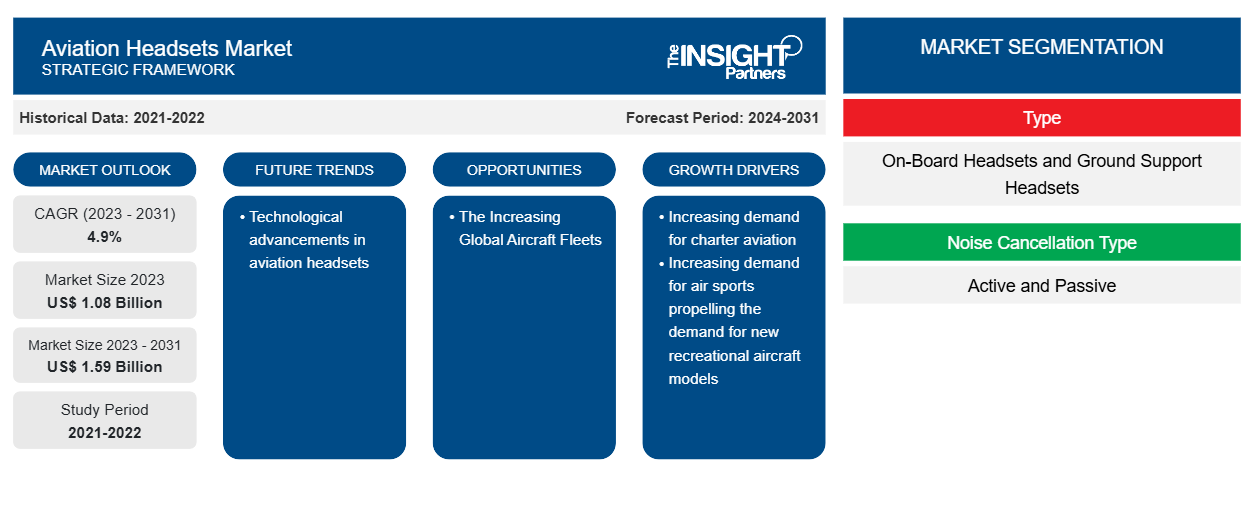

Le marché des casques d'aviation devrait atteindre 1,59 milliard de dollars d'ici 2031, contre 1,08 milliard de dollars en 2023. Le marché devrait enregistrer un TCAC de 4,9 % au cours de la période 2023-2031. Les avancées technologiques dans le domaine des casques d'aviation devraient rester une tendance clé du marché.CAGR of 4.9% during 2023–2031. Technological advancements in aviation headsets is likely to remain a key trend in the market.

Analyse du marché des casques d'aviation

L'écosystème du marché des casques d'aviation est diversifié et en constante évolution. Ses parties prenantes sont les fournisseurs de composants, les fabricants de casques, les distributeurs et les utilisateurs finaux. Les principaux acteurs occupent des places dans les différents nœuds de l'écosystème du marché. Les fournisseurs de composants fournissent différents composants tels que des produits semi-conducteurs/chipsets, des microphones, des composants de haut-parleurs aux fabricants de casques d'aviation qui les utilisent ensuite pour fabriquer et concevoir les produits finaux de casques d'aviation. Le produit final est ensuite distribué aux utilisateurs finaux par le biais de différents supports tels que la vente directe par l'intermédiaire des distributeurs de l'entreprise dans l'ensemble du secteur de l'aviation.chipsets, microphones, speaker components to aviation headset manufacturers who then utilize it to manufacture and design the final aviation headset products. The final product is then distributed to the end users through different mediums such as direct sales through company distributors across the aviation sector.

Aperçu du marché des casques d'aviation

Des entreprises telles que Bosch Security & Safety Systems, Bose Corporation, David Clark Company, Lightspeed Aviation, GBH Headphones, Pilot Communications, Plantronics Inc., SEHT Limited et Sennheiser Electronic GmbH & Co. Kg comptent parmi les principaux fabricants sur le marché des casques d'aviation. Ces entreprises conçoivent, fabriquent et vendent une large gamme de casques d'aviation aux utilisateurs finaux tels que les compagnies aériennes, les sociétés de maintenance, les équipementiers aéronautiques et les forces de défense.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des casques d'aviation

La demande croissante de sports aériens stimule la demande de nouveaux modèles d'avions de loisir

Le nombre croissant de livraisons d'avions de sport léger en raison d'une sensibilisation accrue aux sports aériens chez les jeunes contribue au déploiement de modèles d'avions de loisir de nouvelle génération. Par exemple, la flotte croissante d'avions de sport léger existants génère une demande de nouveaux pilotes et d'accessoires de casque dans le monde entier. De plus, la demande de LSA est principalement motivée par l'intérêt croissant pour les activités de loisirs telles que le parachutisme, qui ouvre la voie à de nouveaux acteurs pour établir des activités tandis que les acteurs existants développent leurs activités en créant une nouvelle base et en achetant de nouveaux avions. Par conséquent, la flotte croissante d'avions de sport léger dans le monde entier contribue à l'adoption de casques d'aviation à l'échelle mondiale.

L'augmentation des flottes d'avions mondiales

Selon les recherches secondaires de The Insight Partners, la flotte mondiale d'avions commerciaux en 2022 était d'environ 25 578 avions, qui devrait encore atteindre environ 28 398 avions d'ici la fin de 2024 et environ 36 413 avions d'ici la fin de 2034. De plus, selon les prévisions divulguées par deux des principaux équipementiers aéronautiques, à savoir Boeing et Airbus, plus de 40 800 avions devraient être livrés d'ici la fin de 2042, ce qui générera davantage de demande de nouveaux pilotes et de nouveaux casques dans les années à venir.

Analyse de segmentation du rapport sur le marché des casques d'aviation

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché des casques d’aviation sont le type, le type de suppression du bruit et l’application.

- En fonction du type, le marché des casques d'aviation est segmenté en casques embarqués et casques d'assistance au sol. Le segment des casques embarqués détenait une part de marché plus importante en 2023.

- En fonction du type de suppression du bruit, le marché des casques d'aviation est segmenté en actif et passif. Le segment actif détenait une part de marché plus importante en 2023.

- En fonction des applications, le marché des casques d'aviation est segmenté en avions commerciaux, avions militaires et aviation générale. Le segment commercial détenait une part de marché plus importante en 2023.

Analyse des parts de marché des casques d'aviation par zone géographique

La portée géographique du rapport sur le marché des casques d’aviation est principalement divisée en cinq régions : Amérique du Nord, Europe, Asie-Pacifique, Moyen-Orient et Afrique et Amérique du Sud.

L'Amérique du Nord a dominé le marché en 2023, suivie de l'Europe et de la région Asie-Pacifique. En outre, l'Asie-Pacifique devrait également connaître le TCAC le plus élevé dans les années à venir. Cela est principalement dû aux livraisons prévues de plus de 18 800 nouveaux avions commerciaux dans la région au cours des deux prochaines décennies. En outre, le nombre croissant d'aéroports dans la région Asie-Pacifique pousse également au déploiement d'un plus grand nombre d'avions dans la région, ce qui devrait encore générer de nouvelles opportunités pour les fournisseurs du marché dans les années à venir.

Aperçu régional du marché des casques d'écoute pour l'aviation

Les tendances et facteurs régionaux influençant le marché des casques d’aviation tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché des casques d’aviation en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché des casques d'aviation

Portée du rapport sur le marché des casques d'écoute pour l'aviation

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 1,08 milliard de dollars américains |

| Taille du marché d'ici 2031 | 1,59 milliard de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 4,9% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par type

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché des casques d'écoute pour l'aviation connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché des casques d'aviation sont :

- Systèmes de sécurité et de sûreté Bosch

- Société Bose

- La société David Clark

- Faro Aviation

- Casques GBH

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché des casques d'aviation

Actualités et développements récents du marché des casques d'écoute pour l'aviation

Le marché des casques d'aviation est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Quelques-uns des développements sur le marché des casques d'aviation sont répertoriés ci-dessous :

- Bose, leader de la technologie des casques d'aviation haut de gamme, a annoncé aujourd'hui sa dernière innovation : le nouveau casque d'aviation A30. Dévoilé au SUN 'n FUN Aerospace Expo à Lakeland, en Floride, l'A30 est un produit entièrement nouveau, conçu pour offrir aux pilotes la meilleure combinaison de confort, de suppression du bruit et de clarté audio de tous les casques d'aviation du marché. (Source : Bose, communiqué de presse, mars 2023)

Lightspeed Aviation a présenté aujourd'hui le Lightspeed Delta Zulu, le premier de la nouvelle génération de casques ANR. Ce casque d'aviation ANR révolutionnaire introduit une série de nouvelles fonctionnalités et annonce une nouvelle catégorie de produits aéronautiques baptisés « Safety Wearables ». (Source : Lightspeed Aviation, communiqué de presse, septembre 2022)

Rapport sur le marché des casques d'écoute pour l'aviation : couverture et livrables

Le rapport « Taille et prévisions du marché des casques d’aviation (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché des casques d'aviation aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Tendances du marché des casques d'aviation ainsi que dynamique du marché telles que les facteurs déterminants, les contraintes et les opportunités clés

- Analyse détaillée des cinq forces du porteur

- Analyse du marché des casques d'aviation couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents pour le marché des casques d'aviation

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des casques d'aviation

Obtenez un échantillon gratuit pour - Marché des casques d'aviation