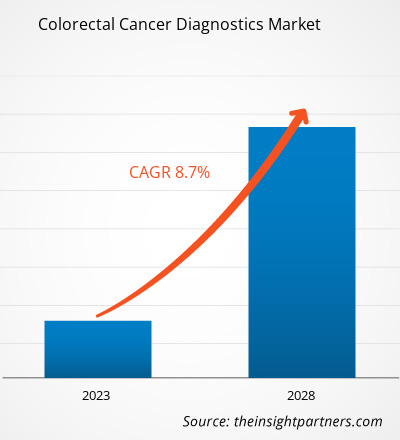

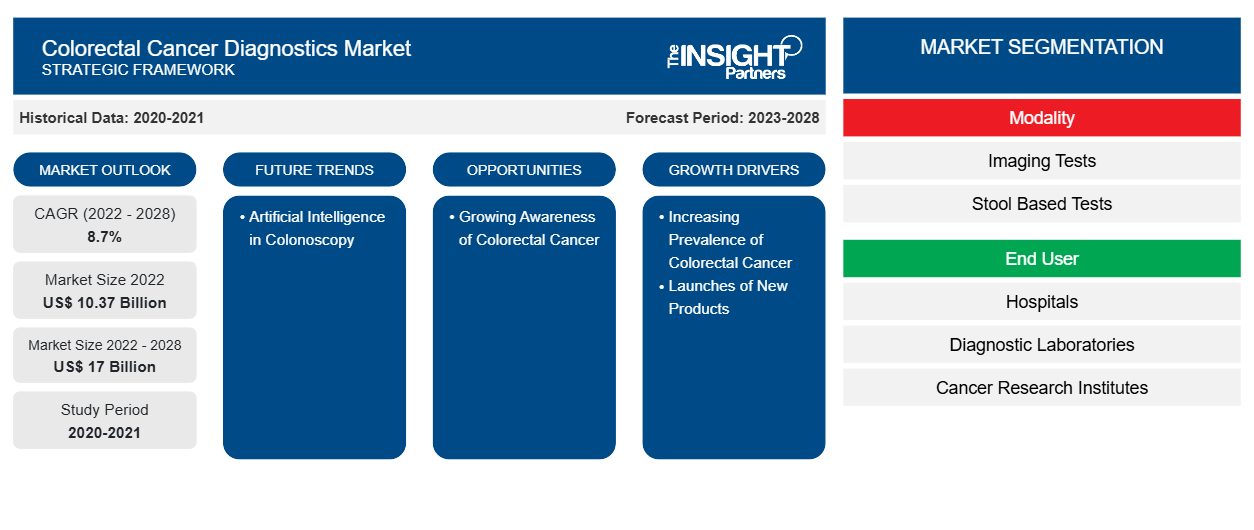

[Rapport de recherche] La taille du marché du diagnostic du cancer colorectal devrait passer de 10 374,68 millions USD en 2022 à 16 996,48 millions USD d'ici 2028 ; elle devrait enregistrer un TCAC de 8,7 % de 2023 à 2028.

Le marché du diagnostic du cancer colorectal est segmenté en fonction de la modalité, de l'utilisateur final et de la géographie. Le rapport offre des informations et une analyse approfondie du marché, en mettant l'accent sur des paramètres tels que les moteurs, les tendances, les opportunités et l'analyse du paysage concurrentiel des principaux acteurs du marché dans diverses régions. Il comprend également des analyses de l'impact de la pandémie de COVID-19 dans les principales régions.

Informations sur le marché

Les lancements de nouveaux produits stimulent la croissance colorectale

Les principaux acteurs du marché du diagnostic du cancer colorectal fabriquent une large gamme d'appareils qui aident à réduire le fardeau du cancer colorectal et d'autres indications associées telles que les polypes du côlon, la maladie de Crohn, la colite et le syndrome du côlon irritable. En juillet 2022, US Digestive Health (USDH), un réseau de cabinets gastro-intestinaux (GI) de premier ordre, a annoncé la commercialisation de dépistages par coloscopie assistée par IA avec la plus grande installation du pays de modules d'endoscopie GI intelligents Genious. Ces modules devraient aider les médecins à identifier en temps réel les polypes difficiles à détecter et potentiellement cancéreux. Avec le lancement de cet appareil, les patients du sud-est, du sud-ouest et du centre de la Pennsylvanie peuvent désormais accéder à une coloscopie assistée par IA avec des capacités améliorées. En septembre 2020, Olympus Corporation a annoncé le lancement d'ENDO-AID, une plateforme de pointe alimentée par l'intelligence artificielle (IA). La plateforme comprend l'application ENDO-AID CADe (app), une méthode endoscopique assistée par ordinateur pour la détection de différentes affections du côlon. Cette nouvelle plateforme d'IA permet l'affichage en temps réel des lésions suspectes détectées automatiquement et fonctionne en combinaison avec son EVIS X1. Ainsi, les développements fréquents et les lancements de nouveaux produits stimulent la croissance du marché du diagnostic du cancer colorectal.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que d'offres et de remises exceptionnelles pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Informations basées sur les modalités

En fonction de la modalité, le marché du diagnostic du cancer colorectal est divisé en tests basés sur les selles et tests d'imagerie. En 2022, le segment des tests d'imagerie détenait une part plus importante du marché du diagnostic du cancer colorectal et devrait enregistrer un TCAC plus élevé au cours de la période de prévision. L'utilisation des tests d'imagerie dans le diagnostic du cancer colorectal a évolué au cours des dernières années. Les résultats d'imagerie jouent un rôle essentiel dans la surveillance, le diagnostic, la stadification, la sélection du traitement et la planification du suivi. Les tests d'imagerie consistent à examiner la structure du côlon et du rectum pour détecter la présence de zones anormales. Les examens d'imagerie utilisent des endoscopes, des instruments en forme de tube avec une lumière et une petite caméra vidéo à leur extrémité, insérés dans le rectum. Ces tests scannent l'intérieur du côlon et du rectum à la recherche de zones anormales qui pourraient être un cancer ou des polypes. Ces tests sont utilisés moins souvent que les tests basés sur les selles et nécessitent plus de préparation au préalable et comportent certains risques associés, contrairement aux tests basés sur les selles. Les examens d'imagerie sont en outre classés en coloscopie, colographie CT, sigmoïdoscopie flexible, endoscopie par capsule et autres.

Le segment de la coloscopie détenait la plus grande part du marché en 2022. Cependant, la coloscopie par tomodensitométrie devrait croître à un rythme plus rapide au cours de la période de prévision. La coloscopie par tomodensitométrie aide à l'analyse morphologique des déformations de la paroi, fournissant les informations nécessaires à l'évaluation préopératoire de la stadification T dans le cancer colorectal. Conformément aux directives des critères d'évaluation de la réponse dans les tumeurs solides (RECIST), la tomodensitométrie est la modalité la plus largement utilisée pour évaluer la réponse au traitement chez les patients atteints de tumeurs métastasées du côlon et du rectum. Les avantages communs de la coloscopie par tomodensitométrie sont les suivants : elle est rapide et sûre, elle permet de visualiser l'ensemble du côlon et aucune sédation n'est nécessaire pour effectuer le test. Il est recommandé de réaliser ce test tous les cinq ans chez les patients asymptomatiques présentant un risque moyen.

Informations basées sur l'utilisateur final

En fonction de l'utilisateur final, le marché du diagnostic du cancer colorectal est segmenté en hôpitaux, laboratoires de diagnostic, instituts de recherche sur le cancer et autres. Le segment des hôpitaux représentait la plus grande part de marché en 2022 et devrait enregistrer le TCAC le plus élevé au cours de la période de prévision.

Les acteurs du marché du diagnostic du cancer colorectal adoptent des stratégies organiques telles que le lancement et l'expansion de produits pour étendre leur empreinte géographique et leurs portefeuilles de produits et répondre aux demandes croissantes. Les stratégies de croissance inorganique adoptées par les acteurs du marché leur permettent d'étendre leurs activités et d'améliorer leur présence géographique. De plus, ces stratégies de croissance aident les entreprises à renforcer leur clientèle et à élargir leur portefeuille de produits.

- En décembre 2022, Epigenomics a obtenu une licence pour une technologie de biomarqueurs protéiques pour le test sanguin du cancer colorectal. La société a obtenu une licence du MD Anderson Cancer Center de l'Université du Texas pour certains droits de brevet et de technologie sur des biomarqueurs associés à la détection du cancer colorectal.

- En août 2021, Illumina a acquis GRAIL pour accélérer l'accès des patients à un test de détection précoce de plusieurs cancers qui leur sauve la vie. Le test sanguin Galleri de GRAIL détecte 50 cancers différents avant qu'ils ne deviennent symptomatiques. L'acquisition de GRAIL par Illumina accélérera l'accès et l'adoption de ce test qui sauve des vies dans le monde entier.

Aperçu régional du marché du diagnostic du cancer colorectal

Les tendances et facteurs régionaux influençant le marché du diagnostic du cancer colorectal tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché du diagnostic du cancer colorectal en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché du diagnostic du cancer colorectal

Portée du rapport sur le marché du diagnostic du cancer colorectal

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2022 | 10,37 milliards de dollars américains |

| Taille du marché d'ici 2028 | 17 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2022-2028) | 8,7% |

| Données historiques | 2020-2021 |

| Période de prévision | 2023-2028 |

| Segments couverts |

Par modalité

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché du diagnostic du cancer colorectal : comprendre son impact sur la dynamique commerciale

Le marché du diagnostic du cancer colorectal connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché du diagnostic du cancer colorectal sont :

- Medtronic Plc

- Illumina Inc

- Technologies de génomique clinique Pty Ltd

- EDP Biotech Corp

- Epigénomique AG

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché du diagnostic du cancer colorectal

Profils d'entreprise

- Medtronic Plc

- Illumina Inc

- Technologies de génomique clinique Pty Ltd

- EDP Biotech Corp

- Epigénomique AG

- F. Hoffmann-La Roche SARL

- Quest Diagnostics Inc

- Novigenix SA

- Siemens Healthineers SA

- Société Bruker

- Eiken Chemical Co., Ltd.

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché du diagnostic du cancer colorectal

Obtenez un échantillon gratuit pour - Marché du diagnostic du cancer colorectal